Emkay Investment Managers

EMKAY

Emkay Global Financial Services Ltd.'s asset management division is called Emkay Investment Managers Limited (EIML).It is a portfolio management and investment advisory firm with SEBI registration that provides clients looking for long-term (at least 3-5 years) outperformance with a variety of investment alternatives.Famous Family Offices, HNIs, Corporates, NRIs, Insurance Companies, Trusts, and PE firms are among its clients. The firm's assets under control as of the previous month total more than INR 800 crore. EIML's investment practice is supported by a knowledgeable and accomplished staff of equity researchers.The combined skills of EIML enable their clients to invest in a variety of high-quality investment opportunities across the Indian equity market. Emkay Emerging Stars Fund - Series I, 2 and 3, Emkay L.E.A.D, and Emkay Capital Builder are some of their most well-liked strategies.

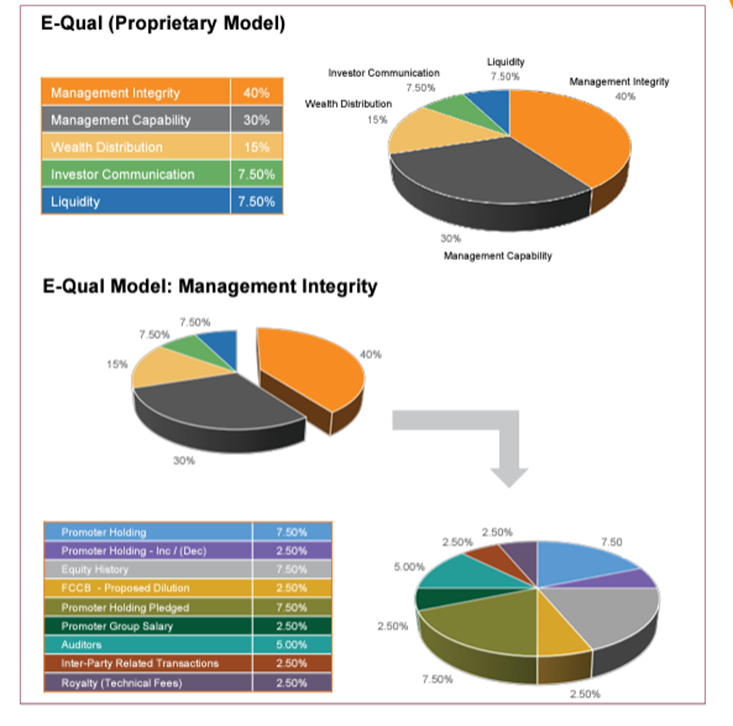

EIML makes use of its broad subject knowledge, meticulous research methodology, and unique module (E-Qual) to provide exceptional insights, trend analysis, short-, mid-, and long-term outlook, products, and services that aid in the long-term wealth creation of its clients.

Mr. Sachin Shah - Fund Manager, Emkay Investment Managers Ltd.

Sachin is a seasoned fund manager with over two decades of experience in the Indian equity markets. By virtue of his extensive research, Sachin realised earlyon the need for a framework in which companies with evasively tricky standing needed to be filtered out very objectively, leading to the development of E-Qual, EIML’s proprietary module which helps to evaluate and compare listed companies on various aspects of governance. Sachin shares his knowledge and insights through various media interactions across print and digital platforms.

Mr. Kashyap Javeri – Fund Manager, Emkay Investment Managers Ltd.

With more than 16 years of experience in company and sector research, Kashyap brings exceptional insights into stocks and economy. Prior to joining Emkay Investment Managers, he was a rated BFSI analyst in Emkay Institutional Equities for eight years and also worked with Sharekhan Ltd as midcap analyst. Kashyap brings with him immense in-depth knowledge on not only a variety of manufacturing and services sectors but also on banking and economics.

INVESTMENT PHILOSOPHY, APPROACH & FRAMEWORK

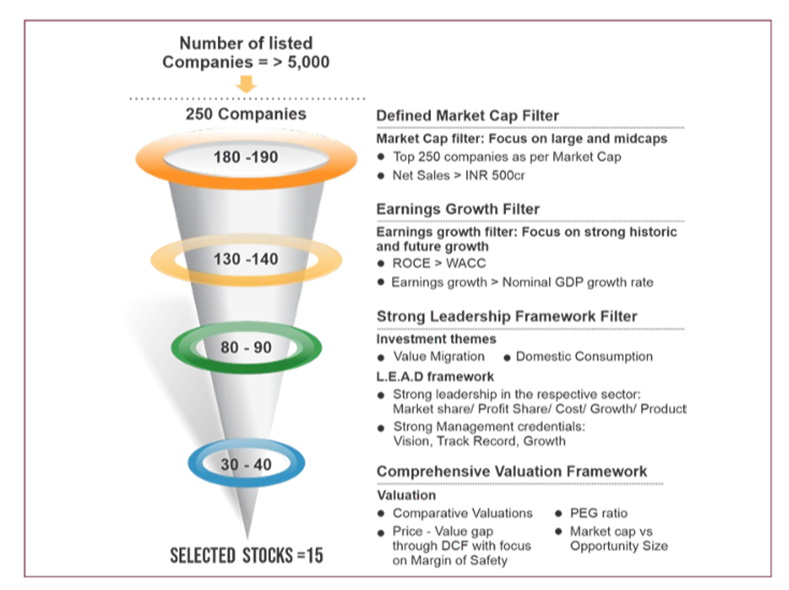

EIML uses a bottom-up stock selection method supported by in-depth fundamental analysis, which includes a close examination of previous annual reports and quarterly results, management quality and integrity, company outlook, channel checks, and industry and stock research reports. A research-backed equities portfolio is intended to produce capital appreciation. The portfolio manager plans to make investments when the prices of the chosen equities represent fair value for long-term investors in light of their potential for earnings growth and capital appreciation. Investors in EIML schemes should have a three-year time horizon or longer for their investments. All of the listed firms on the Indian bourses (BSE & NSE) make up the portfolio's investment universe.

The stock evaluation modules offered by EIML differ greatly from conventional investment methods. The investment portfolios of EIML are built using two different strategies, known as Classical Alpha and Smart Alpha. The term "bottom-up investment" refers to a method of analyzing individual stocks' fundamentals without being impacted by macroeconomic variables or market cycles present in the environment in which the firm works. It makes the supposition that businesses can outperform their larger industries (relatively) and are not sector-specific. The foundation of the Classical Alpha strategy is bottom-up stock selection.

In Classical Alpha, the fund manager prioritizes the microeconomic aspects. These aspects comprise a company's overall financial stability, an examination of its financial statements, the goods and services it offers, supply and demand, and other specific indicators of its performance over the course of time. E-Qual, a unique governance module developed by EIML, which compares businesses on a variety of qualitative and quantitative criteria and aids in preventing investors' portfolios from include risky firms, further supports and distinguishes the traditional alpha method. It is well known that psychological or cognitive biases in people can result in ineffective decisions, and professional investors are not exempt from this rule. However, by being aware of these biases and their origins, one can develop effective risk reduction techniques and improve decision-making. According to research, fund managers are prone to biases including "Selection bias" and "Allocation bias" in their quest to produce more alpha. By requiring a methodical approach to stock selection and equi-weighted allocation, which gives each stock equal weight, a Smart Alpha strategy reduces both selection bias and allocation bias.

E-QUAL FRAMEWORK

E-Qual is a pioneering governance approach that allows for the measurement and objective evaluation of the governance component of management quality in the nation. This unique technique makes it possible to compare all types of stocks side by side and helps keep low-quality stocks out of the portfolio, lowering the risk associated with investing. The algorithm was able to guarantee that EIML's portfolios would experience no blowouts, thereby protecting their clients' capital. According to the E-Qual model, businesses are evaluated on criteria like management's competence and integrity, wealth distribution, investor communication, and liquidity. This results in a systematic exclusion of businesses with problems with accountability, morality, conflicts of interest, and other aspects of corporate governance from portfolios.

In order to buy with a margin of safety and avoid timing the market, the reliable E-Qual model introduces purchase price discipline. This methodology has assisted EIML in avoiding more than 100 businesses that would have eventually collapsed owing to management and governance concerns over the past two years.

We conducted an exclusive interview with Mr. Sachin Shah - Fund Manager in order to know Emkay Investment Managers Ltd. in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

Your investment portfolios are based on two distinct approaches - Classical Alpha and Smart Alpha. Where does Emkay Emerging Stars Fund Series IV fit in and why? Emkay Emerging Stars fund Series IV is a small-cap focused close ended fund, where we plan to construct a portfolio of around 20-25 businesses. Essentially this is an actively managed fund that very much follows a bottom-up approach in selection of each of the stocks. We tend to do a thorough research on each of the companies’ track record, industry structure/ outlook, inherent profitability and most importantly, the management quality – integrity, strategy and execution. And of course last but definitely not the least - the judgment on valuations. Therefore Emkay Emerging Stars Fund falls under our Classical Alpha Offering, as the idea is that over the tenure of the fund (which is 3-3.5 years), we generate decent positive returns and also outperformance over the markets.

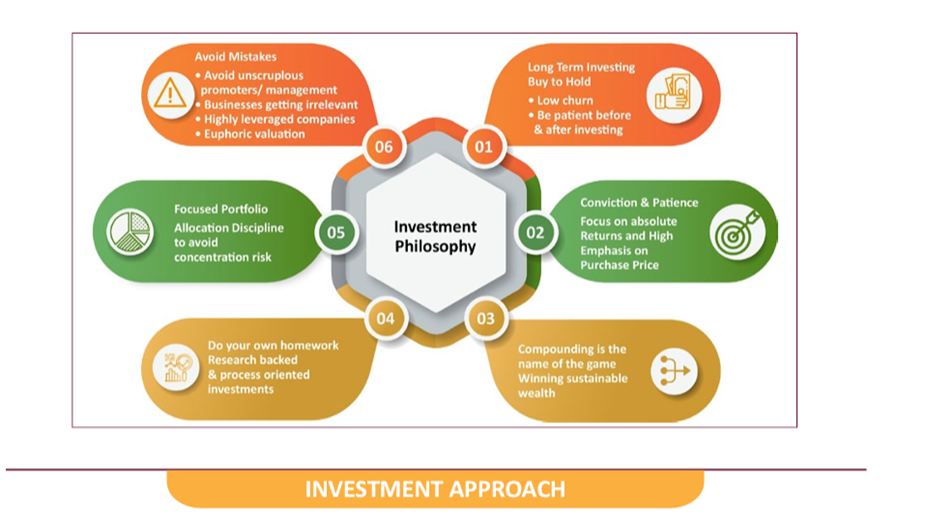

Can you elaborate on the HEXAGON investment philosophy for Emkay Emerging Stars Fund Series IV? The HEXAGON Investment Philosophy is something we have stuck to for more than a decade now, so it’s almost like the Ten Commandments in Bible for us. So whatever we do revolves around this Hexagon. In fact it has almost become our Circle of Competence and therefore we avoid going out of it. Let me elaborate a bit more for better understanding. It essentially starts with the thought process that Fun of Equity Investing is in the Game of Compounding, as Einstein mentioned “Compound Interest is the Eight wonder of the world”

So to achieve compounded returns over our investments, first and foremost is to do:

- Only Long Term Investing (minimum 3+ years), and continue to own businesses for a longer period of time if they continue to have quality growth. Let me back that up with some data points. Over the last decade more than 90%-95% of the profits we have booked have been Long Term Capital gains. More importantly in our current portfolio nearly 50%+ portfolio has more than 5+ years of vintage and probably 40%+ portfolio has over 7+ years of vintage. We are therefore truly long-term. Now come the other tenets, the fact that we want to be long-term drives us to

- Build Conviction & Have patience,

- To build conviction – Do our own Home work - process driven research,

- Let compounding evolve for Sustainable Wealth. The other important aspects since we are building conviction are

- Focused Portfolio to have an impact on the bottom-line of portfolio returns, nevertheless have allocation disciplines to avoid concentration risk, but don’t have marginal positions. And finally the cardinal rule of investing – Rule No 1 – Do Not Lose Money

- Basically Avoid Mistakes – Investing is Not about hitting Sixes but about avoiding unscrupulous promoters / highly leveraged companies / euphoric valuations, etc.

Please tell us about the purchase price discipline principles that will be followed. At EIML we have always been very focused on Purchase Price discipline, evaluating the Risk-Reward matrix for each and every of our portfolio holdings. We have evolved a process as part of our proprietary module – E-Qual, where on the basis of the E-Qual Score and Size of the company (Large, Mid or Small) it helps us to determine the returns that we require from that particular company on our risk-reward matrix. Once the return requirements are set and profit estimates over the next 2-3 years are projected by our research team, it is relatively easy for us to determine the Purchase Price, with decent margin of safety and expected returns over the next two-three years.

Your ability to identify scalable, profitable business models has been seen in the cases of Suven Pharma, Laurus Labs, Tata Elxsi, Timken India etc. Can you tell us about the specific factors that attracted you to them, and what were the entry valuations when you started building positions? It's incredible how well some of the aforementioned companies have performed over the past three to four years, both in terms of business and stock price returns. It has been a textbook example of an emerging star investment. One of the things that unites all of the aforementioned businesses, whether it be Mr. Satyanarayana Chava of Laurus Labs, Mr. Venkat Jasti of Suven Pharma, Tata Elxsi from the Tata group, or Timken a US MNC, is the management's background. Another crucial aspect of each business was that the management had already developed plans (many of which had already been carried out, such as the building of capacities) for rapid growth over the next three to five years. If these plans were to be carried out, some of these businesses would fall into a different league altogether, such as those with EBIDTA under US$50 million delivering EBIDTA of more than or in the neighborhood of US$100 million over the following three to four years.

While Emkay Emerging Stars Fund I and II have beaten the smallcap benchmark since inception, what is the reason behind the lag in III (as on June 2021)? In reality, each of the three series has a mirror portfolio. Simply said, some variation in returns is caused by how the portfolios were launched, with a 3-6 month break between each one. In addition, Series III provides larger returns than Series I & II in absolute terms even though it may lag a little below the benchmark.

For Emkay Emerging Stars Fund IV, what will be different compared to I, II and III? The investment approach, procedure, and focus (small-caps) will all be the same. However, the creation of the Series I, II, and III portfolios took place over three years ago. Some of these businesses, like those already mentioned, have grown and matured from start-ups to large, mid-sized, and huge businesses, with operational earnings currently exceeding Rs. 500-1000 crore. As a result, our goal is to invest in recently emerging firms, and from that vantage point, we anticipate that 65% to 70% or more of the portfolio will be made up of new investment ideas.

Can you tell us about the flexi-invest subscription modules for Emkay Emerging Stars Fund IV? What is the scientific basis for this approach? One of the unique features of the fund is a Flexible Subscription Model that enables investors to choose from three types of investment options – 100% on application, three tranches of 30-30-40 percent over 6 months and 10% every month for 10 months. The fund which is open for both domestic and NRI investors also offers the option for quarterly redemption post an initial lock-in period of one year. These features were introduced basis customer feedback before we launched the product. Most customers wanted to be empowered not just with how they invested in the AIF (hence the flexi subscription modules) but also with the comfort of wanting to exit when they want to (hence the facility of quarterly redemptions).