Finance

360 ONE Asset Multicap PMS

Introduction to 360 ONE Wealth & Asset Management

- WEALTH MANAGEMENT

- Advisory Services

- Broking Services

- Distribution Services

- Lending & Estate Planning

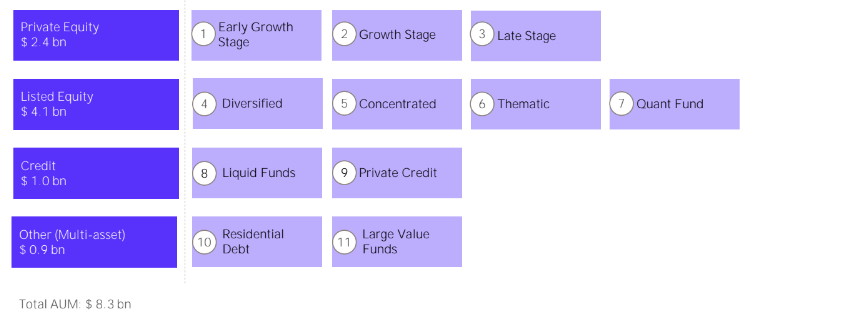

- ASSET MANAGEMENT

- Alternate Investment Funds

- Separately Managed Accounts (Portfolio Management Services)

- Mutual Funds

- Global Asset Management

- CONSOLIDATED AUM: $54.6 bn

- 360 ONE WAM Ltd (formerly known as IIFL Wealth Management Ltd) is one of the largest wealth management firms in India managing an AUM of $46.3 bn across 6,800 families worldwide

- 360 ONE WAM Ltd was listed on Sep 19, 2019 as a result of demerger of IIFL Finance Ltd

- The market capitalization of the firm is ~$3.16 bn

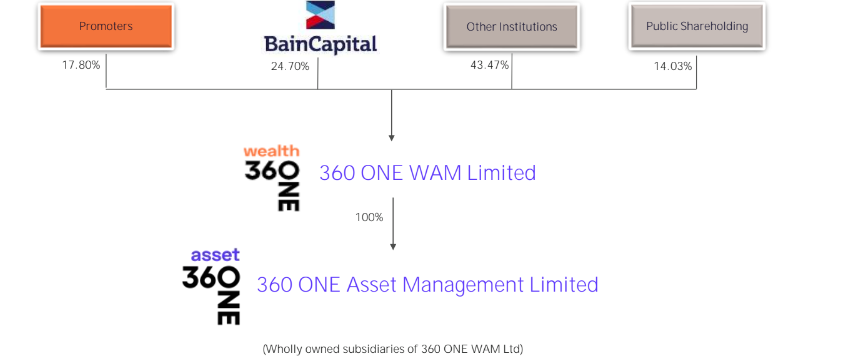

Shareholding Pattern

Asset Management Capabilities – Asset Class Wise

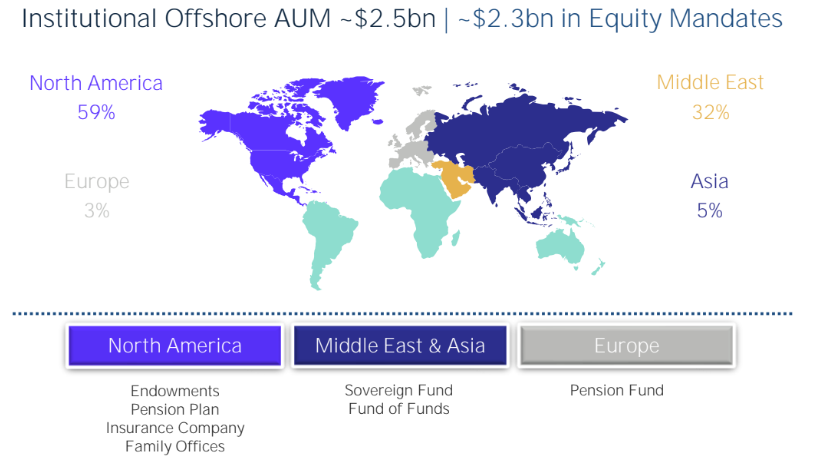

A Trusted Indian Partner

- Asset Class Strength

- Manage assets across public markets, private equity, private debt and real estate

- Cross learnings across asset classes enhances investment capability

- Deep-Domain Knowledge

- Good understanding of financial services sector through 360 ONE group presence

- Focus on financial services sector as a key source of alpha

- Robust proprietary research database

- Collaborative & Strong Team Culture

- Culture of transparency, based on collaboration, respect, and integrity

- Happy to collaborate with the client's internal teams across asset classes and strategies

- Extensive Network

- Relationship with India's largest creators, as one of the largest wealth management firms in the country

- Insights on corporate governance & better access to transactions

Offshore Institutional Presence

Investment Team & Key Terms

Public Equity Team Structure : Fund Management

Building A Collaborative Team That Brings Together A Unique Set of Skillsets

- Anup Maheshwari- Co-founder & CIO (28) MBA

- Anup brings with him 28 years of investment experience. He joined 360 ONE Asset Management Limited (formerly known as IIFL Asset Management Limited) from DSP Investment Managers Private Limited (formerly known as DSP BlackRock Investment Managers Private Limited) in August 2018.

- He was associated with DSP BlackRock since July 1997 and was last designated as the Chief Investment Officer, Equities.

- For a brief period between December 2005 and May 2006, he was the CIO at HSBC Asset Management before returning to DSP BlackRock. Previously he was also associated with Chescor, a British fund management firm managing three offshore India equity funds. Anup is an alumnus of IIM Lucknow

- Fund Managers

- Mehul Jani (19) (Financials & Consumer Staples) MSc, CFA

- Mayur Patel (18) (Oil & Gas and Industrials) CA, CFA

- Nishant Vass (14) (Automobiles, Telecom, Internets) MBA

- Parijat Garg (16) (Quantitative Research, ESG) M.Tech, CFA

Product Team Structure

India Opportunity

India’s Economy – A Global Comparison

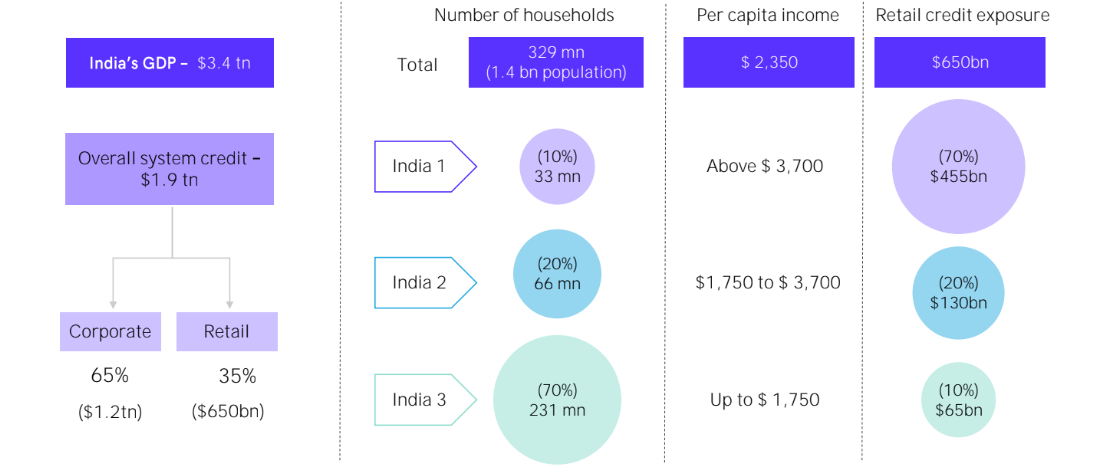

Consumer Lending Opportunity

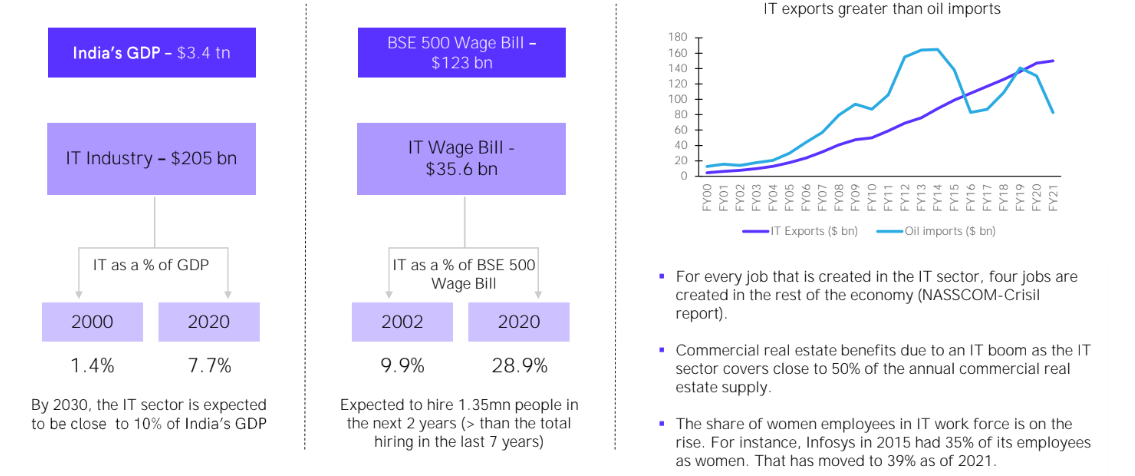

IT Sector Opportunity

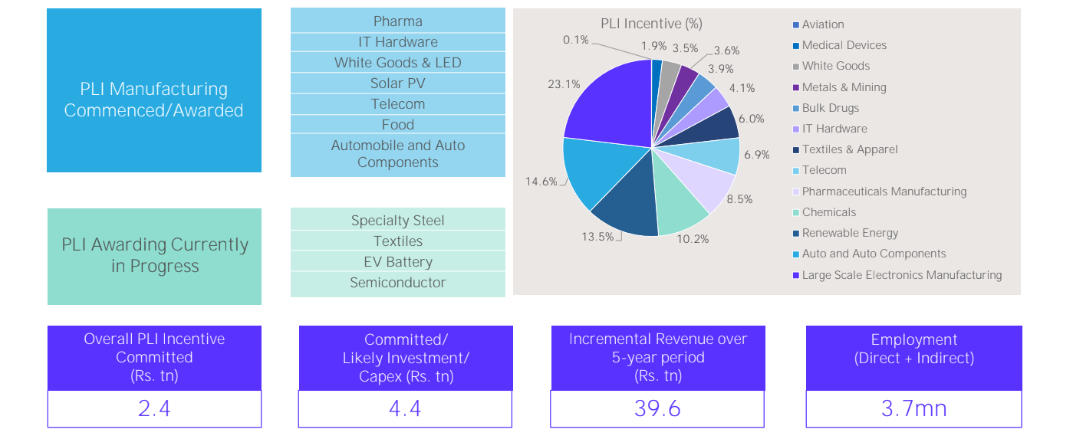

PLI Scheme – A Catalyst for Private Sector Investments

- PLI should garner cumulative capex of ~Rs.4.4tn over the next 4-5 years & could fast track the capex plans from the private sector.

- Revenue addition of ~ Rs 8 tn per year, leading to a 10% addition to current BSE 500 revenues (~ Rs 88 tn).

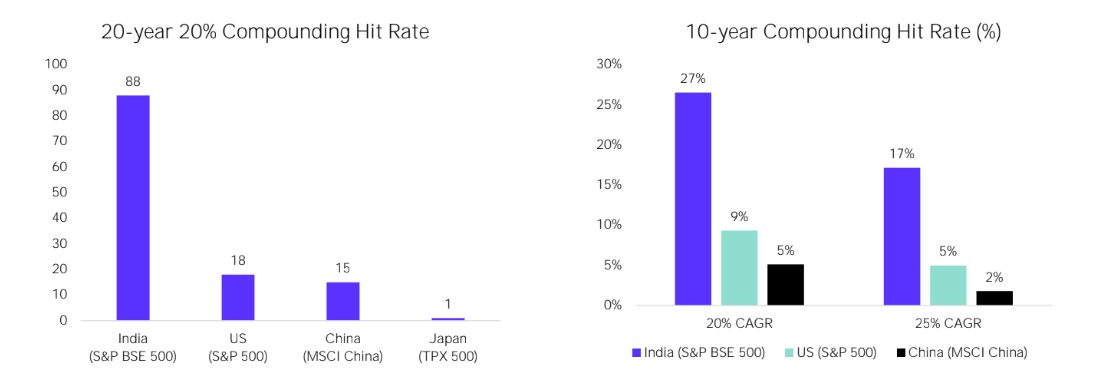

India’s Stock Market – A Compounding Machine

- The importance of investing in compounding stocks is well known

- Indian companies stand out over the long term

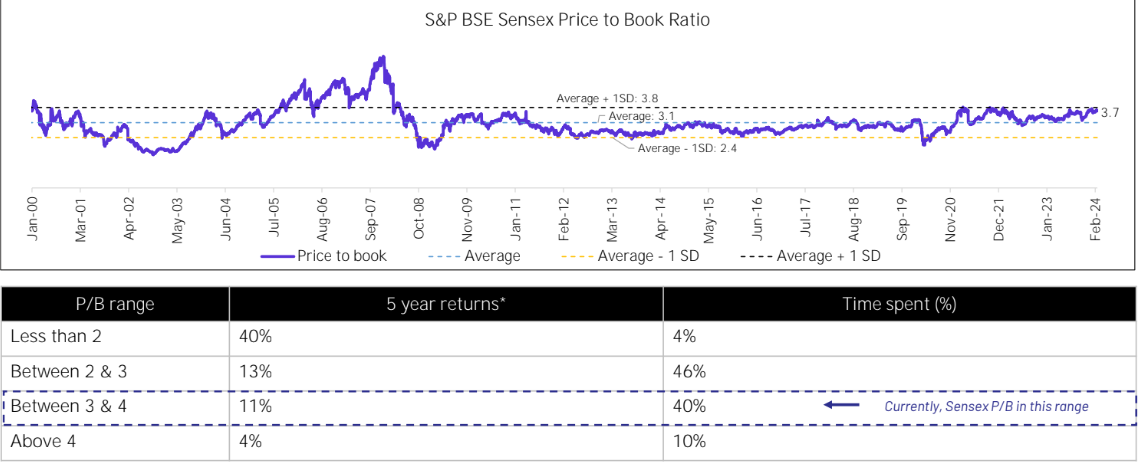

Current Valuations

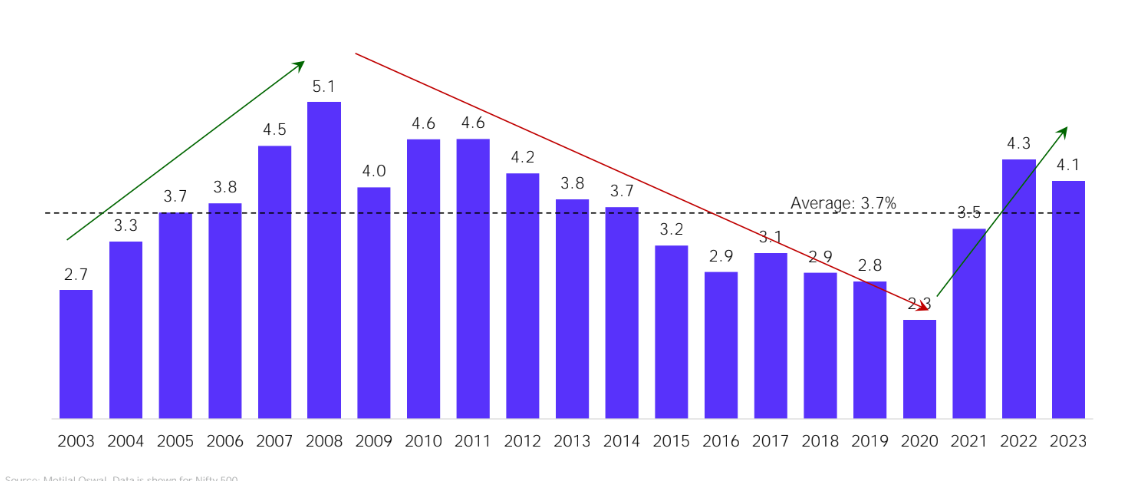

Corporate Profits to GDP (%)

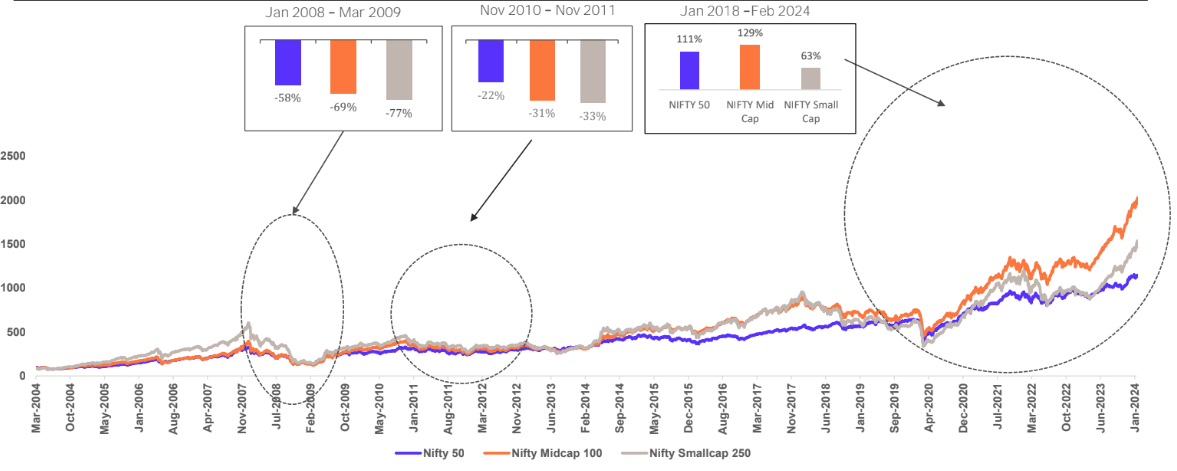

Market Cap Allocation vs Volatility

- During periods of higher volatility, large cap stocks have outperformed mid and small cap stocks.

Investment Framework

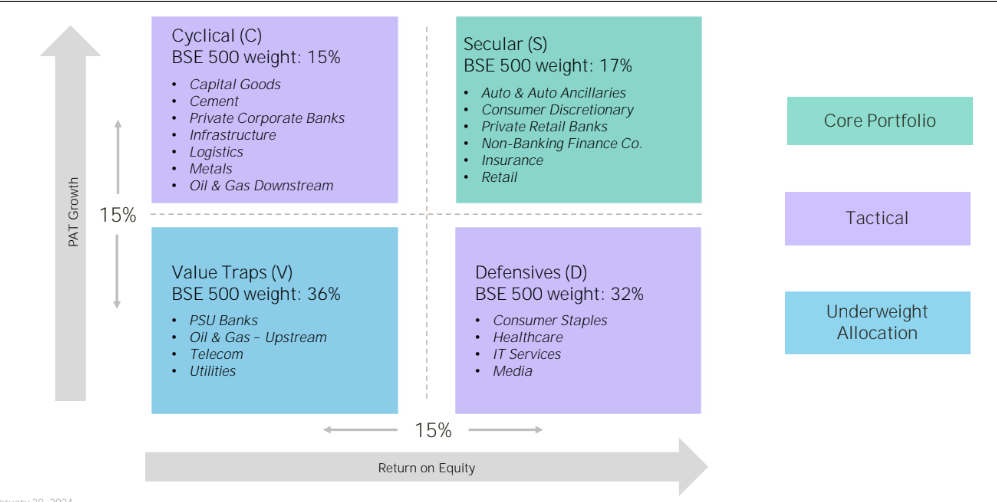

SCDV Framework

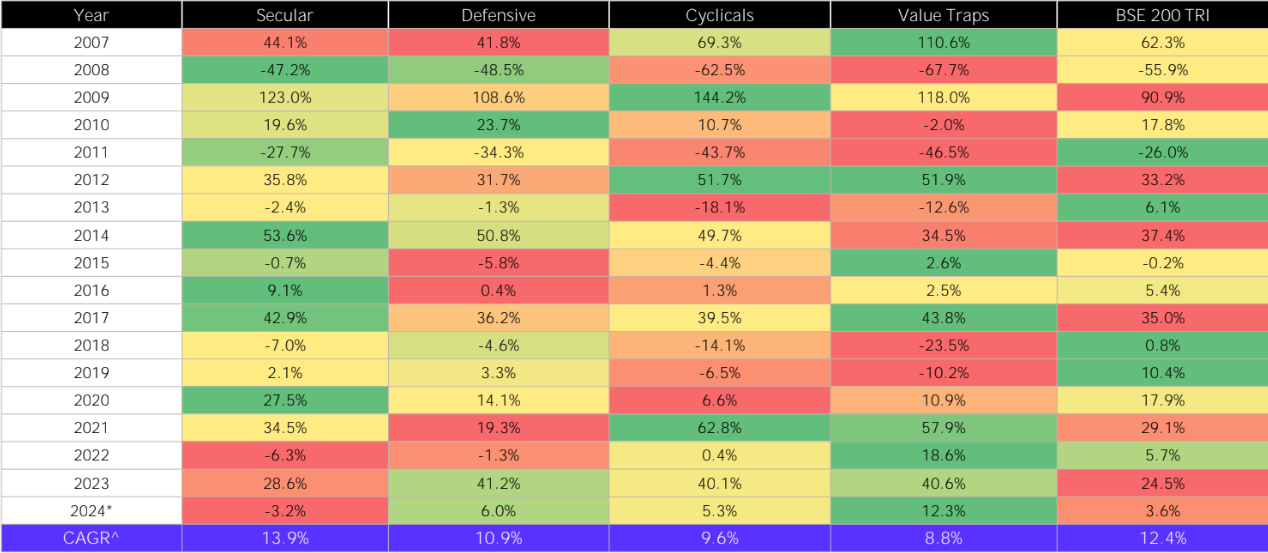

SCDV Historical Performance

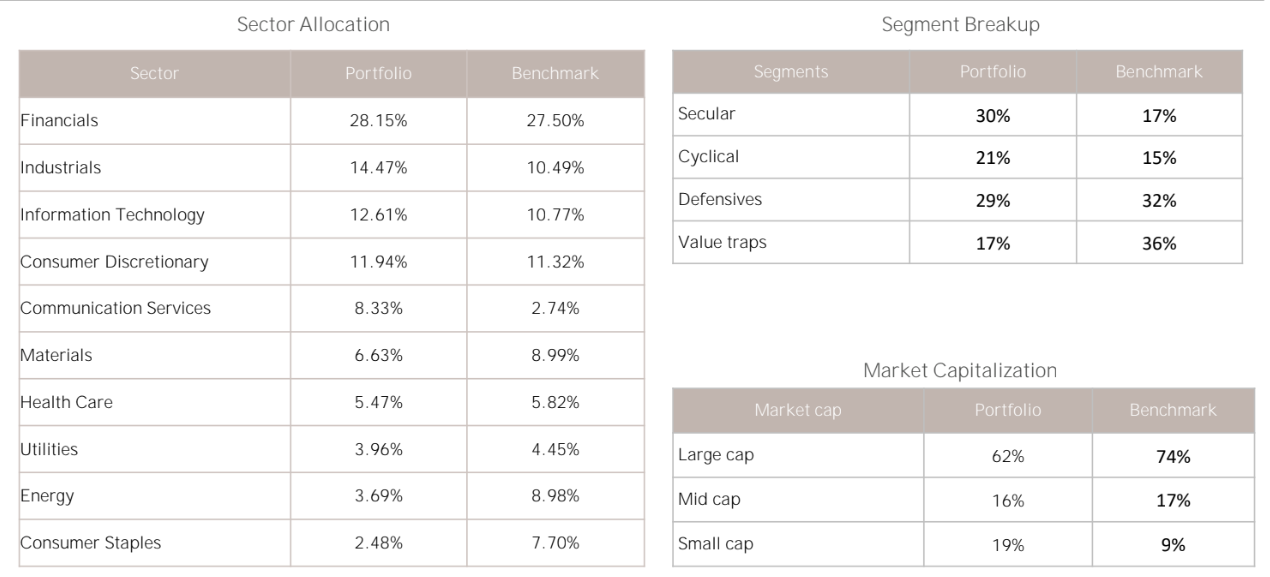

Portfolio Snapshot

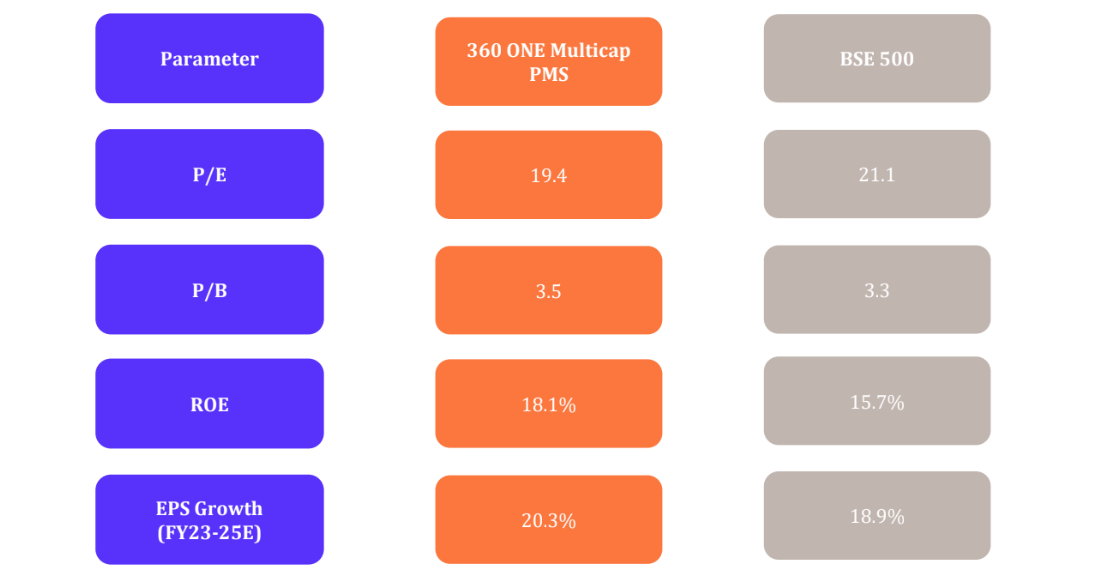

Portfolio Quants

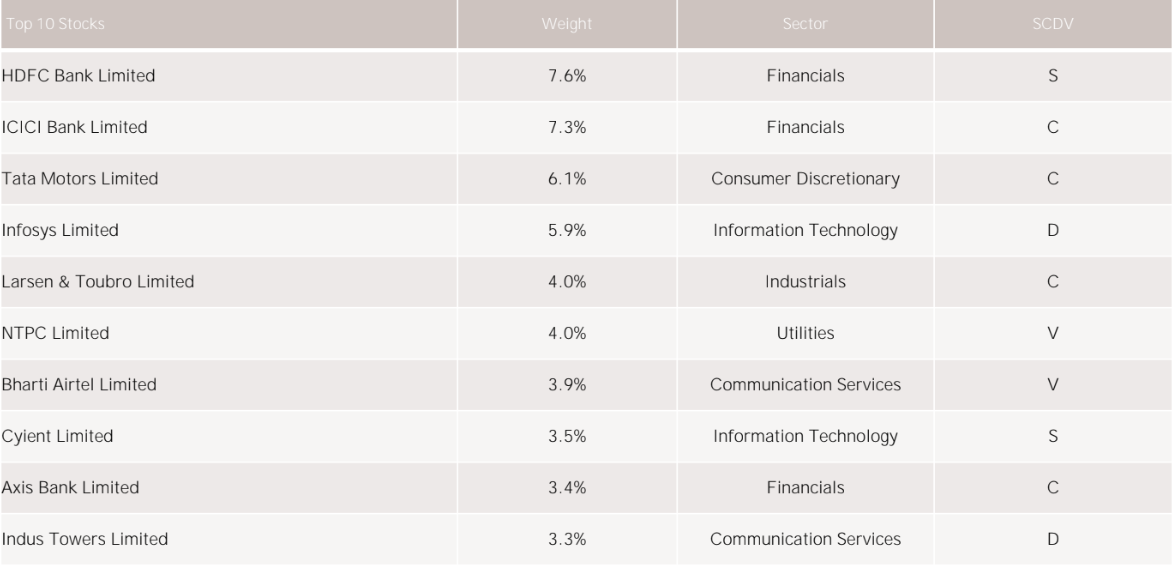

Top Ten Holdings

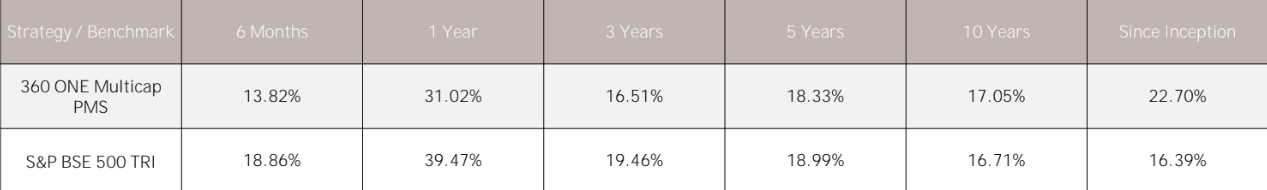

Performance

Key Terms

- PORTFOLIO MANAGER: 360 ONE Asset Management Ltd. (360 ONE AMC)

- INVESTMENT OBJECTIVE: The objective of the investment approach is to generate long term capital appreciation for investors from a portfolio of equity and equity related securities. The investment strategy is to invest in a portfolio following the SCDV framework (Secular, Cyclical, Defensives, Value Trap) wherein it invests a large proportion of the portfolio in high quality Secular growth companies which are long term compounding stories. Rest of the portfolio is invested across quality Cyclicals and Defensives while avoiding Value traps. Portfolio construction across these three quadrants enables us to enhance diversification even with limited number of stocks.

- MINIMUM INVESTMENT AMOUNT: INR 50 Lakhs

- MANAGEMENT FEE: As per executed term sheet

- BENCHMARK: S&P BSE 500 TRI

- BROKERAGE: Cash - 0.12% of transaction value (plus applicable statutory levies)

- OTHER CHARGES: Statutory/Other charges as applicable levied on actual basis (STT/Demat/Goods & Service tax/audit/custodial charges etc.)

- EXIT FEES: As per executed term sheet