Finance

Accuracap Alpha 10 PMS

Executive Summary

- Company

- Started as Family Office in 2009 to manage its own funds. Based out of New Delhi

- Managing Public Funds since 2011

- Product

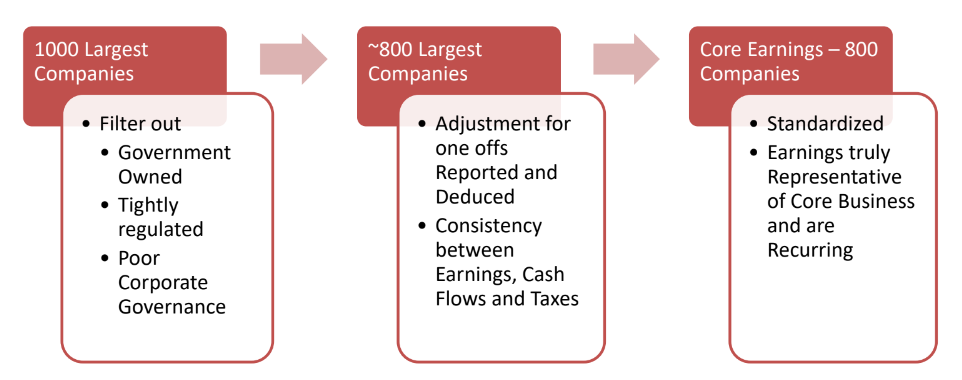

- Diversified Long Only PMS. Four focused Schemes – Large, Mid & Small, Micro and MultiCap

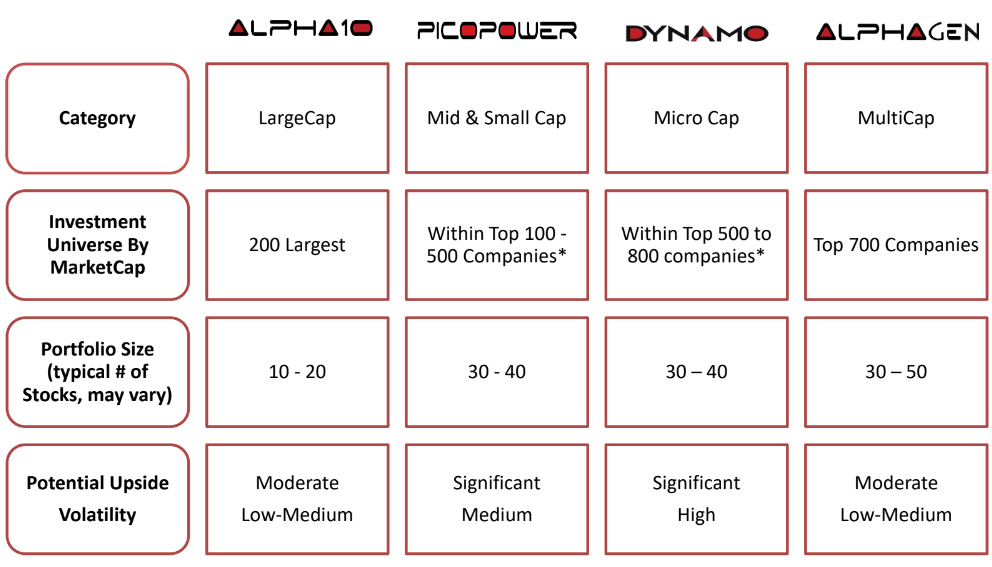

- Stock selection based on fundamental and technical parameters using a proprietary algorithm developed over 10 years

- Performance

- Schemes have outperformed the benchmark and most comparable funds over many periods

- Exceptional Risk-Adjusted-Returns per Morningstar study

- Pedigree

- Founders & Senior Management - Renowned Business Executives and Eminent Computer Scientists

- Part of Global Executive Leadership team and Managed large Businesses at Adobe – a Fortune 500 company - for two decades

Portfolio Philosophy Based on Deep Science

- Objective

- Own diversified portfolio of typically 12 – 35 high quality Companies

- Intelligent Ranking Algorithm

- Stock Selection Based on Proprietary Ranking Algorithm

- Back Tested on data from Jan 1, 1999 and deployed in market since 2009

- Blend Business Growth, Stock Value, and Stock Price Momentum while Controlling Risk

- Comprehensive Valuation Analysis

- Strong focus on Business Fundamentals

- Long Term Earnings trend

- Strength of Balance Sheet

- Risk Management

- Promoter Risk

- Business Growth Risk

- Solvency and Liquidity Risk

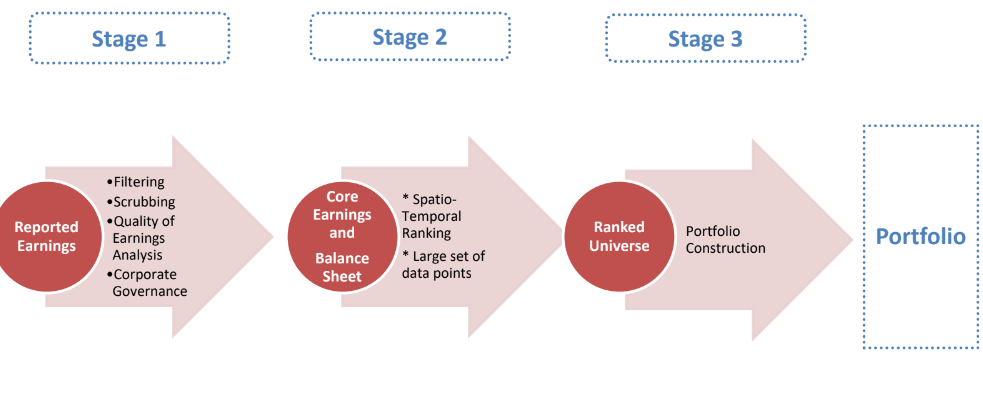

Investment Process

Stage One: Core Earnings

Stage Two: Factors For Model Ranking

- Growth

- Revenue, Core Earnings and Cash Flows

- 20 Quarters Trend Analysis

- Adjusted for Seasonality

- Core Strength & Risks

- Trend Analysis of Margin and Return on Capital Employed

- Strength of Balance Sheet, Solvency, Liquidity

- Delta between Cash Flows and Earnings

- Return on Marginal Invested Dollar

- Stock Price Momentum over Short / Mid / Long Term

- Valuation Relative To

- Universe

- Peers

- History

Stage Three : Portfolio Construction

Disciplined Approach to Portfolio Management

What we Do

- Mostly Fully Invested. No attempt to time the Market

- Portfolio is rebalanced on the basis of stock rankings

- Stock exits the portfolio if the rank is below cut-off on the rebalance date

- Exiting Stock is replaced by the new high ranked stock while keeping number of stocks in portfolio manageable

What we Would NOT Do

- Short Term Investments, Derivatives or Leverage

- Develop Personal Relationships with managements of investee companies

- Invest Based on Stories, Tips, or Whispers

- Invest in Public Sector Company

- Invest in Fad or Hot Sector

- Invest in IPOs

Summary : Investment Philosophy & Process

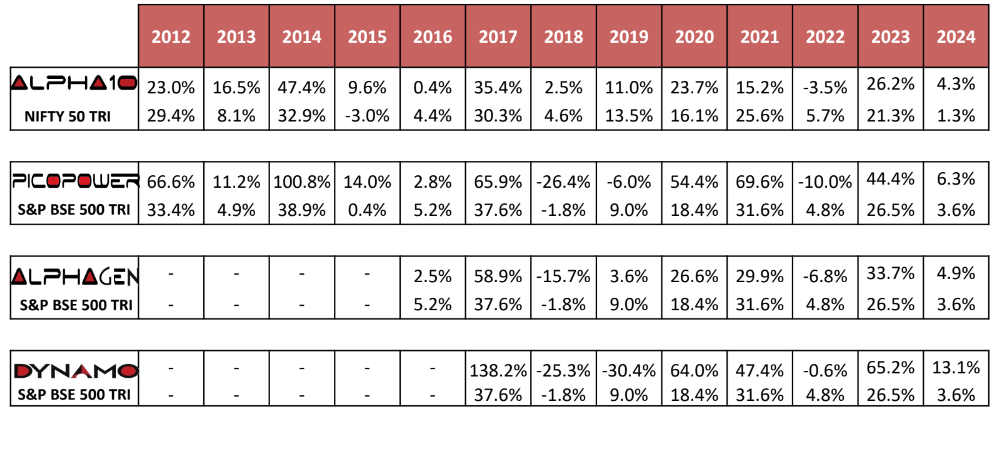

Y-o-Y Returns - on 29th Feb 2024; Net of all Expenses /Fees

Absolute Returns - on 29th Feb 2024; Net of all Expenses /Fees

Quartile Analysis by APMI - on 29th Feb 2024

Three years Rolling Returns - PicoPower & Alpha10

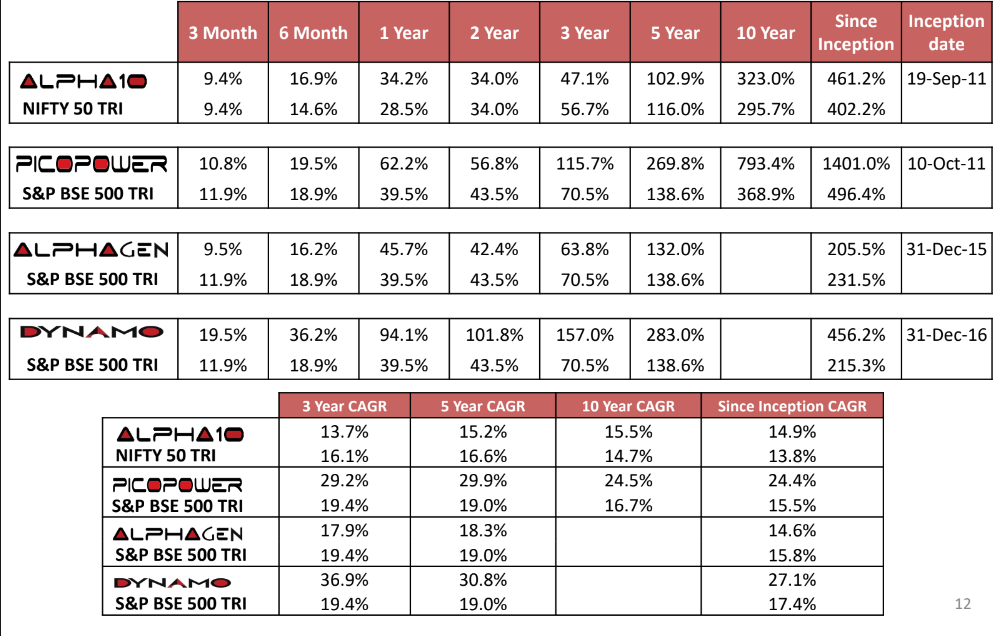

Quarterly Returns – Pico Power

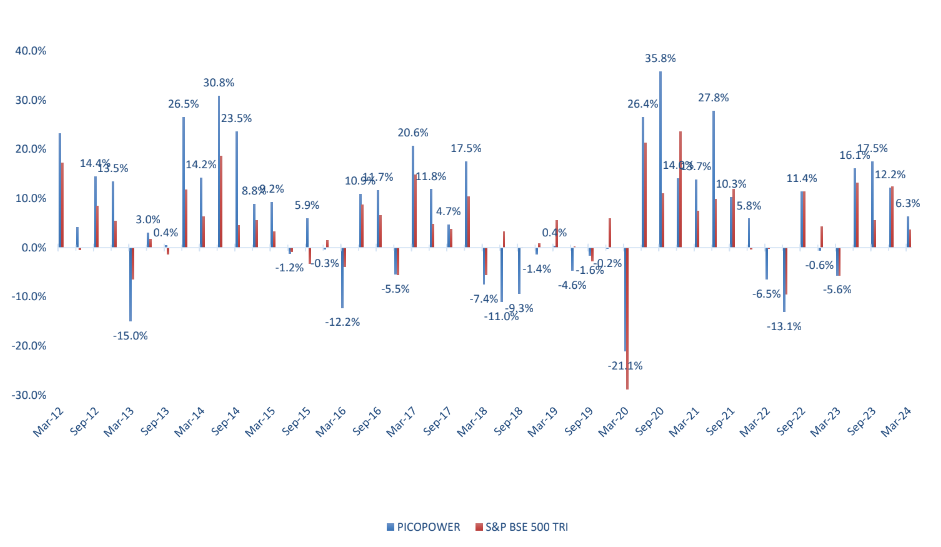

Comparison Peer Mutual Funds – Pico Power

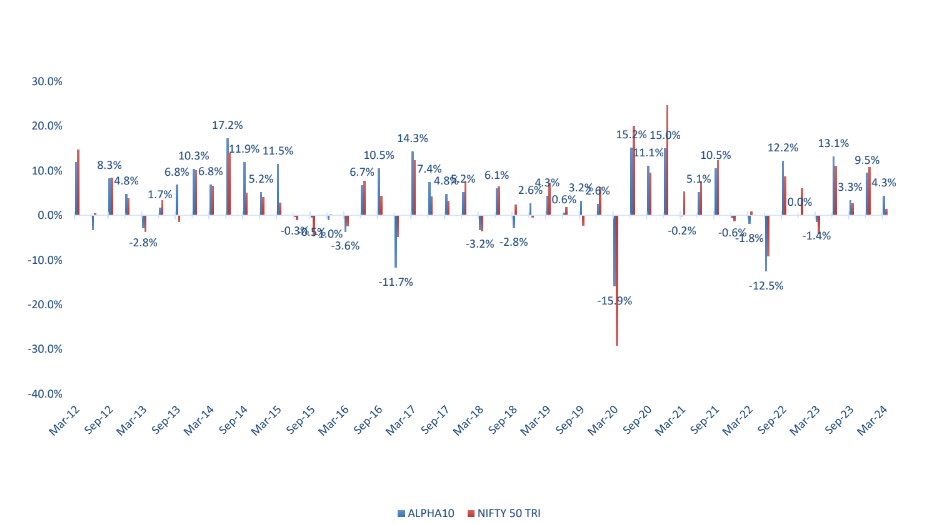

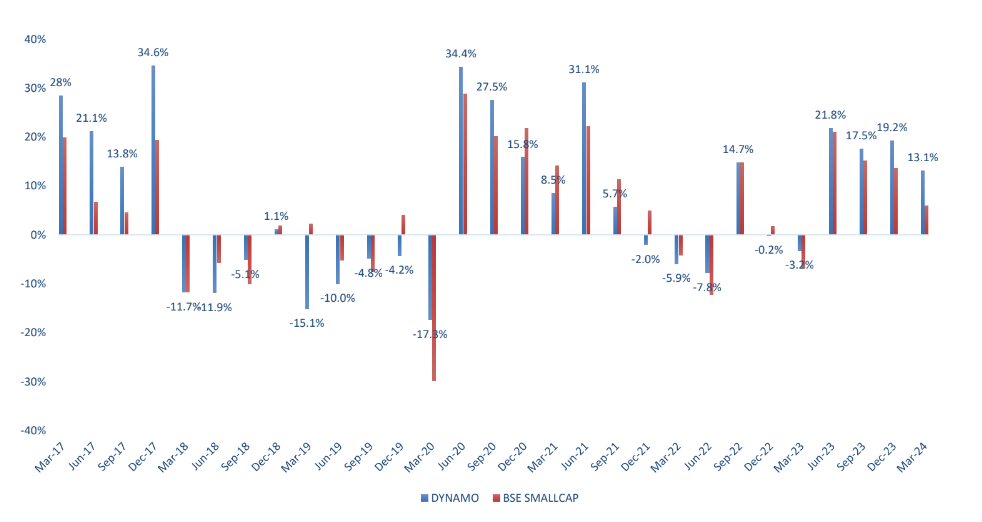

Quarterly Return – Alpha10

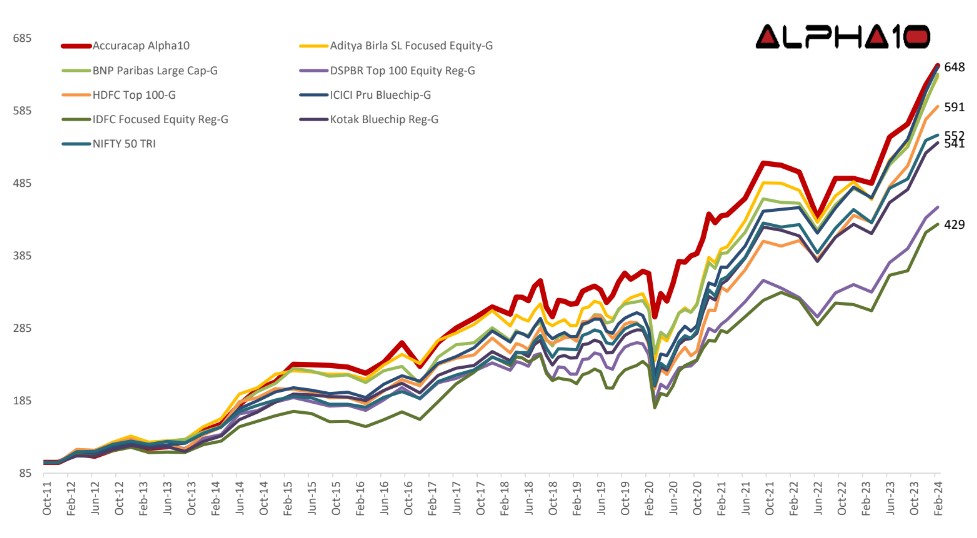

Comparison Peer Mutual Funds – Alpha10

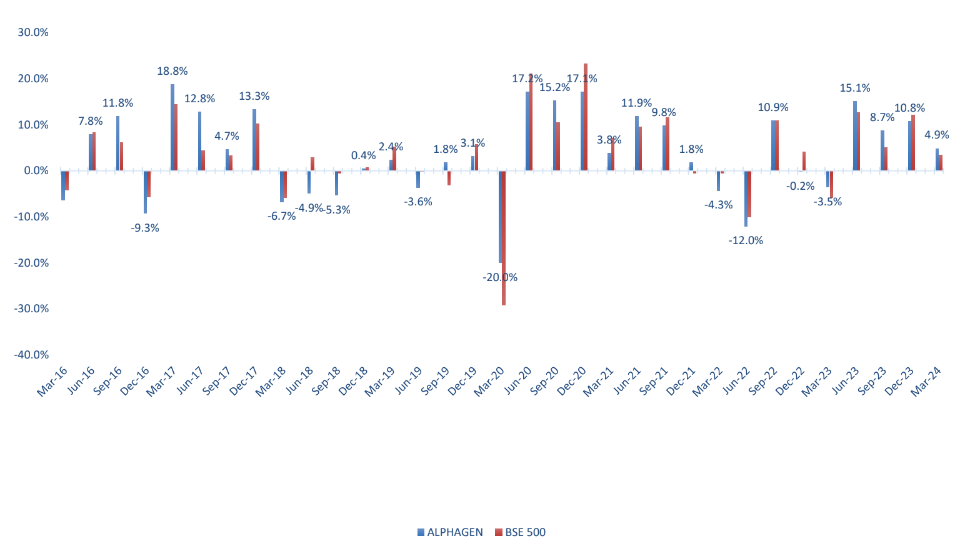

Quarterly Return – AlphaGen

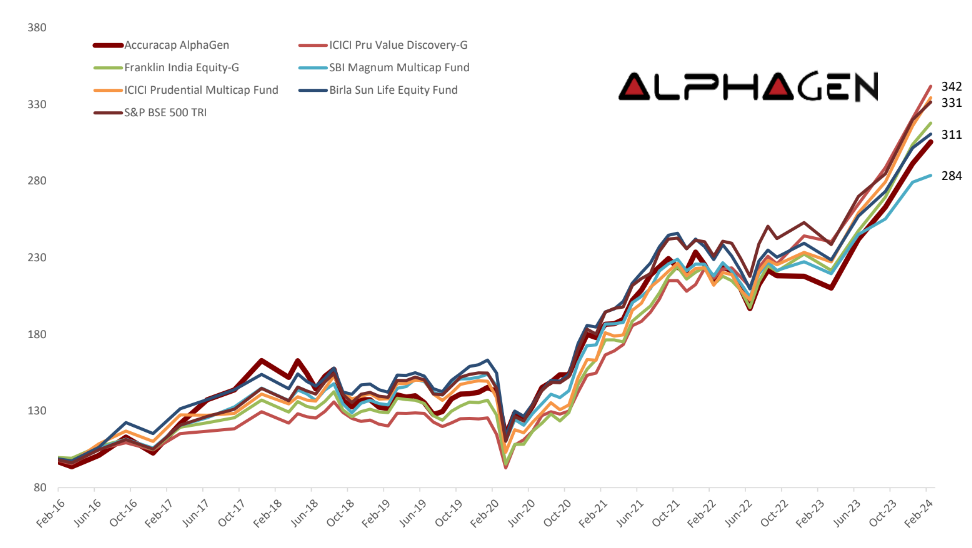

Comparison Peer Mutual Funds – AlphaGen

! ["C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\acap_14.png"]

Quarterly Return - Dynamo

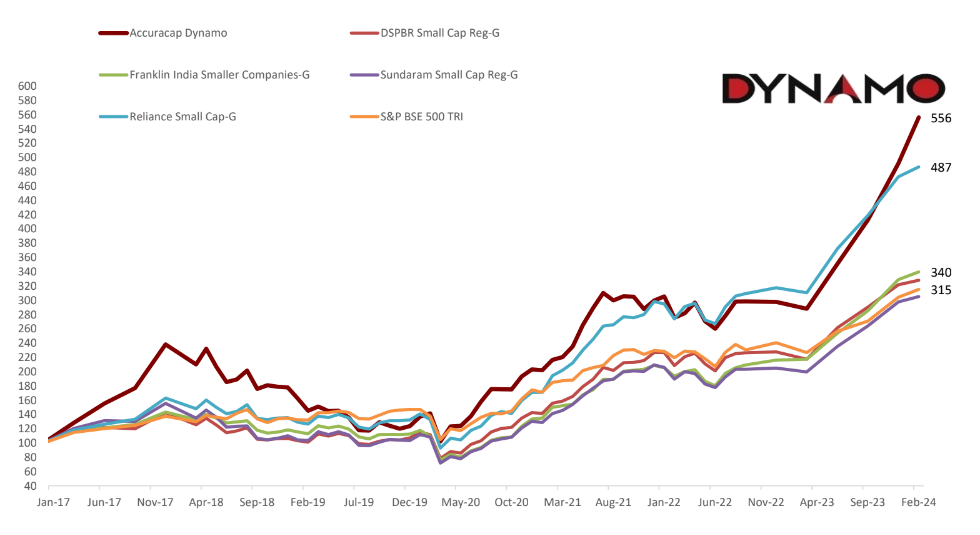

Comparison Peer Mutual Funds – DYNAMO

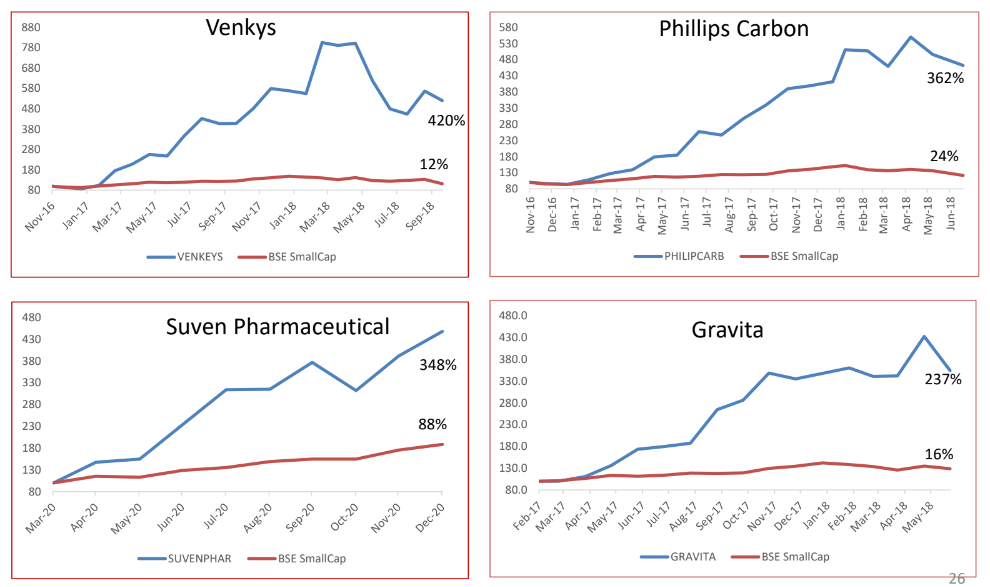

Some Big Winners- PicoPower

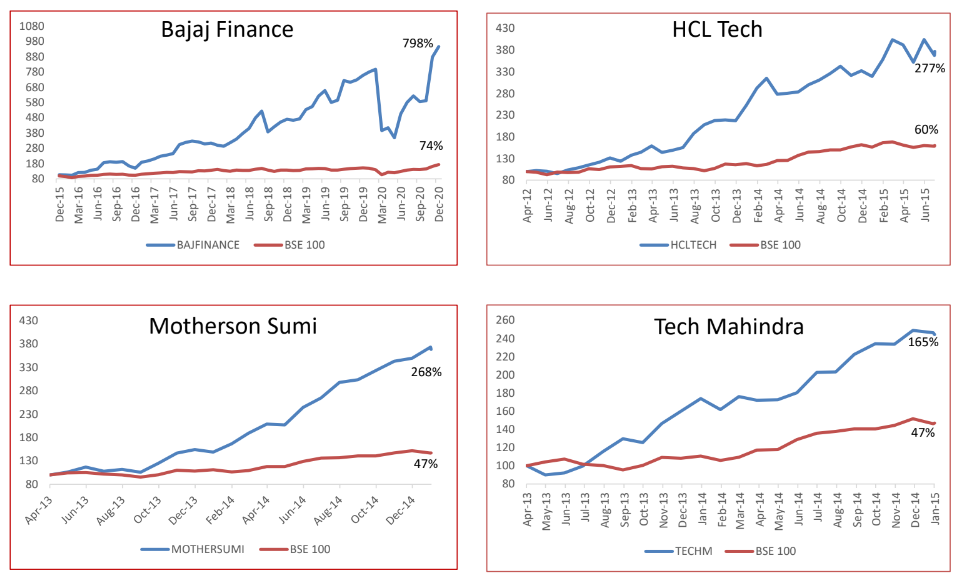

Some Big Winners- Alpha 10

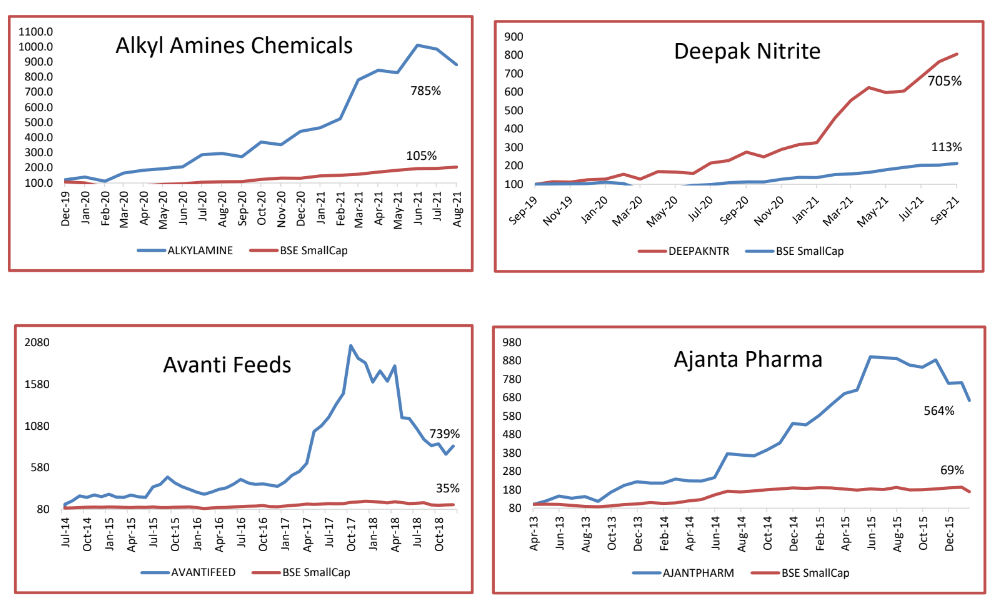

Some Big Winners- Dynamo

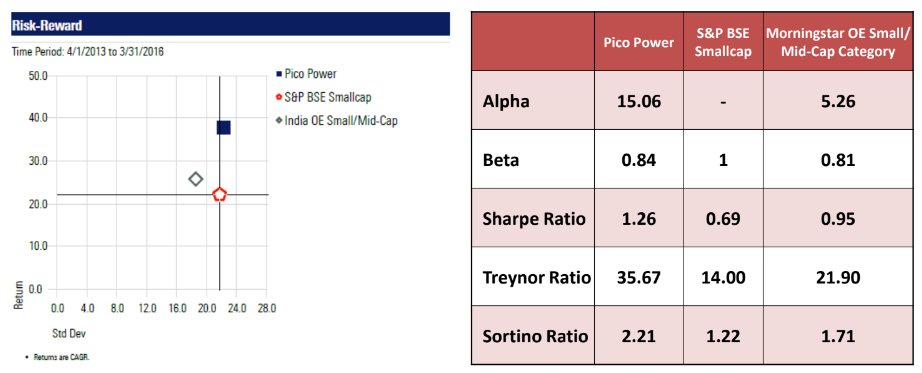

PicoPower - Top of the Charts on Multiple Parameters

- “Compared with the benchmark, the strategy outperforms both in terms of risk and return. Meaning, Pico Power not only assumes a lower level of risk, but also manages to outperform the benchmark at this risk level.”

- “It has not only outperformed the average peer in all trailing periods, but has beaten the top performer in most periods” - Morningstar

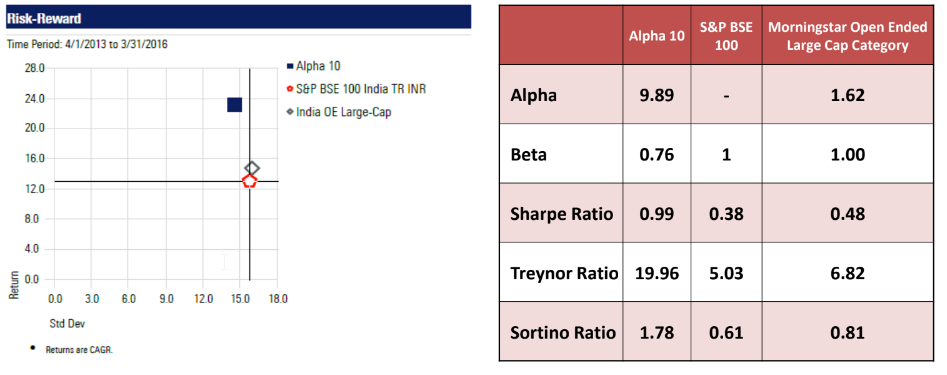

Alpha10 - Top of the Charts on Multiple Parameters

- “On the trailing returns front, it has not only outperformed over the long term, but has also delivered superior returns over longer time frames”

Fund Terms

- Portfolio: PICOPOWER, ALPHAGEN, ALPHA10 & DYNAMO

- Type of Offering: Discretionary Portfolio Management Service (PMS) – Equity

- Portfolio Manager/Advisor: Accuracap Consultancy Services Pvt. Ltd.

- Benchmark: NIFTY 50 TRI for Alpha10

- A) Fixed Fee Option Fixed fees - 2.5% p.a.

- B) Profit Sharing Option

- i) Fixed Fee – 1.5% p.a.

- ii) Incentive Fee - 20% of excess returns generated over hurdle at the end of every FY on high water mark basis.

- Hurdle Rate

- i) 10% for Alpha10

- ii) 12% for PicoPower and AlphaGen

- iii) 14% for Dynamo

- Other Charges: Statutory/ Other charges as applicable (STT/ Demat/ Service Tax/Custodial charges etc.)

- Exit Load Before completion of 1 year : 2% of current investment value After 1 year but before completion of 2 Years : 1% of current investment value After 2 years completion : Nil