Envision Capital India Opportunities Portfolio

Agenda

- About Envision Capital

- Envision India Opportunities Portfolio (IOP)

- Portfolio snapshot

- Investment terms & offering

- The India Advantage

- The Equities Advantage

- Contact us

- The Envision Edge

About Us

Envision Capital Services Private Ltd. (ECS) is an investment management firm founded by Mr. Nilesh Shah and is based out of Mumbai, India.

ECS having a Portfolio Management Services (PMS) License, is registered and regulated by Securities and Exchange Board of India (“SEBI”) since March 2010.

ECS manages money for domestic high net worth individuals, family offices and corporates in India and advises foreign portfolio investors for investments in Indian Public Equities.

ECS offers 2 approaches to clients – Envision India Value Portfolio (Mid and Small cap portfolio) and Envision India Opportunities Portfolio (Flexi Cap portfolio).

Current AUM of the firm is ~INR 1066 cr. as on March 31, 2024.

Our Vision

To be a respected India-centric investment management firm driven by intellect and integrity

Our Founder & CEO

• Nilesh Shah is the Founder and CEO of Envision Capital, a leading investment management institution focused on providing Portfolio Management Services (PMS). He is highly regarded for his stock picking skills and for identifying growth-oriented capital efficient businesses with a long-term perspective.

• Nilesh has over 3 decades of experience in Indian credit and equity markets, with about 15 years of working with two of India’s leading home grown financial institutions – HDFC group and Kotak group. He joined Kotak group as an Executive and soon became Executive Director at Kotak Securities and President, Kotak Asset Management. He also became the youngest member of the Kotak Leadership Team comprised of the group’s top 30 employees. During this period, Kotak Securities became India’s leading brokerage and PMS house and Kotak Asset Management received several awards.

• Nilesh holds a CFA from The Institute of Chartered Financial Analysts of India (ICFAI), where he ranked all-India 1st in CFA Preliminary Levels, and a post graduate in management from IRMA, where he was valedictorian. He is also a recipient of several academic and professional awards.

• Nilesh, in his capacity as CEO, has been successfully managing the Envision India Value Portfolio since 2010 and Envision India Opportunities Portfolio since 2021, outperforming the Benchmark since inception.

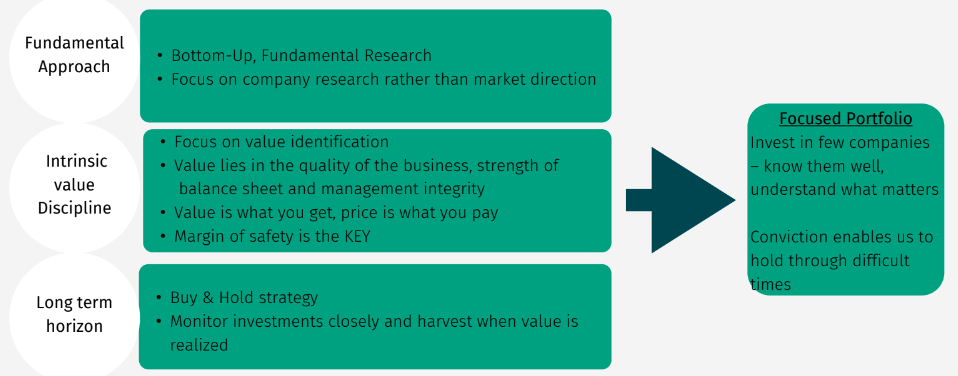

Investment Philosophy

! [C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\envision1.png]

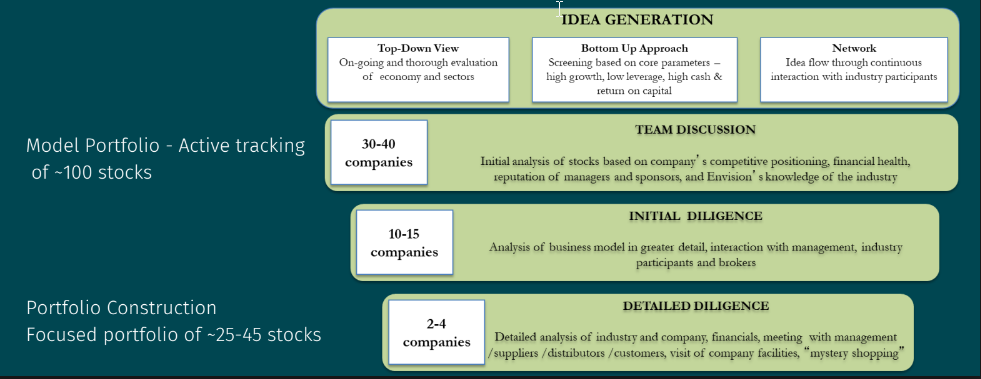

Investment Process

Investment Universe – Active & Passive tracking of ~300 stocks ! [C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\envision2.png]

360 Perspective on Companies

! [C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\envision3.png]

What works - Our learnings

- Big Opportunity, long runway – the starting point, source of compounding

- Cash Flows – fortune lies at the bottom of the pyramid

- Growth Without Cash Flows (GWCF) – an optical illusion

- Identify the delta – the inflection point

- Bad businesses are usually bad investments

- Capital Allocation – the final test

- People & Leadership – the differentiating intangible

- Solving a Problem – icing on the cake

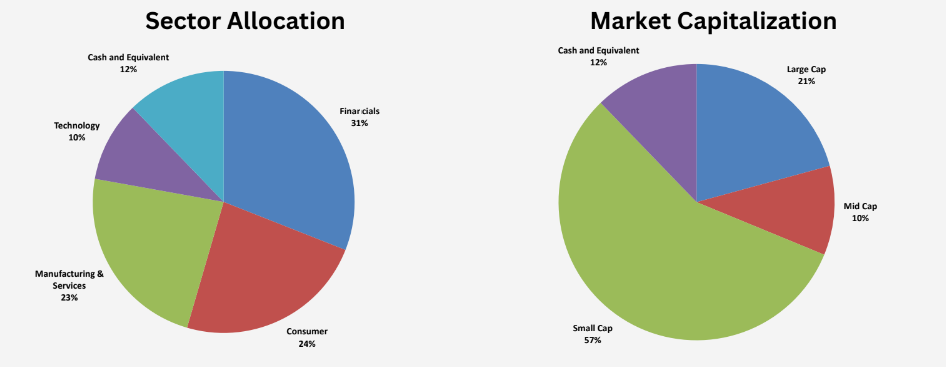

Portfolio Composition

Growth oriented, capital efficient businesses

Combination of both leaders (large caps) and emerging champions (mid & small caps)

Sector Agnostic

~25-45 stock portfolio

3-5 year investment horizon

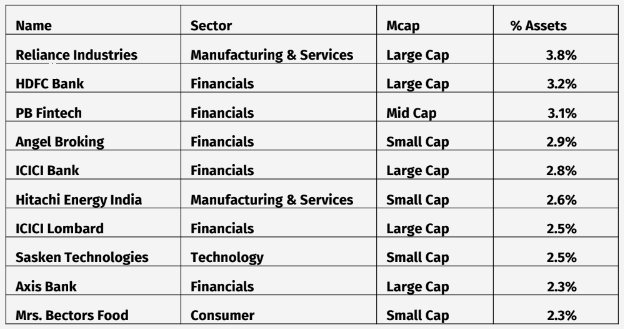

Top 10 Holdings

! [C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\envision4.png]

Sector Allocation & Market Capitalization

! [C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\envision5.png]

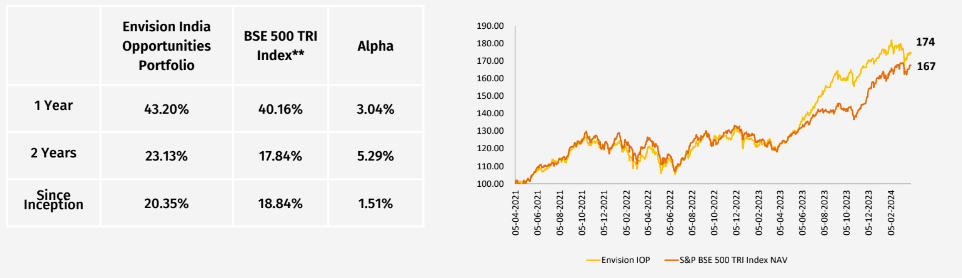

Portfolio Performance

The portfolio has outperformed the benchmark by 151 bps annually

! [C:\Users\meghj\OneDrive\Desktop\md files\ppt mds\images\envision6.png]

Investment Terms

Portfolio Envision India Opportunities Portfolio Service Providers

Strategy Equity / Bottom-Up Approach

Market Cap Allocation Flexi Cap

Lock-in NIL

Minimum Investment As applicable and capped as per SEBI

regulations

Fixed Management Fee 1.75% p.a.

Performance Management Fee 10% above 10% hurdle rate

Exit Load As applicable and capped as per SEBI

regulations

Statutory Levies As applicable

The India ADVANTAGE

Present

- 5th largest economy in the world and 5th largest stock market by market Capitalization

- USD 3.5trn economy

- Per Capita Income ~USD 2500 at the cusp of multi-year growth for consumption driven economy

- Large young population driving the growth

- Growth oriented focus of Government and favourable taxation policies attracting huge investments

Future

- On its way to become the 3th largest economy in the world by 2030

- Targets to become USD 5 trn economy by 2027

- Per Capita Income of USD 10000 over next 10-15 years will drive discretionary spends

- Moving towards becoming the manufacturing hub of the world

- Multiple growth drivers

Equities ADVANTAGE

Equities outperform in long run Equity has significantly outperformed fixed income over long period in spite of the volatility Equity offers long term wealth creation opportunities to investors

Envision EDGE

Specialized portfolio management team

- Over 3 decades of equity market experience

- Team based in Mumbai, with significant experience analyzing Indian businesses

- Investment is the only business we do

Differentiated investment strategy

- Bottom-up, fundamental research mindset

- Focused portfolio of quality, emerging, growth-oriented, capital- efficient businesses

- Long-term investment horizon

Strong Pedigree

- Regulated under Securities and Exchange Board of India (SEBI) PMS Regulations

- Team with long standing experience in Investment research and Portfolio Management

Long track record

- Outperforming Benchmark since inception