360 ONE Phoenix PMS Portfolio

Executive Summary

- Businesses often witness short-term cycles of decline in profitability and growth, due to several factors like:

- Suboptimal capital allocation

- Policy & regulatory changes

- Behavioral shifts

- Weak economic activity

- These short-term disruptions often provide opportunities to invest in businesses with quality managements and strong performance track records.

- These companies have the potential to recover and mean revert to their long-term growth trends.

- The reversal in fundamentals is usually accompanied by strong improvement in financials and wealth creation opportunities for early investors in the turnaround cycle.

- 360 ONE Phoenix Portfolio intends to create a portfolio of such businesses with an established track record, which have the potential to see a sharp improvement in fundamentals in the future

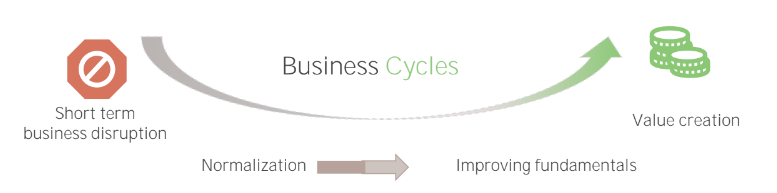

Business Cycles - Explained

Invest in businesses having the potential to revive growth and create value

- Businesses may witness disruption or downturns due to multiple factors

- Firms react to these downturns by making strategic, organizational, operational or financial changes

- The strategy intends to identify and invest in such businesses which are taking steps to revive growth and create long term value

Turnaround Cycle- Stages (1/3)

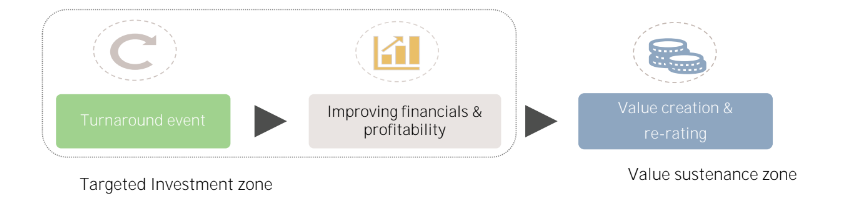

A business turnaround cycle has 3 main stages:

Proactive identification of investment opportunities can be in stages:

Turnaround event is about to occur

Turnaround event has occurred and may have positive implications on business

Post turnaround event, improved visibility on business fundamentals creating investment opportunities

Improved fundamentals usually unlock value in the businesses

Re-rating & Value Sustenance After a successful turnaround, sustenance of turnaround factors may further lead to compounding of value, creating new highs for the business

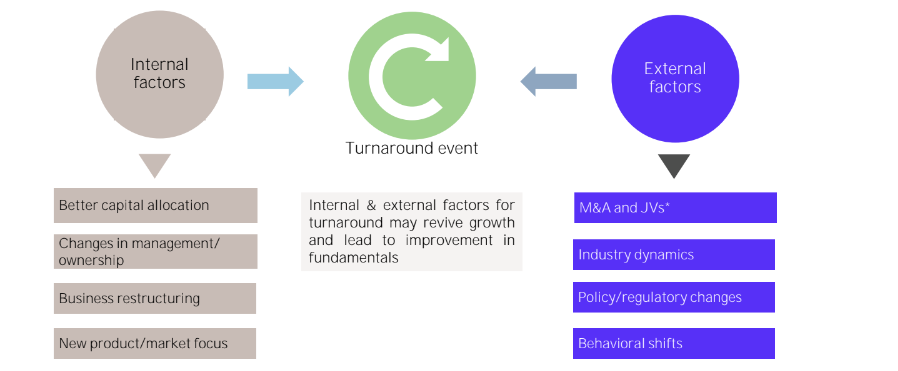

Turnaround Cycle - Factors For Turnaround(2/3)

The turnaround cycle is initiated by a turnaround event which may be internal and/or external

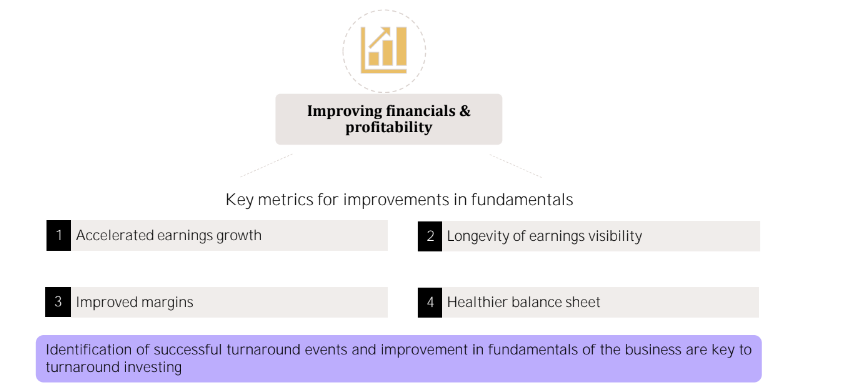

Turnaround CYCLE – improving financials (3/3)

The turnaround events may revive growth and improve fundamentals of the business

360 ONE Phoenix Portfolio - Stock Selection Criteria

Upgrade in quadrant (SCDV)

Lower profitability vs historical trends

Proven track record and capital efficiency (ROE > 15%)

Trading at a discount to historical valuations

Changes in management / ownership

Forensics/ Strong governance

Stocks where price correction has occurred

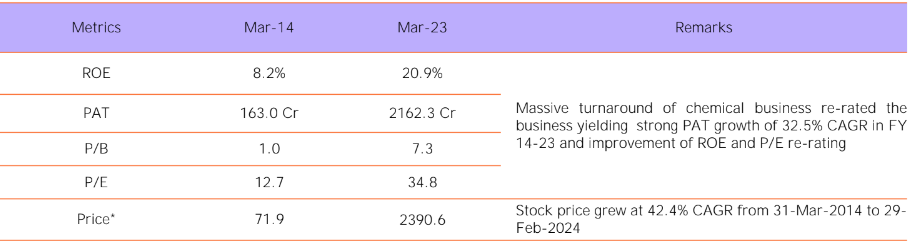

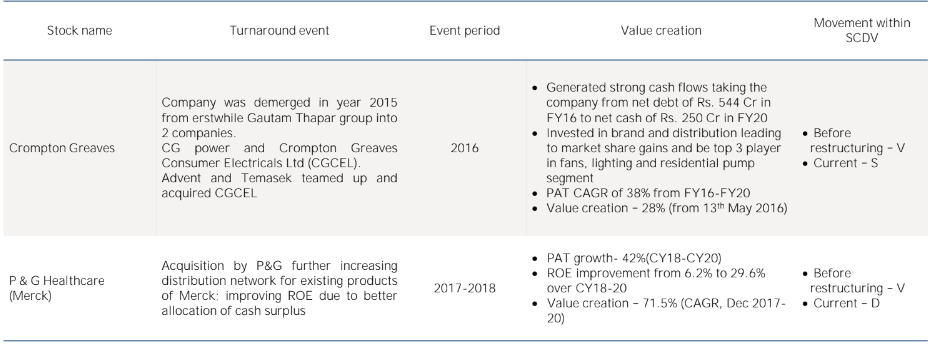

Case Study - SRF Ltd. (1/2)

SRF Ltd. is a leading manufacturer of industrial and specialty chemical intermediates

Event Period 2010-2012 What went wrong? SRF's largest division in 2012 was Technical Textiles, which had long term declining fundamentals. Its packaging films division was cyclical in nature. Historically, ROEs were structurally low due to its capital allocation towards these two businesses.

Catalyst Entry into high growth and margin chemical business - The company used cash flow from its sale of carbon credits and deployed it into setting up fluoro-specialty chemical business enabling the company to expand revenues and profit

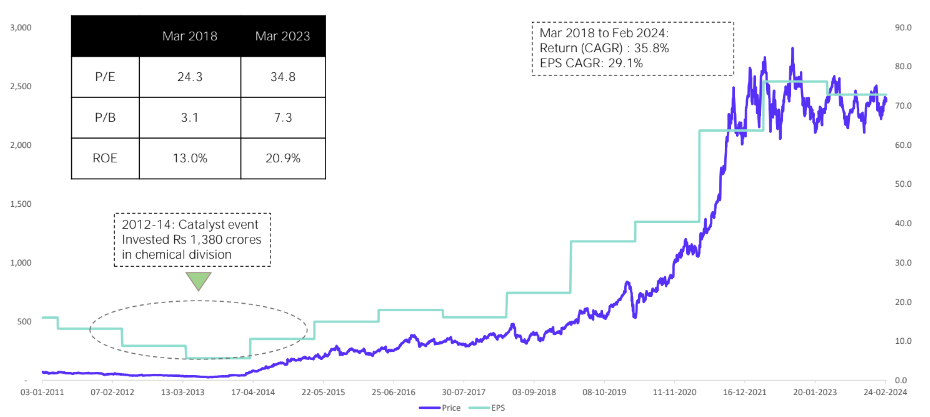

Case Study – SRF Ltd. (2/2)

SRF Ltd. stock price movement (INR)

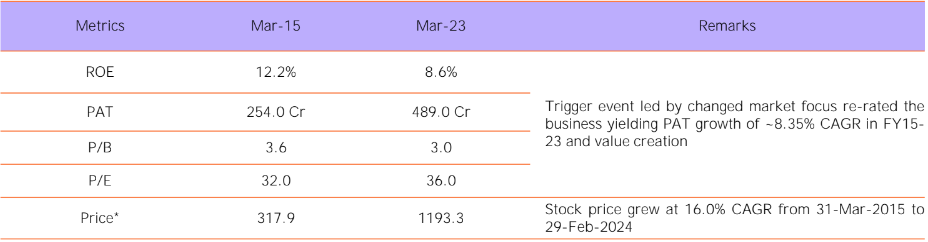

Case Study – IPCA Ltd. (1/2)

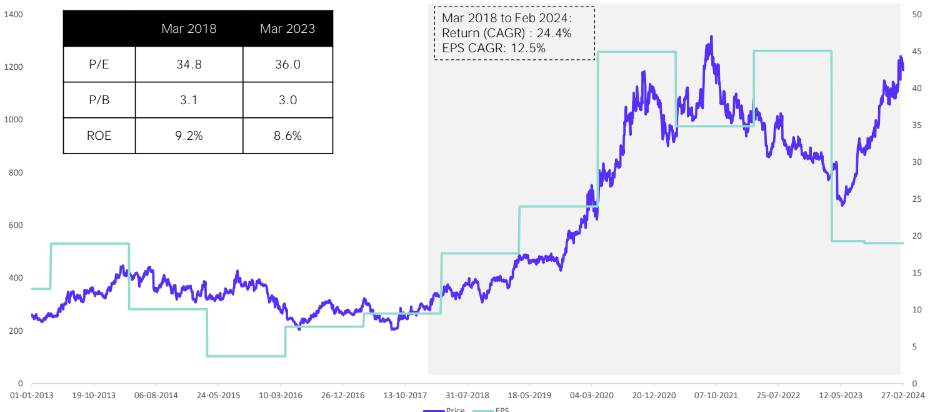

The firm is a pharmaceutical company manufacturing APIs and formulations What went wrong? In July-14, Ratlam API plant received a serious 483 from USFDA highlighting data integrity issues which got converted to an import alert in March-15. As a result, IPCA had to stop export of US formulations as well as API exports to other countries causing collapse of margins and revenue. Trigger event Change in market focus strategy the firm increased focus on India business and took steps to improve operating leverage on ex-US business opportunities.

Case Study – IPCA Ltd. (2/2)

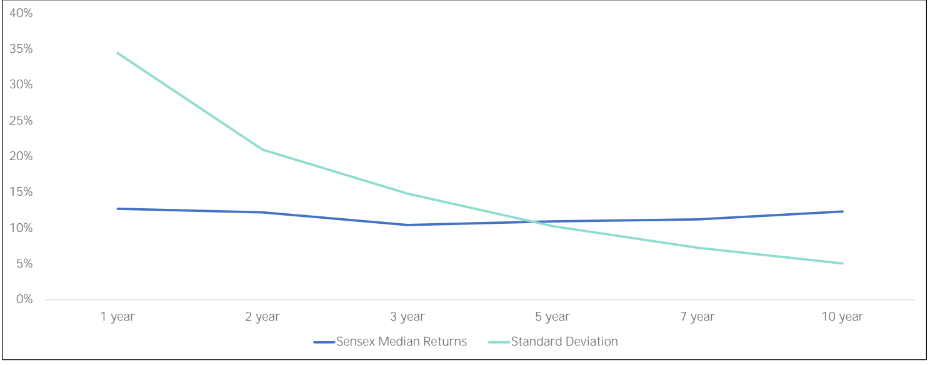

Relation Between Time, Volatility And Returns

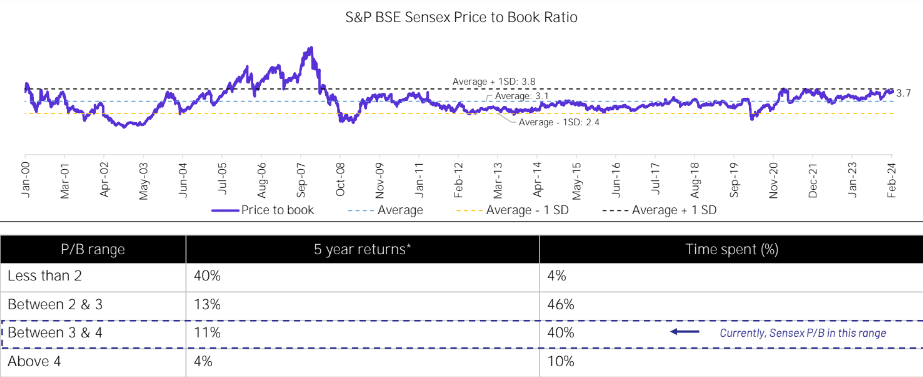

Current Valuations

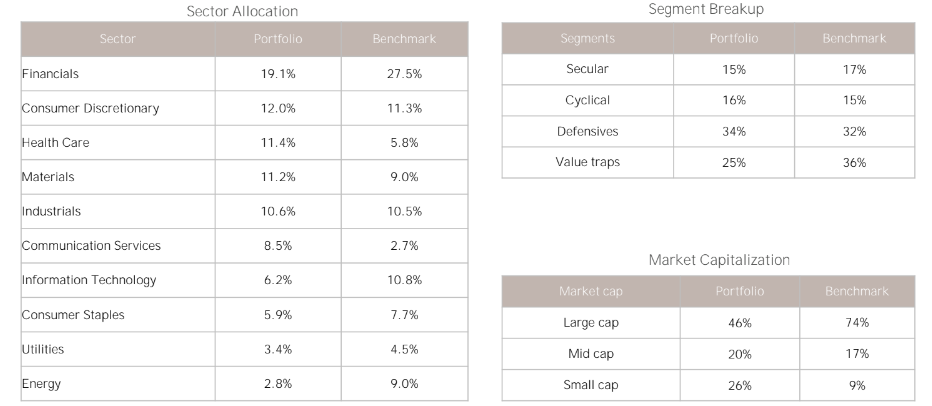

Portfolio Snapshot

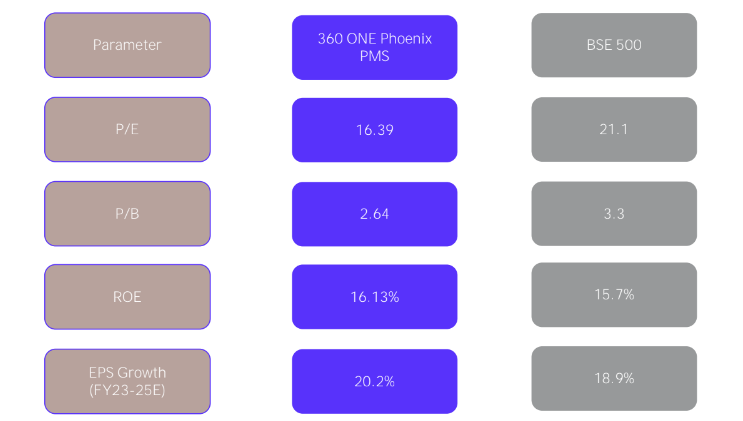

Portfolio Quants

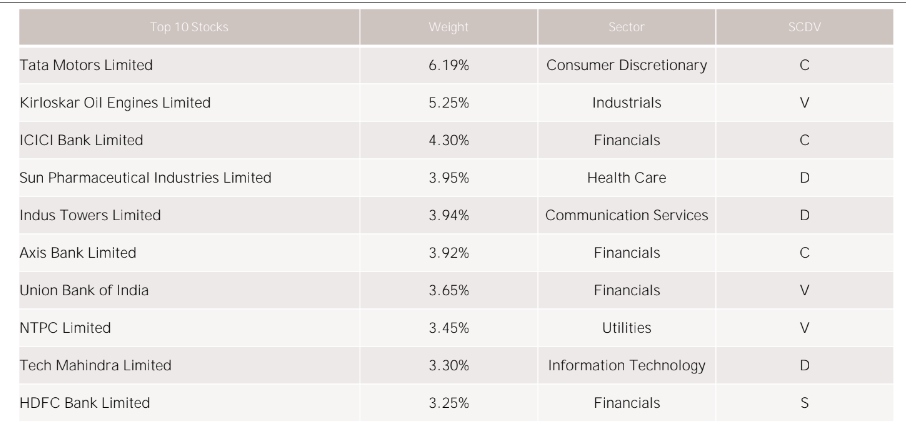

Top Ten Holdings

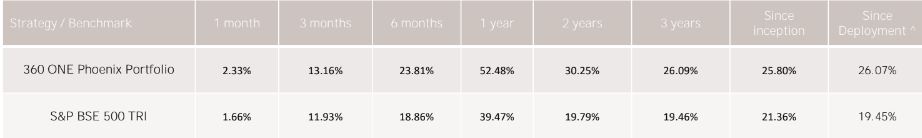

Performance

Investment Team & Key Terms

Public Equity Team Structure : Fund Management

Building A Collaborative Team That Brings Together A Unique Set of Skillsets

- Anup Maheshwari- Co-founder & CIO (28) MBA

- Anup brings with him 28 years of investment experience. He joined 360 ONE Asset Management Limited (formerly known as IIFL Asset Management Limited) from DSP Investment Managers Private Limited (formerly known as DSP BlackRock Investment Managers Private Limited) in August 2018.

- He was associated with DSP BlackRock since July 1997 and was last designated as the Chief Investment Officer, Equities.

- For a brief period between December 2005 and May 2006, he was the CIO at HSBC Asset Management before returning to DSP BlackRock. Previously he was also associated with Chescor, a British fund management firm managing three offshore India equity funds. Anup is an alumnus of IIM Lucknow

- Fund Managers

- Mehul Jani (19) (Financials & Consumer Staples) MSc, CFA

- Mayur Patel (18) (Oil & Gas and Industrials) CA, CFA

- Nishant Vass (14) (Automobiles, Telecom, Internets) MBA

- Parijat Garg (16) (Quantitative Research, ESG) M.Tech, CFA

Key Terms

- PORTFOLIO MANAGER: 360 ONE Asset Management Ltd. (360 ONE AMC)

- INVESTMENT STRATEGY: The objective of the investment approach is to generate long term capital appreciation for investors from a portfolio of equity and equity related securities. The investment strategy is to invests in businesses having long- term track record where profitability and growth may have been impacted by short term cycles. The investment manager would target such opportunities having long-term mean reversion capability, having potential for sharp improvement in fundamentals.

- MINIMUM INVESTMENT AMOUNT: INR 50 Lakh

- BENCHMARK: S&P BSE 500 TRI

- BROKERAGE: Cash - Up to 0.12% of transaction value (plus applicable statutory levies)

- MANAGEMENT FEE, EXIT LOAD: As per term sheet signed

- OTHER CHARGES: Statutory/Other charges as applicable levied on actual basis (STT/Demat/Goods & Service tax/audit/custodial charges etc.)