Finance

Counter Cyclical Investments Diversified Long Term Value

About Us

- Counter-Cyclical Investments is Portfolio Management Service Provider, registered with SEBI vide Registration number INP000006554.

- We invest in small companies to generate big returns.

- Our expertise lies in spotting, evaluating & investing in promising small capitalization companies.

- Our experience has shown that a diversified portfolio of such small caps, with strong growth prospects, honest & competent management, bought at a significant discount to intrinsic value, held patiently & tracked constantly for changes in business fundamentals, generates market- beating returns over long periods of time.

- Over the years, our team has interacted with hundreds of management/promoters, which has enabled us to develop an in-depth understanding of their business, prospects & corporate governance.

- We are probably the only PMS which does not charge any upfront management fee from our investors. We only charge the performance fee after our investors make over 10% returns p.a. on their investment.

- Honestly & forthrightness is our policy.

Investment Philosophy

- We want to invest in companies with the following characteristics:

- Average Business @ deep discount or above average business @ moderate discount.

- Small companies with big market shares in niche sectors.

- Strong companies in cyclical downturn.

- EV/EBITDA < 5x & EV/OCF < 10x *[EV = Enterprise Value, EBITDA = Earnings before Interest, Tax, Depreciation & Amortisation ,OCF = Operating Cash Flow]

- Companies operating at low capacity utilization with strong orders expected to ramp up in the near future.

- Strong promoter track record of delivery & smart capital allocation.

- We generally stay away from Financials, Real Estate, Gems & Jewellery & Technology.

- Business insulated from technological disruption.

- Business with high value addition.

- Companies with very low or negative EV due to cash, investments or surplus real estate. Track record of volume & unit realization growth without debt and equity dilution.

- Companies operating at low or negative Working Capital.

- We avoid companies in tender business or where the company is unable to pass on increases in input prices to its customers.

- Businesses with low CAPEX requirements.

- Thinly traded counters with low volumes.

- Cos. doing regular share buybacks (which provides insurance in a bear market as the company would be able to take advantage of lower share price by extinguishing more shares via buyback thereby reducing share capital & increasing EPS permanently.)

- Cos. with change in management leading to improvement in efficiency & corporate governance.

- Unpopular, hated, hopeless, tainted (unfairly) cos.

- We generally avoid cos. with fixed price contracts or annual price reduction contracts with customers.

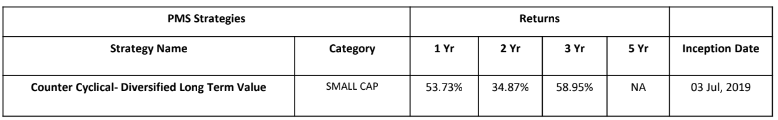

Performance

- Best performing fund for 3 years ending March 2024 with 58.95% CAGR.

- Amongst top 10 performing funds for 12 month period ending March 2024 with 53.73% returns.

Team

KESHAV GARG (Director):

- He is alumni of Fergusson College, Pune having experience of over a decade in the equity markets.

- He has in-depth knowledge of small-cap companies and has personally met with the management of hundreds of companies to date.

- He is responsible for the day-to-day operations of the company.

GUNIT SINGH NARANG (Principal officer):

- MA Economics from Delhi School of Economics (DSE)

- NISM certified

- Half decade experience in credit risk management & market research at American Express & Wells Fargo.

CA MAYUR SHRIKANT DESHPANDE (Advisor):

- Member of Institute of Chartered Accountants Of India.

- He has 11+ years of experience in corporate finance, fundraising & capital Markets.

- He was a vital member of investment banking division of ICICI Bank proprietor desk and credit research team in CRISIL in International Banking Sector.

MOHIT RATHI (Senior analyst):

- M.Sc. Wealth Management, Singapore Management University BA (Hons) Economics, Hindu College, Delhi University.

- Possesses in depth knowledge & experience in industrial processes & financial markets.

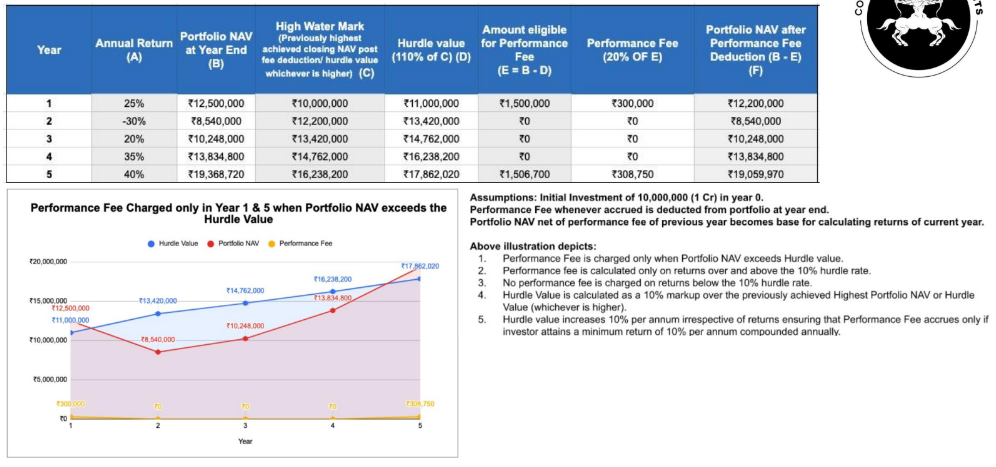

Fee Structure

- Fixed Fee & Charges: NIL

- No enrolling/ fixed fee

- Performance Fee:

- 0% on returns up till 10% p.a.

- 20% of returns in excess of 10% p.a.

To simplify

- Mr Kabir decides to invest INR 1 Crore with CCI

- He has to pay a fixed fee of INR 0 upon enrolling

- After 1 year, Kabir earns a return of 25% on his initial investment

- His portfolio is worth INR 1.25 Crore

- Mr Kabir is not charged any fee on his earnings of INR 10 lakhs (10% return is exempt of any fee)

- On earnings above INR 10 lakhs (10% return) i.e. INR

- 15 lakh (INR 25 lakh – INR 10 lakh), he is charged a performance fee of 20% on earnings i.e. 20% of 15 lakhs which is 3 Lakhs

- Total earnings of Mr Kabir after 1 year is 22 lakhs!

Fee Structure Example