Finance

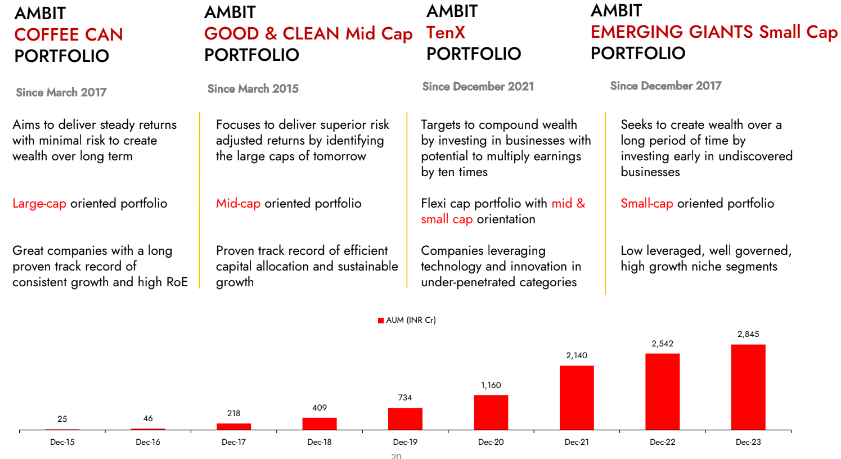

Ambit Good & Clean Mid Cap Portfolio

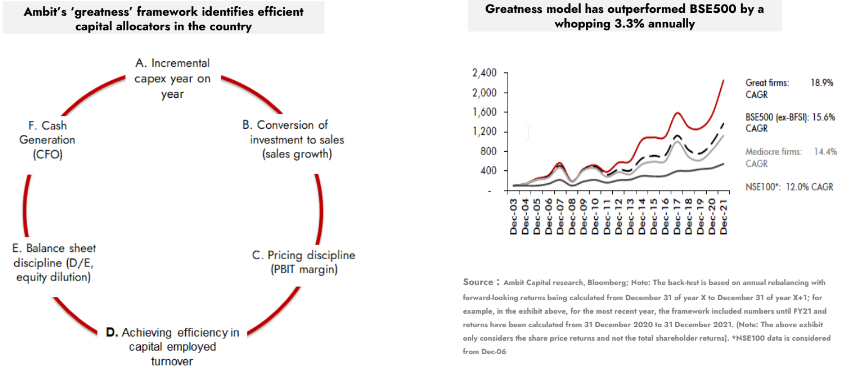

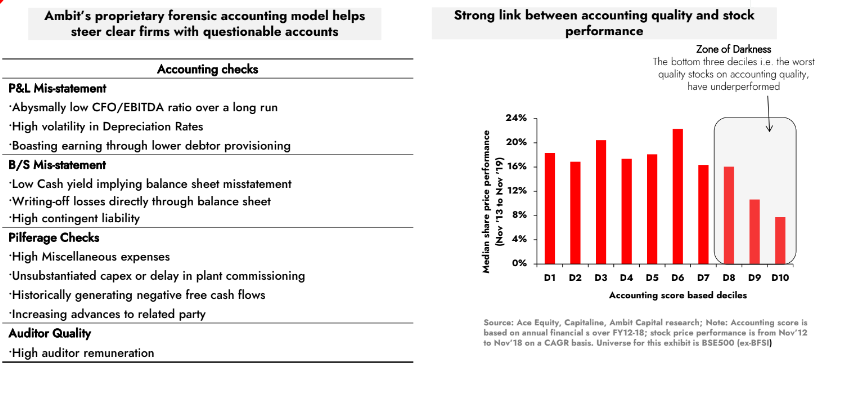

What drives success for corporate India?

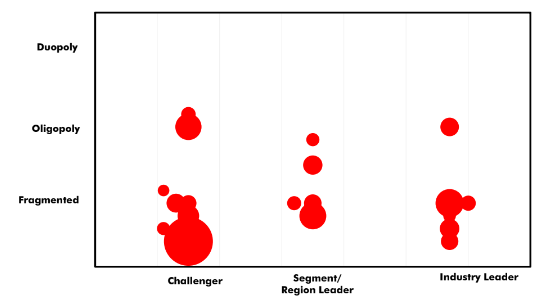

Our research over the past few years shows that over and above firm-specific competitive advantages, three factors are essential for a company to consistently outperform

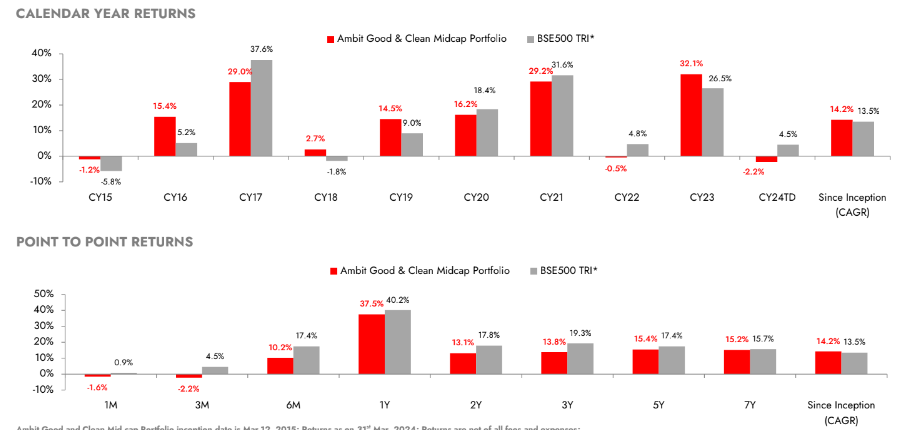

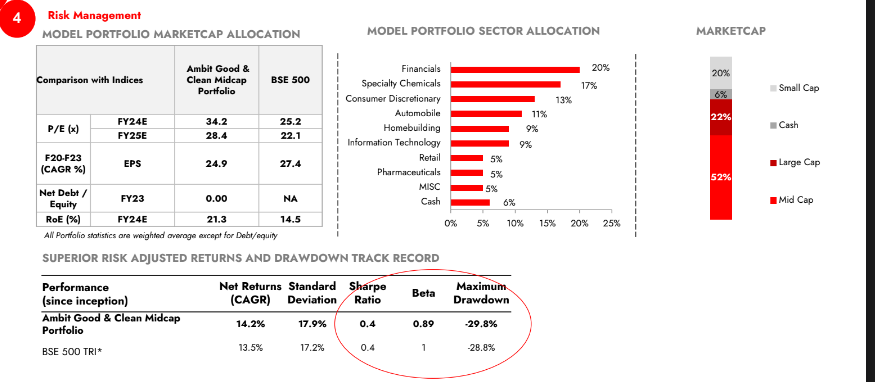

Ambit Good & Clean Mid Cap Portfolio : Performance Track Record

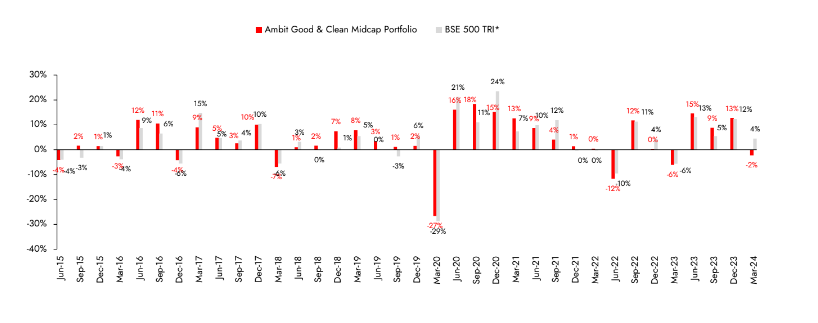

Quarterly Performance – Ambit Good & Clean Midcap Portfolio

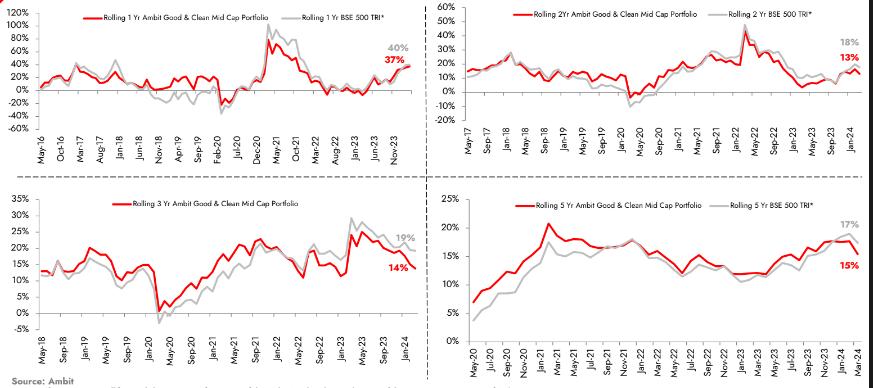

Performance: Rolling basis

How did we deliver this?

Good risk adjusted returns is an outcome of Good Processes characterized by:

- Stringent quantitative filters

- Each offering is based on deeply researched and back tested framework to generate the investment universe

- High threshold for performance over long spans of time, greatly minimize chances of poor performers or poor quality companies entering into the investment universe

- High quality of accounts and corporate governance is uncompromised

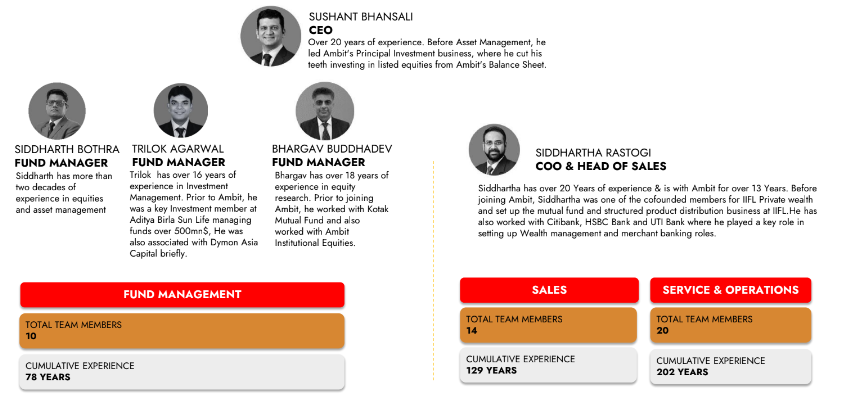

- Experienced team & deep-dive research

- Dedicated and experienced research team

- Research processes inspired by IE Research

- Investment Committee to approve all investment decisions

- Part of larger Ambit group lends advantages

- Focus on what is knowable and what is important

- Focus on earnings growth + earnings quality

- Lower obsession with timing when one is investing in a superior calibre of companies

- Companies with a consistent track record and leadership traits are preferred

- Past track record + Future sector potential + Current management capabilities = Comfort on delivering quality earnings

- Risk management

- Concentrated Portfolios deliver best returns as returns do not get average out

- Lower drawdowns due to consistent performers in secular sectors

- Long term orientation with low churn realize the power of compounding

Stringent quantitative filters

- SEBI Defined Small Cap companies

- Check for efficiency of capital allocation(Good)

- Check for quality of accounts & Corporate Governance(Clean)

- Bottom-up Research

- Industry Analysis, Management meets & Channel checks

- Concentrated portfolio of 15-20 companies

- Constant monitoring & review

- Churn = 15-20%

Invest in firms which are: (a) Good - On the basis of capital allocation track record and quality of improvement in financial metrics over the past six years, and (b) Clean - Based on the quality of their accounts & corporate governance.

- The focus on ‘good’ helps generate upside while not compromising on ‘clean’ reduces downside risk. Essentially, while the objective is to generate returns, the even bigger goal is to better manage drawdowns because we believe doing the latter successfully is critically vital in achieving the former.

- The bigger idea is to identify small cap businesses, with strong leadership position in the micro or niche market that they are operating in. It not only gives them effective pricing power but help them gain in scale and become large companies of tomorrow

- These businesses have Zero or near Zero leverage with ethical and prudent management. When investing in small cap business, we believe its of paramount importance to look for companies with strong management pedigree, with established competence and unparalleled integrity.

- This funds draws down lesser than the market in corrections and has low churn (not more than 15-20% of portfolio).

Focus on ‘good’ helps generate upside

Not compromising on ‘clean’ is critical to managing drawdowns

Portfolio Composition & Characteristics

- Stellar track records of capital allocation reflecting high RoE.

- Strong corporate governance & fairness of accounts.

- Strong pedigree of management with high competency and integrity.

- Negligible leverage at portfolio level.

- Growth potential above the comparable index. Median market cap of the portfolio is ~Rs38,426 cr.

- Reasonable valuation for quality stocks

Good & Clean philosophy delivers

"Earnings growth is the only driver of share prices..."

Earnings growth is the key driver of stock price...

Key terms

- Fund Type SEBI Registered PMS

- Fund Tenure Open Ended

- Structure Discretionary PMS

- Minimum investment INR 50 lacs

- Stock selection Investible universe is stocks that perform well on the framework noted earlier. A further subjective assessment then leads to a more concentrated stock portfolio

- Number of stocks 15 – 20, 25% per sector (except BFSI), 10% per stock

- All cap with ‘BSE 500 TRI’ as the benchmark

- Time horizon and turnover The investment horizon is 3-5 years and longer; turnover therefore low

- Cash calls Not to take aggressive cash calls; this is keeping in mind the longer term investment horizon of the fund and is suitable from a taxation standpoint

- Custodian & Fund Accountant ICICI Bank Limited.

- Brokers Ambit Capital, Motilal Oswal, Kotak Securities, HDFC Securities, Spark Capital, Batlivala and Karani Securities Pvt Ltd

- Depository Participant Ambit Capital (Central Depository Services Limited)

Ambit Asset Management Team

Ambit Asset Management Overview

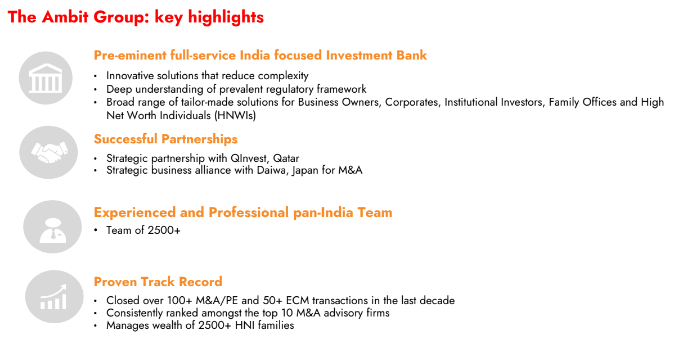

Ambit Overview