AlfAccurate Advisors Pvt Ltd

AlfAccurate Advisors

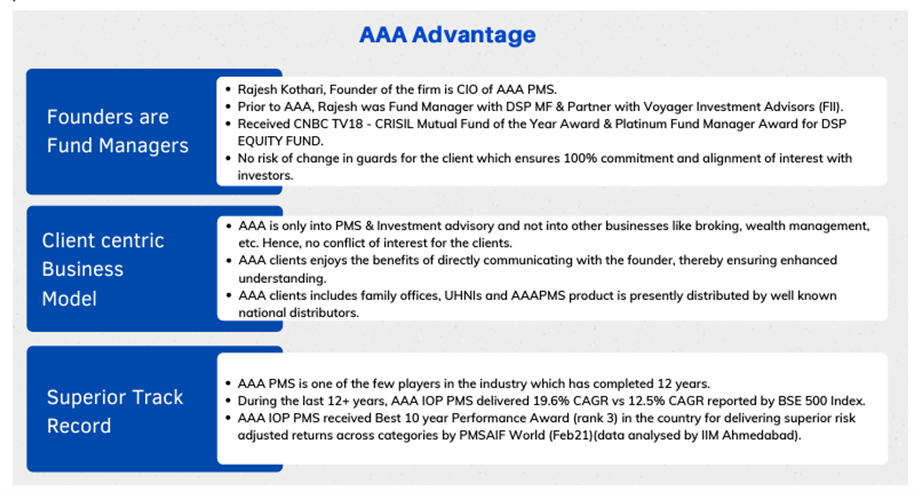

AlfAccurate Advisors (AAA), situated in Mumbai, is one of the few companies operating in the Indian capital investment and portfolio management space that has been around for more than 12 years. The business only specializes in investment management. AlfAccurate's team strategically operates at the highest echelons of open corporate governance and has the time and resources to concentrate on what matters most: thorough research and quick decision-making when it comes to tracking client investments. Rajesh Kothari, a pioneer in the field of investment management with more than 25 years of experience routinely beating the benchmark and garnering numerous awards, launched AlfAccurate Advisors. With him in charge, the business is led by a group of seasoned portfolio management professionals with more than 75 years of total expertise. The staff at AlfAccurate collaborates to develop investing strategies that balance risk and return, offer protection against volatility, and provide exceptional performance to its cherished investors. Contrary to many other companies, AAA is committed to providing superior risk-adjusted returns, which is represented in its investment philosophy of Protect Capital, Create Wealth. Customers who join AlfAccurate benefit from the strong partner ecosystem the business has developed over the years as well as unmatched direct access to its team of highly skilled fund managers. AlfAccurate Advisors' distinguishing characteristics include prompt portfolio performance updates, quick response times to enquiries, and seamless client onboarding. Currently, the business serves over 500 families, including several CEOs, UHNIs, and major family offices. Additionally, clients have the chance to dispel myths and misconceptions around investment opportunities through the company's periodical AAA Insights and AAA Webinar Series, which helps them get greater clarity on the investing landscapes and decisions.

INVESTMENT PHILOSOPHY: PROTECT CAPITAL, CREATE WEALTH

AlfAccurate Advisors finds well-managed, shareholder-friendly firms with solid business models that have a high possibility of profitability and favorable shareholder returns using a disciplined, fundamental, research-driven methodology. The idea that a disciplined set of procedures followed by an experienced team produces higher risk-adjusted returns is a fundamental premise of investment culture. The plan calls for swift reaction to change, capital protection from market shocks, and long-term wealth creation. AlfAccurate Advisors are the ideal partners for investors to grow their wealth and prosper over the long term because of the special combination of a well-disciplined exit strategy, well-guided investments on reliable and sustainable businesses, and sound advisory given by the highly experienced team of investment outperformers.

Investment Philosophy

The goal of AAA is to provide our clients with enticing long-term profits. To do this, it employs a systematic, basic, research-driven methodology to find well-managed, shareholder-friendly businesses with solid business models that have a high probability of remaining profitable and providing significant shareholder returns. A disciplined exit plan, cautious risk management, and the selection of 3M stocks form the foundation of our distinctive 4-Step Investment Process. According to the company, continuous profits growth is the main factor driving intrinsic value and stock price rise since, over the long run, the market reflects earnings growth. That results in delivering steady earnings growth, which, when compounded, can help our investors create wealth. In contrast to many other companies, AAA's emphasis on diversity and a controlled exit strategy helps it to navigate unfamiliar seas, which naturally reduces market risks. Its approach of being quick to adapt to change helps to safeguard investors' money from market shocks and produce wealth over the long term.

3M STOCK SELECTION APPROACH

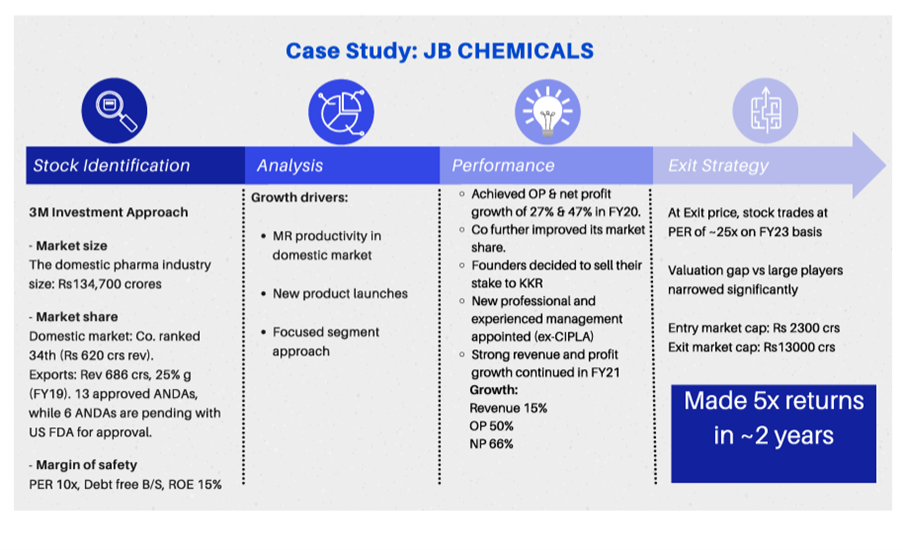

Over the past 12 years, AAA has created a proprietary 3M approach for company selection that has consistently produced higher risk-adjusted returns and produced a number of multibaggers, including Hitachi, Honeywell, Dixon, and JB Chemicals. It makes investments in businesses with seasoned management, a solid financial position, high profits growth, and first-rate corporate governance. Size of the Market: The size of the market affects the magnitude of the opportunity. In order to achieve exponential returns, AAA favors businesses that are focusing on huge markets.

Market Share: AAA invests in businesses that are market leaders since they are better equipped to weather economic ups and downs. The cost that you pay is the margin of safety. What you receive has value. When companies are offered at fair prices, AAA will buy them.

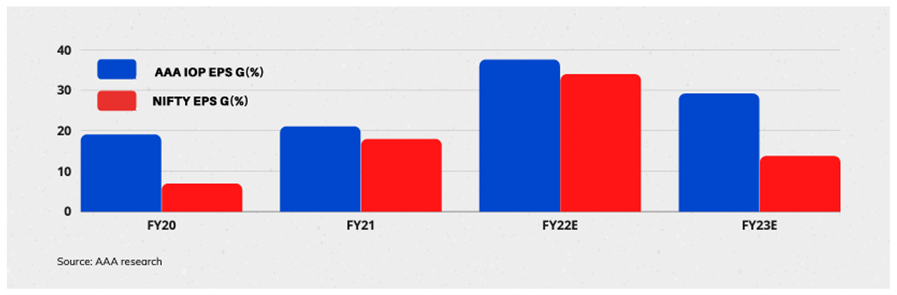

Earnings Growth is a crucial characteristic for the investment team once a firm has been chosen based on its 3M investment approach. The company is adamant that while India is home to many excellent businesses, due to a lack of earnings growth, they may not always be wise investments. In its twelve years of existence, the AAA portfolio has consistently shown substantial earnings growth. Even during the economic slowdown (FY20), its IOP PMS main product produced earnings increase of 19% compared to Nifty's 6.9% growth, as illustrated below:

AAA IOP PMS PLAN PERFORMANCE:

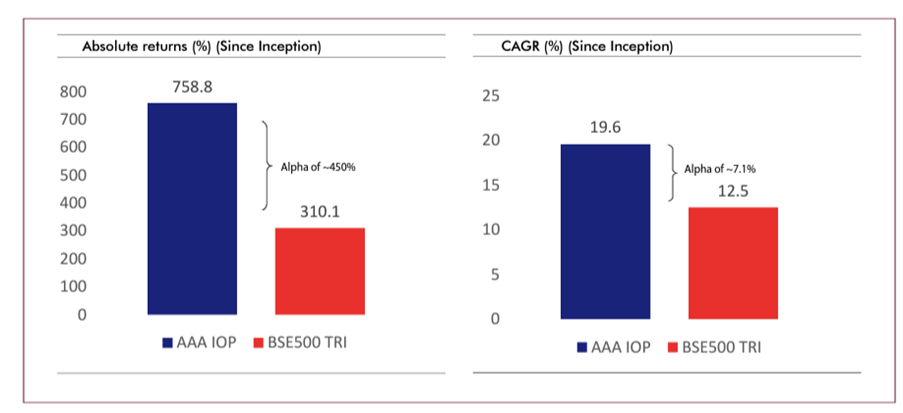

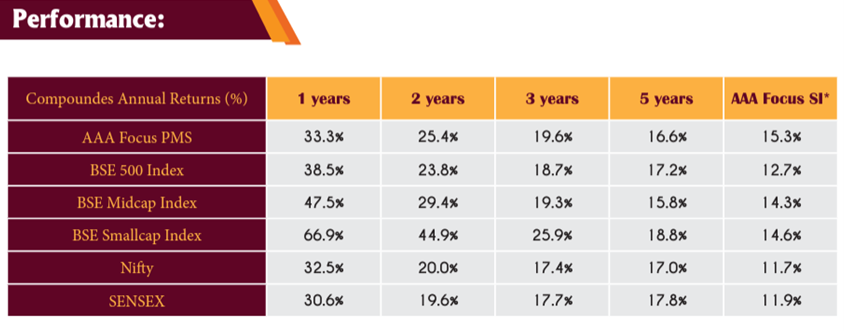

As of 30 November 2021, Rs 1 cr invested in AAAIOP PMS had grown to Rs 8.6 crs, or 8.7x, over the previous 12 years. Most importantly, unlike many companies, this result was achieved by investing in a diverse portfolio of about 50 stocks, which means that the risk associated with individual companies and industries is far smaller. However, despite having lesser risk, it did not sacrifice producing greater alpha, as evidenced by its exceptional outperformance. For example, AAA IOP achieved a 19.8% CAGR compared to the 12.2% CAGR of the BSE500 TRI Index, giving investors a 7% annual return on their investment.

Rolling Returns – an acid test of any product

The term "rolling returns," frequently referred to as "rolling period returns" or "rolling time periods," refers to annualized average returns for a period that ends in the year specified. Rolling returns are helpful for analyzing the nature of returns for holding periods that are comparable to those that investors actually experience. A portfolio or fund's rolling returns provide performance outcomes that have been averaged over the course of the fund's tenure. When compared to a single snapshot at one time, such information frequently gives investors a more accurate view of the market.

Over time periods of one year, three years, and five years, AAA IOP PMS produced strong rolling returns. The median 5-year return of 22.5% for AAA IOP is much higher than the 5-year return of 13.7% for BSE500 Index.

Why Invest in AAA IOP PMS?

- India investment strategy with a strong emphasis on superior and sustainable growth

- Focus on companies with a strong balance sheet and high return on capital employed

- Diversified portfolio with 40-60 high quality growth companies

- Enjoy the benefits of true multicap with right mix of large, mid and smallcap exposure

Why Invest in AAA Focus PMS?

- India investment strategy with strong emphasize on superior and sustainable growth

- Concentrated portfolio of 30 high quality growth companies

- Focus on companies with strong balance sheet and high return on capital employed

Why Invest in AAA Mid & Smallcap PMS?

- India investment strategy with strong emphasize on superior and sustainable growth

- Focus on companies with strong balance sheet and high return on capital employed

- Focus on companies which are emerging giants

We conducted an exclusive interview with Mr. Rajesh Kothari - Founder & Managing Director in order to know AlfAccurate Advisors Pvt Ltd. in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

Rajesh, you started entrepreneurship in 2009 post your successful stint at DSP Mutual Fund and then a hedge fund. You have a vintage of now 12 years as PMS. How has been the journey so far? My corporate career began in 1996. I held positions in mutual funds and hedge funds as a fund manager and an equities research analyst, respectively. Having my own business has always been a goal. After working in corporations for a decade and a half, I made the decision to go it alone in 2009. Our goal is to become the most renowned investment advisors in the world. For the past 12 years, we have had the good fortune to have support from the best family offices, national distributors, and our clients who commit their wealth to us. It is an extremely humble moment. The biggest success is creating a strong, dependable investing culture. Our investment culture is based on the principle that a disciplined set The idea that a disciplined set of procedures, applied by a talented and experienced team, will result in higher risk-adjusted returns, is a fundamental pillar of our investment culture. This laser-focused investing culture has contributed to our performance's top position.

What is the USP of AlfAccurate Advisors? How do you differentiate AAA compared to other asset management firms? Business strategy that puts the client first: At AlfAccurate, we only focus on the core competencies and illustrious track records of our team members in the field of investment management. Since we don't provide any additional services, such wealth management or broking, like many of our competitors do, there is no conflict of interest. This deliberately gives our team the time and resources needed to concentrate on what's really important - in-depth research and agility in tracking the growth of your investment - while operating at the highest levels of corporate governance in a transparent manner. You have unrivaled direct access to our team of fund managers and gain from our strong partner ecosystem at the same time. We have incorporated client-centricity into our operations in a variety of ways, including seamless client onboarding, quick response times to queries, and regular portfolio performance reports.

Superior track record: As long-term investors, we work to find and invest in well-governed businesses that have solid foundations and are able to handle volatility in order to protect your money and take advantage of all wealth-generation opportunities.

Fund managers who are founders: Our strategy at AlfAccurate is straightforward but effective. The guard is completely committed and has our valued investors' best interests in mind, therefore there is no chance of change. Our employees, who are all devoted, seasoned experts with a common code of ethics and a singular focus on quality, are the reason we thrive in the first place.

During the last 12 years, AAAIOP delivered a CAGR of 20% i.e. almost 8x returns, but importantly while taking a much lower risk. This is also reflected in strong rolling returns. What is the investment philosophy at AAA?

"Protect capital, create wealth" is our slogan. In our opinion, risk management is crucial when investing in equities as a form of asset. In the world of investing, operational, technological, and environmental pressures are nothing new. But what we are currently observing is a higher failure frequency together with a larger probability of a catastrophic incident. A risk-adjusted investment strategy's role as a line of defense in response to these risks necessitates a foundation of radical resilience. We navigate new territory with the support of a rigorous exit strategy and our primary focus on diversification, which naturally reduces market risks. Our swift reaction to modify strategy helps to safeguard capital from market shocks and produce value over the long run.

Well, that well explains your risk management part, please explain us your stock selection strategy. Although we have no control over the macroeconomic climate, we try to make sure that the stocks we own are as resilient as possible. Our investment team, which is informed by our 3M methodology, focuses on choosing businesses with established management, a solid balance sheet, excellent profits growth, and outstanding corporate governance. Size of the Market: The size of the market affects the magnitude of the opportunity. For exponential returns, we choose businesses that are aiming for huge markets. Market Share: We invest in businesses that are market leaders because they are better equipped to weather economic ups and downs. This is a crucial USP of our approach to investing. Our portfolio companies have capable management. Innovation and agility give businesses a long-lasting competitive advantage as they concentrate on developing a healthy, balanced portfolio of market-competing and market-creating strategic movements. This results in steady earnings growth, which, when compounded, can provide stockholders with enormous value. The cost that you pay is the margin of safety. What you receive has value. To generate long-term returns, it is crucial that we purchase businesses that are offered at fair market prices. Over the past 12 years, our 3M methodology has helped us identify a number of multi-baggers.

AAA is one of the few firms, which focuses not only in selecting the right stocks but also believes in Exit strategy? Can you please explain to us your Exit Strategy in detail? Business cycles, in our opinion, are getting shorter every day. Everything is temporary. 75% of the Sensex has changed over the past sixteen years. As a result, it is crucial to continuously check the business cycle stage of the organizations in which you have investments. We take an exit when the underlying growth assumptions change, the portfolio has to be rebalanced, the company has attained its target price, and there are generally better opportunities. For instance, we increased exposure to healthcare and decreased exposure to cyclical in the early days of the pandemic in March 2020. That was a great strategy because healthcare companies performed incredibly well between March and September of this year. Then, in October 2020, as the unlock down began, we once more repurchased cyclical equities and decreased our exposure to the healthcare sector as the majority of stocks earned returns of three years in only four months.

Market is at an all-time high? What is your view on the equity market from current levels? Which are the key themes on which you are positive? Which sectors do you prefer from this level?

In the long run, earnings growth is reflected in the market. Nifty earnings increased at a CAGR of 6.5% , while market returns increased at a CAGR of 8.5%. Over the next two to three years, we anticipate continued high earnings growth for Indian corporations. Since the ratio of corporate profits to GDP has fallen from a peak of 8% to only 2.3% right now, we still have a long runway. Although corrections are a normal feature of bull markets, we continue to be optimistic about the equity asset class and anticipate that it will outperform all other asset classes in the long run. I also caution readers not to put too much emphasis on forecasting market levels because India provides a variety of bottom-up options that can yield substantial returns. The most significant theme, in our opinion, is that Big is getting Bigger. Top firms have gained market share as a result of structural adjustments over the past six years, the IL&FS credit crisis, and pandemic waves. The huge players with solid balance sheets are in an undeniably favorable position not just in the transition from unorganized to organized sectors but also within organized sectors themselves. Our investment premise is that it is rewarding to acquire businesses that are industry leaders.

With exposure to 13–16 sectors, our portfolio is well-diversified from a sectoral standpoint. A few years ago, we recognized the specialty chemical sector. It worked incredibly well, and we continue to be optimistic in that sector. The sector has spent Rs 40000 crore on capital projects over the past five years, and it anticipates spending another Rs 70000 crore on capital projects over the following five years. Due to its scalability, cost competitiveness, and on-time delivery while adhering to pollution standards, Indian specialty chemical firms are gaining popularity with international clients. We have put more emphasis on the capital goods sector during the past 6 to 9 months. We think that an increase in capex is necessary for the growth story of India. Over the next three to five years, increased capex should be expected as a result of the government PLI plan, China +1, and improved corporate balance sheets for both the borrower and the lenders. Key industries including cement, metal, and refineries have already announced projects, indicating strong capex over the next five years.

How about the valuations? Also, if you can give some colour on the new edge businesses which are getting listed. How one should look at them.

From a market standpoint, the Nifty trades at 23x PE on an FY23 basis, which is 12% over the average for the last ten years. Given the substantial 20%+ earnings growth expected over the next 2-3 years, I don't think it's overly costly. The new edge businesses—I'm assuming you're referring to digital businesses—can significantly alter the Indian equities market. Currently, it makes up less than 2% of the market capitalization, as opposed to 25% in the USA. Compared to 13% of Nifty companies, many companies in this sector already command market caps of more than $15 billion. The market capitalization of the digital economy will eventually expand in tandem with its share of GDP. It is a learning curve for us as an investment manager. We have hope in this area and will carefully consider each option while keeping an open mind.