Abbakus Asset Manager LLP

Abakkus is a boutique asset manager with a concentration on alpha that oversees INR 13,000 crores in long-only strategies for Indian stocks. Their services consist of:

- Close-ended Category III Alternative Investment Funds

- Portfolio Management Services

- Advisory Services for Domestic and Global Investors Abakkus has made a name for itself in the Indian equity horizon in only five years, both in terms of performance and asset development. Their goal is to eventually establish Abakkus as one of the most prestigious and successful asset managers in India.

Mr. Sunil Singhania

- Mr. Sunil Singhania is the Former CIO Equities of Reliance Nippon Life Asset Management (now Nippon Life India Asset Management) overseeing ~USD 11 billion of equity assets.

- First Indian to be appointed to the Global Board of CFA Institute, USA (20132019)

- Ex-Honorary Chairman of the Investment Committee of CFA Institute (2018-19)

- Currently on the IFRS Capital Markets Advisory Committee (CMAC) and the only Indian member to be appointed (2020-2023)

- Rated as among the best fund managers (Rated best Fund Manager by Outlook Business in 2016 & 2017 over a 10-year time frame)

- CA & CFA Charter Holder

Aman Chowhan (Senior Fund Manager)

Aman heads the investment team. He has 22 years of Indian equity experience of which 13 years he has worked with Sunil Singhania at Reliance Nippon Life Asset Management (now Nippon Life India Asset Management) under various roles. Previously he was the Portfolio manager for all local and offshore schemes for the PMS division of Reliance Nippon Life Asset Management (now Nippon Life India Asset Management) During 2006 – 2013. He was based at the Singapore office of Reliance which helped him gain a regional and global perspective for investing in India. He has a strong track record across long-only, absolute, and long-short strategies across market cycles. Before joining Reliance in 2004 he was part of the research team at TAIB Securities, Tata TD Waterhouse, and other brokerage firms Aman holds an MBA degree in Finance from Mumbai University.

Deven Sangoi (Senior Fund Manager)

Deven is Senior Fund Manager at Abakkus. He brings a rich experience of 22 years on the asset management side, out of which 10 years in the mutual funds space and 12 years in the insurance industry. His previous assignment was as Chief Investment Officer (CIO) of Canara HSBC OBC life, managing both Equity and Fixed Income with a corpus of around USD 4 bn (INR 25,000 Cr). Previously he worked with many reputed organizations in the financial service space which include names such as Aditya Birla Sun Life Insurance Ltd, Aditya Birla Sun Life Asset Management Co. Ltd, ICICI Prudential Asset Management Co. Ltd & Canara HSBC OBC Life Insurance. He graduated in Electronics Engineering from Mumbai University and holds a postgraduate degree in Finance from Newport University.

Investment Approach

Abakkus is an investing firm that focuses on alpha and uses an untested investment strategy. Their investment strategy focuses exclusively on fundamentals, and they typically hold investments for three to five years. In light of this context, they have developed a portfolio of firms with stable values and solid earnings growth visibility.

Investment Philosophy

Alpha Generators

- Believe in investing with an endeavour to generate alpha over the markets rather than just allocating within the benchmark index

- Growth companies where profitability is expected to grow higher than the market average.

- Fundamentally under-priced stocks with reasonable growth expectations

- Mid Cap companies with a scalable business model and growth potential to become large-cap

Fundamental Driven

Bottom-up research with a focus on the balance sheet

- Numbers speak more than presentations and hype.

- Returns ultimately are all about earnings

Happy to be contrarian

- Prefer to be first, early, and/or only investors.

- Do not chase the momentum

- Open to looking at companies across sectors and market caps and business cycle

Agile and Flexible

Each investment opportunity is looked upon individual merit

- Not constrained to a particular theme or style

Patient Investors

Buy and hold

- Invest in stock as if investing in a business

- Think like a partner

Risk Reward Equation

- Expected returns must justify the risk/uncertainty taken

- A good company might not necessarily be a good stock

- Focus on the price they pay, and value derived

- What is in the price

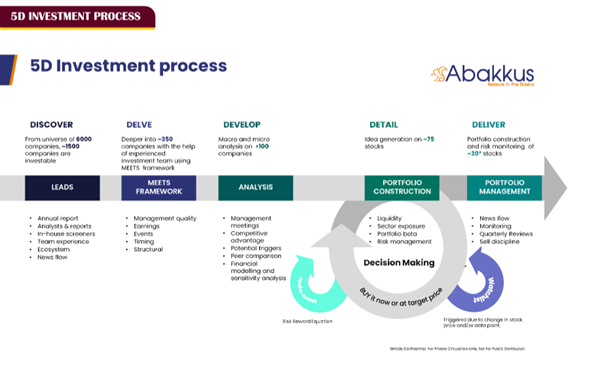

Meets Framework

They have a sizable, knowledgeable investing staff that is supported by a team of competent, committed professionals with a combined expertise of about 200 years. They carefully follow their MEETS methodology, which stands for management, earnings, events, timing, and structural opportunities, while investing in businesses with a focus on alpha production.

Management

a. Quality - Capability and track record b. Capital Allocation – capex is fine if ROE is maintained or enhanced c. Capital Distribution – fair to minority shareholders d. Error in decision – Business errors vs avoidable mishaps

Earnings

a. Quality of earnings vs reported numbers b. Actual earnings vs expected c. Cyclical vs Structural earnings d. Companies that can double profits in 4 years or less or where EV/EBITDA can halve in four years

Events/Trades

a. Management meetings b. Com Stock movement because of events c. Can be a Buy or Sell opportunity d. Events on the horizon e. Disruptive trends/New themes

Timings

a. Good company is not necessarily a good investment if the price is not right b. What is the price discounting? c. The time frame of investment d. Mean Reversion 01 05 02 03 04 Management Structural

Structural

a. Size of the opportunity b. Competitive positioning / MOAT c. Consistent growth in profits

ABAKKUS ALL CAP APPROACH (PMS STRATEGY)

Abakkus's All Cap Approach fund follows their unique "MEETS" investment philosophy and is a Benchmark agnostic diversified portfolio. With an emphasis on stocks that potentially quadruple their earnings in the next 4-5 years, it concentrates on bottom-up investing ideas. Typically, the portfolio will have a 30–50% allocation to large caps and larger mid–caps, with the remaining holdings in broader markets. The portfolio aims for respectable profit growth of at least mid-teens, without overvaluing any stocks. Due to the fact that the majority of these names trade at a large premium to market levels and are perfectly priced, you won't often find them in the portfolio, either. While their mid-cap exposure typically involves investing in companies that are second or third in their industry, but well-known players nonetheless, and that have a sustainable business with over 15% ROEs, their focus within the large-cap sector is on investing in companies with earnings visibility and that are slightly contrarian to industry peers.

We conducted an exclusive interview with the Abakkus Asset Manager LLP team in order to know their PMSs in-depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

Both of your PMS strategies "All cap approach" and "emerging opportunities" have beaten the benchmark since its inception. How to you manage to produce alpha despite the global macros" volatility?

As a bottom-up investment firm, we place a strong emphasis on alpha. Our emphasis is on investing with a long-term performance perspective that is fundamentally driven and value aware. We steer clear of following trends and do not prioritize breaking news. In light of this context, we have developed a portfolio of firms with solid earnings growth visibility, reasonable valuations, and an investment strategy independent of benchmarks. Regardless of how much weight they have in the index, there are several sectors to which we have absolutely no exposure. The emphasis is on being "rightly deployed" as opposed to hastily "fully deployed." The goal is to invest wisely rather than only on an allocation basis, which has in the past produced risk-adjusted returns. These elements all worked together to enable us to produce the alpha. We place a strong emphasis on earnings growth, and since the fund's inception, portfolio firms have produced growth that is superior to the benchmark, which has aided in their re-rating.

From the perspective of volatility, it is in the nature of equities markets to continue responding to various news flow and feelings. Mid and small caps in particular stocks may have a tendency to underperform in the near term in response to mood and liquidity in conditions of excessive volatility on both sides for reasons that are both global and local. The strategies often succeed throughout phases of recovery and economic recovery over a 3-5 year time frame since they are focused on underlying earnings growth together with valuation expansion.

Where is the margin of safety in the kind of an environment and how can one really make a bullet-proof portfolio in this volatile market for an investor?

According to our experience over the past 25–30 years, no portfolio can be impenetrable. Safe stocks don't even exist. Various industries and stocks are highlighted at various times. IT and digital companies may have been viewed as a good area to invest a year ago, but they are currently the sector with the lowest performance. The financial industry, which is now hot, had the worst performance in the first half of last year. There are also certain high-quality "growth" corporations with premium valuations whose growth is comparable to or less than the nominal GDP growth of the nation. In these cases, either a time correction or a price adjustment, or both, may be justified.

The profitability, growth, and return measures of the company you buy, as well as the price you pay for it, are two sources of margin of safety. We tend to pay value that should be in line with the potential future profitability of the company because we are value-conscious investors. We want to invest in companies with respectable ROE of over 15% and potential for profit growth of up to 15% over the course of 4-5 years. The likelihood of a significant decrease in capital over a longer period of time is minimal if you have not overpaid in terms of value.

How is ESG factor incorporated in your portfolio? As the investors are also evolving, how well has these have received by the investors?

We have taken on the responsibilities and resources necessary to bring about real change because we believe in the idea of an environmentally and socially sustainable future. One of the few asset managers that is carbon negative across the board is Abakkus Asset Manager LLP, a bronze signatory to the UNFCC initiative Climate Neutral Now Pledge. The PMS strategies managed at this time don't have a clear ESG mandate from the perspective of portfolio investments. However, the entire investment process considers ESG factors. The MEETS framework and business fundamentals do include aspects of governance and disruptive trends, assuring the longevity of the enterprise.

The governance and sustainability aspects of business, including corporate governance and behaviour such board quality and effectiveness, are covered in the analysis of M (Management) and E (Earnings). The category of events (E) includes disruptive trends like climate hazards, resource constraints, pollution and waste, and environmental opportunities. By incorporating sustainability into the Framework, it is ensured that: - Opportunities and risks within portfolios are identified. - Improving the effectiveness of the investing process to include broader goals beyond merely financial measures and valuation.

Can you brief us on 15:15:15 investment discipline considered while stock picking?

The 15:15:15 rule was developed as part of the Abakkus Emerging Opportunities Approach to integrate all three important components of return measurements, growth, and value into a framework for investment discipline. Through this framework, we can attempt to use this discipline to ensure that risks are reduced over a period of 4-5 years through a fundamentally based investing strategy. The goal of this framework is to achieve a good equilibrium between the three main variables that, in our opinion, influence stock performance. Investment discipline is to focus mostly on businesses that at the time of the investment meet at least two of the three criteria.

- 15 P/E Ratio

15% ROE

- < 15% Earnings Growth

What are the factors should an investor should beware off while investing in this volatile market? Investing in the equity market involves volatility. Investors should pay close attention to return indicators, company quality, and the cost of the firm. In terms of equities markets, volatility has always been the name of the game. Global news flow is currently highly intense. As a result, future returns won't be linear either. Everyone dislikes deep corrections, as is obvious given that we are all fundamentally bullish on the equity markets.

The increased worldwide news flow makes the corporate climate highly dynamic and difficult. Last year, we witnessed severe corrections in commodity prices, regular Chinese lockdowns, and the Russia-Ukraine crisis, all of which had an influence on energy prices and disrupted international supply chains. Interest rates are rising by 3-4% in a year, whereas in the past it would have taken 2-3 years. Additionally, business cycles are getting shorter. It is wise to avoid a buy-and-forget strategy in this situation for ten years. We should consider how our lives are evolving and make investments in line with that. Therefore, the key would be to invest in companies that we like while taking advantage of market and stock level volatility.

Over the past 18 months, Indian stocks have not delivered any returns. This has caused the values of the Indian markets to approach the 10-year trend, along with the profits increase of roughly 25% over that time. Currently, the NIFTY50 trades between 18 times and 16 times the prior year's earnings, offering prospects to make respectable gains. The severe decline in broader markets has also created opportunities for investors to produce alpha—returns above those of the market—by picking fewer well-known companies.

Our exit discipline:

- Fundamentals don’t pan out as expected due to sector deterioration, company specific issues, governance issues.

- Not shy to accept when thesis goes wrong.

- Stocks may do much better than expected.

- Position becomes insignificant and can’t /don’t want to add.

- New investment idea better than existing holding in terms of risk reward.

Today's focus is on financial services sector and the products it offers. We have seen significant increase in number of demat accounts in our country. It seems that the people are increasingly investing in financial assets. What are the trends are you observing in this sector moving forward?

In this country, equity market investing has come a long way. The value of long-term investing and systematic equity investing has been recognized by highly mature investors. The SIP book has reached INR 13,000 crore as of right now. From the standpoint of the economy, this controlled investment flow is excellent for supplying risk capital. Along with mutual funds, a significant number of investors are also interested in other products like AIF and PMS. India has emerged from the instability in the world as one of the top economies with the quickest growth rates. We are in a great place going forward because the growth rates are anticipated to pick up.

There are more growth pillars in the economy today than there were when we were solely dependent on consumption. The four pillars of the India Story are democracy, demographics, domestic consumption, and digitization, which is among the greatest in the world. Democracy is supported by pragmatic government expenditures and policies, a growing working-age population, and abundant product offerings. Along with the robust domestic flow, India is attracting a lot of global investment. In the past, we have received flows as a component of the total Emerging Markets basket. According to our opinion, future flows specifically to India should also rise. We are now highly optimistic and think that the coming two years could be beneficial for investors in Indian equities.