Carnelian Asset Management LLP

CARNELIAN

A boutique asset management company established in April 2019 by seasoned professionals with the goal of building a worldwide asset management platform renowned for its "values & expertise"

- Focus on investing in Indian equities for HNIs, family offices, institutions, and partners' own cash using two techniques, a variety of sizes, and a variety of sectors.

- With complementary skill sets, proven track records of developing leadership enterprises in the capital market area, and an enduring research platform, the founding team of three motivated, passionate professionals is supported by a staff of 25 professionals who are just as driven and passionate.

- They believe that earning "risk-adjusted returns" "consistently" over "a long period of time" is the key to successful investing.

Founder’s Profile

Mr. VIKAS KHEMANI (CA, CFA, CS)

- Chartered Accountant & CFA Charter holder, having ~ 25 years of capital markets experience, most recently as the CEO of Edelweiss Securities Ltd, where he spent 17 years incubating & building several businesses to leadership including Institutional Equities business and Equity Research

- He has a strong business acumen & deep understanding of Capital markets; enjoys strong reputation with Corporate India.

- He is Associated with several industry bodies and committees:

- Member of the CII National Council on Corporate Governance & FICCI Capital Markets Committee

- Serving as an invited member of Executive Council of Bombay Management Association

Mr. MANOJ BAHETY (CA, CFA)

- ~ 22 years of financial services experience, most recently as the Dy. Head - Institutional equity research, Head - forensic, thematic & mid cap research at Edelweiss Securities

- Known for his non-consensus research. Pioneered differentiated forensic research, popularly known as “Analysis Beyond Consensus” (ABC research) ABC research has helped investors across the globe to take informed investment decisions based on true numbers instead of reported numbers, thus “avoiding pitfalls”- One of Carnelian’s virtues

- he has represented several committees of the CFA Institute including Chairperson of India advocacy committee and member of the US based global CDPC committee.

- Member of Young Presidents Organization (YPO) a global forum for entrepreneurs and CEOs

Mrs. SWATI KHEMANI (CA)

- ~20 years of experience in the financial service industry including 7 years at Edelweiss Financial Services across Investment Banking and Institutional Equities businesses including equity research and institutional sales

- She has actively covered the financial sponsor and enjoys a good relationship with the investor & corporate community

- Over the last couple of years, she has found interest in angel investing and been investing & mentoring in the start-up world

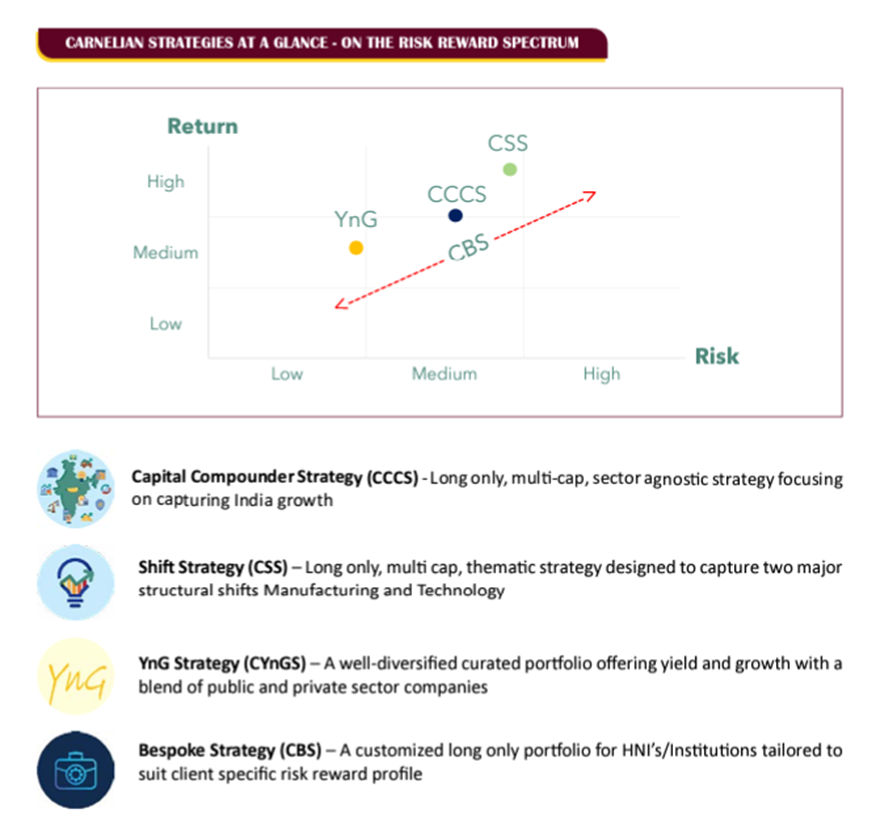

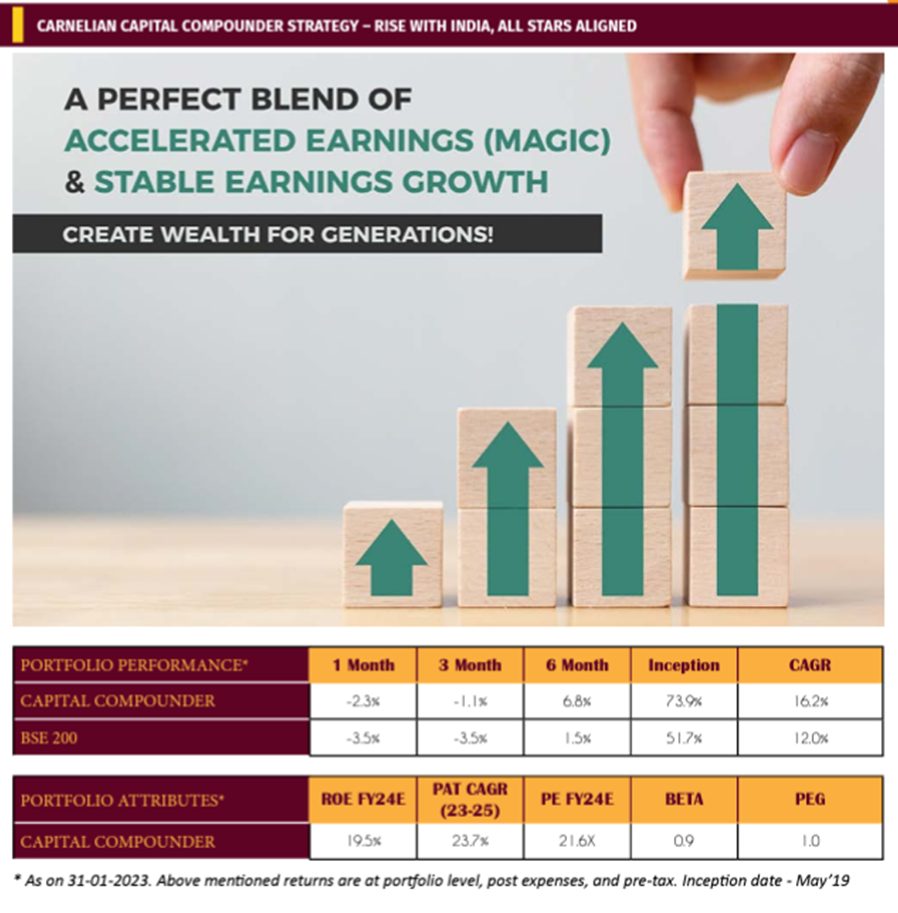

STRATEGY FOR CARNELIAN CAPITAL COMPOUNDER (Began in May 2019)

- A well-diversified, industry-neutral multi-cap with a 50/30/20 split of big, mid, and small caps created to take advantage of a huge wealth creation opportunity in the Indian economy. 1. BFSI -- 40% -- profit from the expansion of credit in the economy as a whole. 2. Manufacturing - 40% (consisting of industries including transportation, pharmaceuticals & APIs, capital goods & engineering, consumer durables, etc.) - gain from structural changes brought on by Atma Nirbhar/China+1 - benefit from a robust domestic and export-friendly market 3. IT - 15% - defence and gain from the surge of global digitalization - demand worldwide, supply locally

- Offers a special & unusual blend of Magic (accelerated growth), Compounder (steady growth), & Opportunistic companies.

- Concentrates on investments in high capability /niche companies well positioned to gain from India's growth.

- PMS provides forensic analysis for all businesses.

The Carnelian Shift Strategy was launched in October 2020.

- Well-diversified to take advantage of a sizable opportunity for wealth development throughout

- Manufacturing (well-diversified across sectors with the exception of BFSI/Real estate)

- Technology

- Focus on investments in high capability/niche companies well positioned to benefit from this shift

- No other comparable offering with this combination/theme

- Ability to invest up to 30% in Pre-IPO companies (in AIF)

- Forensic analysis on all companies; available in AIF & PMS formats

- Aims to invest in mid-small caps to capture these young with a potential to deliver 2.5x to 3x returns over the next 5 years.

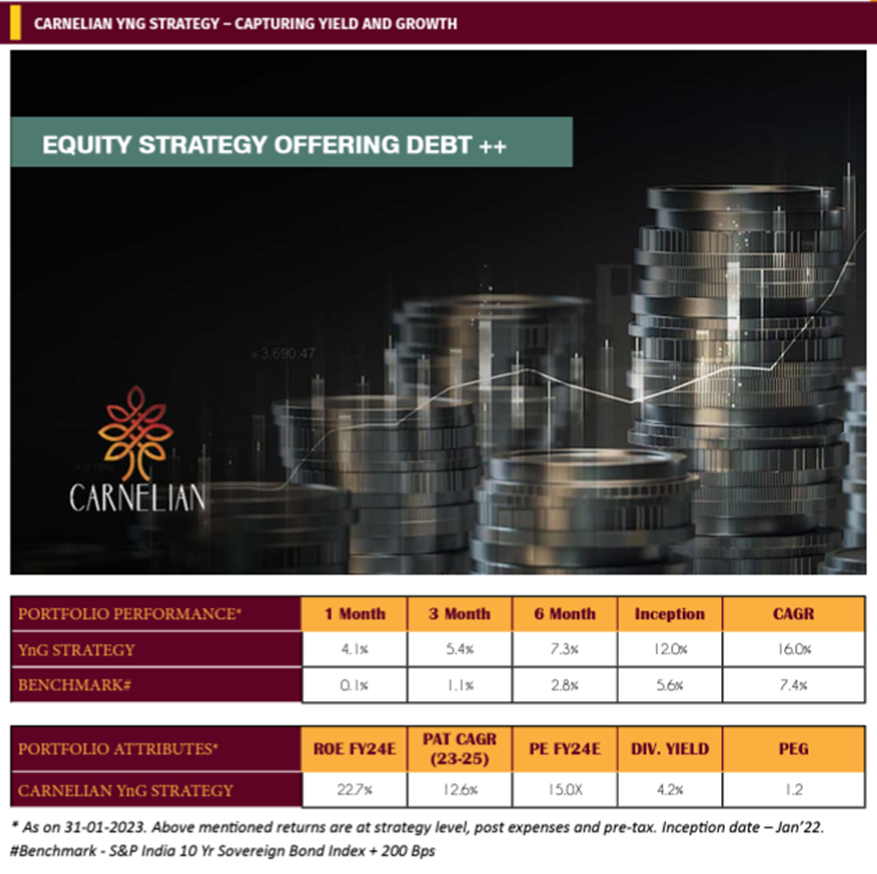

CARNELIAN YnG STRATEGY (Jan 2022 date of inception)

- A long-only, multi-cap, well-diversified portfolio that focuses on industrials, financials, and services in order to capture yield and growth. combination of public and private sector businesses Portfolio attributes

- 10 - 11x FY24 forward PE

- 10 - 11% free cash flow (FCF) yield

- 5% - 7% dividend yield

- 12 - 13% estimated 3-yr earnings CAGR

- 12 - 17% expected dividend yield

- Stock universe: 12-15

- Forensic study on all firms; available in PMS over the next 5 years

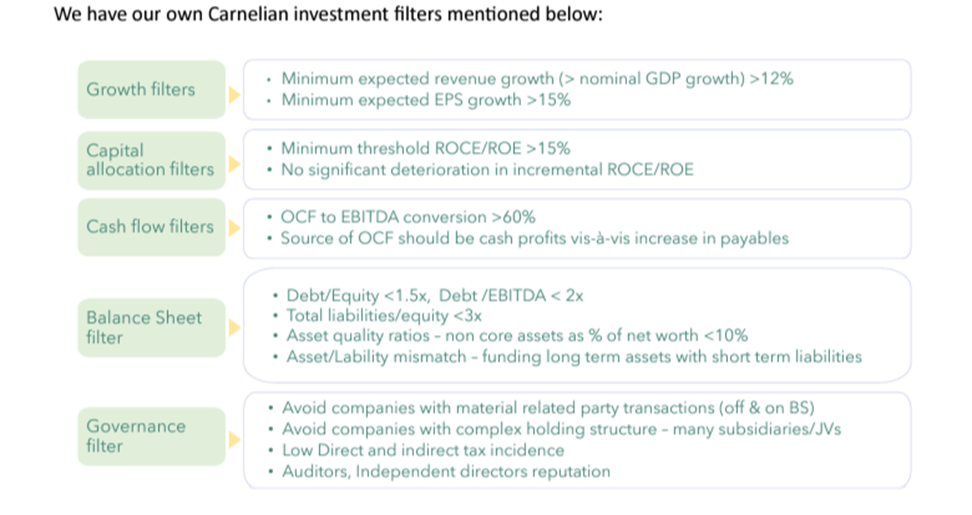

CARNELIAN BESPOKE STRATEGY (Starting in October 2021) Fundamental growth driven investing; bottom-up stock selection; customized long-only portfolios for HNIs and institutions that are tailored to each client's unique risk and reward profile; a limited stock universe of 5 to 10 stocks; strict adherence to "Carnelian filters" and "forensic checks" to produce long-term returns and alpha; and limited stock universe. • PMS provides forensic analysis for all businesses.

CARNELIAN INVESTMENT PHILOSOPHY Carnelian believes in making investments in companies with strong growth potential that are valued fairly. They are willing to be contrarian when risk reward is compelling. They are obsessed with risk reward and believe in risk-adjusted returns. They think there are specific catalytic moments in the life of a company that, if captured well, can catapult it into a different growth trajectory. They strictly adhere to "Carnelian filters" and "forensic checks" to provide sustainable returns and alpha. Mimicking the herd results in regression to the mean. • They think that success in investing comes from making wise choices repeatedly over time.

CARNELIAN MCO FRAMEWORK

Unique combination of businesses: Magic (accelerated growth), Compounder (steady growth), and Opportunistic (exceptional situations) make up the proprietary architecture. "There are many distinct investing concepts and styles in the world of investing. Each has advantages of its own. It can work successfully for a very long time if one is consistent and follows it logically. We have faith in ours. The PIU framework, which incorporates a thorough dive into Business, Management, and Risk Reward indicators, serves as the foundation of Carnelian's investing strategy. They build portfolios utilizing their unique three-basket approach (Magic, Compounder, Opportunistic), in which ideas are thoroughly vetted using their MRFG and CLEAR frameworks.

CARNELIAN MCO FRAMEWORK

Magic Basket

However, in the Carnelian world of investing, magic moments are visible changes/catalysts in the life of a company, when the company gets into an accelerated growth trajectory, which is not yet recognized by Mr. Market. Magic literally means having supernatural power or qualities, which they have none of. As the change takes place over time, Mr. Market begins to recognize them, which results in a valuation re-rating and a sizable chance for wealth creation (the dual effects of income growth and re-rating). It obviously takes a lot of effort and knowledge commitment, and it is not simple.

A change in management, a structural shift in the business cycle, a change in business strategy, the end of a period of high capital expenditures and operating expenses, and the subsequent increase in operational leverage can all act as catalysts.

Carnelian has developed numerous ideation funnels to seize the aforementioned magic possibilities; just a few of these include ICICI Bank, Tube Investments, JK Paper, LTIMindtree, LTTS, Praj, and KPR Mills. It's interesting that ideas can be found in this basket throughout market cycles. According to a 2019 study by the Carnelian team, the combined effects of valuation re-rating and earnings compounding led to significant wealth growth as a result of successful magic occurrences. A thorough analysis of a universe of 250 companies to backtest their magic hypothesis showed that prosperous businesses generated a CAGR of around 14% for the five years before the magic event and a CAGR of about 63% for the five years that followed (post magic event). This number drops to 56% even after accounting for the failed cases in which the magic event did not occur. Although there may be survivor bias and one would not be able to take advantage of every opportunity all the time, this framework aids in taking advantage of excellent opportunities.

Aiming to capture both earnings growth and valuation re-rating, The Magic Basket.

- Because markets disregard the change during the initial period, a better risk-reward opportunity is presented.

- A person can make a big amount of money if they are able to correctly and on time identify the "Magic Moments" that Carnelian refers to as catalytical times in the life cycle of a company or enterprise.

- Their goal with the Magic Basket is to continually locate such businesses.

- In their tactics, they provide the Magic Basket between 50 and 60 percent of the weight.

- According to their back testing, equities after a magic event provided a 14% CAGR over the previous 5 years (before to the magic event) compared to a 63% CAGR over the subsequent 5 years (post magic event).

Most investors worry about risk when they invest money, but occasionally a misguided perspective of risk causes them to concentrate on the wrong matrix, which results in subpar decision-making. Carnelian divides risks into three major categories. Type A: Permanent capital loss risk There is a 70–100% chance of capital loss. Risk of an investment momentarily quoting below the investment price, also known as Type B volatility risk (MTM loss risk). Type C - Opportunity loss risk: The chance of investing in inferior companies as a result of numerous biases and ignorance and missing out on superior profits. The Carnelian team claims that Type B risk is a market phenomenon that is neither predictable nor controllable, despite the fact that Type A and Type C risks may be managed or controlled. Sadly, the majority of investors waste a lot of time and energy "trying" to manage volatility risk (Type B), which distracts them from the true goal of managing or investing in Type A and Type C risk. The two main causes of this risk are poor management and a susceptible company strategy, both of which can lead to a permanent loss of cash. According to Carnelian, there are several indicators of inadequate management that can be seen in a variety of places, including the balance sheet, accounting procedures, interactions with channels and customers, etc. To prevent investing in a company that is subject to disruption, one must be extremely adaptable, vigilant, and up to date. The management of Type A and Type C risk takes up a lot of time at Carnelian. They have created the following comprehensive methodology to manage Type-A risk (risk of irreversible loss): The thorough Cash flow analysis, Liability analysis – true vs reported debt, Earnings quality analysis, Asset quality, Related Party & governance checks are all included in the Carnelian CLEAR framework (focused on Forensics). They can prevent mistakes of investing in businesses with questionable intentions or misguided goals thanks to their unique capability and extensive expertise of over 16 years in forensic investigation of the firms' annual reports and seeing through some of the evident accounting practices or frauds. The Carnelian PIU system includes scoring management and business on a number of factors, including business disruption risk.

Even if the other requirements are acceptable, they have a clear NO GO when they discover that the firm faces a danger of interruption or if management's honesty and competence are in doubt. Sources of Type C risk include ignorance or long-held prejudices that prevent individuals from making the best investments. The ability to continually adapt, get above one's preconceptions, and keep an eye on current trends aid in sifting through chances to weed out Type C risk.

We conducted an exclusive interview with Mr. Vikas Khemani - Founder of Carnelian Asset Advisors in order to know Carnelian AIFs and PMSs in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim MR. VIKAS KHEMANI

How do you differentiate your boutique investment management from other investment houses?

We think that our distinctiveness and competitive advantage are a result of our investment process, style, and approach, as well as the founding team's extensive experience in the capital market. We use a special three-basket methodology (Magic, Compounder, Opportunistic) to build portfolios, and the ideas we produce are put through rigorous due diligence using our MRFG and CLEAR frameworks. We detected the structural shift topic (in manufacturing and IT) in July 2020 (first in the industry) through our distinctive investment style, and we established a specific plan that was regularly articulated through our interactions.

The Carnelian Shift Strategy was well appreciated by the market and garnered awards for: a. Best PMS on Absolute returns & Best Theme Identification (Post-Pandemic era) b. No. 2 in the top 30 PMSs based on the QRC Framework. Attributes of quality, risk, and consistency

Manoj has more than a decade of experience in forensic investigation, which has been included into the Carnelian process of stock choosing to help us avoid investing in risky businesses and preventing mishaps. Last but not least, we plan to build a top-notch asset management platform, and this is our first move in that direction, which is where the distinction resides.

What do you think will be the risk which Indian investors should watch out for in 2023?

We have a conflicted sense of reality as we enter 2023. On the one hand, there are headwinds that could have a big impact, and on the other hand, there are big tailwinds that will help the India story both in the short and long term. We are cautiously bullish about the markets since these opposing factors coexist. The headwinds and the tailwinds will both be present. The Nifty market valuation is in the fair value zone due to the rise in interest rates, and if the markets are in the fair value zone and other causes are in play, volatility is inevitable. The "known unknowns" that the world is currently struggling with are significant to consider. Among the significant ones are

- Recession fears & impact on global demand

- QE withdrawal and high-interest rates

- Geo-political issues Domestically, a few risks that one needs to be cognizant of are:

- Emerging political scenario in India as 5 large states are going into elections in 2023 followed by central-level elections in 2024

- Potential re-emergence of imported inflation due to high commodity/energy prices as China opens up

- Re-emergence of trade deficit leading to currency volatility

- Slowing down the demand scenario

Do you believe the bulls will make a significant return following the market's seeming carnage? In comparison to any other emerging economy, India has exceptionally strong structural foundations from a 3 to 5-year perspective. Our home economy is quite strong, which will enable us to increase our exports and increase market share globally across all industries. Therefore, looking at things a bit longer term, we ought to be the best-performing markets. All things considered, it is inevitable that there will be volatility due to concerns about the economy, world politics, state elections, etc., but investors can take advantage of this to diversify their holdings. Also in my opinion, now that the Budget, Adani, and Fed have passed, it's only a matter of time before FII flows return in conjunction with ongoing robust domestic flows.

What are the financial components you would look into in the MCO framework?

Do you see 2023 as a year for bottom-up stock picking?

When it comes to investing, I've always used a combination of top-down and bottom-up strategies. We recognized the IT, manufacturing, and banking sectors as having structural advantages. At the same time, best companies in the industry are required to play the sector, which requires a bottom-up approach. Similar to this, one can always find specialized enterprises that succeed by taking a bottoms-up approach.

Can you brief us on your exit strategy and what you feel is the ideal time horizon for the realization of exit? Our initial investment horizon was between three and five years. While investing, we follow our investing strategy attentively and constantly test the hypothesis in addition to our investing logic. We reevaluate what has not worked and why it has not worked when we receive information that business is departing from our logic. Are the causes of underperformance transient and capable of self-repair? study of what could go wrong includes a thorough sensitivity study. How much money, in the worst situation, is at stake We concentrate on the risk of capital loss on the occurrence of the most likely extreme event rather than analysing situations on the normal distribution curve. We won't take advantage of the chance if any circumstance has the potential to permanently drain a sizable percentage of investor capital.

What are the potential pitfalls avoided by Carnelian AMC while selecting a stock? These are the potential pitfalls we avoid while selecting the stock.

- Aggressive accounting practices

- High financial leverage

- Low tax incidence

- Management having no skin in the game or misaligned objective

- Management with a consistent poor governance track record

- Management in a hurry to create value

FY24 could be the inflection point for the surge in India's manufacturing capex, what is your opinion on the statement?

Yes. I've never been more optimistic about our manufacturing than I am right now. The nation's industrial industry continues to be prioritized by the government. The FM eliminated the import duty on capital goods and machinery for lithium-ion batteries, as well as decreased the basic customs charge (Import duty) on open cells of TV panels and certain mobile phone components. The FM also suggested injecting Rs. 9,000 crores into the MSMEs Credit Guarantee Scheme, which will allow for an extra Rs. 2 trillion in collateral-free guaranteed credit. The stars have aligned for India's Manufacturing Renaissance thanks to PLI, lower corporate tax rates for new manufacturing setups, deregulation, and a focus on China + 1. In our opinion, India is well-positioned to boost its manufacturing GDP from USD 450 billion to USD 1 trillion over the next five years. Carnelian Shift Strategy (PMS) was created with the express purpose of taking part in the industrial boom narrative. When the globe was preparing to exit COVID in August 2020, we saw this theme and developed a strategy around it. Clearly, our early detection has benefited our investors. Everyone is now speaking.

What are your preferences in terms of sectors and how do you see the same for 2023? India is in the best position to take on the role of the global growth capital since its expanding economy offers both attractive investment prospects and depth. Manufacturing, banking, and consumption, in my opinion, are the industries that will drive India's growth story. India is ideally situated to benefit from the global move away from China due to its 4Ds (Demand, Demographics, Democracy, and Domestic Markets). With Tier 1 capital at its highest level and leverage at its lowest, banks are more capitalized than ever. Now that the NPA issues are behind them, banks are trying to expand. India as a whole is in the Goldilocks Stage.