Axis Securities

AXIS SECURITIES

For more than ten years, Axis Securities PMS has a long and illustrious history of giving its investors reliable returns that outperform the market. Their initial strategy, Vision 2020, was introduced in 2009 with the goal of transforming India over the ensuing ten years (2010–2020). Before being abandoned in early 2020, this strategy generated constant returns of 16% CAGR over the course of 11 years. During this sunset time, the majority of the original investors have transitioned to new strategies like Pure Contra or Pure Growth, demonstrating their sustained faith in their investment advisors. Axis Securities now provides five different strategies, with Axis Pure Contra and Axis Pure Growth commanding the majority of Assets Under Management. Their other tactics are client-specific; thus, they might be classified as bespoke. The two flagship strategies, Axis Pure Growth and Axis Pure Contra, are the subject of this newsletter. Both of these approaches, which were introduced as novel, two-pronged tactics, involved the use of multi-factor models (based on quantitative models) and in-depth basic research (qualitative check). This marked a significant change in the company's strategy from a theme to a more all-encompassing factor-based strategy, which helps clients diversify their portfolios across different investment strategies based on risk laddering. The strategies are based on a risk laddering strategy and cater to a wide range of investor requirements. Axis Pure Contra strategy takes an aggressive stance in contrast to Axis Pure Growth's balanced approach. A highly skilled fund management group led by Naveen Kulkarni, chief investment officer, and Nishit Master, portfolio manager, oversees the strategy. Naveen Kulkarni has over 16 years of substantial experience in the capital markets, in addition to his two decades of overall experience. He oversaw institutional and retail equity research at Reliance Securities in his prior position. Prior to joining Reliance Securities, he spent 11 years as Co-Head of Institutional Research at Phillip Capital. Nishit Master is the Portfolio Manager for the Strategies and has over 17 years of diverse experience in both BUY side and Sell side Equities. Nishit started his career with Kotak Mahindra Bank before moving to Anand Rathi where he covered the Capital Goods sector. He then worked for 4 years with ING Mutual Fund covering many sectors such as Capital Goods, Telecom, and Oil & Gas sectors. Post-ING Mutual Fund, Nishit had various stints with various firms including Head of Institutional Equities at Reliance Equities, SVP at Motilal Oswal, and Emkay Global before joining Axis Securities as Portfolio Manager.

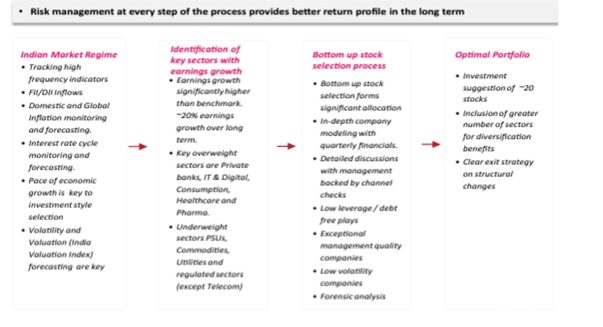

AXIS SECURITIES PORTFOLIO CONSTRUCTION METHODOLOGY

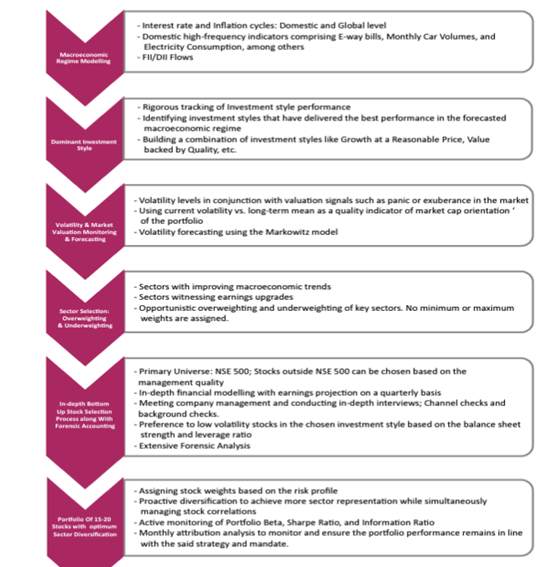

The Indian equity market has changed over time and is still improving in terms of efficiency. In spite of this increase in efficiency, producing alpha over the benchmark necessitates a disciplined long-term investing strategy without discounting short-term indications. While investment types like Value, Growth, Quality, and Momentum can be blamed for a sizable amount of market returns, all of these styles also experience large periods of outperformance and underperformance. Value, for instance, has consistently outperformed other themes over the past three and five years, despite dramatically underperforming other themes over the past year. On the other side, growth has significantly outperformed over the past year but underperformed over the past three and five years. Keeping the above data in perspective, they concluded that the combination of key investment styles backed by judicious risk management provides the most consistent long-term returns and outperformance.

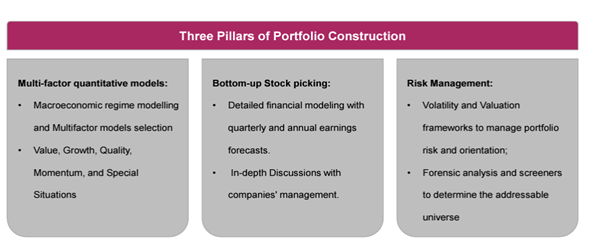

Axis Securities follows a unique portfolio construction methodology that comprises

- Multi-factor quantitative models,

- In-depth bottom-up stock research,

- Robust Risk Management framework based on volatility forecasting and forensic screeners.

Based on these factors, they build a highly concentrated portfolio of just 15-20 stocks while achieving the necessary diversification benefits.

AXIS SECURITIES FLAGSHIP STRATEGIES ARE

Axis Pure Contra

Axis Pure Growth

- Key Factor models and Investment Styles

- Value Investing

- Momentum Investing

- Special Situations

- Key Factor Models and Investment Styles

- Growth Investing

- Quality Investing

- Risk Management

- Portfolio beta management based on volatility forecasting

- Portfolio leverage management

- Cash Positions in the portfolio

- Sector Rotation

- Forensic Analysis

- Risk Management

- Market Cap orientation (Large vs. Mid vs. Small) based on volatility forecasting

- Low Volatility stock selection

- PE management based on macroeconomic regime modelling

- Forensic Analysis

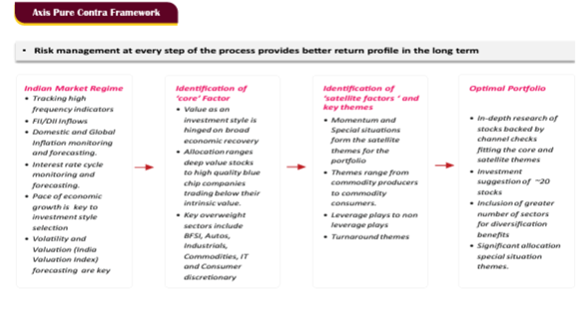

AXIS PURE CONTRA STRATEGY

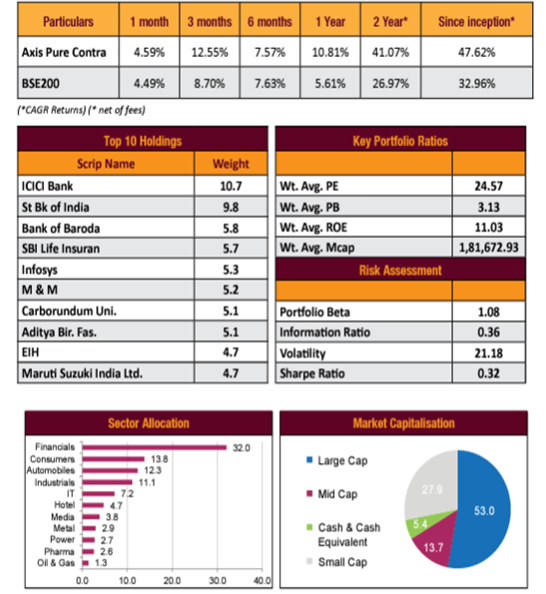

Their most popular strategy, accounting for more than 50% of their AUM, is Axis Pure Contra. Since its inception, the approach has produced better returns and alpha. It does, however, come with increased market and stock-specific risk. Axis Pure Contra strategy hinges on three major investment styles Value Investing: Some of the most successful investors in the world, from Warren Buffet to our own ace investor R K Damani, who controls one of the most prosperous retail chains in India, use the well-researched value investing method. Based on their unique value scores they assign to the top 500 stocks, they keep an extensive list of stocks. Their sector allocation spans from commodity PSU firms that are offered at a significant discount to their intrinsic values due to regulatory risks to high-quality blue-chip corporations that trade below their inherent value.

Momentum investing: It's interesting that momentum investing has consistently produced profits throughout a range of timeframes despite difficulties in addressing the length of holding periods. Stocks must be held for a shorter period of time to maintain the return profile of momentum investing. Therefore, it implies a higher rate of portfolio churn by definition.

Special Situation: Using concepts like delisting, merger arbitrage, buybacks, acquisitions, and court rulings, to mention a few, Special Situations is an absolute-return strategy. Rarely has the portfolio allocation for unusual scenarios gone over 20%. However, they do help to manage portfolio risks and offer downside security.

RISK MANAGEMENT IN AXIS PURE CONTRA STRATEGY

Beta Management

Beta management is based on market conditions. Volatility analysis holds the key to beta management.

Portfolio leverage management

High growth can be produced by leverage in an environment of rapid macroeconomic expansion. High leverage, meanwhile, also comes with a lot of hazards. They are aware of this and continuously monitor and manage portfolio leverage based on the changing macroeconomic environment and interest rate cycles.

Sector Rotation

Based on changing the macroeconomic regime, their sector rotation is implemented.

Forensic analysis

Their forensic screeners form the basis of stock selection and their portfolio stocks are in the top quadrant of clean accounting practices.

SBI: One of the largest allocations

With about 10% of the portfolio weight, SBI is one of the largest exposures in their Pure Contra portfolio. After Bajaj Finance left the portfolio, SBI was added to it. Despite the fact that SBI had a long history of underperformance and wasn't a market favourite, they nevertheless made this decision despite the fact that Bajaj Finance had been one of the greatest wealth creators of the decade. However, using their research framework, they identified a number of advantageous aspects of SBI that the market had overlooked. The following highlights are only a handful of them.

SBI Subsidiary Valuation

The subsidiaries of SBI are on par with or even superior to many private businesses. SBI Life, SBI Cards, SBI AMC, and SBI Caps are a few of these. All of these businesses are led by very competent management teams that adhere to excellent corporate governance norms. As a result, a sizeable portion of SBI's valuation could be accounted for by the value of the subsidiaries, indicating that the core business was vastly undervalued.

SBI Core business:

A closer examination of SBI's lending book by their research team showed that the assets were of generally good quality. More crucially, they noted that despite trading at a substantially higher valuation than many other private banks, SBI was not qualitatively different from them. Additionally, according to their channel checks, the atmosphere in the SBI camp was surprisingly positive. They gave SBI a sizable allocation as a result, considering the increased growth and business quality. Since its allocation, the stock has significantly outperformed the majority of the private banks and has been one of their best-performing investments, demonstrating the tenacity and soundness of their research methodology.

Vedanta: Deep value money spinner; Entry and Exit strategy

One of their best bets for 2020–21 is Vedanta. It has also been their wager in a unique circumstance. The company will be delisted in 2020, according to Vedanta. Their research team could see right away from the announcement that Vedanta was a firm with significant worth. They decided to take a sizable investment in Vedanta as a result of the large turn in the commodity cycle and the business's cash flow production. Vedanta's management consistently made buybacks and paid out sizable dividends during the holding period, resulting in exceptional returns for investors.

Exit Strategy

When the management strategy shifted to unlocking value through listing rather than de-listing, they left Vedanta because it cast doubt on how they would use the cash flows that were provided to them. In addition, the commodity cycle had turned directions and was once more experiencing a decline. They consequently sold their position, beating the market by a wide margin. Currently, the stock is trading below the exit price.

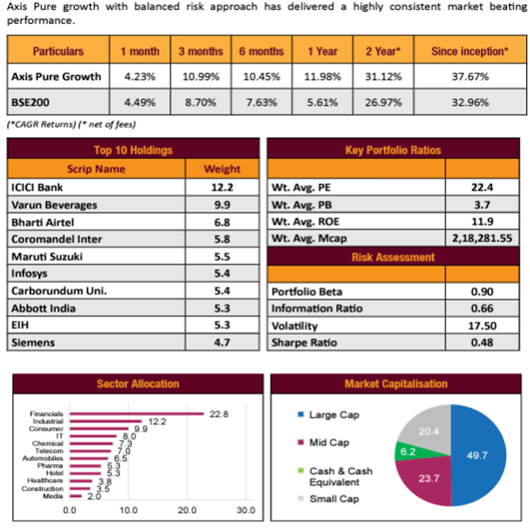

Axis Pure Growth has been a very consistent strategy that has delivered significant market-beating returns. The strategy is hinged on two major investment styles:

Growth Strategy

They focus on businesses that have revenue/EBITDA/earnings growth of 20% or more. The next step is to choose a sector based on a requirement of growth above the benchmark. A crucial evaluation criterion is sustainability, visibility of growth, and steady compounding of earnings over the last ten years. Cyclical and PSU equities are not regarded as long-term growth stocks because of their substantial bouts of losses.

Quality Investing

Quality investing is one of the most successful investment styles in India. It entails strong financials, the variance of cash flows, top decile accounting standards, and strong management.

Risk management in Axis Pure Growth Strategy

Market-cap orientation based on volatility forecasting: The balance of large, midsize, and small caps in a portfolio is essential for long-term results. Depending on the direction of volatility, their allocation to small and midsize companies may reach 70%. They take advantage of the opportunity to boost their allocation to small and mid-cap stocks in the case of declining volatility. They are nevertheless aware, though, that the relationship between volatility and market valuations is crucial.

Low volatility stock selection: Low volatility stocks have a superior track record of long-term outperformance

PE management based on macroeconomic regime modelling: Portfolio returns might significantly differ between growth at a reasonable price and growth at any price. Growth at any price can outperform other investing styles in a situation with dropping interest rates, but in a scenario with rising interest rates, Growth at a Reasonable Price emerges as the most effective strategy.

Forensic Analysis: Clean accounting processes are essential for long-term holding of stocks. The foundation of stock selection is its forensic screeners. Their portfolio equities rank among the best in terms of transparent accounting procedures.

Exit Strategy: Exit strategy is based on structural changes in the industry, company, and other aspects of the business.

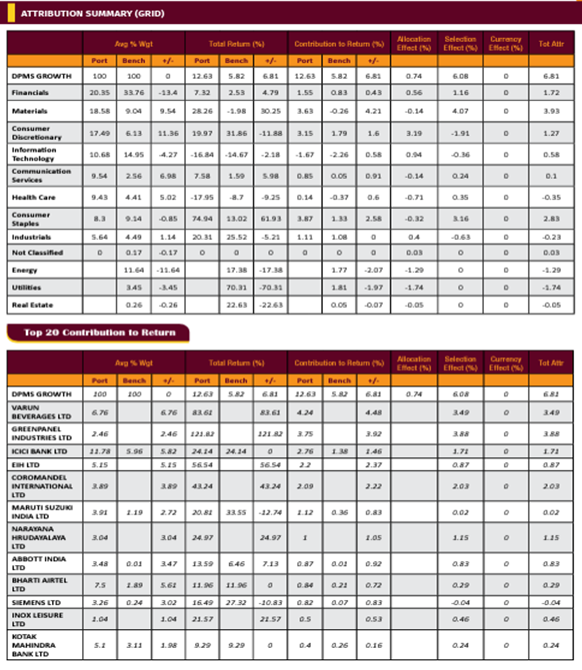

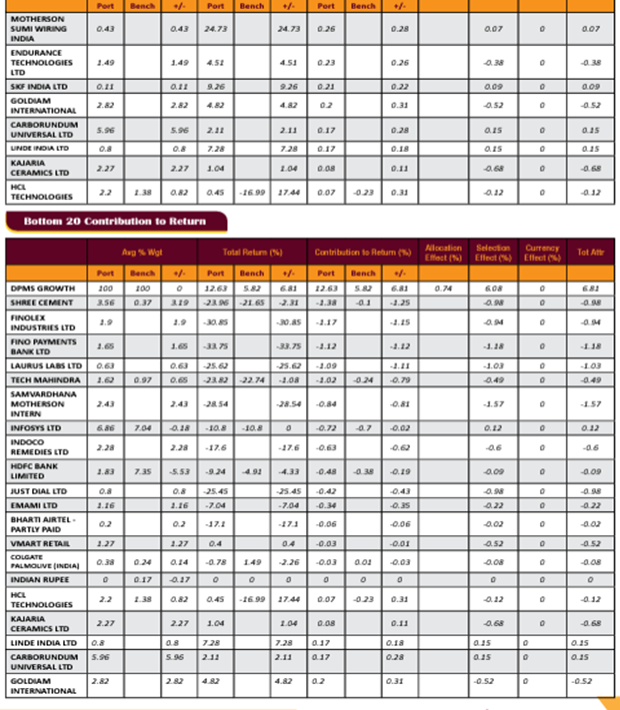

CASE STUDY

Axis Pure Growth has been a very consistent strategy that has delivered significant market-beating returns. The strategy is hinged on two major investment styles:

Varun Beverages:

Since the beginning of this approach, Varun Beverages has been a part of the growth strategy. Additionally, it has been their best choice in the consumer industry. With a strong PepsiCo brand identity, Varun Beverages is a bet on small-ticket discretionary consumption. The business has been growing its operations well in a difficult environment, and it has a history of strong earnings growth that is much better than the industry average and the benchmark. Varun Beverages has produced gains in excess of 130% since it was added to the portfolio, outperforming the benchmark by a significant margin.

Goldiam International: Entry and Exit strategy

In an effort to profit from increased discretionary consumption in the US market, Goldiam International was added to their portfolio. their interactions with the Goldiam management across a variety of forums have convinced them of the superior management of the business. Additionally, the company's operations have a proven track record of producing steady, leverage-free development. Before putting the stock in their strategy, they undertook a number of channel checks, including interviews with channel partners and rivals. Additionally, Goldiam meets all of their criteria, ranging from Forensic Analysis to Growth, justifying a sizeable position in their portfolio despite its reduced liquidity.

Exit Strategy

Goldiam's values significantly outperformed the long-term average of the US market, which had been showing unmistakable symptoms of slowing down. Small Caps were becoming less popular as a result of increasing inflation and volatility and rising macro risks. Consequently, they left Goldiam after realizing huge profits.

Axis Pure growth with balanced risk approach has delivered a highly consistent market beating performance.

We conducted an exclusive interview with Mr. Naveen Kulkarni - CIO in order to know Axis Securities LTD. in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

The FED has recently raised the rate by 75bps. With the rate hikes slowing down the growth, the US economy is on the verge of a recession. Also, the Euro region is already in a recession with their energy crisis and the Chinese economy is in a bad shape with the fall of their real estate and COVID. On this note, how do you position the Indian economy in the upcoming global headwinds?

The unexpected increase in inflation is the root cause of the problems the West is currently experiencing. For a long time, it was thought that supply-side problems, which were predicted to improve, were mostly to blame for the inflation in developed economies. However, the difficulties associated with inflation ended up being more widespread, with significant demand-side scenarios and supply-side limitations both playing a role. In this case, the Federal Reserve is forced to raise interest rates in order to handle demand-side challenges and deal with inflation expectations. The Federal Reserve is currently rising interest rates more quickly than anticipated, which not only creates problems with global currencies but also causes multiple compression in the equities markets on a global scale. As a result, the effect will be felt in all global markets, including the Indian equity market. On the plus side, increased interest rates will help slow down inflation, especially price increases for crude oil. Any decrease in crude prices would be highly beneficial for the economy because India is particularly susceptible to fluctuations in the price of oil. Therefore, even though the Indian economy will see negative short-term effects, its long-term prognosis has actually improved.

Despite the global turmoil, India remains the fastest growing economy and experts are expecting it to reach the 5 trillion economy this decade. From your point of view, what are the factors that can be the major catalysts for the Indian market to hit the target of a 5 trillion economy? Also, what are the possible risks and signals to be cautious in this journey? India is very likely to become a 5-trillion-dollar economy in this decade. The key catalysts supporting our thesis are

- Capacity creation cycle (Capex cycle – both private and public) as bottlenecks are emerging and being addressed in various sectors including Energy and Transmission areas among others;

- Significant ramp up in the Infrastructure space which will include multiple projects ranging from roads, rails, ports, and other areas. While the Indian Urban infrastructure needs to improve significantly, its rural infrastructure, too, needs a tremendous push.

- Managing inflation and inflation expectations at a reasonable level

- Continued thrust on the digital economy.

At this point, the majority of these goals are experiencing a strong surge. Even while the nation's cycle of capital expenditures (CAPEX) is accelerating, infrastructure is nevertheless experiencing a positive surge and receiving strong support for expansion in the digital economy. However, the corporate environment faces a few sizable dangers that could be domestic or international in scope. The rupee has significantly declined due to global issues, and many foreign currencies have had a rout. On the local front, however, political stability is now a key concern because of the Lok Sabha elections, which are scheduled to take place in 2024. Finally, major dangers that will need to be closely watched going ahead are global difficulties and internal political stability.

What, according to you, are the emerging themes in the upcoming years? With major economies facing the heat of inflation and other economic slowdowns, what are the emerging trends that will drive the economy in the coming years?

The global supply-side restrictions are what are causing the themes to emerge. Furthermore, China is no longer seen as being as trustworthy as it once was, which has allowed for the emergence of new supply networks. This suggests that throughout the following ten years, manufacturing will be a major theme. Considering this perspective, automation and engineering capabilities will be essential, and businesses that can demonstrate these capabilities will see a significant boost in sales. Furthermore, as energy security will be a major subject going forward, the push for renewable energy will continue. In addition to this, the next ten years will focus on issues like financial inclusion and digitization.

India has the least corporate debt to GDP ratio as our companies are less leveraged. Now, many companies are looking to increase their CAPEX. On this note, what are the segments where you are expecting growth in the upcoming years with the infusion of Capex and expansion of businesses?

As previously said, during the next ten years, manufacturing will experience a significant uptick. Renewable energy will be significantly important in India in addition to manufacturing since energy security will continue to be a top priority. This cycle's uptrend will mostly benefit engineering companies. Additionally, the automobile industry is beginning a new growth cycle as a result of the introduction of new goods and categories including hybrid and electric vehicles. These new categories will open up new potential markets for everything from ancillaries to charging infrastructure. It goes without saying that utilities will see increased investments in infrastructure for generating and distribution. As a result, the investment cycle is probably going to be highly diverse over the next ten years.

Many companies are now looking for an alternative for China and Europe to establish their manufacturing units. Can India capitalize on this trend and become a manufacturing hub in the upcoming decade? Yes, China + 1 will play a significant role since new supply networks must be created and reliance on China must decline. This covers a wide range of industries that include consumer durables and electronic products like mobile phones, air conditioners, and refrigerators. Specialty chemicals will experience tremendous expansion as a result of India's strong chemical engineering capabilities. Overall, a variety of investment themes are currently in play, from the well-known specialized chemical theme to a highly-specific subject related to chip fabrication.

Financial services and banks are now gaining the attention of investors. As NPAs are at a decade low and companies are expected to increase CAPEX, experts are expecting a solid performance from these sectors. What's your take on this trend and how far can this positive trend sustain?

The balance sheet strength of banks now, which was a problem in the previous five years, is their greatest asset. Their ability to raise money has significantly increased as a result of this improvement in balance sheet strength. Financial institutions are ideally positioned to take advantage of the enormous opportunity presented by businesses entering the current Capex cycle by financing and strengthening their balance sheets. Therefore, it is obvious that this is a once-in-a-decade opportunity for both lenders and borrowers.

The Auto sector is showing signs of recovery in recent times, reviving from a multi-year low. In recent times, with the price of raw materials like aluminium, copper, etc., and the semi-conductor supply easing, the Auto sector is gearing up to meet the pent-up demand and capitalize on the upcoming festival season. What’s your view on the revival of the auto sector?

The auto industry is doing quite well. The difficulties caused by high raw material costs are fading, and the industry has also entered a fantastic model cycle and premiumization. New categories like EVs and Hybrids are gaining a lot of popularity, while new models with better and more enticing features are being introduced, leading to higher average selling prices. All of these are significant advantages for the industry because they will increase the market's size and its long-term growth potential. Issues with chip shortages are also gradually fading, which will boost manufacturing. Finally, we think the industry is seeing a very robust upcycle.

The IT sector is underperforming lately and is recording a significant outflow from FIIs as well. With a possible recession looming over US Market, the IT sector is not able to maintain its previous growth numbers. However, with the digital economy spurring up and the COVID induced work-from-home mechanism helping them to cut costs, can they revive back strongly? After a record high valuation followed by a correction of 25% in recent times, when can we expect them to get back to pre-covid and Covid time numbers?

Although the surge in employee costs is creating significant cost issues for the IT business, western markets may respond by sharply reducing their discretionary expenditure. As a result, the next six months may be difficult for IT companies in this difficult environment. However, if growing costs in the West encourage them to enhance outsourcing and implement strict cost management in the offshore company, the sector may have a robust recovery. However, it will take some time for the IT industry's fog to lift. On the plus side, the industry is benefiting from some currency tailwinds.\ Although attrition should decline as the new personnel receives training, it will still take some time for the sector to meaningfully recover because valuations are still high. Mid-Caps in this sector are trading at valuations that are much higher than those of Large Caps. Time correction will therefore probably occur in the industry going forward.

In volatile market conditions like now, large caps will provide the necessary stability. However, when it comes to generating higher returns, only a few can match the expectation in the market. In your strategies, how do you select the right large-cap companies that have strong fundamentals as well as the potential to boost the returns? And, in asset allocation, what is the ideal large cap allocation according to you? Our strategies use different investment styles, so it's important to pick the best one while also getting the best sector allocation. In light of this, we place a strong emphasis on getting these topics right. We think that large caps will also produce the required returns if we can successfully apply the appropriate investment approach based on the macro outlook and support it with overweight positions in the appropriate sectors. Therefore, given the current macro climate, ensuring that the factor model and sector selection are done appropriately completes the job in half.

What are the non-financial characteristics that your research team considers to pick a stock? Do you have any quantitative metrics to qualify the companies in terms of governance which is very important? The promoter's past and extensive background checks are used to evaluate the management quality. Additionally, in order to fully understand the management style, we meet with the major suppliers or distributors of the company's products. Following the qualitative evaluation, we implemented specific quantitative models to look for fraud in accounting procedures. To assess the accuracy of financial statements and make sure the business adheres to sound accounting principles, for instance, we have an 8-point check on accounting procedures. All things considered, we carefully evaluate the management quality using these qualitative and quantitative evaluation measures.

As India's VIX almost reaching its 52-week high - how do you manage to generate superior alpha in Axis pure contra strategy? Our Contra strategy's ability to be extremely agile and effectively manage sector allocation has allowed it to produce market-beating returns even in highly volatile circumstances. In our Contra strategy, we switch between Value, Value supported by Quality, Momentum, and Special Situations while concentrating on macro strategy. We put a lot of emphasis on the portfolio beta and adjust it accordingly to the state of the market. Furthermore, we don't hesitate to quit losing positions in order to free up funds that can be invested in more lucrative opportunities. Therefore, being flexible and paying attention to macro situations enables us to provide returns that surpass the market and are sustainable.

How do you allocate your total corpus to your pure growth portfolio and pure contra portfolio in the current market situation?

In accordance with the risk profile, we provide a wide choice of strategies. So, based on his risk profile, the investor is given a plan. Contra is a great strategy for those that have a higher risk tolerance and don't mind experiencing drawdowns. Growth would be a good strategy for investors that desire more linear returns and less drawdowns, though.

How do you instil confidence among your current investors in uncertain times? And, what are your messages to investors and market players facing the current volatile market? The single thing any seasoned investor learns is that while volatile times offer lucrative opportunities to take advantage of market inefficiencies, normal markets are quite efficient in general. In normal circumstances, it's rare to get high-quality stocks at a bargain, but in unstable times, even these firms' expected returns become unrealistic. Therefore, unstable times offer excellent entry points. It is our responsibility to inform investors about investing in uncertain times and to offer security by creating high-quality portfolios.