Edelweiss Asset Management Limited

Edelweiss

One of India's top financial services conglomerates, Edelweiss Financial Services provides a strong platform to a diverse clientele in both domestic and international markets. The Edelweiss Group's Investment & Advisory line of business includes Edelweiss Asset Management Limited (EAML). One of the AMCs in India with the quickest growth is EAML. To deliver outstanding value to partners and investors, EAML concentrates on innovation and uniqueness, process-driven approach, customer centricity, and consistency. Mutual Funds and Alternatives are EAML's two main investment platforms that serve the diverse demands of investors. Investment ideas are available on the Alternatives platform through Portfolio Management Services and Alternative Investment Funds (AIF). The AIF Platform: EAML is one of the biggest players in India's market for alternative investment products. The main goal of EAML's investment methods is to provide investors with absolute returns that are uncorrelated with conventional investments. Additionally, the funds frequently exhibit lower volatility than the market and have a strong preference for reducing downside risk. Since 2009, EAML has been managing alternative investments for investors and providing portfolio management services as well as investment ideas for alternative investment funds. The EAML investment team has extensive knowledge of the financial markets and the AIF sector.

Mr. Nalin Moniz, CFA - CIO Alternative Equity

Mr. Nalin Moniz is a graduate of the Jerome Fisher program in Management & Technology from University of Pennsylvania (USA) with joint degrees in Economics from the Wharton School & Computer Science Engineering from the Moore School and a CFA. He has more than 15 years of experience and has managed portfolios under Goldman Sachs and Forefront before joining Edelweiss. He has many prestigious accolades including being voted as one of the “Top 40 Professionals of Indian Alternative Investments under 40”. He has been instrumental in building Edelweiss AIF platform to the current level. He is the Chief Investment Officer of EAML, leads the team across platforms and manages Edelweiss Alternative Equity Scheme.

Mr. Nilesh Saha, CFA - Co-Fund Manager

Mr. Nilesh Saha is a graduate from BITS Pilani and a CFA. He is the Co-Fund manager for the Alternative Equity Funds. He has co-led the investment philosophy of these funds from inception and has played a key role in setting up and growing the Alternative Investment Management business. He currently leads the fundamental investing practice in the firm across multiple strategies and sectors. Investment experience spans value and growth investing, fundamental driven short selling, special situations risk arbitrage and macro driven asset allocation.

Edelweiss Alternative Equity Scheme: CAT-III AIF Open Ended (SEBI – Registration: IN/AIF3/12-13/0004) Launched on 19th August 2014, Edelweiss Alternative Equity Scheme is a Category III open ended Alternative Investment Fund that aims to provide absolute returns over a 2+ year investment horizon. The objective is to provide equity upside participation with limited downside by combining a fundamental Core equity strategy with satellite absolute return strategies. Essentially, while the objective is to generate consistent returns, the even bigger goal is to better manage drawdowns. Managing equity market downside successfully is critical in achieving better overall return. The strategy aims to generate Capital appreciation over market cycles, with lower volatility and lower drawdown than the market. The fund has been able to deliver a consistent track record over a 5 year plus period covering many cycles.

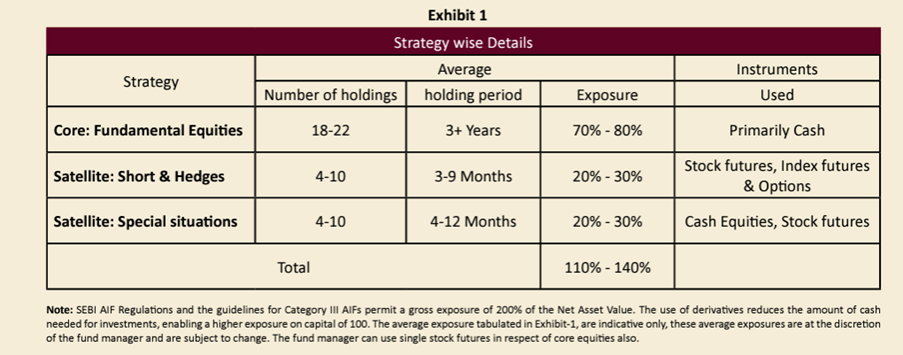

Investment Strategy:

The Fund follows a unique ‘Core & Satellite’ approach to equity investing. The strategy's core holdings are a concentrated portfolio of 20 high-quality equities that have strong earnings and sales growth momentum, high ROE, etc., and are trading at fair prices. There is little turnover in the portfolio. Markets are anticipating a cleaner, better governed, and rapidly expanding Corporate India. This is excellent news for the investing approach. The plan is to judiciously participate in publicly publicized business events such open offerings, buybacks, IPOs, mergers, demergers, etc. Satellite-2 - Shorts & Hedges: It also has opportunistic short positions in structurally poor companies that are currently trading at high values.

Various market cycles have occurred since the fund's founding (19 August 2014) and continuing through 31 January 2020. We compared the behavior of the Edelweiss Alternative Equity Scheme to Nifty-TRI during numerous similar cycles in order to study it. To make the results easier to grasp, charts are presented below.

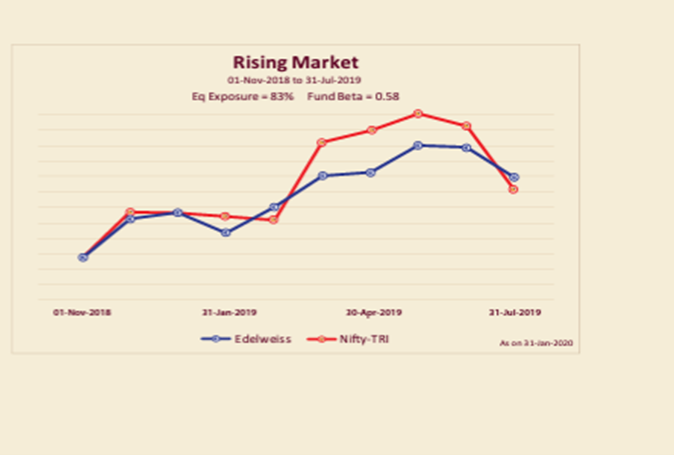

Rising Market:

The market rose from November 1, 2018, to June 30, 2019. The exposure has been 83%, while the fund's beta throughout this time was 0.58. Charts depict the outcomes.

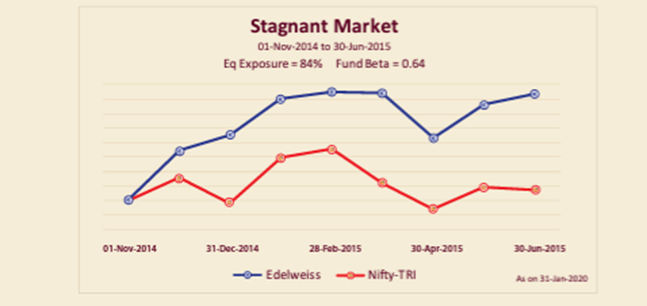

Stagnant Market:

The period from 01-Nov-2014 to 30-Jun2015 witnessed a range bound market. The fund beta was 0.64 and the equity exposure was 84%. The results are charted.

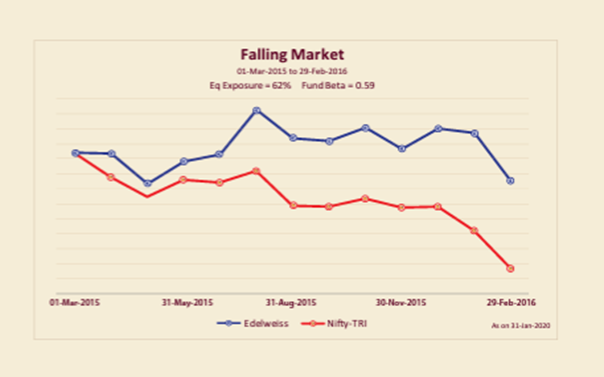

Falling Market:

The period from 01-Mar-2015 to 29-Feb2016 witnessed a bearish phase. The fund beta was 0.59 and the equity exposure was 62%. The results are charted. The resilience of the Fund is proven through the lesser fall in falling market.

Depending on the state of the market, the fund's equity exposure varies. This demonstrates the focused and calculated strategy used by the Fund Management team to enhance returns during favorable market situations while also protecting investments during unfavorable market conditions.

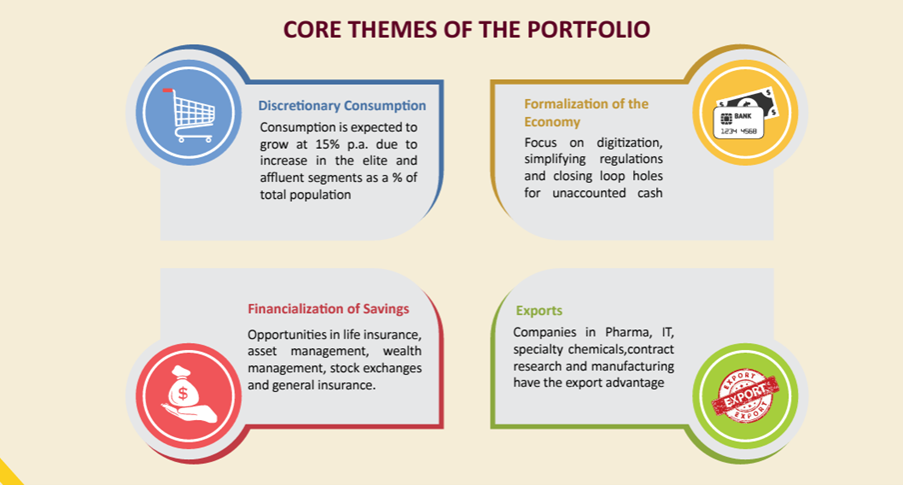

20 high-quality growing companies comprise the core portfolio, which has a 3 to 5-year outlook. Frontline mid cap and large cap stocks are both equally represented in the portfolio. Four themes can be used to roughly classify the portfolio. The largest sector wagers are placed on structural themes like consumer discretionary, home construction, speciality chemicals, and domestic pharmaceutical and healthcare. Throughout 2018 and 2019, the fund had no exposure to non-bank financial service providers. It also had no exposure to cyclical, commodities, or businesses with leveraged balance sheets. The fund has been able to successfully sail through market cycles because to this concentration on business and management quality.

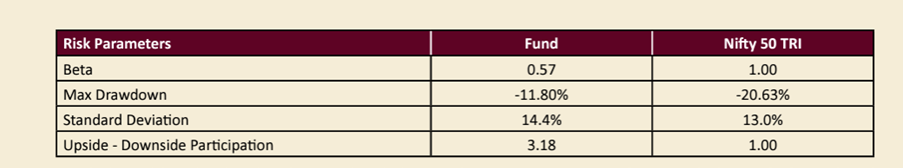

Satellite - Special Situations: In a bull market, the special situations portfolio typically resembles equity style opportunities (such as IPOs, Demergers, and delistings) and low-risk style opportunities (such as open offers, buybacks, and mergers). This allows the fund manager to properly rebalance the fund's asset allocation. Indian stock markets are ideal for stock pickers. If buying firms that will succeed is a stock picker's market, then selling companies that won't succeed is also a stock picker's market. On an average exposure of just 10–13% in the past, single name shorts have been a standout for the fund, and it continues to short broken companies that are selling at high prices. Rolling Return Analysis: Rolling Return Analysis is an additional metric for understanding how consistently the Fund performs. Over one, two, three, and five year rolling periods, the Edelweiss Alternative Equity Scheme has remained consistent when compared to Nifty TRI. The maximum returns on a rolling basis have always been higher for the fund than the benchmark; the losses indicated by the minimum rolling return have always been lower than the benchmark, for one, two, three, and five year periods. As we increase the time horizon, the return outcomes are within a tighter range. The Fund has produced absolute returns while limiting drawdowns during market downturns. Here are several risk factors that back this up.

Conclusion:

- The Fund’s approach is “Core-Satellite”, which caters to all market conditions.

- It is an open ended AIF and suitable for investors seeking equity returns in the long term, 3 to 5 years or beyond, with well controlled moderate risk.

- The Fund is a unique source of diversification, due to its long/short nature and the ability of the Fund Manager to adjust exposure, depending on the market conditions.

- Performance studies conducted since inception reveals the ability of the Fund to outperform its benchmark Nifty-TRI, during bullish, bearish and stagnant cycles generating returns in a tax efficient manner for investors.

- The fund has witnessed consistency in process, approach and team since inception.

In order to understand the AIF Edelweiss Alternative Equity Scheme better, we have conducted an exclusive interview with the Fund Manager. The questions and his replies are appended:

PMS bazaar is privileged to appreciate the consistent performance of Edelweiss Alternative Equity Scheme, CAT III AIF across market cycles. How could you achieve this consistent good performance? An "all-weather" equities fund is Edelweiss Alternative equities Scheme. It is created with a Core portfolio as well as two Satellite portfolios, Special circumstances and Shorts & Hedges. The fund is able to offer investors significant risk-adjusted returns across the course of a market cycle because to three strategies, which each stand out in a bull, range-bound, and bear market, respectively. All strategies over the past five and a half years have improved performance during all market cycles. The hallmarks of our fund management are team stability, a solid bottom-up fundamental research approach, and diligent risk management oversight.

To what kind of Investors the Fund is suitable? What is your suggested holding period to the Investors? The fund is suitable for more defensive-oriented equity investors. These are investors who appreciate the consistency of returns and an equal balance between capital appreciation and preservation. The suggested holding period is 2-3 years and many investors have held the fund since inception in August 2014.

The Satellite - Special situations has performed well and contributed to the total return of the Fund; can you please share your experience on allocation during such opportunities and during absence or lack of event arbitrage opportunities?

There are always opportunities in corporate events - but the type of events we see changes with the market environment. Promoters are always two steps ahead of markets because they have the best understanding of on ground realities. In a bear market - when valuations are cheap, you see a lot of buybacks, open offers and creeping acquisitions. When markets are range bound, you see a lot of mergers, acquisitions, demergers and corporate restructurings and in a bull market - you see a lot of IPOs, QIPs and rights issues. This promoter behaviour means that the risk-return profile of special situation opportunities is low risk arbitrage oriented in a bear market and high return equity oriented in a bull market. Hence, this strategy allows us to correctly rebalance the fund's asset allocation - reducing risk in a bear market and increasing risk in a bull market. We typically have 6-10 opportunities in the portfolio at any point of time.

Majority of the Industry believes that “hedge” means safety during adverse market conditions, combined with “reduced-profit” invariably. Edelweiss’s Satellite shorts & hedges Portfolio has proven this belief as a myth, through its performance of positive performance; can you please, share your experience on managing this Satellite portion of the Fund?

India is a market for stock pickers. If buying firms that will succeed is a stock picker's market, then selling companies that won't succeed is also a stock picker's market. We conduct equally meticulous basic research for our main long positions and our short positions. We focus on shorting failing companies that trade at high values. Although it benefits us disproportionately when markets are bad, we short firms to add alpha to the portfolio, not as a hedge or as a pair trade.

While many Fund Managers of the market appears to be biased & heavy towards Banking & Financials sector, it is quite heartening to note the Core Portfolio of Edelweiss Alternative Equity Scheme is really differentiated on sectoral allocations. Can you please share your views on sectoral themes of the current and future?

We are not constrained by whether a stock is in the NIFTY or SENSEX and at a particular weight. Rather, we look to own market leaders with strong corporate governance which have at least a 15% ROCE, can consistently grow sales & earnings at least at 15%, have low debt (in the case of non-financials) and are reasonably valued. Our stock picking approach is quality-oriented growth at a reasonable price. Sectoral allocations are an outcome of the stock selection process, but today our three largest bets are consumer discretionary, chemicals and insurance. All three are structural stories where we have visibility of a long growth runway.