Alchemy High Growth Select Stock Strategy

ALCHEMY HIGH GROWTH SELECT STOCK

Investment Objective: To generate long-term returns by investing in equities and equity related instruments, across all market capitalizations.

- Combination of top-down & bottom-up stock picking and High Conviction: A demonstrable long-term track record of finding winners with a deep understanding of the businesses and the drivers of long-term sustainable performance in companies, which may then translate into long-term return performance.

- Over diversification dilutes returns: A well-diversified portfolio is essential to capture a wide variety of businesses, too much diversification tends to dilute returns. A concentrated portfolio helps to focus more on individual stock performance and returns.

- A differentiated strategy for UHNI, Family Offices & Large allocators: A slice of the capital allocated to a concentrated strategy makes eminent sense as the investors are already diversified, and a differentiated strategy can help generate differentiated returns.

ALCHEMY HIGH GROWTH SELECT STOCK (AHGSS)* - PRODUCT HIGHLIGHTS

Philosophy: The philosophy behind growth investing is based on the assumption that India is a high growth economy with a strong entrepreneurial culture. Our endeavor is to identify and invest in growth companies through a combination of top-down and bottom up fundamental research to enable long term wealth creation. A typical Portfolio may generally consist of between 8-14 stocks across sectors. We may construct such concentrated portfolios as per the clients need and understanding.

Strategy**: Invest in companies across the market capitalization range, which have high growth potential and potential to deliver long term capital appreciation.

Fund Manager: Hiren Ved

Description of types of securities: Equity | Investment horizon: 3 to 5 Years

Risk associated with Product/Investment approach^^: High Risk

Allocation of Portfolio across types of securities: Upto 100% in equity(cash portion may be deployed in liquid funds/ debt securities).

Allocation across Market Cap: Since portfolio is concentrated, focus is more on stock selection than on market cap allocation.

- Relevant Universe: We have identified a relevant universe of about 500 companies based on market capitalisation (above 1,000 crores preferably), qualitative governance filters, long term attractiveness and ROE profile of business amongst other parameters.

- Investible Universe: From this relevant universe, an investible universe of companies is created based on assessment of past and future fundamental variables like revenue and EBIDTA growth, cash flow conversion efficiency and core ROE of the business amongst several other relevant variables which may be unique to a business. In addition to objective fundamental parameters and assessment of qualitative management capabilities, governance standards and competitive ability of the business is also carried out. A comprehensive valuation exercise is also carried out based on one and/or combination of valuation parameters like P/E, P/B, EV/EBIDTA, DCF etc to arrive at an acceptable valuation range for investing in the security.

- Portfolio Construction: The Portfolio Manager managing the strategy is then free to construct the Clients Portfolio from within the investible universe at its discretion.

Benchmark: S&P BSE 500 TRI *

Basis for choice of benchmark: As per APMI Circular APMI/2022-23/02 dated March 23, 2023

ALCHEMY HIGH GROWTH SELECT STOCK – APRIL 2024

- Group AUM is over USD 1.1 billion*

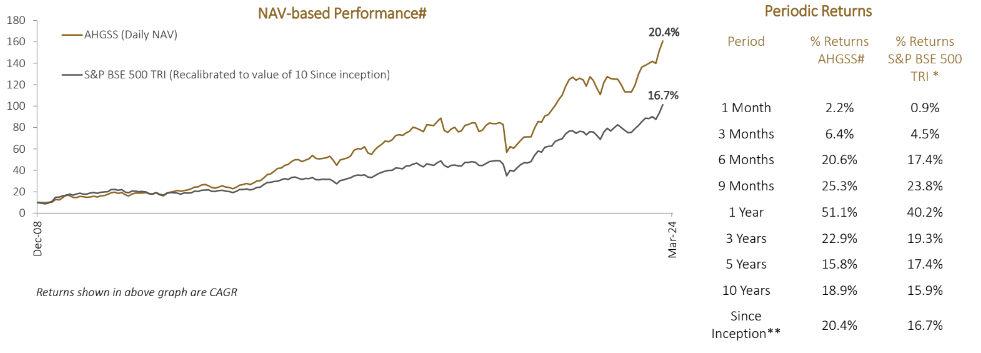

- INR 1 crore invested in Dec 2008 in Alchemy High Growth Select Stock could have grown to over INR 17.1 crores*

- Outperformed its Benchmark (S&P BSE 500 TRI **) 10 out of 16 calendar years#

- Generated a net annualized alpha of 372 bps# (INR returns)

ALCHEMY HIGH GROWTH SELECT STOCK (AHGSS) - PERFORMANCE HIGHLIGHTS

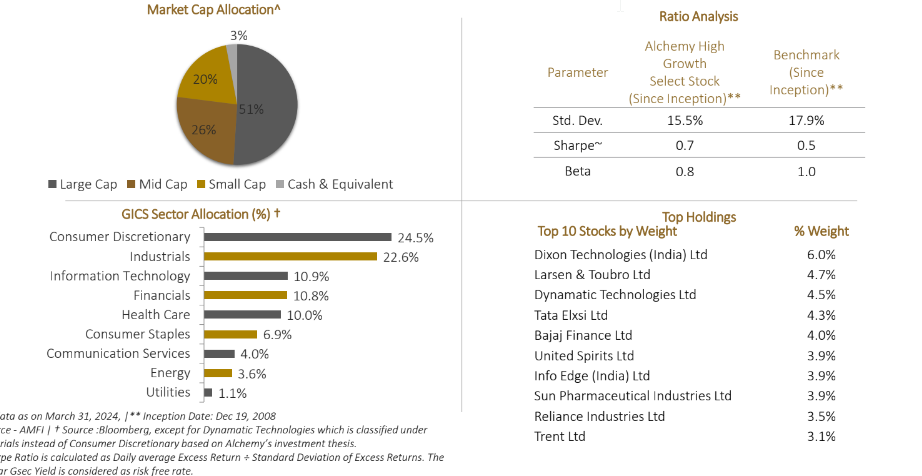

PORTFOLIO COMPOSITION & ANALYSIS*

ALCHEMY CAPITAL MANAGEMENT

Alchemy Capital Management is one of the pioneers in providing bespoke Portfolio Management Services in India. The company is registered with the Securities and Exchange Board of India (SEBI) as a Portfolio Manager and based out of Mumbai.

- One of the few Portfolio Managers in India to have been in existence since 2002

- Pioneers in bottom-up stock picking skills with a long-term investing approach

- With an experienced team of investment professionals at the helm, there is a strong emphasis on Compliance and Risk Management

- Managing/advising AUM of USD 1.1 billion*, we have earned the trust of institutional investors, sovereign funds, ultra HNIs and family offices.

OUR INVESTMENT PHILOSOPHY

- We believe that consistent and superior long term absolute returns can be made across market cycles by investing in growth companies with good management teams.

- We like businesses which address large and growing external opportunities, have a competitive advantage in effectively exploiting those opportunities and have a scalable business model with higher-than-average Return on Capital Employed (ROCE) over the investment horizon.

- We believe that management teams are key to business success. We look for managements which have aggression, are aligned to business outcomes while simultaneously having respect for governance and capital allocation.

- While growth companies form the core of our portfolio, we also tactically invest in deep value opportunities and special situations that may appear due to and during market cycles.

INTERVENTION: RISK MANAGEMENT

Firm Level

- Performance patterns analysis.

- Dedicated pre and post trade checks, ongoing internal reviews.

- Statutory and legal risk managed by the compliance and legal function which is monitored by the Group Compliance Head.

- Business Risk managed by the CEO.

Portfolio Level

- Daily monitoring by in-house operations team basis the fund/strategy mandate.

- Fund Manager evaluates performance of each strategy vis a vis the benchmark on a monthly basis.

- CIO reviews the performance of each strategy with the respective fund manager every month.

- Contribution analysis conducted each month by investment team. Portfolio action on absolute and relative performance analysis and portfolio positioning are discussed every month and actions where needed, decided upon.

Security Level

- Sectoral limit based on mandate .

- Individual stock limit based on mandate.

- We also monitor the ownership in companies at Fund/Strategy level.

- Investment positions - flags raised by operations team if a position is close to the maximum permissible limit weight-ages.

INTERVENTION: INVESTMENT COMMITTEE

- CEO, CIO, COO, Fund Managers, Business Heads and Head of Research

- Forming and reviewing macro view, Performance Tracking, Contribution Analysis, Outlier Management and decisions Exception Reporting and Priority Actions.

- Macro View: The investment team presents their view on the changes in macro & micro variables and what can be expected in future.

- Fund Performance: Performance of all funds/products is analyzed. Each fund manager has to present his portfolio positioning and the impact of change in macro and micro variables that have affected or may affect the portfolio in the future. In case of consistently underperforming positions, triggers of events are defined. If these triggers are not achieved, then relevant actions to be taken/already taken and discussed.

- Risk Monitoring: An in-depth contribution analysis is presented to understand under-performers, out- performance and plan of action for the same.