Finance

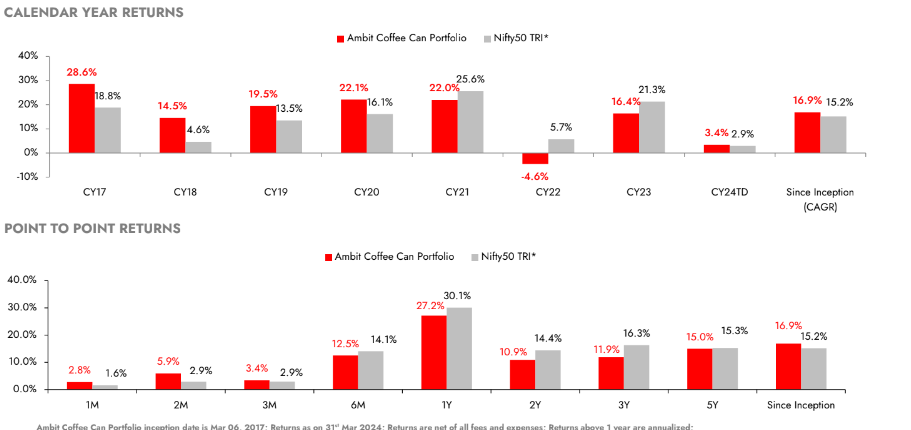

Ambit Coffee Can Portfolio

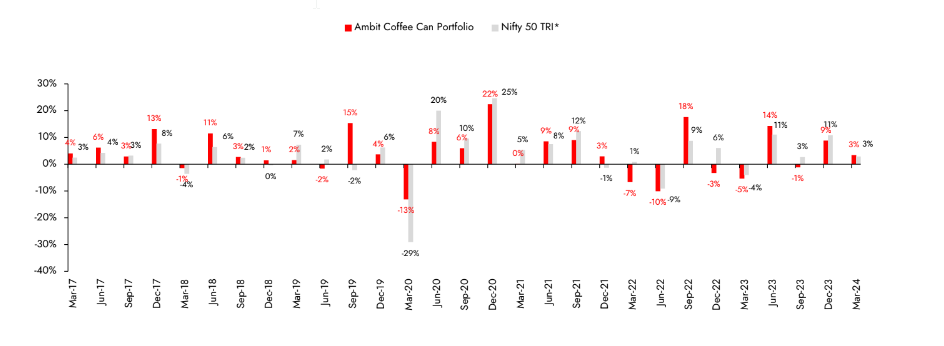

Ambit Coffee Can Portfolio : Performance Track Record

Quarterly Performance – Ambit Coffee Can Portfolio

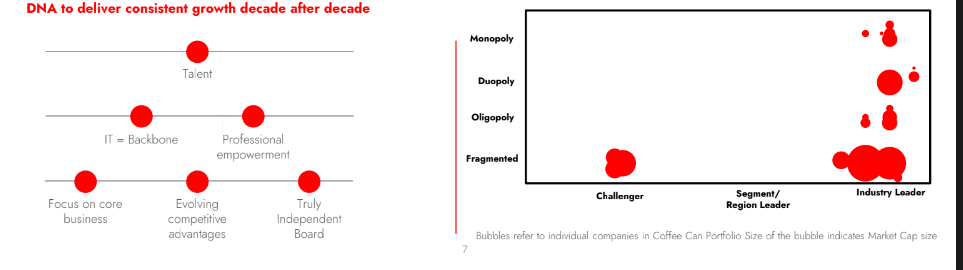

How did we deliver this?

Good risk adjusted returns is an outcome of Good Processes characterized by:

- Stringent quantitative filters

- Each offering is based on deeply researched and back tested framework to generate the investment universe

- High threshold for performance over long spans of time, greatly minimize chances of poor performers or poor quality companies entering into the investment universe

- High quality of accounts and corporate governance is uncompromised

- Experienced team & deep-dive research

- Dedicated and experienced research team

- Research processes inspired by IE Research

- Investment Committee to approve all investment decisions

- Part of larger Ambit group lends advantages

- Focus on what is knowable and what is important

- Focus on earnings growth + earnings quality

- Lower obsession with timing when one is investing in a superior calibre of companies

- Companies with a consistent track record and leadership traits are preferred

- Past track record + Future sector potential + Current management capabilities = Comfort on delivering quality earnings

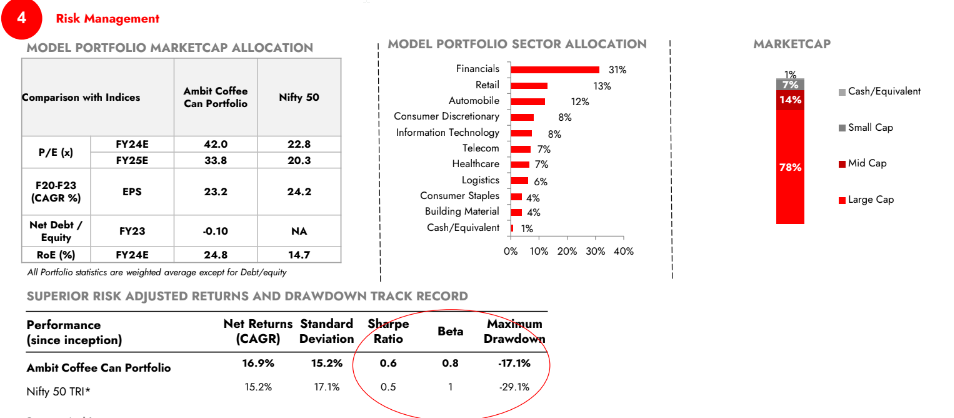

- Risk management

- Concentrated Portfolios deliver best returns as returns do not get average out

- Lower drawdowns due to consistent performers in secular sectors

- Long term orientation with low churn realize the power of compounding

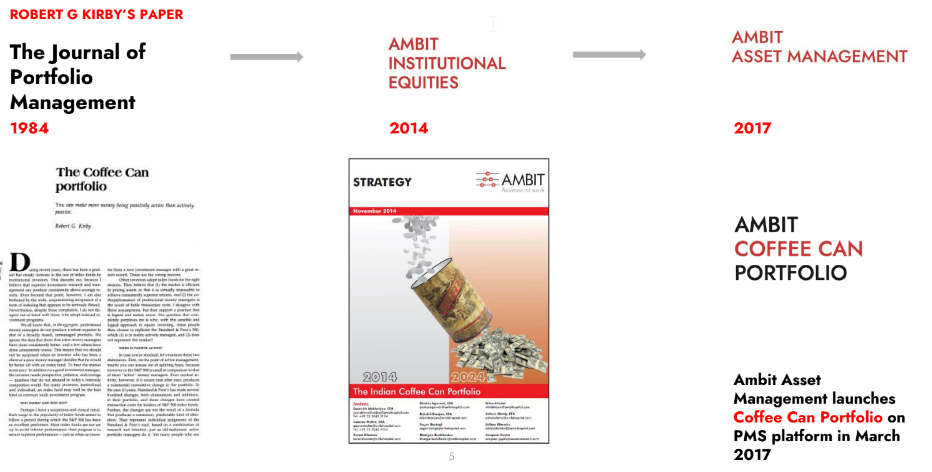

Origins of Ambit’s Coffee Can Portfolio

Stringent Investment Framework

- Investment universe:

- Established Coffee Can companies - 10-20 years of historical track record of consistency (>10% YoY Revenue Growth + >15% ROCE)

- Prospective Coffee Can companies – Qualitative parameters

- Our competitive advantage = Deep understanding of organizational DNA

- Concentrated portfolio of up to 20 stocks

- Marry valuations with longevity

- Churn (if required) = <1 stock per year on average

- Monitor earnings potential of companies in portfolio

- Will the firm sustain CONSISTENCY of growth in future (more than a decade)?

Ambit Coffee Can Portfolio Philosophy

- Consistent Track Record

- Companies having excellent financial track record of revenue growth and earnings for over 10-20 years with identifiable DNA

- Long Term Wealth Creation

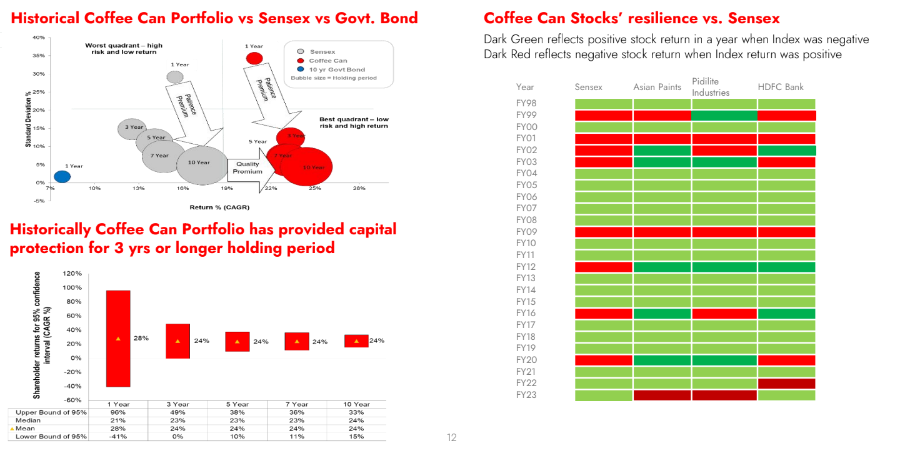

- Coffee Can Portfolio intends to provide 20-25% Earnings CAGR over long term holding periods with volatility of portfolio similar to Govt. bonds (holding period>3 years)

- Low/Negligible Churn

- Coffee Can Portfolio is a highly concentrated portfolio with 10- 15 stocks and intended churn of less than 1 stock per year on average. This allows the portfolio to benefit from “Power of Compounding”

- Do not “TIME” the market

- Do not attempt to time the market on the basis of speculation surrounding oil price, exchange rates, politics or other non- fundamental factors

- Market Leaders in B2C Sectors

- Most companies in Coffee Can Portfolio dominate their markets and possess unassailable competitive advantages in their core industries.

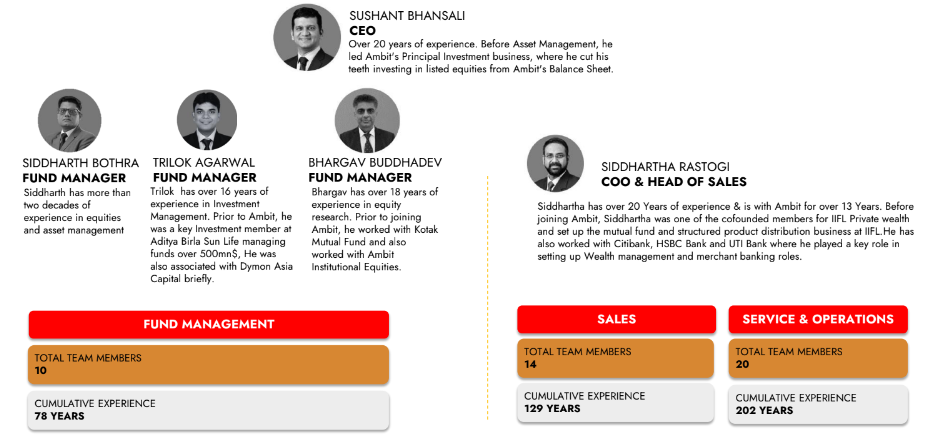

Ambit Asset Management Team

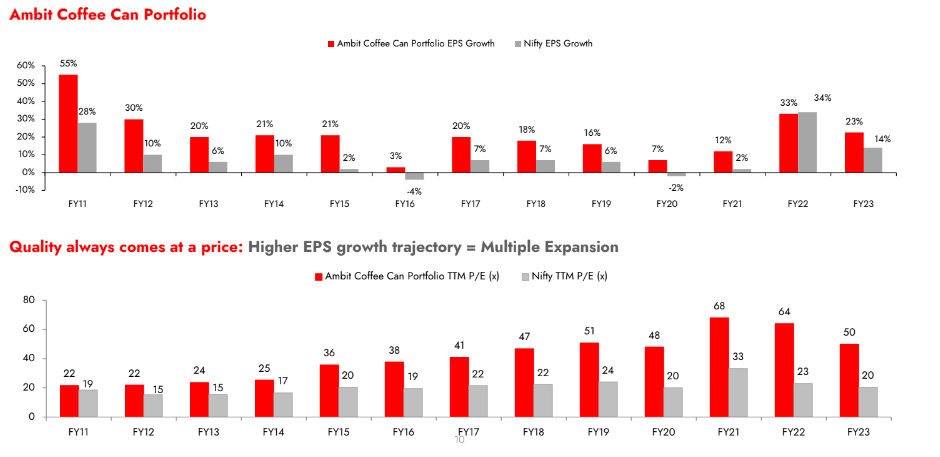

"Earnings growth is the only driver of share prices..."

Ambit Coffee Can Portfolio Earnings vs. Nifty Earnings

Ambit Coffee Can philosophy delivers

Ambit Coffee Can Portfolio exhibits superior risk adjusted returns

Deep dive research presented through our Disruption series...

Key terms

- Fund Type SEBI Registered PMS

- Fund Tenure Open Ended

- Structure Discretionary PMS

- Minimum investment INR 50 lacs

- Stock selection Investible universe is stocks that perform well on the framework noted earlier. A further subjective assessment then leads to a more concentrated stock portfolio

- Number of stocks Up to 20 Stocks, 33% per sector, 15% per stock Large cap biased with Nifty 50 TRI* as the benchmark

- Time horizon and turnover The investment horizon is 3-5 years and longer; turnover therefore low

- Cash calls Not to take aggressive cash calls; this is keeping in mind the longer term investment horizon of the fund and is suitable from a taxation standpoint

- Custodian & Fund Accountant ICICI Bank Limited.

- Brokers Ambit Capital, Motilal Oswal, Kotak Securities, HDFC Securities, Spark Capital, Batlivala and Karani Securities Pvt Ltd

- Depository Participant Ambit Capital (Central Depository Services Limited)

Our presence

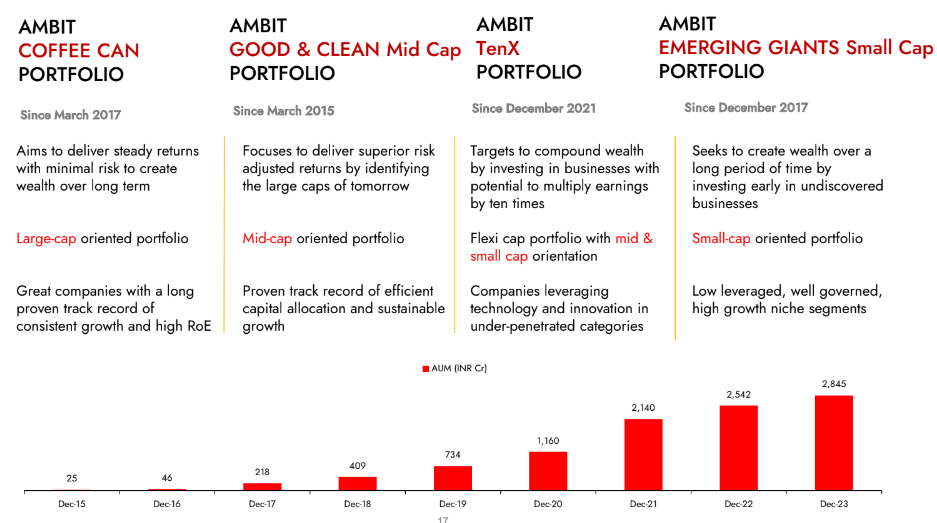

Ambit Asset Management Overview