Green Lantern Alpha Fund

Who are we? – We live, eat and breathe Equities

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

We are a team of highly experienced investment professionals with passion for investing. Green Lantern Capital is our endeavour to create long term value for all stakeholders by practicing disciplined approach to investment.

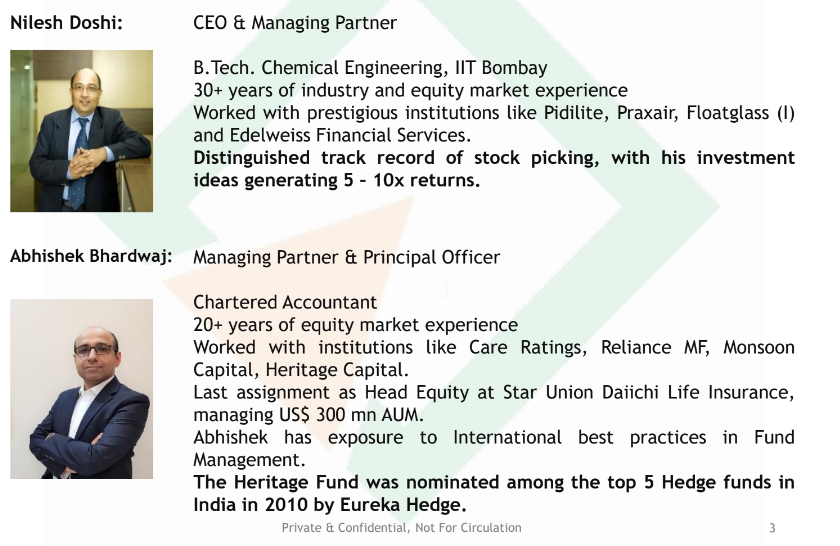

Team: 80+ Years of Cumulative Experience

Head or Tails. It’s the right team that makes the win.

What to expect from us?

- Margin of Safety and capital preservation

- Disciplined approach

- Rigorous research and due diligence

- Long term focus

- Skin in the game

- Transparency & regular communication

Investment Approach: Rigor of Buying a Business

Business Selection:

- Our starting point of any investment is to study and understand the business threadbare as we are business investors, which means investment to us is like buying a business. We invest in quality businesses that we understand well and which are likely to generate improvement in earnings and cash flows in the foreseeable future and avoid ones facing headwinds.

Judgement of Business cycles:

- Our understanding of global macroeconomics along with the judgement of economic and business cycles helps us to endeavour to remain ahead of the curve in our investments. We may be a bit early in our investment and may have to wait for the businesses to bear fruit but have generally found them to be very rewarding with higher IRRs.

Margin of Safety:

- Being early in identifying themes/stocks allows us the ‘Margin of Safety’ that we require before we invest. This entails that we will not shy away from being contrarian provided we are able to identify triggers for improvement in earnings and/or rerating of sector/stocks.

Thus, Investing in quality, growing businesses with desired margin of safety ensures capital protection, lower volatility and generates superior returns over a period of time.

Our Investment Approach helps us focus on...

Asymmetric risk : reward Earning inflection points High margin of safety Growth and earning tailwinds

Disciplined selling: the most crucial and difficult part of investing

- Run up in stocks & valuations getting rich

- Significant change in investment rationale

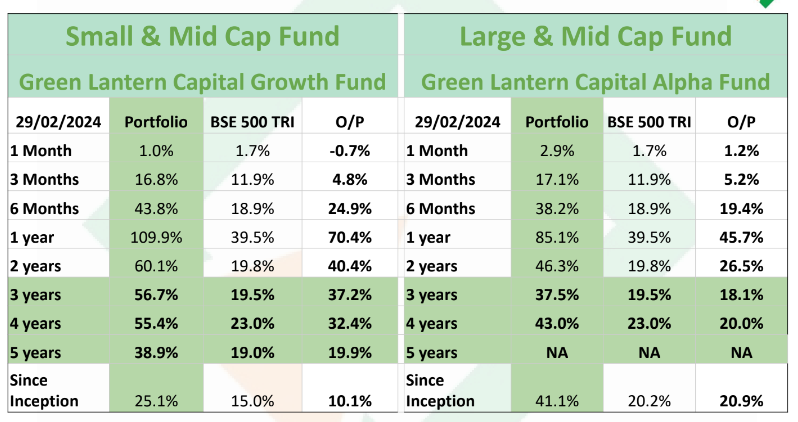

Our Performance

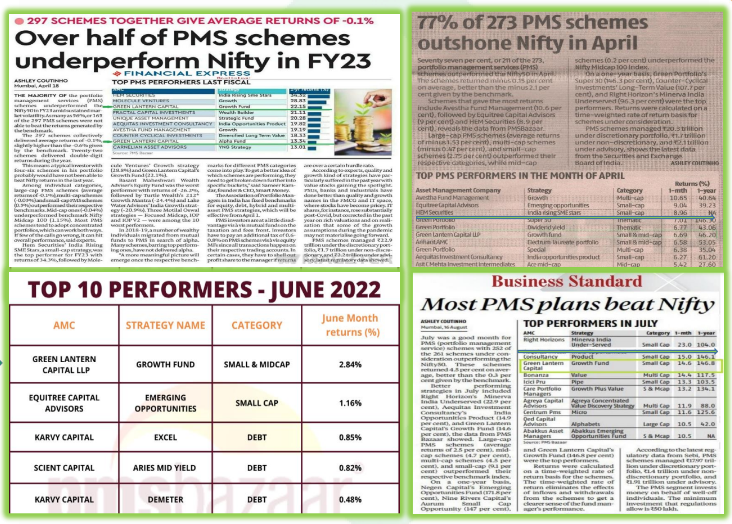

Media coverage

Global Macro

- Record Global Elections: India, USA, Russia.

- Geopolitical Instability.

- Trade war to continue: Protectionism.

- Technological Innovation and Competition: To Transform the world

- Deglobalization & Re-Industrialization: Domestic manufacturing to increase from National Security Perspective:

- Bilateral Trade (ex of USD ) among developing countries to gather speed.

- Europe is in structural decline of demography and economic growth.

USA

- Massive Treasury Issuance will continue:

- Will weigh on interest rates

- Crowd out other Investments

- End of free money Era: Possibility.

- Stress in Commercial Real Estate.

- Inflation Yo-Yo

- FED pause on hikes to continue & may begin rate reduction in CY 24

- Structural decline in GDP growth?

India Macro- Positive in a difficult world

- Political Stability: expected based on recent states election outcome.

- Continuation of policy Reforms.

- Domestic Manufacturing to gather pace in many areas due to: (I) PLI schemes, (II)

- Increased outsourcing by developed world, (III) Make in India/Self-reliance/National Security Reasons:

- Infrastructure capex to continue & gather pace:

- Exports of IT, Pharmaceuticals, Agrochemicals to continue.

- Exports of Engineering Goods to gather pace.

Equity Market Outlook: CY2024

- Though lot depends on outcome of:

- India Lok Sabha Election

- USA Election: What if Trump wins?

- Inflation & Economy Growth Outlook in USA is key to Policy action.

- Nifty consensus earnings is 1076 for FYE i.e 20x FY25E

- Economy to grow @10% nominal GDP: For us to reach 5 Trn $ over next 3-4 years.

- Rising Direct Retail Participation to drive the market in this decade.

- Rising Algorithm Trading & Options Trading.

- FEAR OF: MARKET IS EXPENSIVE + MISSING OUT

- Expect Volatility to continue.

- Finally, Market may be narrow & need to moderate return expectation in CY2024.

Investment Strategy

- Active Management with stock picking will create value.

- Key is to identify good businesses with higher probability of

- Revenue Growth

- Improvement in Earnings

- Invest with high margin of safety & favorable risk-reward.

- Invest in sectors of Structural Growth: Provides huge tail wind

- Manage your risks:

- Position sizing

- Diversification

- Margin of safety for capital protection

- Continuous monitoring & evaluation of investment