Centrum Flexicap Strategy

Patience is a virtue

Lots of ups and downs, but strong returns over the long-term

Crises cannot be predicted....

Nor their reactions !

Types of Risk

Broadly there are 3 types of equity risks A - risk of losing all your capital B - opportunity losses, other stocks/portfolios doing better than ours C - temporary stock price correction post our purchase

Type A is eminently controllable, Type B is also controllable to a large extent, Type C is not controllable at all.

Investors spend maximum time on Type C risk !

Type C risk

Minor consequences

- Trying to ‘time’ the market entry

- Stress-induced trading

- The best stocks get sold too early

Major consequence – smaller allocation to equity asset class.... opportunity loss

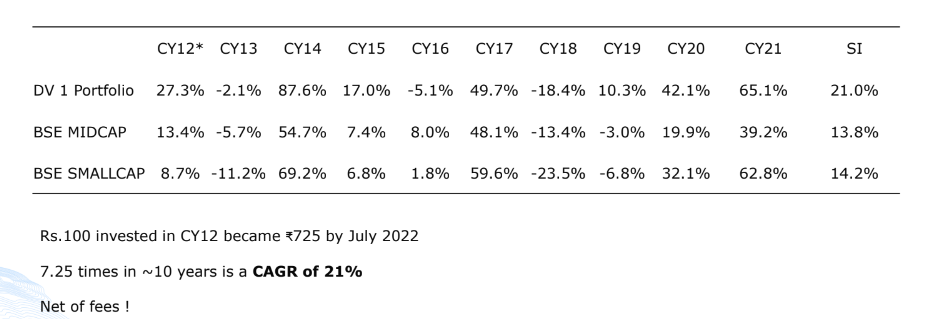

Experience of our midcap/smallcap strategy (Deep Value - 1) teaches us that while there will be year-to-year volatility, a lot of money can be made over the long term.

Investing tenets

- Focus on type A and type B risk

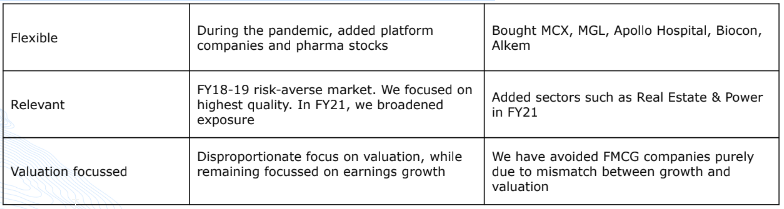

- Ensure ‘relevance’ – be aligned with emerging long term trends

- Rising cash flows + Moderate valuation + Patience = Great returns

Why Flexicap ?

Style rotation Growth vs Value Defensive vs Aggressive Consistent performers vs Cyclicals Market Cap rotation Over last 15 years, market leadership has changed many times (on a rolling 3 year CAGR basis)

It is important to capture such rotation to improve portfolio performance

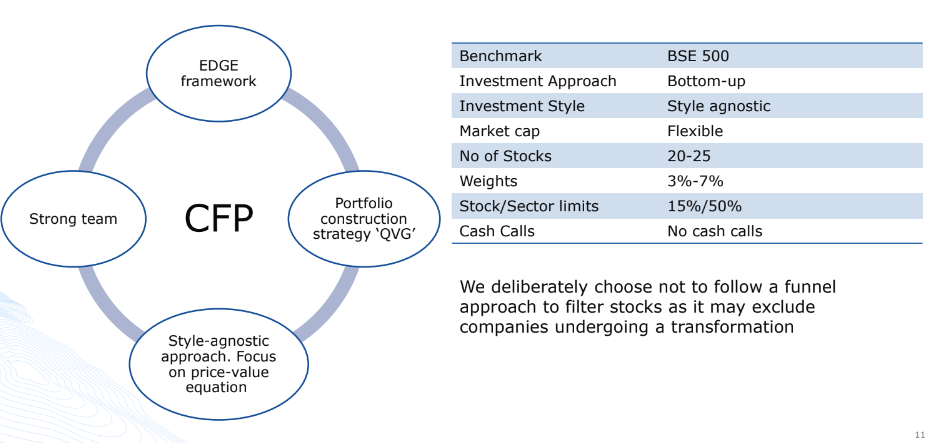

CFP - Salient Aspects

CFP - Key Differentiators

- Large Caps reduce volatility and provide medium term growth

- SMID caps provide outperformance

- Combination approach works well over the long term

- Centrum has track record of successful SMID Cap investing

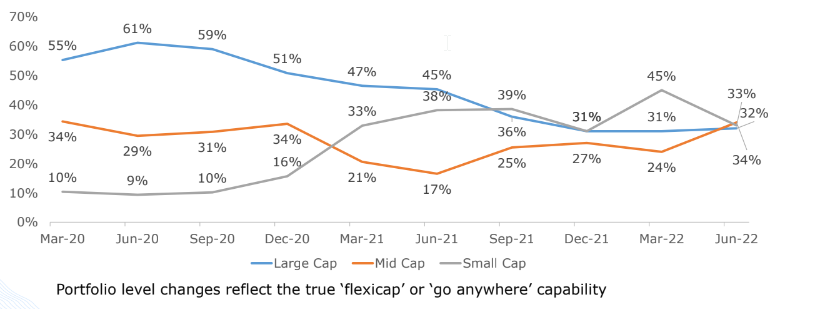

Nimble segment allocation

- Large caps have underperformed in last eight quarters,

- CFP large cap share reduced from 55% in Mar-20 to 31% in Mar-22

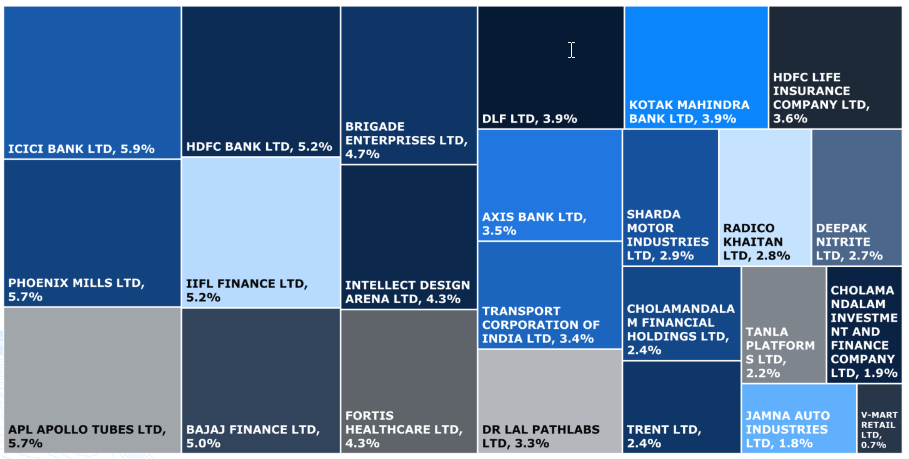

Centrum Flexicap Portfolio – July 2022

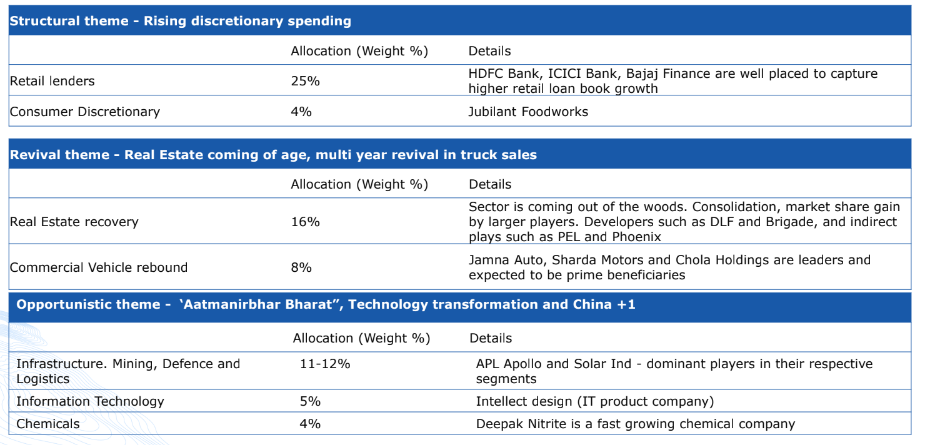

Exposure to lucrative medium term opportunities

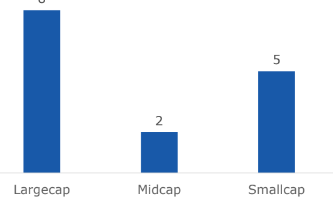

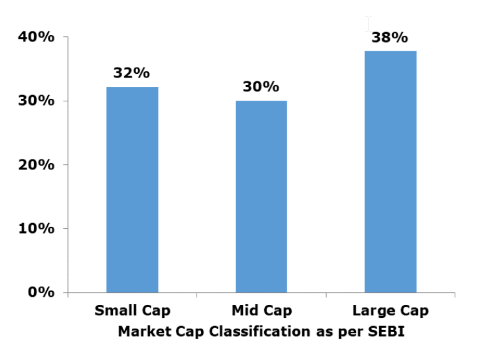

Market cap allocation

Portfolio currently positioned towards smallcap to generate alpha

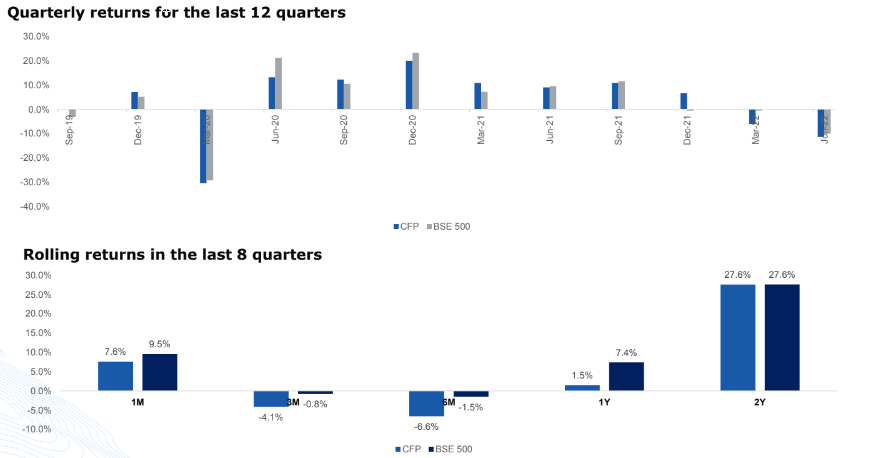

CFP performance

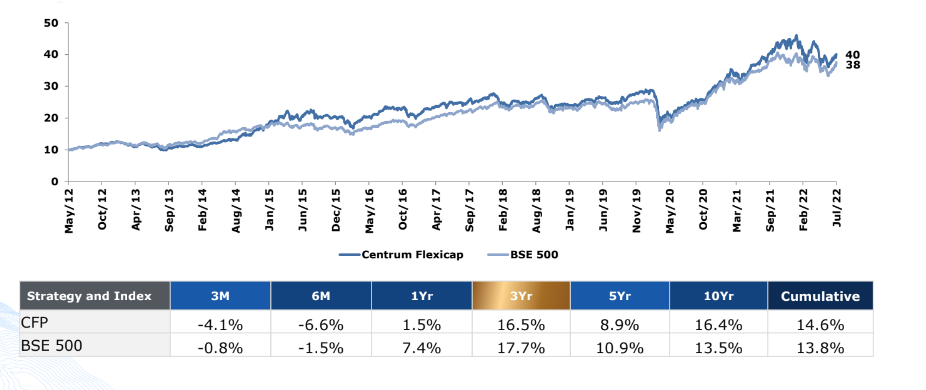

Portfolio performance – long term

The CFP strategy delivered 14.6% CAGR since inception (net of fees) over the last 10 years

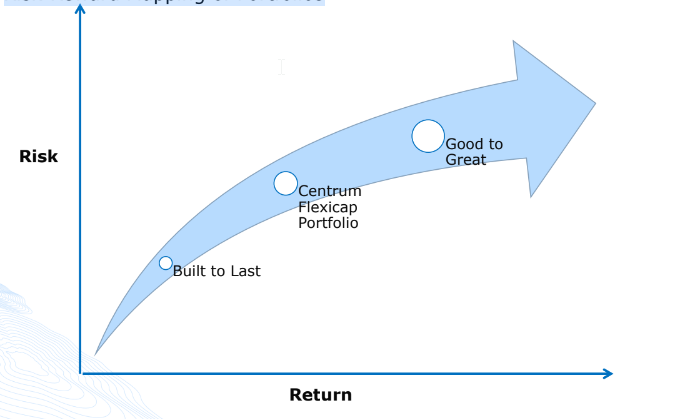

Centrum PMS positioning

Risk-Reward Mapping of Portfolios

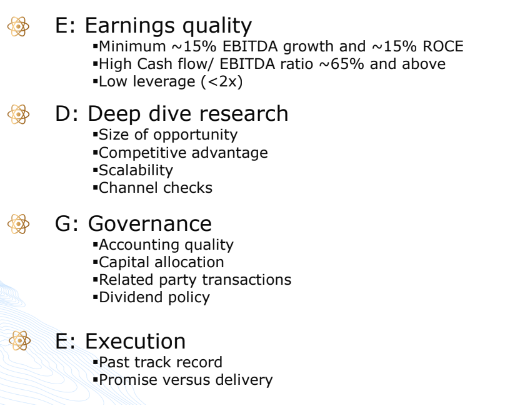

EDGE framework

An proprietary framework developed over time shapes the investment approach

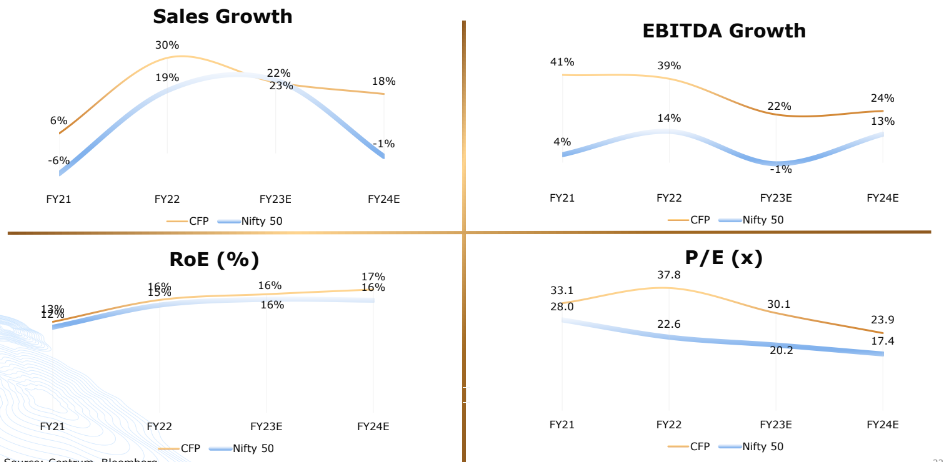

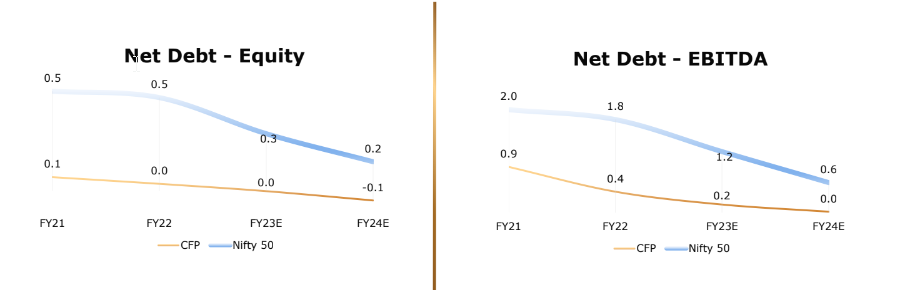

Portfolio analytics – CFP

Comparisons with the market (Nifty 50) on key metrics