Finance

Anand Rathi Impress Opportunity

Objective & Investment Philosophy

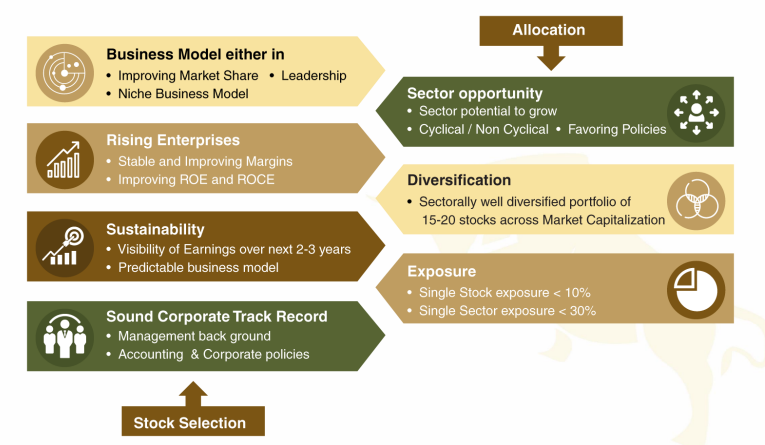

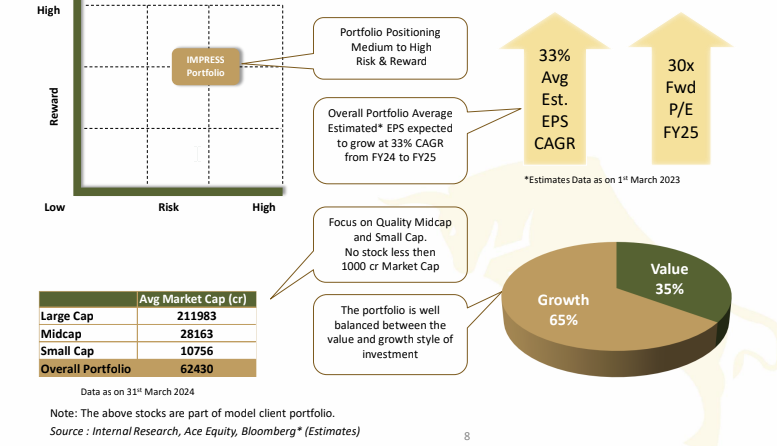

Focus on Return Optimization by investing in multicap portfolio of rising enterprises with sound corporate track record and sustainable business model keeping balance between value and growth strategy.

- Value: Value investing is the art of buying stocks which trade at a significant discount to their intrinsic value. Portfolio Manager achieve this by looking for companies on cheap valuation metrics, typically low multiples of their profits or assets, for reasons which are not justified over the longer term.

- Growth: Growth investing is a style of investment strategy focused on capital appreciation. Portfolio Manager invest in companies that exhibit signs of above- average growth, even if the share price appears expensive in terms of metrics such as price-to- earnings or price-to- book ratios.

Why Multicap Strategy

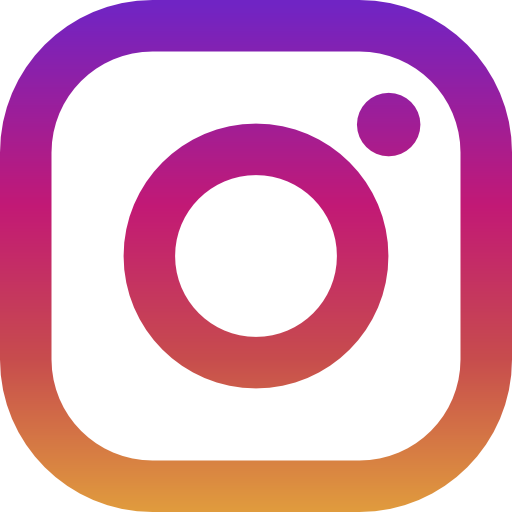

- The table shows outperformance of the Mid Cap and Small Cap Index over the Sensex Indexduring the Bull Period.

- Outperformance of the Mid Cap and small caps happens because of better earnings growth in the bull phase.

- The P/E for Mid cap and Small Caps also expands as earnings growth is superior v/s Sensex earnings growth.

- Identifying the business within attractive valuation compare to their growth is key factor for outperformance.

- Returns delivered from Mid Cap and Small Cap do outperform the Large Cap, however one should keep in mind the risk associated with it as we see the higher volatility in it. Therefore we emphasis on stringent stock selection strategy and create a diversified Multicap portfolio to create alpha over the benchmark.

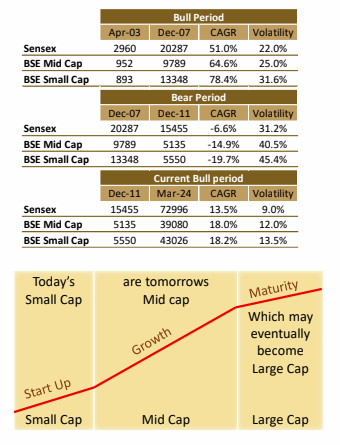

4P Strategy – Stock Selection

Companies to undergo 4 P Analysis to make it to the Universe

Companies to undergo 4 P Analysis to make it to the Universe

Investment Process

Re-VIEW Strategy

- Valuation Check: A constant check is kept on the valuation of the companies so that any stock whose valuation becomes relatively high, due to any reasons like sentiments or increase in liquidity, is exited before any price correction comes to the stock. We then shift the money to a new stock with a reasonable valuation.

- Impact of Events: A stock price can be highly affected by an event or series of events, recent examples: COVID crisis, Russia-Ukraine War, Increase in Crude Price, Interest Rates Hike etc. Our team actively tracks these events and makes timely modifications as per the situation’s needs to minimize risks & optimize returns.

- Earnings Visibility Changes: Our fundamental research team scrutinizes the quarterly results of the companies to understand the current & future estimated growth. If we are not satisfied with 2 or 3 quarterly results of the company & don’t see growth, we take an exit to move to another stock.

- Weightage Check of the Holdings: Every stock & sector has been capped to a certain percentage of the total allocation to limit downside due to any uncertainties and also diversify the portfolio. If any stock or sector reaches near to the decided percent of allocation, we book profits and reduce the weightage and invest into any other stock.

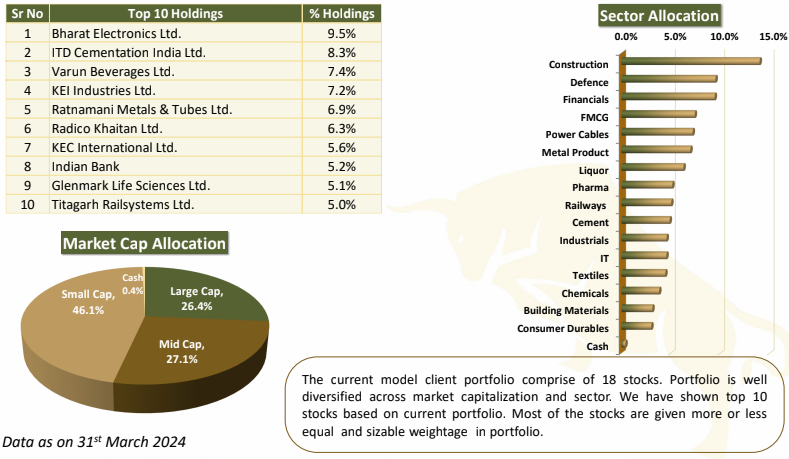

Top Holdings & Market Cap Allocation

Portfolio Strategy

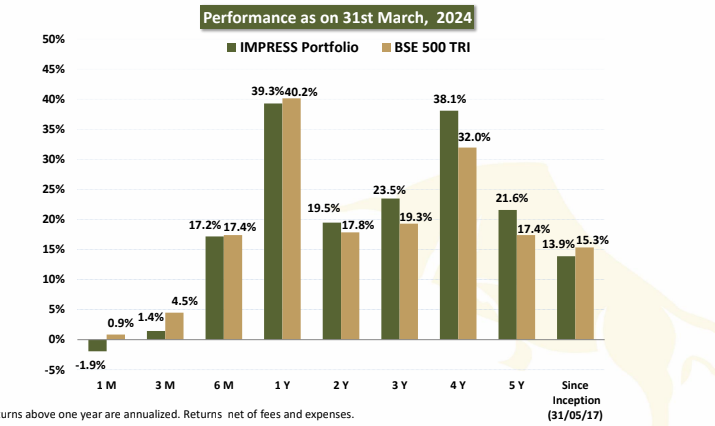

Portfolio Performance

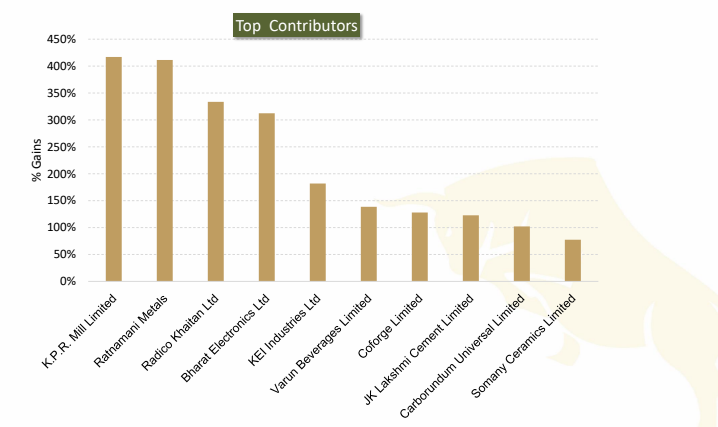

Top Contributors

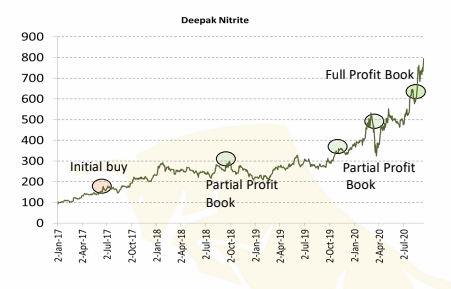

Success Stories - Deepak Nitrite

- Deepak Nitrite is part of Deepak group (Deepak Fertilizer)

- It operates in Basic Chemical, Fine and Speciality chemical, Performance Product.

- The Story evolve in 2017 with their green field expansion plan at Dahej,Gujarat for manufacturing phenol (2,00,000ton/year) and acetone(1,20,000T/year) getting completed.

- The global chemical Industry was shifting from china to emerging Asian region.

- These were the chemicals which were 80% imported and provided a lot of scope to cater to domestic demand.

- By end of 2019 company started to operate at full capacity.

- Although we have exited some greenshoots with respect to Isoprophyl Alcohol capacity expansions are available to company.

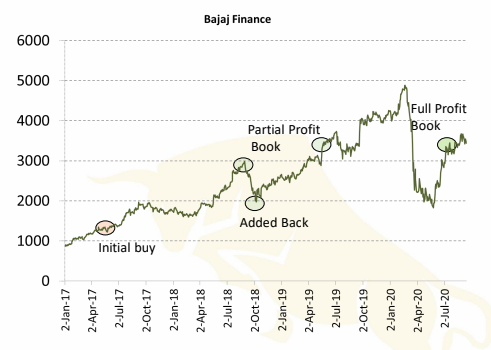

Success Stories - Bajaj Finance

- One of the Fastest growing and well diversified NBFC from the Bajaj Group.

- Consistent growth in NII and ROA with NPA under control.

- Focus on retail franchise.

- Always got better valuation then peers.

- Exited full investment as credit growth is lilkely to be slower and with base reaching so high for NBFC and Capital raising to dilute earning. Which will pull down the premium valuation it command due to high growth.

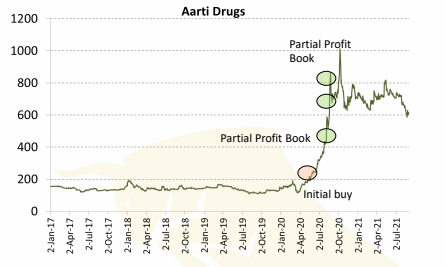

Success Stories - Aarti Drugs

- Aarti Drugs Ltd is part of $900 Million Aarti Group of Industries is engaged in the manufacturing of Active Pharmaceutical Ingredients (APIs), Pharma Intermediates, Specialty Chemicals and also produces Formulations with its wholly-owned subsidiary – Pinnacle Life Science Private Limited. Products under APIs includes Ciprofloxacin Hydrochloride, Metronidazole, Metformin HCL, Ketoconazole, Ofloxacin etc. whereas Specialty Chemicals includes Benzene Sulphonyl Chloride, Methyl Nicotinate etc.

- The Company is one of the leading producer of Metamorfin and Fluoroquinolones in the world. It is largest producer of Tinidazole, Metronidazole, Ketoconazole, Nimesulide in the world.

- Aarti Drugs is in a sweet spot as it will benefit from opportunities arising out of China. It has started contract manufacturing of afew products which are in shortage and is further evaluating a few more. Besides, its key products feature in the list of 53 drugs for which the government is keen to boost indigenous manufacturing. Favorable macros along with recent additions in capacity for diabetes and specialty chemicals will help Aarti’s earnings to grow 20% over FY20-22.

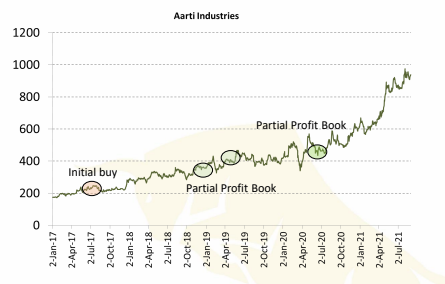

Success Stories - Aarti Industries

- Aarti Industries is part of Aarti Group

- Manufacturer of Specialty Chemicals and Pharmaceuticals with a global footprint. Chemicals manufactured by Aarti are used in the downstream manufacture of pharmaceuticals, agrochemicals, polymers, additives, surfactants, pigments, dyes, etc.

- Largest producer of benzene based basic and intermediate chemical.

- It was strategically placed to exploit growth opportunities in the chemical industry with products available across value chains of benzene, toluene and ethylene, and nitro-toluene.

- Winning of multi contract from couple of clients added further visibility.

- Constant capacity addition, and product launches is helping the company.

- To benefit from rising share of high-margin products, greater efficiencies, higher utilization and growing supplies to regulated market in the Pharma category.

Features

IMPRESS Portfolio

- Minimum investment Rs. 50 lakhs.

- Strategy EQUITY

- Allocation 15-20 STOCKS, diversified across sectors. Multicap – Spread between Small, Mid and Large Cap

- Investment Approach Multicap Portfolio - Balanced between Value and Growth. Most of the companies have adequate analyst coverage. Most of the stocks will be part of core portfolio.

- Risk - Reward & Tenure Medium to High Risk. Investment tenure 3 year plus

- Type of instruments Equity & Equity Related Instruments, Fixed Income Instruments, Cash & Cash Equivalent

- Benchmark BSE 500 TRI

BSE 500 TRI

- Benefits

- Dedicated Web Login for client to monitor portfolio.

- A relationship manager to cater to investment needs

- Constant monitoring of the portfolio

- Audited statement at year end for tax filing purpose.

- Support

- Back office customer service desk to address client queries

! [C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\impress12.png]