Finance

Alchemy Ascent Strategy

ALCHEMY ASCENT* THE STRATEGY

- Investment objective** : To generate long term risk adjusted returns.

- Philosophy & Strategy** : A High-Risk High Return oriented strategy where capital allocation is as important as stock selection and which aims at generating long term return by investing in companies using data intensive research driven investment approach, to identify companies based on various parameters such as growth, valuation, quality earning and balance sheet health.

- Fund Manager : Alok Agarwal (From 1 Oct 2023) Co-Fund Manager : Deven Ved (From 1 Oct 2023) | Description of types of securities : Equity

- Basis of selection of types of securities as part of the Product/Investment Approach: Equity stocks are chosen for investment on the basis of 3 factors :

The company fundamentals, as reflected in reported numbers

Investment strategy research regarding various market cycles and

Cash or cash equivalents are chosen when an appropriate equity opportunity is not availableRisk & Reward ratios

- Benchmark : S&P BSE 500 TRI ^

- Basis for choice of benchmark: As per APMI Circular APMI/2022-23/02 dated March 23, 2023

- Allocation of Portfolio across types of securities : Upto 100% in equity (cash portion may be deployed in liquid funds/ debt securities). Portfolio Construct: Average of 25-30 stocks across sectors.

- Investment horizon: 3 to 5 years

- Risk associated with Product/Investment Approach^^ : High Risk

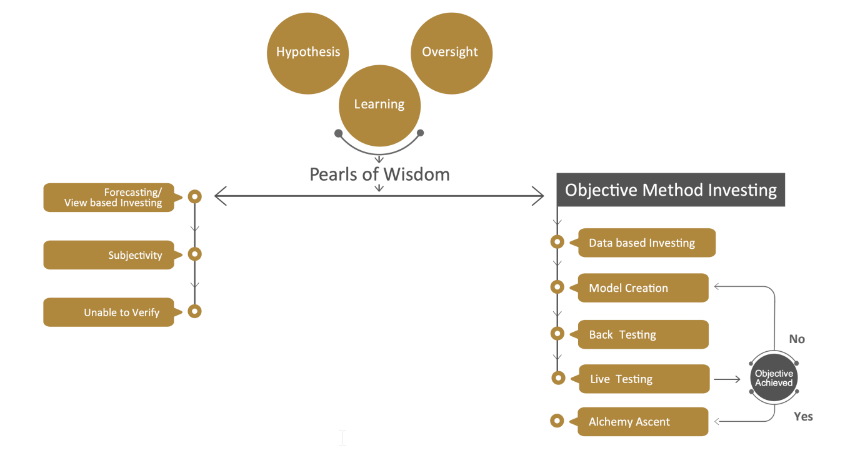

In the current investment world it is believed that the key to any successful investment strategy is in finding the “right stock”, the “right theme”, the “right sector” and the “right cycle”. Even the most experienced investors are prone to biases which are inherent in the investing process. This results in inconsistent alpha generation.

- However, we believe that building a high performance portfolio involves much more. Stock allocation, its relative ranking in the portfolio and timing along with risk controls, also play a very important part of the alpha generation process. We believe in strong data based research process, which considers all sources of alpha generation comprehensively, thus helps in creating an unbiased and disciplined investment approach – a key to successful and consistent investment outcomes.

- Alchemy ASCENT* endeavors to provide a consistent "high alpha" investment strategy which build portfolios to deliver consistent outperformance over the long term, using an objective, back tested and data driven approach devoid of any biases.

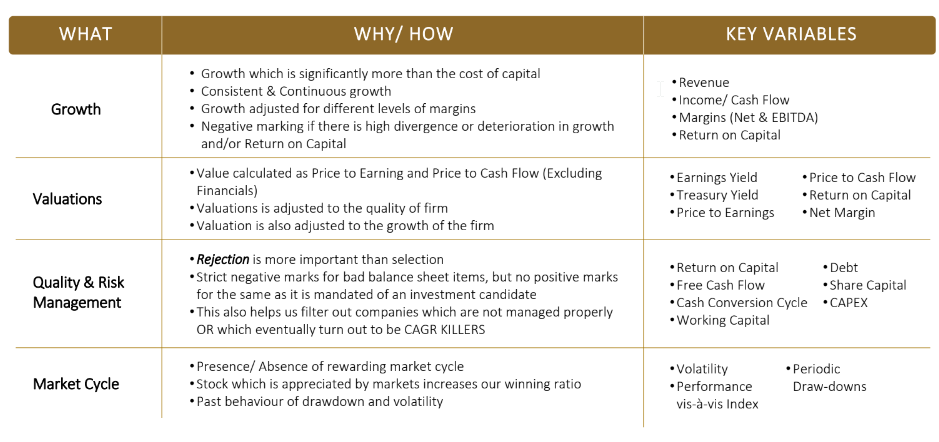

ALCHEMY ASCENT WHAT, WHY & HOW

INVESTMENT PROCESS

- STOCK SELECTION

-Market Capitalization Cut-off: INR 4,000 Crores

-Investible stocks have to pass a stringent system of eliminating value destroying factors & are sometimes vetoed based on riskand fundamental forensic analysis

- Over 50 Quantified fundamental parameters and their combinations used for screening of investible universe

- Highest Ranked Stocks based on points filtered

- CAPITAL ALLOCATION

- Portfolio on an average holds 25 stocks-30 stocks

- Weight per stock may range from 3% to 6% @cost, exceptional stocks may get an allocation of 10% @cost

- Ranking system optimizes stock to be held in the portfolio and creates allocation for the same

- RISK MANAGEMENT

A. Prohibitive Risk

- Quality Filters

- Negative Marking for Unfavourable factors such as Balance Sheet ratios B. Participative Risk/ Exit Strategy

- Daily change in Rank/ Score of Individual Stock (Using Fundamental Data)

- Draw-Down/ CAGR non performer

- Multiple rules based on above scenarios C. Operational risk minimized using automation of processes

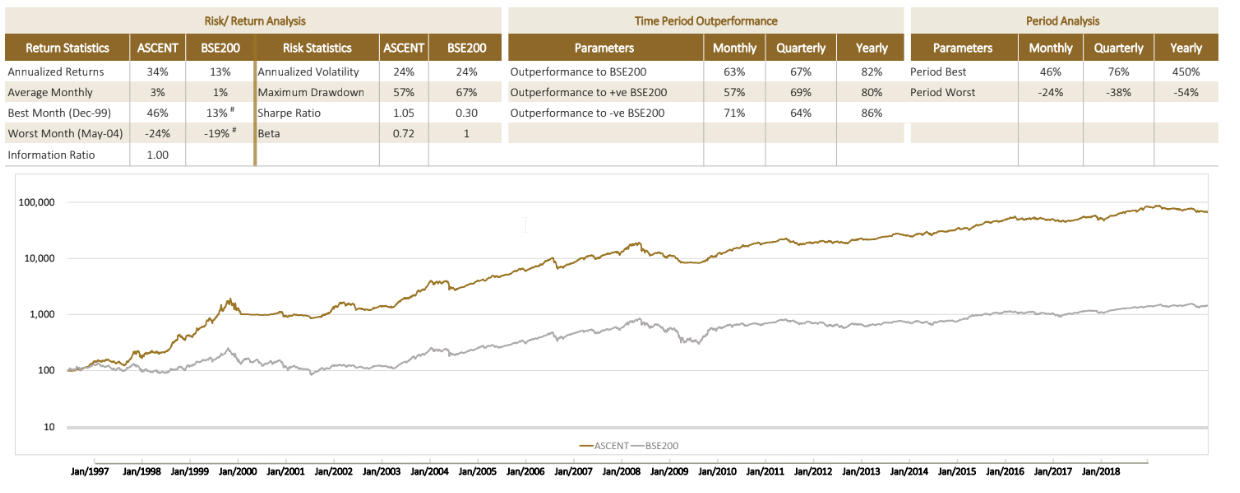

ALCHEMY ASCENT BACK TESTED PERFORMANCE

Return, Risk and Period Analysis for 01- January 1997 – 31-December 2018*

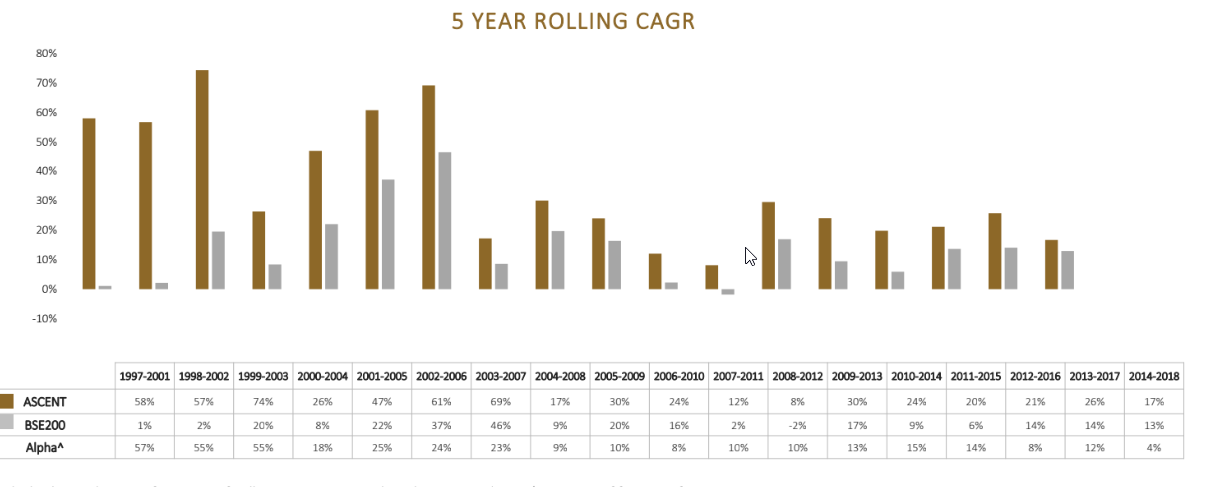

ALCHEMY ASCENT BACK TESTED ROLLING RETURNS

5 years rolling returns for Portfolio starting 01- January 1997 till 31-December 2018*

Cash level vs Benchmark for Portfolio started 01- January 1997 till 31-December 2018*

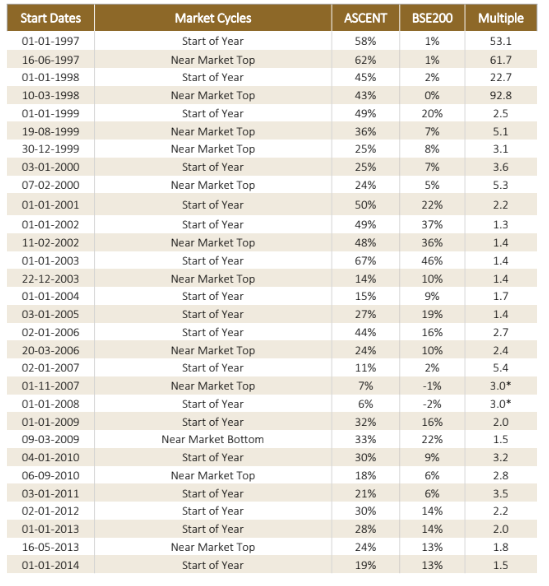

ALCHEMY ASCENT 5 YEAR CAGR RETURNS FOR DIFFERENT START DATES

- 5 Year CAGR returns for different Start Dates^

- “Start Dates” correspond to different portfolio starting dates for back testing, these dates represent

- Different market cycles or;

- Start of each year since 1997

- Selection of Different Market Cycle Dates:

- “Near Market Top”:- Corresponds to a random date between a market top and a 3 month earlier period, so that we get 90%-100%

- “Near Market Bottom”:- Corresponds to a random date between a market bottom and a 3 month earlier period. This tests the dynamic deploying capacity of the strategy

- “Multiple” = Ascent Return’s ÷ BSE 200 Return’s where

- *Represents a multiple of 3 as Benchmark is – ve and Ascent is+ ve

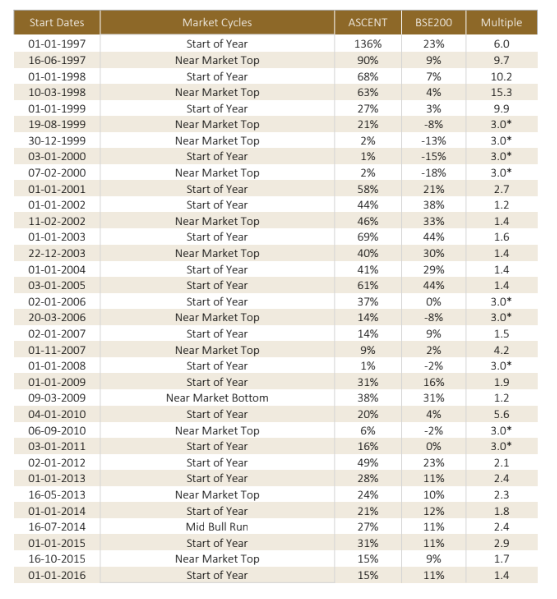

ALCHEMY ASCENT 3 YEAR CAGR RETURNS FOR DIFFERENT START DATES

- 3 Year CAGR returns for different Start Dates^

- “Start Dates” correspond to different portfolio starting dates for back testing, these dates represent

- Different market cycles or;

- Start of each year since 1997

- Selection of Different Market Cycle Dates:

- “Near Market Top”:- Corresponds to a random date between a market top and a 3 month earlier period, so that we get 90%-100% deployed before the crash. This tests the vulnerability of the strategy

- “Near Market Bottom”:- Corresponds to a random date between a market bottom and a 3 month earlier period. This tests the dynamic deploying capacity of the strategy

- “Mid Bull Run”:- Corresponds to a random date in a running bull market. This tests the ability of the strategy to catch-up to the index when index is gaining rapidly

- “Multiple” = Ascent Return’s ÷ BSE 200 Return’s where

- Represents a multiple of 3 as Benchmark is – ve and Ascent is + ve

WHY ALCHEMY ASCENT

- Unbiased approach towards each stock

- Back Tested for more than 21 years across many market cycle

- Greed/Fear/Hope are mitigated by having objective method for investment

- Focus on Discipline & Data to generate CAGR

- Ability to scan over 2000 stocks daily to find a winner

- Endeavor to generate returns outperforming the relevant Index over 3-5 Year

- Churn ratio of ~ 1-1.2x

- Average cash level is ~ 5%

- Focused unbiased active portfolio management

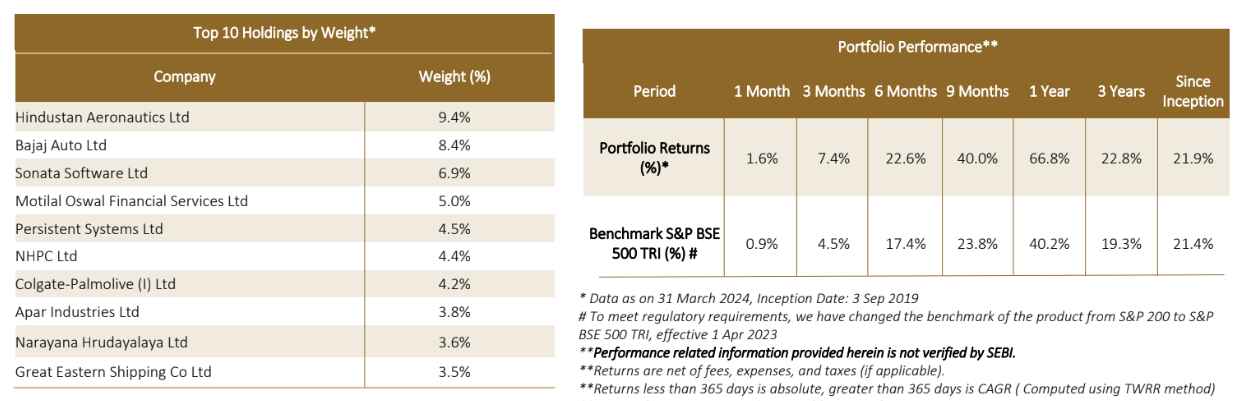

ALCHEMY ASCENT PORTFOLIO PERFORMANCE

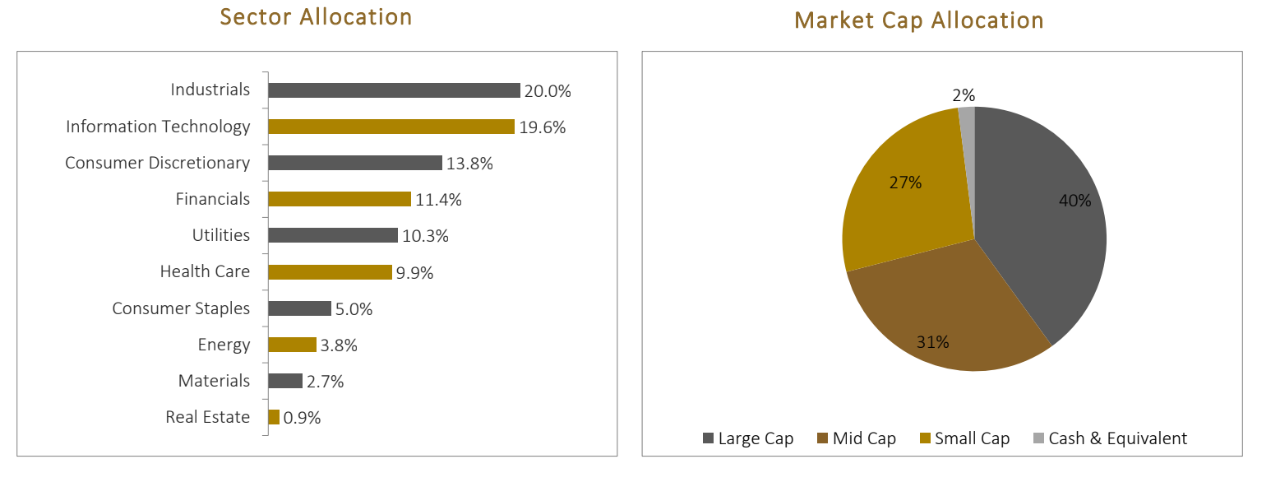

ALCHEMY ASCENT PORTFOLIO COMPOSITION

Alchemy Capital Management is one of the pioneers in providing bespoke Portfolio Management Services in India. The company is registered with the Securities and Exchange Board of India (SEBI) as a Portfolio Manager and based out of Mumbai.

OUR INVESTMENT PHILOSOPHY

- We believe that consistent and superior long term absolute returns can be made across market cycles by investing in growth companies with good management teams.

- We like businesses which address large and growing external opportunities, have a competitive advantage in effectively exploiting those opportunities and have a scalable business model with higher-than-average Return on Capital Employed (ROCE) over the investment horizon.

- We believe that management teams are key to business success. We look for managements which have aggression, are aligned to business outcomes while simultaneously having respect for governance and capital allocation.

- While growth companies form the core of our portfolio, we also tactically invest in deep value opportunities and special situations that may appear due to and during market cycles.