Finance

Carnelian Capital Shift Strategy

Shift Strategy (PMS)

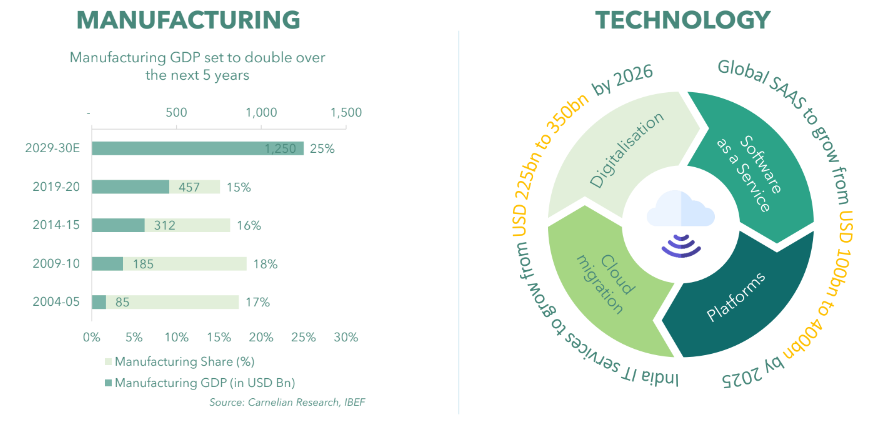

- Strategy designed to capture structural decadal shifts presenting large opportunity in

- Manufacturing led by conducive regulatory and global environment

- Tech evolution empowered by digitalization globally

- Concentrated QGARP (quality growth companies at a reasonable price) portfolio

- Blend of mid & small cap listed companies having

- niche core competence & large opportunity size

- Proven track record

- impeccable management capabilities

- Stock holding : 20-25 ; Benchmark against BSE 500 TRI

- Subjected to stringent Carnelian filters & forensic checks (CLEAR framework)

Pandemic accelerated 2 structural shifts

India on the cusp of manufacturing boom on account of

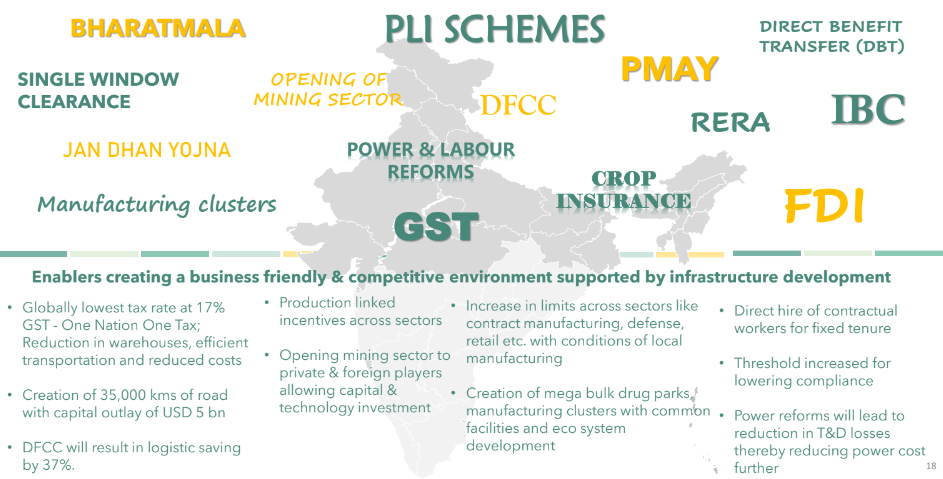

Govt. Reforms

- Focus on Atmanirbhar Bharat

- Manufacturing boost by production linked incentive schemes

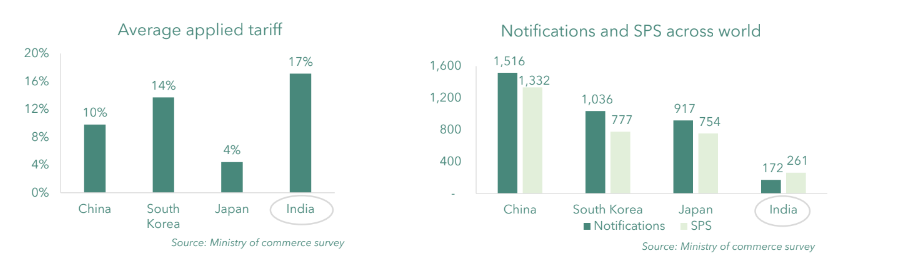

- Tariff & non-tariff barriers

- State labour reforms

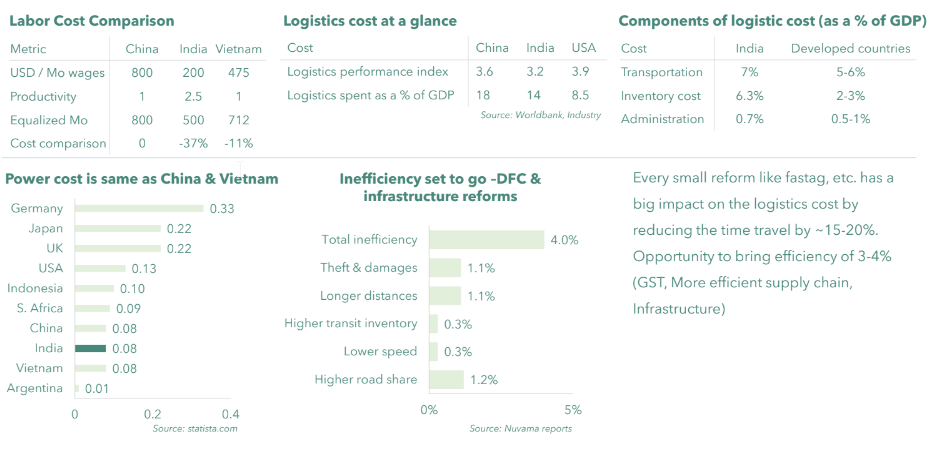

Cost Competitiveness

- Labour: 1/2-1/3x China

- Logistics & power costs = China

- Lowest tax rates globally @ 17%

- China’s cost advantages have significantly narrowed down

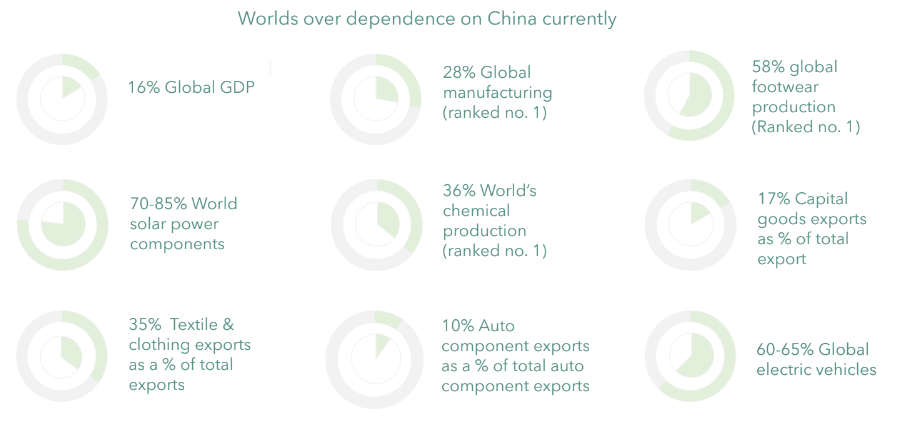

China + 1 Shift

- Led by anti China sentiments

- Over dependence on China to create huge opportunity for China +1

Strong Domestic Markets

- Domestic markets + exports/ imports = economies of scale

Government initiatives and reforms

Further impetus through tariff & non-tariff barriers

India hardly used non-trade tariff barriers like China/other countries which is set to change;

- No global tenders less than INR 200 cr

- No automatic FDI approval to 200 countries sharing borders

- Special registration required for participating in contracts with neighboring countries

Aided by cost competitiveness

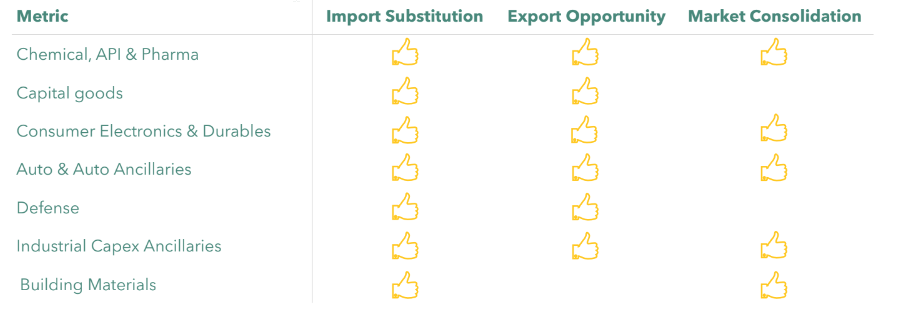

China+1 shift will create big opportunities

Which sectors will benefit

Who will benefit – characteristics of companies

- Core competence/ niche capability

- Proven track record / platform

- Strong balance sheet

- Strong Governance

- Existing presence (market share)

Technology

Key emerging tech shifts accelerated post pandemic:

- Digitalisation

- Cloud Migration

- Software as a service

- IT services

- Tech enabled platform businesses

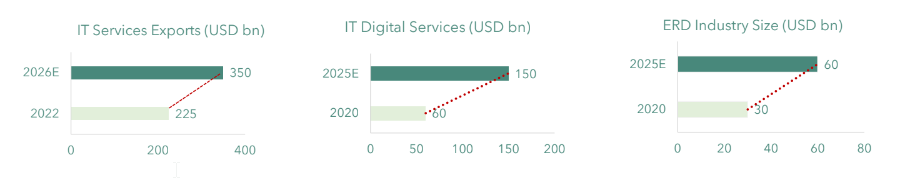

Technology – IT Services

- Covid has prompted companies worldwide to rethink & shift; Indian IT Tech companies an important clog in the wheel

- Demand for digital spending is “global” & supply is only “local”

- IT services exports industry to grow from USD 225bn in 2022 to USD 350bn by 2026

- 50% of the revenue getting spent as salaries/wages in the economy as first order effect which will boost consumption. Second and third order effect yet to follow.

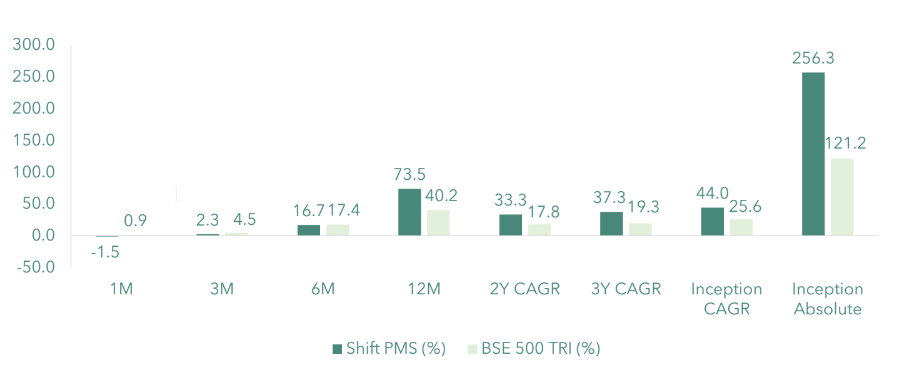

Performance

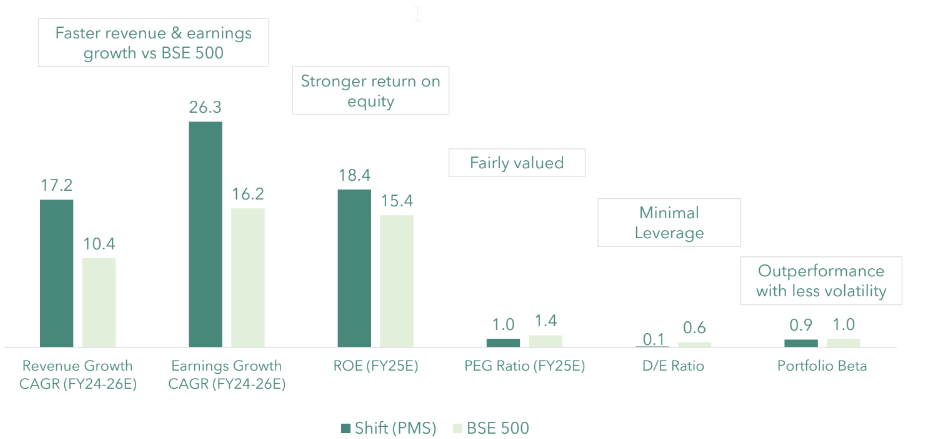

Faster, Stronger, Cheaper

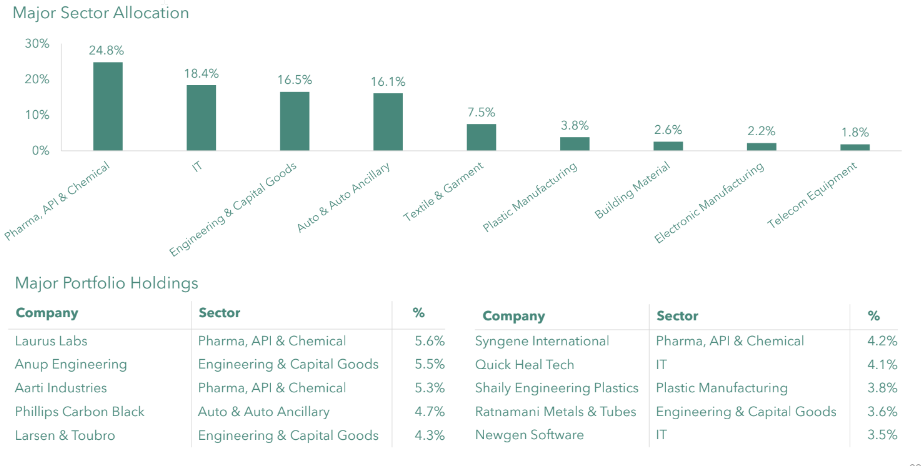

Holdings