Avendus Capital Private Limited

Avendus Capital

Avendus Capital Public Markets Alternate Strategies LLP ("ACPMAS LLP"), a financial institution that provides financial advisory, wealth management, structured credit solutions, and alternative asset management services, was established on January 25, 2017, and serves as the Investment Manager (IM) for Category III Alternate Investment Funds that are registered with SEBI. With more than 100 years of combined expertise investing in Indian equities markets, ACPMAS LLP is a strong organization. Since 2005, the IM team, which is made up of highly skilled individuals, has been managing long/short strategies in the Indian equity markets.

With *USD 632 mn across long and short strategies, a stellar team track record spanning 15 years in the Indian stocks market, creative investment management strategies, and good risk management for capital preservation, they are also the largest hedge fund manager in the nation. In most market conditions, the team has effectively managed a long/short equity fund focused on positive absolute return techniques and low volatility. For their flagship product, Avendus Absolute Return Fund, the team received awards from HFM Asia Hedge Awards and Eureka Hedge Awards in 2019 for Best Single Country Fund and Best Indian Hedge Fund, respectively.

There are currently three products available for onshore investors: Avendus India Large-cap ESG Strategy via PMS, Avendus Enhanced Return Fund via AIF, and Avendus Absolute Return Strategy via PMS. Avendus Absolute Return Strategy is a low net long/short strategy. In early 2021, they plan to introduce its flagship strategy, the Avendus Absolute Return Fund, to foreign investors via an ICAV structure domiciled in Dublin.

Mr. Vaibhav Sanghavi, Co-CEO & Portfolio Manager

Vaibhav has over 17 years of experience in managing funds across leading financial institutions. He joined Avendus in December 2016 as Co - CEO of Avendus Capital Public Markets Alternate Strategies LLP and is the Portfolio manager to the Avendus Absolute Return Fund and Enhanced Return Fund. Prior to Avendus, he was part of Ambit Holdings Pvt. Ltd from October 2008 to September 2016 and was responsible for managing Ambit Alpha Fund. His fund management experience prior to Ambit, was with DSP Merrill Lynch from October 2005 to September 2008, where he was instrumental in building the Proprietary Trading team, managing and advising over USD $1 bn of capital. He has also worked with HDFC Bank, as part of treasury, managing proprietary investments in equities - from 2001 to 2005

Mr. Piyush Shah, Managing Director & Portfolio Manager

Piyush has over 20 years of experience in managing funds across leading financial institutions. He joined Avendus in December’2016 and is the Portfolio Manager to the Avendus Absolute Return Fund and Enhanced Return Fund. Prior to Avendus, he was part of Ambit Holdings Pvt. Ltd from October 2008 to September 2016 and was responsible for managing Ambit Alpha Fund. During his tenure at DSP Merrill Lynch from June 1996 to September 2008 he was instrumental in setting up the structured product desk and was responsible for building the Proprietary Trading team, managing /advising over USD $1 bn of capital.

Mr. Tarun Kewalramani, Director & Portfolio Manager

Tarun has over 20 years of industry experience across leading financial institutions. He joined Avendus in November 2016 and is responsible for managing the Avendus Absolute Return Fund and Enhanced Return Fund. Prior to joining Avendus, he was part of Ambit Holdings Pvt Ltd from May 2015 to October 2016 where he was responsible for managing the Ambit Alpha Fund. He also worked with DWS Asset Management and ING Asset Management in roles encompassing from Research to Fund Management

Mr. Abhay Laijawala, Managing Director & Portfolio Manager (Manages the Long only portfolio for Avendus Enhanced Return Fund and the Avendus India Large-Cap ESG Strategy)

Abhay is the Managing Director and Fund Manager at Avendus. Abhay joined from Deutsche Bank where he was the Managing Director and Head of Equity Research. With an experience stretching close to a quarter century, Abhay is a veteran in India’s capital markets, having seen their evolution since they were liberalized and opened to foreign institutional investors post the 1991 reforms. At Deutsche Bank, he spent a decade overseeing research coverage of more than 120 stocks across sectors, lead covering Indian metals companies and writing India Equity Strategy. Prior to joining Deutsche Bank, Abhay was Regional Head for Metals and Mining research at JP Morgan. Abhay has been a highly ranked analyst and strategist and prior to Deutsche Bank and JP Morgan, Abhay worked with Citigroup, DSP Merrill Lynch, HSBC and BZW Barclays. Abhay has earned his MBA from the University of Rhode Island, USA with a specialization in finance and holds a master’s degree in commerce from the University of Bombay. Apart from equity markets his other interests include global macro, international finance and the economics of climate change.

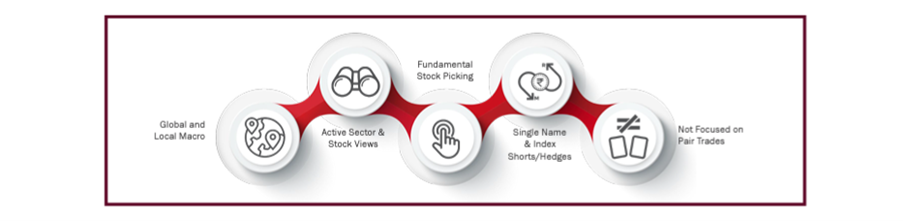

On its long/short strategy, as seen in the chart below, the team uses a thorough top down and bottom up approach to security selection, while for the long only portfolios, it uses a proprietary screener methodology to find better, sustainable, or turnaround enterprises.

AVENDUS ABSOLUTE RETURN FUND (AARF)

Investment Purpose

Through long and short positions in equities and indices, the fund pursues capital growth and positive returns in an effective, risk-adjusted way. Investment Methodology The goal of the fund strategy is to provide absolute returns across a range of market conditions with lower volatility than the entire stock market and low correlation to traditional asset classes. Investment Methodology The team's analysis of the global and local markets, as well as its examination of significant macroeconomic indicators, served as the foundation for the approach, which identified the sectors and stocks most likely to outperform and underperform the markets.

In addition to this, assessment of fundamental, technical and momentum factors are used to arrive at the pool of stocks for portfolio construction on long and short side. The fund may also invest into IPOs, QIP, arbitrage opportunities and other opportunities.

Investment Objective

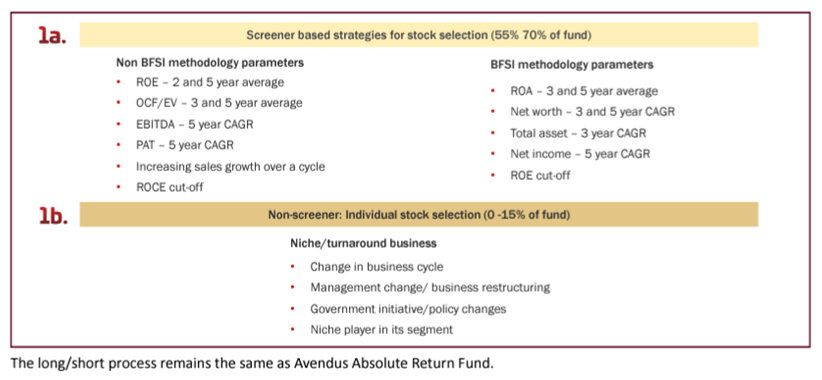

The objective of the Avendus Enhanced Return Fund-Series II is to generate superior returns to Nifty 50 index while limiting downside Investment Strategy Avendus Enhanced Return Fund tries to limit downside while outperforming the Nifty 50 index. The long only portfolio of this fund targets high alpha, while the long/short strategy, which can be used to tactically leverage returns or aim reduced beta, receives 30% of the proceeds. By making investments in a portfolio of 15–25 high conviction companies based on a custom screener model, high alpha is sought after. Stock Selection Process for Long Only Portfolio: Every year, the BSE 200 Index is run through the fundamental screener to provide a universe of shortlisted investible stocks. The investing team narrows down the portfolio stocks from that range. The investment team will assess them and offer them to the investment committee if there is any particular long-term theme or turnaround narrative (such as housing, rural, infrastructure, defense, etc.) that could operate as a positive catalyst for certain businesses. Recent IPOs with short financial histories can fall under this category. At the time of investment, the outside screener portfolio will not be larger than 15%. Every stock in the portfolio is supported with a research report outlining the investing thesis. The research team uses the screeners to filter companies which do not meet our fundamental parameters as laid down below. The research team builds their framework basis the financial information reported by the companies on an annual basis

AARF Portfolio Characteristics

A debt* alternative is ideal for one's portfolio and has the following benefits:

- A primary focus on capital preservation

- A potential greater post-tax yield compared to liquid and arbitrage funds** It deals in derivatives such as futures and options for underlying equities or indices. It involves buying equities and equity derivatives that are anticipated to increase in value and selling short through derivatives that are anticipated to decline in value or underperform the longs. Its goal is to deliver better risk adjusted returns with lower volatility.

- Historical volatility of 5-6% is consistent with debt funds.

- Data since June 2013 including the team track record of earlier strategy managed by the same team

- Debt category includes low duration funds, ultra short term funds, short term income funds, Banking and PSU Funds, Corporate Bond Funds

- Basis comparison of post tax yields of Avendus Absolute Return Fund with liquid and arbitrage funds during Calendar year 2018 & 2019 and current prevailing yields considered till November 2020

AERF Portfolio Characteristics

- Target is to generate equity plus returns with an equity minus risk over a longer period relative to the Nifty 50 Index

- Ideal to take equity exposure with lower volatility compared to long only large cap funds

- 30% long/short portfolio helps enhance returns or limit downside unlike long only funds

- Could potentially work as an alternative to large cap or balanced funds in one’s portfolio We have conducted an exclusive interview with Mr. Vaibhav Sanghavi, Co-CEO & Portfolio Manager in order to know the Avendus portfolios in depth and enable our investors to make informed decisions. The questions and answers are reproduced verbatim:

What is the Key difference between Avendus Absolute Return Fund & Avendus Enhanced Return Fund and to what category of investor’s risk profile these funds are suitable? The Avendus Absolute Return Fund is a long/short strategy with the goal of generating positive returns through long and short positions in indices and stocks in an effective and risk-adjusted way. Capital preservation and generating greater risk-adjusted returns with lower volatility would be this fund's main objectives. When compared to liquid and arbitrage funds, it is the perfect debt choice for a portfolio and targets possibly greater post-tax yield. A long-biased long/short strategy is the Avendus Enhanced Return Fund. The approach will allocate around 70% of the proceeds to a long-only portfolio that seeks high alpha and roughly 30% to a long-short portfolio that can be tactically leveraged to increase returns or utilized to seek lower beta. In comparison to the Nifty 50 Index, the goal is to create equity plus returns with equity minus risk over a longer period of time. As opposed to long-only large cap funds, equity exposure with lower volatility is ideal. Alternative to large-cap or balanced funds that could be used in a portfolio In the Avendus Absolute Return Fund portfolio, is there a fixed component of long ideas and a fixed component of short ideas, or this is dynamic blend? What is the thinking behind this? It is a dynamically managed portfolio with the goal of generating positive returns through long and short positions in equities and indices in an effective and risk-adjusted manner. It entails purchasing equity derivatives and stocks that are anticipated to rise in value and selling short through derivatives that are anticipated to fall in value or perform worse than the longs. This more adaptable investment approach can produce greater alpha in both rising and falling markets. However, the fund always keeps a minimum of 30% hedged, and this can only go up depending on the market situation.

Avendus Absolute Return Strategy is available through the AIF and PMS platform. Is there any major or minor difference in the way the strategies are run on AIF and PMS platforms? If yes, please share info on the tweaks. On both the AIF and the PMS platforms, the strategy remains largely the same except for a minor difference that on the AIF platform we may invest in IPOs or arbitrage.

Please tell us about Avendus Enhanced Return Fund’s record in terms of generating superior returns to Nifty 50 index. Also, during downside periods, how has the strategy done in terms of limiting downside? The Avendus Enhanced Return Fund has produced a 14.9% net return since inception, compared to the 13.7% return of the Nifty. Compared to Nifty's 12.1% return, Avendus Enhanced Return Fund Series II has produced a net return of 10.7%. The strategy allocates 70% of funds to a long-only portfolio with a high alpha target, while the remaining 30% is allocated to a long-short portfolio that can be leveraged to increase returns or reduce downside risk with lower volatility. Nifty has had four negative quarters in the last three years, which is the third time since the Fund's inception. In three of those quarters, the long short portfolio (30% of the fund) produced positive returns. Consequently, I was able to limit the negative 75% of the time. The volatility has been kept in check and kept below the benchmark. As of November, the Avendus Enhanced Return Fund's since-inception volatility was 18.3% compared to the Nifty's 21.2% volatility, while the Avendus Enhanced Return Fund Series II's volatility was 20.0% compared to the Nifty's 23.9% volatility. Lastly, how does Avendus India Large-cap ESG Strategy, available through the PMS route, differ from the existing ESG products in the mutual fund platform? The Avendus India large-cap ESG strategy is an extension of our prior ESG AIF and has a track record of 19 months of outperformance over the benchmark, in contrast to the majority of other products on the MF platform, which are mostly recent debuts. The ESG AIF portfolio firms have not encountered ESG concerns since launch, which gives us confidence in the reliability of our procedure. As ESG investing pioneers in India, we aim to raise the bar through our unique methodology. Integrated ESG investment philosophy, proactive corporate involvement on material ESG issues, and conscientious stewardship on ESG issues are the three pillars that support our approach to ESG investing. A key component of our thorough ESG process is the explicit integration of ESG factors with fundamental factors. Our method goes much beyond simply ranking or rating the firms based on their ESG performance. We consciously monitor carbon emissions at the businesses in our portfolio and report the portfolio's carbon footprint in comparison to the benchmark. In a nation like ours, which is in the center of the sensitivity to climate change, this metric becomes more important. We believe in a more focused approach to portfolio management and have no more than 25 stocks in our portfolio, as opposed to other MF products that have a long-tail portfolio.