Dolat Capital Market Pvt Ltd

Dolat Captial

India's first Cat III Alternative Investment Fund formed as an LLP is Dolat Absolute Return LLP (The Fund). Dolat Capital Market Private Limited is the sponsor and manager (investment manager) of the fund. The Dolat Capital Group (The Group) includes Dolat Capital Market Private Limited. The Group is a technology-driven, multi-strategy quantitative trading organization that has been active in the Indian Capital Market (equity and derivative) for more than 60 years. The Group is present in institutional equity, investment banking, non-bank financial companies, and foreign exchange. Legendary trader Shri Dolatbhai Shah founded the Group in 1971 in Mumbai, India, by offering two-sided markets in non-listed equities derivatives. The Group is currently being managed by the second and third generation of the family including 4 sons of Mr Dolatbhai Shah. The Group is a "Scientech firm" that uses quantitative analysis to improve trading. They are a technology-driven, multi-strategic quantitative trading firm that trades on financial markets. They combine cutting-edge technology with a solid grasp of the underlying markets. The Group is a math and technology firm where scientists and engineers collaborate to find solutions to challenging issues in the fast-paced world of finance. Their team consistently employs mathematical and statistical techniques in the study and development of quantitative trading algorithms. They offer a two-sided market on a wide range of listed financial assets, including commodities, stocks, futures, and options.

The Group's core engineering team is crucial to the development and implementation of Dolat's low latency trading infrastructure as well as the creation of high-performance, interactive, and responsive trading applications. Our high-performance, distributed systems that allow our company to trade on financial exchanges are designed, programmed, tested, and maintained by the engineering team. To enable numerous varied quantitative trading techniques, the Group offers one of the fastest, most flexible, and reliable electronic trading systems. The Group employs seasoned engineers with advanced knowledge of test automation, SDLC, C++, and Python.

The Group aims to constantly enhance its approach to risk management, market making algorithms, prediction, and pricing. reduced liquidity risk and reduced implicit transaction costs are benefits that market participants receive as a result of their unique long-term experience, risk management, and market obligations. Over 300 institutions make up the group's present clientele, which is spread across India, the US, Europe, and the Asia Pacific. Consistent, aggressive pricing is its competitive advantage. Even in challenging market situations, the group is renowned for quick response times, narrow spreads, and the ability to execute huge blocks of deals across a variety of financial products.

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) both recognize Dolat Capital Market Private Limited as a member. It provides its customers with services for equity research, trade execution, and settlement (for both stocks and derivatives). Dolat Capital Market Private Limited's research division provides precise and in-depth analyses for all industries. Due to its intense emphasis on the Indian mid-cap market and the derivatives sector, it is in a unique position to support institutional clients and provide alpha for their investors. The group's proprietary desk, the first of its type in India, is run by a family office and manages assets in the commodities, options, and arbitrage markets.The group maintains a strong presence in the cash and derivative markets and is accredited with various FIIs, Mutual Funds, Banks, and Insurance firms.

Mr Purvag Shah

Purvag Shah is from the 3rd generation of the family. As representative of the promoter family, Purvag is actively involved in business strategy, risk management and trading floor. He is MSc in International Securities and Investment and Banking at Reading University. He has been active in the financial industry for over ten years. His previous engagements have been Bloomberg, UK and IDFC Offshore Fund before joining the Institutional Equities business of the group.

Mr. Amit Saxena

Amit Saxena is Director and Head of Alternative Investment Fund. He has over 16 years of professional experience in Indian asset management Industry across Sales and Product Management. Before joining Dolat, he has had stints with IDFC Asset Management, Nippon Life Asset Management Company and ING Investment Management. He has been actively involved in setting up, product management and fund raising activities of equity/capital markets products including Alternative Investment Funds, Portfolio Management Services, Structured Products etc.

Mr. Abhishek Jaiswal

Abhishek Jaiswal is Fund Manager of Dolat Absolute Return LLP. A Chartered Accountant with over 13 years of experience in fund management and equity research. A specialist investment expert across equity and derivative strategies. In the past he has been associated with India focused Long Short fund, and has also managed Long only & sector portfolios. He has worked with marquee investment teams across Hedge Fund, PMS, AIF and Mutual Fund including Nippon Life Asset Management Company and Marshal Funds.

The first hedge fund (Category III AIF) launched in India under an LLP structure is called "Dolat Absolute Return LLP". Limited partnerships are very well-liked as fund structures for investing in securities on a global scale. The fund started doing business on January 29, 2021, and Dolat Capital Market Private Limited is sponsoring and managing (investment manager) it. The Fund offer two unique advantages as against other Absolute Returns based funds:

Most efficient tax structure

Time bound target risk-return approach

Most Efficient tax structure

The Fund is set up as an LLP in an effort to offer investors in Category III AIFs one of the most straightforward and tax-efficient structures currently available. An LLP's taxation is more straightforward and certain; the income earned by the Fund is taxed at the Fund level at the applicable tax rates of 34.94% as opposed to 42.74% that are applicable to a trust (assuming the highest slab of income). Any distributions made to the investors/partners from income that has already been taxed should be exempt in their hands. In contrast to a trust, where many schemes can be established under the same AIF, an LLP can only launch one AIF, which presents a problem to ring fence assets and liabilities in relation to each plan under the trust from a legal and tax perspective.

- Time bound Target Risk-Return Approach

The fund plans to operate with a clear, time-bound mandate. Every year, it publishes a distinct portfolio strategy and gross return target and works to meet those goals within a given time frame. The risk-return expectations and attractiveness of the strategy/mandate may also be taken into account when changing the fee structure. This distinct strategy offers investors a clear understanding of what to expect for the year and gives them a better opportunity to efficiently manage their portfolio allocations. The fund's current mandate is a "Low Risk Market Agnostic" strategy with a target Gross return of 12%.. The fund provides skilled risk-averse investors (mostly in the fixed income segment) with a diversification opportunity with the goal of producing somewhat greater returns than conventional short-term fixed income investments without increasing capital risk. As part of its present mandate, the fund will invest in fully hedged positions, such as hedged derivative strategies, option trading techniques, and active arbitrage positions, all while preserving high liquidity and little capital risk. To meet its risk-return objective and maintain consistent quarterly returns, the fund will employ a variety of strategies. The mandate could change the next year, with a higher/lower risk-return than the existing offering based on market opportunities. For the following nine to twelve months, the current strategy is anticipated to be used.

In order to implement "Market Neutral" Strategies into a portfolio and get the desired return, this is the methodology. The Fund's core mission is to achieve consistent absolute returns through a variety of trading and investment techniques, regardless of changes in the equity and fixed income markets. To find, price, and capture alpha across its sub-strategies and across time horizons, the Fund will use a process-driven methodology.

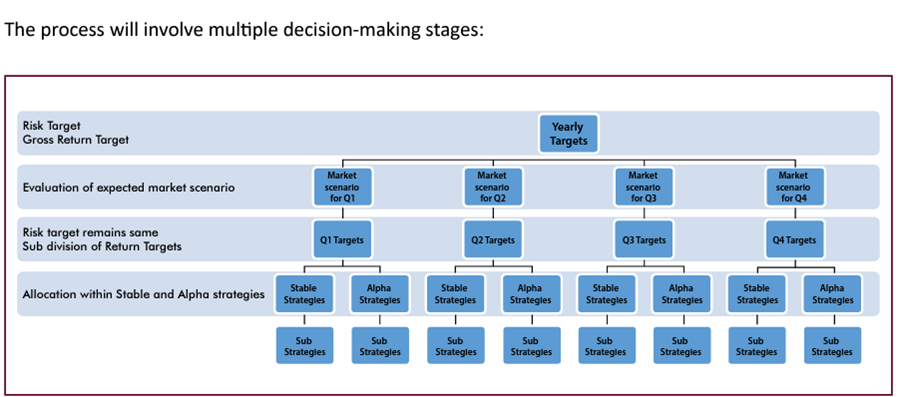

The fund's annual plan is implemented with discipline, and it studies a variety of market indicators, including but not limited to several quantitative and fundamental screening criteria, to assess the current market situation. The initial level of decision-making will play a key role in deciding what the quarterly return targets should be.

Second Level After assessing the market environment, the fund decides the quarterly goals to be met during the current quarter. Because it establishes a defined target approach for the quarter, the fund breaks down the annual targets into smaller milestones to be completed on a weekly basis.

Third Level: The initial allocation between the stable and alpha strategies is decided by the fund based on market circumstances and quarterly targets; this decision is crucial to maintaining the risk-return criteria of the fund.

The fund decides the final allocation within the sub strategies at this, the fourth level, which is the most active step of decision-making. After that, the allocation is dynamically maintained to maximize the fund's risk return performance.

Due to the Fund's current mandate, which calls for it to produce absolute returns regardless of market conditions at all times, each sub-strategy is assessed based on the attractiveness of its return potential, risk, and correlation to other sub-strategies as well as to the relevant asset class.

Each sub-strategy, asset class, and investment style is then assessed in light of need and ask, or the goal risk-return of the Fund, once the allocation between various asset classes, sub-strategies, and investment styles is crystallized.

Sub-Strategies

The Fund has access to a number of sophisticated trading methods based on cash segment and derivatives. All of these methods are carefully analyzed and ranked according to their appeal, liquidity, risk-return criteria, and market correlation.

Arbitrage

The arbitrage book will aim to capture significant differences between such spreads as the cash price of a portfolio of stocks and its equivalent future price for a single stock.

Algo-Trading proprietary tactics created by a team of internal developers using numerous quantitative and statistical inputs. When the market circumstances meet any predefined requirements, the orders are carried out using computer codes. With little to no operator intervention, trading algorithms carry out buy or sell orders in the derivatives industry.

Derivatives Using futures and options with delta neutral positioning, active call on opportunities in the derivatives segment based on risk profile and return aim.

Tactical It involves placing short-term bets on expected near-term price changes in the derivatives market, using Long/Short bets when chances present themselves and supported by derivatives research. Also available to the Fund are long and short positions.

The market network of different analysts helps generate ideas for long-term strategy. These proposals will then be carefully examined through desk research and possibly field research (sourcing alpha) before being appraised to determine the potential magnitude of mispricing and the drivers that make it possible for them to materialize (pricing alpha).All concepts are elevated to potential actionable ideas once they have passed through the strategy criteria and fundamental vetting and if they provide a sufficient amount of mispricing to their fair values. The screening and shortlisting of proposals use similar procedures.

We have conducted an exclusive interview with Mr. Amit Saxena & Mr. Abhishek Jaiswal in order to know the Dolat Absolute Return LLP in depth and enable our investors to make informed decisions. The questions and answers are reproduced verbatim: Why LLP structure, what are the advantages and how is it different from Trust structure? Under the SEBI (Alternative Investment Funds) Regulations, 2012 (the "AIF Regulations"), the Securities and Exchange Board of India ("SEBI") enables the establishment of an Alternative Investment Fund ("AIF") as a trust, a company, a limited liability partnership ("LLP"), or a body corporate. Because Trust Structured Hedge Funds of Category III AIF primarily produce business income, the effective tax rate on annual earnings over 5 crore rupees has increased from 35.9% to 42.7% after the introduction of the superrich tax in 2019. Since nearly every Indian Cat III AIF hedge fund is structured as a trust, the additional tax burden has a direct influence on the net profits that investors receive. This increased tax burden has also had an impact on the industry's expansion.

That's when we began to consider the LLP structure; on the other hand, the LLP structure is taxed at 34.94% and thus offers the investors the much-needed relief when the net returns in their hands grow more large. Additionally, the financial terms provided to investors in the LLP and Trust are essentially identical. Limited partnerships are also widely used as fund structures for investing in securities on a global scale. In comparison to the complicated trust taxation rules provided by the tax legislation, an LLP's taxation is more certain.The taxability of income earned by Dolat Absolute Return LLP ("Fund"), a SEBI registered Category III AIF, would be governed by normal taxation laws that apply to LLPs.

Considering the highest income slab, the income earned by the Fund will be taxed at the Fund level at the 34.94% relevant tax rate rather than the trust level at the 42.74% applicable tax rate. Additionally, any distributions given to the investors/partners from income that has already been taxed should be exempt in their hands.

How are you planning to run the fund over a period of time?

We want to manage this fund more in the manner of a mandate and target return approach, that is, as a fund that seeks to meet its gross return target with a distinctive methodology for a specific time frame. Our goal is to establish a specific expectation target with a time frame and work toward delivery. Long-term, we wanted to keep things simple for both us and our investors. To that end, we will work toward an annual goal, and investors will also be able to see clearly what level of risk and return they can anticipate for the year. As a result, we'll disclose our portfolio strategy and gross return goal each year and work to meet those goals within the allotted period.

Although, Dolat Absolute Return LLP is an open ended CAT III AIF and the fund offers a monthly redemption and subscription facility, the fund strategy may undergo significant changes on yearly basis, and a new strategy will be announced. The fees structure may also be accordingly changed basis the risk return and attractiveness of the offering/mandate.

For instance, if the fund is currently managed as a low-risk market-neutral fund, it may change to a moderate-risk fund the following year with an even higher absolute gross return target, or it may adopt a similar strategy with a lower or higher gross return target. The fees structure may also change, either higher or lower than the current offering depending on how appealing the offering is. The current approach is anticipated to be employed for the following 9 to 12 months. Based on the state of the market, we will then announce the strategy and return objective for the following year.

For how long are you raising the money?

In order to attract the correct group of investors who are aware of the risk-return implications of such sophisticated offers, we plan to raise Rs 200–250 Cr for the first tranche and offer the fund primarily to smart investors. Family offices, corporate treasuries, and Ultra HNIs are our main targets. The absolute return fund involves sophisticated strategies to deliver its outcome. Since Dolat is a new entrant, how confident are you about capabilities that are required to run the fund successfully? Dolat is a newcomer to the AIF market, but not to the financial markets. To manage such money, we have the necessary competencies and infrastructure in place. The group possesses the following qualifications:

- Over 60 years of experience in the Indian Capital Markets (Equities and Derivatives);

- Strong presence in the institutional B2B segment;

- Market leaders in derivative-based strategies;

- One of the largest participants in high-frequency trading;

- Leading executor of arbitrage-based strategies;

- Market makers of Exchange Traded Funds;

- One of the largest executors of algorithm-based trading strategies;

- State of the art technological expertise;

- Leading research capabilities.

With more than 60 years of experience in the Indian Capital Market (equity and derivative), The Dolat Group is a major player in the country's financial services. Institutional equities, investment banking, NBFCs, and FX trading are all already covered by the organization. The family office-managed proprietary desk is the first of its type in India and manages assets in the commodities, options, and arbitrage markets. Dolat Capital (Parent Group) is a multi-strategy, technology-driven quantitative trading company that operates in the financial markets. Dolat Capital offers two-sided markets on a wide range of listed financial assets, including commodities, equities, futures, and options. The fund's sponsor, Dolat Capital Market Private Limited, is a participant in both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The group maintains a strong presence in the cash and derivative markets and is accredited with various FIIs, Mutual Funds, Banks, and Insurance firms.

Can you tell us the pipeline of products that Dolat has lined to grow business? Will the expense structure remain similar across all funds?

We don't now have many funds planned, but we might add one or two additional funds in the future (which would be very different from what we currently offer). The fee structure for the funds will be disclosed at the time of launch and will be based on the risk and return involved. It may differ greatly depending on the fund.

What is your game plan to generate absolute returns consistently?

Generating absolute return consistently is a difficult task, our approach is to break it up in two parts:

- First Protect Capital (Primary motive)

- Then Generate Returns (Secondary motive)

For ensuring the safety of capital, we follow overall portfolio level hedging approach i.e. typically the gross total of returns from all sub strategies should not be negative. It is important to note that the summation of all the strategies can be "zero" and returns at the sub strategy level can be negative independently. Our"s is a multi-strategy portfolio and there is a vide variation between risk-return payoffs at the substrategy level. Thus, we always overview things from an overall portfolio perspective.

For generating the desired returns, we deploy a mix of strategy basis the prevailing market condition Generating attractive Returns is further divided into two segments: 1. Stability Approach 2. Alpha Approach

Stability Approach: There are several extremely low-risk strategies that can produce returns that are nearly risk free and are highly stable in nature, but the returns from such strategies are frequently insufficient to deploy a sizable portion of the portfolio.

Alpha Approach: Typically, we use a combination of tactics, such as market neutral, algo trading, tactical, delta neutral option strategies, and arbitrage. The distribution within the sub-strategies is entirely dynamic, ranging from 0% to 100%.

The allocation of the sub-strategy will typically be based on the expected risk return payoff from the sub-strategy and its contribution to the overall risk return at the portfolio level.

With your strategies, how do you ensure lower volatility, low correlation with equities & fixed income?

We want to emphasize that we only trade in stock and equity derivatives and that we have no exposure to fixed income, commodities, or any other asset class. Derivatives (equities) are what we consider to be our core expertise, thus we only focus on that area. Second, we frequently use market neutral hedged methods to limit the volatility associated with stocks. In certain cases, the returns may be subpar, but the risk connected with market direction is reduced. This is where portfolio design comes into play; for example, if one or two sub-strategies are producing subpar returns, we don't hesitate to immediately reduce our exposure to those sub-strategies and invest in others.

It goes without saying that some of our strategies will have some correlation to fixed income or equities. For instance, the arbitrage strategy is low risk, but returns are correlated to overall interest in the economy, so last year we saw that returns for arbitrage funds dropped by 250 to 300 bps as a result of falling interest rates. Similar to how volatility levels and interest rates may affect option strategy reward. Our tactics can be broadly classified as follows:

Little returns with large liquidity and little risk

By dynamically combining several sub-strategies, we seek to maintain lower volatility and low correlation with equities and fixed income at the level of the entire portfolio.High yields with low risk and modest liquidity

What are the triggers for swift shifts between strategies based on market conditions?

The US VIX, India VIX, market depth, volumes, interest rates, and implied volatilities in single stock futures are just a few examples of the triggers and important indicators that are used to try to measure market conditions and forecast volatility. Additionally, we have a variety of market simulation data on our strategies that shows the likelihood that certain sub-strategies will perform at their best under different market situations. For instance, the options approach tends to underperform our projected return at levels of rising implied volatility.

Tell us about the framework in terms of stop losses & profit booking triggers at sub strategies level. What ensures that discipline is maintained for target execution?

This ensures that discipline is upheld for the execution of the target? What do you mean by sophisticated trading using options and tactical derivatives? Discuss the circumstances under which your absolute return fund may underperform. Keep in mind that we must hedge and safeguard capital at the portfolio level, not the level of the individual substrategies. Gains from secure and risk-free strategies provide the buffer needed to achieve alpha by taking calibrated risks at the level of substrategies. At the sub-strategy level, internal threshold returns and potential loss targets are established. All of these threshold levels can be dynamically controlled based on the sub-strategy's expected risk return. Only the substrategy will receive the intended allocation if the necessary risk return expectations at the sub-strategy level meet our criteria. All such allocations are then carefully monitored and can be dynamically modified based on the real-time performance of the strategy. Few of our trading techniques include precise stop loss and profit booking levels, but all of these levels are a part of the total cushion created by risk-free strategies.

What do you mean by tactical derivative & options based sophisticated trading? Tactical Derivative based trading are quick money making opportunities presented by the market, typically they can be directional in nature. Given that we are running a mandate wherein we are not taking directional calls, in case, any such opportunity arises, we would still try to capture it by taking contrarian hedged positions to reduce the judgement error and directional risk. All such tactical opportunities are not frequently presented by the market. The probability of occurrence of such opportunities is low but the potential of generating returns is high. Options based sophisticated trading strategies are automated options based trading strategies executed based on algorithms. Typically, all such strategies are illiquid in nature and run throughout the month. The risk associated with such strategies is typically limited but the payoff can be exponential. Talk about the conditions when your absolute return fund can under-perform. As stated earlier, our first motive is to protect Capital and then to grow it. Underperformance to the stated gross target absolute return may happen, the possible scenarios can be: First, irrational exuberance in the markets just liked witnessed in March 2020 where they volumes go very low in the market selloff at all levels. Secondly, when stocks move together in lockstep, which tends to happen at the extremes. Thirdly falling interest rates may have a negative impact on our risk free strategies, thus reducing the returns. Would also like to reiterate that we would be happy protecting the hard earned capital for our investors rather than losing capital while chasing returns in the fear of underperformance. So, the investors should understand that there can be month(s) with minimal or muted returns, our first aim is Safety of Capital, we want to achieve our quarterly and yearly target and not a monthly target.