Anand Rathi Advisors Decennium Opportunity

Objective

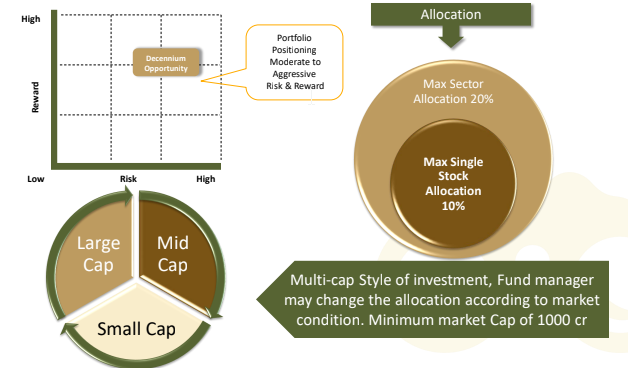

Focus on return optimization by investing in multicap portfolio of companies with good corporate governance, strong emerging business or companies entering into next business upcycle.

Dual Focus Portfolio Strategy

Investing in companies which are likely to benefit from Industrial Revolution, new age business, favorable Policies, and companies that are showing visible sign of turnaround with higher growth in their next business up cycle.

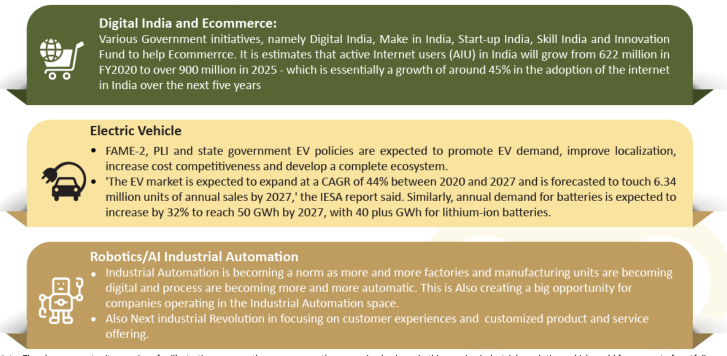

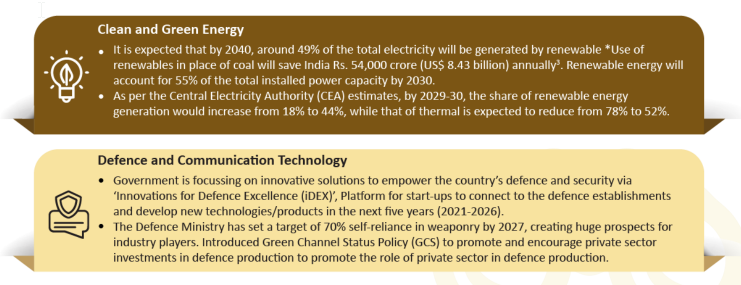

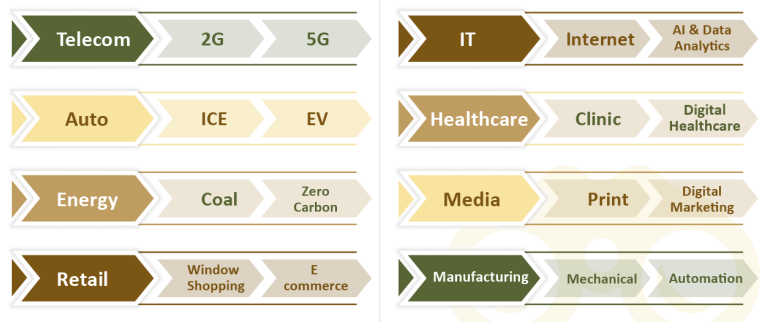

Emerging business of ongoing Industrial Revolution

Emerging business of ongoing Industrial Revolution

Emerging business of ongoing Industrial Revolution

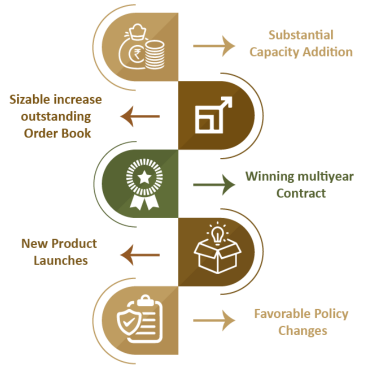

Opportunity - Accelerated Growth from Business Upcycle

- Indian economy has found its place among the key global players in many of the sectors.

- India increasing its share and becoming a part of the global supply chain and also a reliable partner.

- Government focus on building capabilities, scale and good manufacturing practices.

- PLI, Export incentive and Atmanirbhar Bharat Initiative very well supportive to strengthen India’s private players/ Enterpreneurs to scale up their business.

- With overall economic growth both at macro and micro level and favorable policy many sectors enters into their next business upcycle

Opportunities at every level of emerging business

The key to success is to adapt to the changing business dynamics.

Potential Opportunity

- We can see from the graph the stocks in New economy China has outperformed the broader markets in China.

- Indian economy too is witnessing the similar trend with new economy sectors and companies likely to showcase strong growth relative to broader market in coming years.

- The MarketGrader China New Economy Index seeks to follow the most fundamentally sound companies with the best growth prospects in the Consumer Staples, Consumer Discretionary, Technology, and Health Care sectors that are domiciled and listed in Mainland China.

- We can see from the graph the stocks in New economy China has outperformed the broader markets in China.

- Indian economy too is witnessing the similar trend with new economy sectors and companies likely to showcase strong growth relative to broader market in coming years.

- The MarketGrader China New Economy Index seeks to follow the most fundamentally sound companies with the best growth prospects in the Consumer Staples, Consumer Discretionary, Technology, and Health Care sectors that are domiciled and listed in Mainland China.

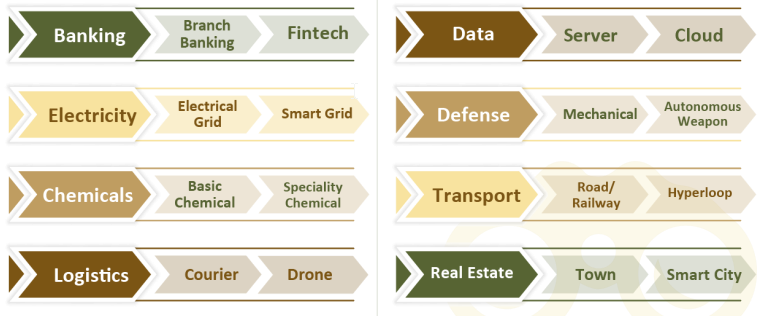

Stock Selection Process

4P Strategy – Stock Selection

Companies to undergo 4 P Analysis to make it to the Universe

Companies to undergo 4 P Analysis to make it to the Universe

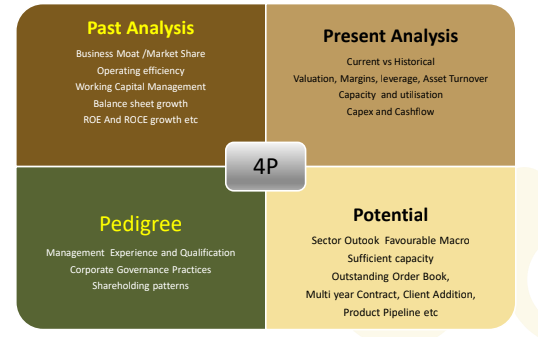

Portfolio Strategy

Re-VIEW Strategy

- Valuation Check: A constant check is kept on the valuation of the companies so that any stock whose valuation becomes relatively high, due to any reasons like sentiments or increase in liquidity, is exited before any price correction comes to the stock. We then shift the money to a new stock with a reasonable valuation.

- Impact of Events: A stock price can be highly affected by an event or series of events, recent examples: COVID crisis, Russia-Ukraine War, Increase in Crude Price, Interest Rates Hike etc. Our team actively tracks these events and makes timely modifications as per the situation’s needs to minimize risks & optimize returns.

- Earnings Visibility Changes: Our fundamental research team scrutinizes the quarterly results of the companies to understand the current & future estimated growth. If we are not satisfied with 2 or 3 quarterly results of the company & don’t see growth, we take an exit to move to another stock.

- Weightage Check of the Holdings: Every stock & sector has been capped to a certain percentage of the total allocation to limit downside due to any uncertainties and also diversify the portfolio. If any stock or sector reaches near to the decided percent of allocation, we book profits and reduce the weightage and invest into any other stock.

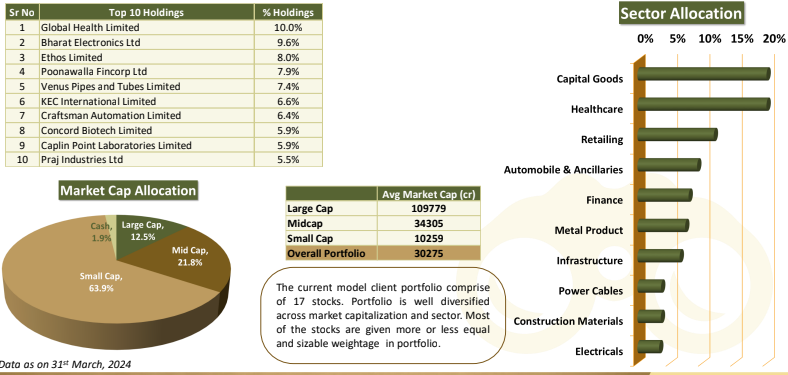

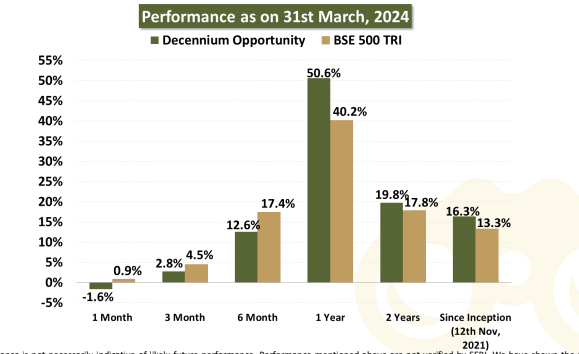

Portfolio Synopsis

Portfolio Synopsis

Founder & Promoter (Anand Rathi Group)

- Gold medalist Chartered Accountant having more than four decades of rich and varied experience in corporate management, financial & capital markets and corporate & management consultancy.

- Served Aditya Birla Group at very senior positions for more than 25 years before starting his own financial services outfit. Shri Rathi was earlier President of BSE for two terms.

- Anand Rathi Group derives its strength and vision from legendary leadership of Shri Anand Rathi and charting growth path in his able guidance.

- Over twenty years broad based experience in the securities market and key driver of the Retail and Institutional Equities business of the group.

- Under his leadership, the Group’s Institutional & Retail Business has won great recognition and many accolades. He has played a pivotal role in the Group’s network expansion and pan India growth.

- His valuable contribution towards professionalizing the management of the Group has won him immense respect from the corporate world.

Fund Management Team

- More than 17 years of rich experience in Investment advisory, Product Development and Portfolio Management.

- Working with Anand Rathi since 2007 across Portfolio Management and Private Client Group Equity Advisory Started Career with “Kotak

- Securities Ltd” in 2005 as an Investment Advisor subsequently got into developing Equity products and running the same.

- Qualified MBA (Finance) from Mumbai University and Certified Financial Planner.

- More than 17 years of rich experience in Investment advisory, Portfolio Management and research.

- Worked in past with Standard Chartered Securities, Religare Securities, Enam Securities.

- PGDBM from Mumbai.

Features

Decennium Opportunity Portfolio

Minimum Investment Rs. 50 lakhs Allocation 15-20 STOCKS, diversified across sectors Investment Approach Diversified portfolio of emerging business in India and Companies entering in next business up cycle. Risk - Reward & Tenure Aggressive risk reward. Investment tenure preferably 3 years+ Type of Instruments Equity & Equity Related Instruments, Fixed Income Instruments, Cash & Cash Equivalent Benchmark BSE 500 TRI

- Benefits:

- Dedicated Web Login for client to monitor portfolio.

- A relationship manager to cater to investment needs

- Constant monitoring of the portfolio

- Audited statement at year end for tax filing purpose.

- Support:

- Back office customer service desk to address client queries

Fees & Charges

- AMC fees : 2.5% p.a (Charged Pro-rata at end of each quarter)

- Brokerage : 0.25% on Equity delivery transaction

- Exit Load : 2% - 1st Year, 1% - 2 nd Year, NIL from 3rd Year.

- Other Charges : GST, Other charges levied by Exchange, Custodial charges (3 bps) levied by custodian and any other statutory charges.