Finance

Green Lantern Growth Fund

byInvestment Approach

Our Investment Approach helps us focus on...

- Asymmetric risk : reward

- Earning inflection points

- High margin of safety

- Growth and earning tailwinds Disciplined selling: the most crucial and difficult part of investing

- Run up in stocks & valuations getting rich

- Significant change in investment rationale

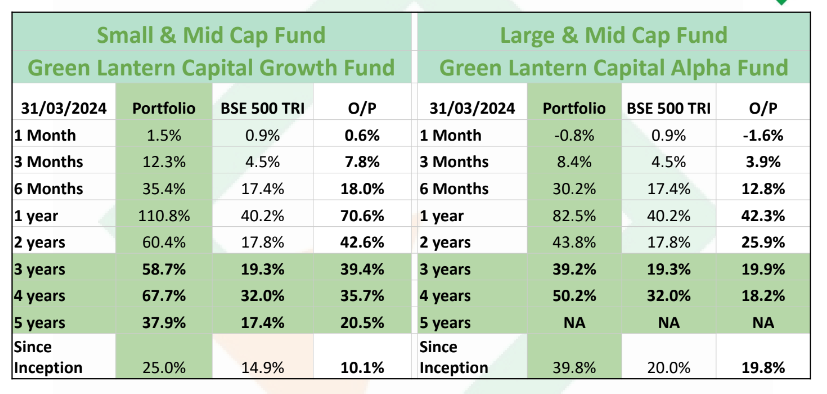

Our Performance

Global Macro

- Record Global Elections: India, USA, Russia.

- Geopolitical Instability.

- Trade war to continue: Protectionism.

- Technological Innovation and Competition: To Transform the world

- Deglobalization & Re-Industrialization: Domestic manufacturing to increase from National Security Perspective:

- Bilateral Trade (ex of USD ) among developing countries to gather speed.

- Europe is in structural decline of demography and economic growth.

USA

- Massive Treasury Issuance will continue:

- Will weigh on interest rates

- Crowd out other Investments

- End of free money Era: Possibility.

- Stress in Commercial Real Estate.

- Inflation Yo-Yo

- FED pause on hikes to continue & may begin rate reduction in CY 24

- Structural decline in GDP growth?

#### Investment Strategy

- Active Management with stock picking will create value.

- Key is to identify good businesses with higher probability of

- Revenue Growth

- Improvement in Earnings

- Invest with high margin of safety & favorable risk-reward.

- Invest in sectors of Structural Growth: Provides huge tail wind

- Manage your risks:

- Position sizing

- Diversification

- Margin of safety for capital protection

- Continuous monitoring & evaluation of investment

Subscribe to Newsletter

AMC's

- 1729 Advisors Llp

- 2Point2 Capital Advisors Llp

- 360 ONE Asset Management.

- 360 One Portfolio Managers Ltd

- A C Choksi Share Brokers Pvt Ltd

- Aarohan Holdings And Advisors Pvt Ltd

- Abakkus Asset Manager Pvt Ltd

- Abans Broking Services Pvt Ltd

- Abchlor Investments Pvt Ltd

- Accelt Asset Management Llp

- Accuracap Consultancy Services Pvt Ltd

- Acepro Advisors Pvt Ltd

- Aditya Birla Money Ltd

- Aequitas Investment Consultancy Pvt Ltd

- Affirma Capital Investment Adviser India Pvt Ltd

- Aialpha Financial Advisory Services Pvt Ltd

- Alchemy Capital Management Pvt Limited

- Alder Capital Advisors Llp

- ALFACCURATE ADVISORS

- Allegro Securities Pvt Ltd

- Almondz Financial Services Ltd

- Alpha Alternatives Fund Advisors Llp

- Alphagrep Investment Management Pvt Ltd

- Amaltas Asset Management Llp

- Ambit Investment Advisors Pvt Ltd

- Ambit Wealth Pvt Ltd

- Anand Rathi Advisors Ltd

- Angel One Investment Managers And Advisors Pvt Ltd

- Apricus Wealth Investment Managers Llp

- Ardeko Asset Management Pvt Ltd

- Arth Portfolio Management Pvt Ltd

- Arthalpha Llp

- Ashima Capital Management Ltd

- Asian Markets Securities Pvt Ltd

- Asit C Mehta Investment Interrmediates Ltd

- Ask Investment Managers Ltd

- Atlas Integrated Finance Ltd

- Atman Capital Management Pvt Ltd

- Avendus Investment Managers Pvt Ltd

- Avendus Wealth Management Pvt Ltd

- Avestha Fund Management Llp

- Awriga Capital Advisors Llp

- Axis Asset Management Company Ltd AIF

- Axis Securities Ltd

- Ayan Analytics Pvt Ltd

- Badjate Wealth Pvt Ltd

- Banyan Tree Advisors Pvt Ltd

- Basant Maheshwari Wealth Advisers Llp

- Bay Capital Investment Advisors Pvt Ltd

- Bellwether Capital Pvt Ltd

- Bhana Equity Advisors Llp

- Bharat Bhushan Equity Traders Ltd

- Blue 91 Portfolio Managers Llp

- Bmc Advisors Pvt Ltd

- BN Rathi Securities Ltd

- Bonanza Portfolio Ltd

- Brain Point Investment Centre Pvt Ltd

- Brightseeds Advisors Llp

- Buglerock Capital Pvt Ltd

- Burman Capital Management Pvt Ltd

- Capgrow Capital Advisors Llp

- Capital 8 Llp

- Capitalmind Financial Services Pvt Ltd

- Capstocks And Securities (India) Pvt

- Care Portfolio Managers Pvt Ltd

- Carnelian Asset Management And Advisors Pvt Ltd

- Centrum Investment Advisors Ltd

- Chanakya Capital Services Pvt Ltd

- Chona Financial Services Ltd

- Citrus Advisors Pvt Ltd

- Clearview Capital Advisors Pvt Ltd

- Clockvine Capital Advisors Pvt Ltd

- Clubmillionaire Financial Services Pvt Ltd

- Composite Investments Pvt Ltd

- Compound Everyday Capital Management Llp

- Concept Investwell Pvt Ltd

- Consortium Securities Pvt Ltd

- Cosmea Portfolio Management Pvt Ltd

- Counter Cyclical Investments Pvt Ltd

- Courser Park Advisors Llp

- Credent Asset Management Services Pvt Ltd

- Cumulus Advisory Llp

- Dalal And Broacha Stock Broking Pvt Ltd

- Darashaw And Company Ltd

- Dezerv Investments Pvt Ltd

- Divya Capital One Pvt Ltd

- Dmz Partners Investment Management Llp

- Drchoksey Finserv Pvt Ltd

- Driv Drisht Llp

- Dt Portfolio Managers Llp

- Dv Investment Advisors Llp

- Dwaith Advisory Pvt Ltd

- Dynamic Equities Pvt Ltd

- East Green Advisors Llp

- East Lane Capital Llp

- Ebisu Investment Advisors Llp

- Edelweiss Asset Management Limited

- Edelweiss Global Wealth Management Ltd

- Eklavya Capital Advisors Llp

- Electrum Portfolio Managers Pvt Ltd

- Elever Investment Adviser Pvt Ltd

- Elite Wealth Ltd

- Elixir Equities Pvt Ltd

- Emkay Investment Managers Ltd

- Entrust Family Office Investment Advisors Pvt Ltd

- Envision Capital Services PvtLtd

- Equentis Wealth Advisory Services Ltd

- Equipoise Capital Management Pvt Ltd

- Equirus Wealth Pvt Ltd

- Equitree Capital Advisors Pvt Ltd

- Equity Intelligence India Pvt Ltd

- Escorp Asset Management Ltd

- Eureka Portfolio Management Services Pvt Ltd

- Fe Securities Pvt Ltd

- Fident Asset Management Pvt Ltd

- Fincos Technology Solutions Pvt Ltd

- Findoc Investmart Pvt Ltd

- Finwizard Technology Pvt Ltd

- First Global Finance Pvt Ltd

- Five Rivers Portfolio Managers Pvt Ltd

- Fort Capital Investment Advisory Pvt Ltd

- Fortuna Investment Advisors Llp

- Fortune Wealth Management Company India Pvt Ltd

- Fractal Capital Investments Llp

- Fyers Asset Management Pvt Ltd

- Gems Imperial Portfolio Advisory Llp

- Geojit Financial Services Ltd

- Ghalla Bhansali Stock Brokers Pvt Ltd

- Girik Wealth Advisors Pvt Ltd

- Globe Capital Market Ltd

- Green Portfolio Pvt Ltd

- Growthfiniti Wealth Pvt Ltd

- Guardian Advisors Pvt Ltd

- Hanut Alternate Investments Llp

- Harmoney Finserv India Pvt Ltd

- Hedge Equities Ltd

- Hem Securities Ltd

- Himalaya Investment Advisors Llp

- Hpmg Shares And Securities Pvt Ltd

- Hsbc Asset Management (India) Pvt Ltd

- Icici Securities Ltd

- Idbi Capital Market Services Ltd

- Ifm Investment Advisors Pvt Ltd

- Ime Portfolio Managers Llp

- Impetus Arthasutra Pvt Ltd

- Incred Asset Management Pvt Ltd

- Incred Capital Wealth Portfolio Managers Pvt Ltd

- Infinity Alternatives Investment Managers Pvt Ltd

- Invasset Llp

- Invesco Asset Management (India) Pvt Ltd

- Invesq Investment Managers Llp

- Investsavvy Portfolio Management Llp

- Ironclad Asset Management Llp

- Ithought Financial Consulting Llp

- Itus Capital Advisors Pvt Ltd

- Jade Wealth Management Llp

- Jain Investment Advisors Pvt Ltd

- Jainam Broking Ltd

- Janak Merchant Securities Pvt Ltd

- Jeetay Investments Pvt Ltd

- Jm Financial Ltd

- Joindre Capital Services Ltd

- Kapm Ventures Llp

- Karma Capital.

- Karvy Capital Ltd

- Kb Capital Markets Pvt Ltd

- Kedia Shares And Stocks Brokers Ltd

- Klay Securities Pvt Ltd

- kotak mahindra asset management company ltd

- Kriis Portfolio Pvt Ltd

- Ksema Wealth Pvt Ltd

- Kunvarji Finstock Pvt Ltd

- Kyng Capital Management Pvt Ltd

- Ladderup Asset Managers Pvt Ltd

- Lakewater Advisors Pvt Ltd

- Laurel Securities Pvt Ltd

- Lc Capital India Pvt Ltd

- Lgt Wealth India Pvt Ltd

- M/S Jhp Securities Pvt Ltd

- Magadh Capital Advisors Llp

- Mansi Share And Stock Broking Pvt Ltd

- Marathon Trends Advisory Pvt Ltd

- Marcellus Investment Managers Pvt Ltd

- Marfatia Stock Broking Pvt Ltd

- Markets Mojo Asset Management Pvt Ltd

- Master Portfolio Services Ltd

- Maximal Capital Pvt Ltd

- Mehta Equities Ltd

- Merisis Advisors Pvt Ltd

- Milestone Capital Advisors Pvt Ltd

- Mittal Analytics Pvt Ltd

- Miv Investment Services Pvt Ltd

- Mo Alternate Investment Advisors Pvt Ltd

- Moat Financial Services Pvt Ltd

- Molecule Ventures Llp

- Moneybee Securities Pvt Ltd

- Moneygrow Asset Pvt Ltd

- Motilal Oswal Asset Management Company Ltd

- Motilal Oswal Wealth Ltd

- Mrg Investment Partners Pvt Ltd

- Multi-Act Equity Consultancy Pvt Ltd

- Nafa Asset Managers Pvt Ltd

- Narnolia Financial Services Ltd

- Negen Capital Services Pvt Ltd

- New Berry Capitals Pvt Ltd

- Nine Rivers Capital Holdings Pvt Ltd

- Nirmal Bang Securities Pvt Ltd

- Nmr Capital Advisors Llp

- Nnm Securities Pvt Ltd

- Northern Arc Investment Managers Pvt Ltd

- Nuvama Asset Management Ltd

- Nv Alpha Fund Management Llp

- Oaks Asset Management Pvt Ltd

- Ohm Portfolio Equi Research Pvt Ltd

- Old Bridge Capital Management Pvt Ltd

- Pace Financial Investment Adviser Pvt Ltd

- Paterson Securities Pvt Ltd

- PCS Securities Ltd

- Pelican Holdings Pvt Ltd

- Pgim India Asset Management Pvt Ltd

- Pioneer Client Associates Pvt Ltd

- Pioneer Wealth Management Services Ltd

- Piper Serica Advisors Pvt Ltd

- Pl Asset Management Pvt Ltd

- Prescientcap Investment Advisors Llp

- Prithvi Finmart Pvt Ltd

- Profitgate Capital Services Llp

- Profusion Investment Advisors Llp

- Progressive Share Brokers Pvt Ltd

- Prosperity Wealth Management Pvt Ltd

- Prospero Tree Asset Management Llp

- Prp Edge Wealth Pvt Ltd

- Prudent Equity Pvt Ltd

- Prudent Investment Managers Llp

- Purnartha Investment Advisers PvtLtd

- Qed Capital Advisors Llp

- Qode Advisors Llp

- Qrc Investment Advisors Llp

- Quest Investment Managers Pvt Ltd

- R Wadiwala Securities Pvt Ltd

- Rbsa Investment Manager Llp

- Reliance Wealth Management Ltd

- Revelation Portfolio Management Pvt Ltd

- Right Horizons Portfolio Management Pvt Ltd

- Roha Asset Managers Llp

- Sageone Investment Managers Llp

- Sahasrar Capital Pvt Ltd

- Samatva Investment Advisers Llp

- SAMEEKSHA CAPITAL INVESTMENT FUND

- Sammaan Asset Management Ltd

- Samvitti Capital Pvt Ltd

- Sanctum Wealth Pvt Ltd

- Savvy Capital Advisors Llp

- Scient Capital Pvt Ltd

- Securities Investment Management Pvt Ltd

- Seers Fund Management Pvt Ltd

- Shade Capital Pvt Ltd

- Sharekhan Ltd

- Shepherds Hill Financial Advisors Llp

- Shree Rama Managers Llp

- Shriram Asset Management Company Ltd

- Silverarch Investment Advisers Pvt Ltd

- Sirius Advisors Pvt Ltd

- Smartowner Services India Pvt Ltd

- Smc Global Securities Ltd

- Sohum Asset Managers Pvt Ltd

- Soldiers Field Investments Pvt Ltd

- Solidarity Advisors Pvt Ltd

- Sowilo Investment Managers Llp

- Spark Asia Impact Managers Pvt Ltd

- Spice Route Advisors Llp

- Square 64 Capital Advisors Llp

- Stallion Asset Pvt Ltd

- Stalwart Investment Advisors Llp

- Stewart And Mackertich Wealth Management Ltd

- Sundaram Alternate Assets Limited

- Svan Investment Managers Llp

- Svobodha Infinity Investment Advisors Pvt Ltd

- Swyom Advisors Ltd

- Sykes And Ray Equities India Ltd

- Systematix Shares And Stocks (India) Ltd

- Tailwind Financial Services Pvt Ltd

- Tata Asset Management Pvt Ltd

- Tcg Advisory Services Pvt Ltd

- Thinqwise Wealth Managers Llp

- Tradeswift Broking Pvt Ltd

- TRam Financial Services Pvt Ltd

- Trivantage Capital Managment India Pvt Ltd

- True Beacon Investment Advisors Llp

- Trustline Holding Pvt Ltd

- Tulsian Pms Ltd

- Turtle Wealth Management Pvt Ltd

- Unicorn Investment Managers Llp

- Unique Asset Management Llp

- Valentis Advisors Pvt Ltd

- Vallum Capital Advisors Pvt Ltd

- Val-Q Investment Advisory Pvt Ltd

- Valtrust Partners Llp

- Value Prolific Investments And Consulting Pvt Ltd

- Valuequest Investment Advisors Pvt Ltd

- Varanium Capital Advisors Pvt Ltd

- Ventura Securities Ltd

- Vivekam Financial Services Pvt Ltd

- Vspartans Consultants Pvt Ltd

- Wallfort Pms And Advisory Services Llp

- Wave Asset Pvt Ltd

- Way2Wealth Brokers Pvt Ltd

- Waya Financial Technologies Pvt Ltd

- Wealth First Portfolio Managers Ltd

- Wealth India Financial Services Pvt Ltd

- Wealth Managers India Pvt Ltd

- Wealthbridge Capital Advisors Pvt Ltd

- White Pine Investment Management Pvt Ltd

- White Whale Partners Llp

- Willow Advisors Llp

- Wryght Research And Capital Pvt Ltd

- Xponent Tribe Llp

- Zen Wealth Management Services Ltd

- Edelweiss Mutual Fund

- A9 Finsight Private Limited

- Aarth AIF

- Abakkus Asset Manager Private Limited.

- Accuracap Consultancy Services Pvt Limited

- Aditya Birla SL Insurance Co Ltd

- Aditya Birla Sun Life AMC Ltd

- Aditya Birla Sun Life Mutual Fund

- Aegon Life Insurance

- Aequitas Investment Consultancy Pvt Ltd

- Ajanta Advisors LLP

- Alpha Alternatives Fund Advisors LLP

- AlphaGrep Investment Management AIF

- Altacura AI

- Ambit Investment Advisors Limited AIF

- Amcha Partners Trust

- AMPERSAND CAPITAL TRUST

- Angel One Mutual Fund

- ASHIKA INVESTMENT MANAGERS PVT. LTD.

- Ashmore Investment Management India LLP

- ASK Long-Short Fund Managers Pvt Ltd

- Astratinvest Financial Advisors Pvt. Ltd.

- Avendus Capital Markets

- Aviva Life Insurance

- Axis Max Life Insurance

- Axis Mutual Fund

- Bajaj Allianz Life Insurance

- Bajaj Finserv Asset Management

- Bandhan Mutual Fund

- Baroda Mutual Fund

- Bharti Axa Life Insurance

- BNP Paribas Mutual Fund

- BOI AXA Mutual Fund

- Bonanza Portfolio Limited

- Brighter Mind Asset Management Pvt Ltd

- Buoyant Capital Private Limited

- Canara HSBC Life Insurance

- Canara Robeco Mutual Fund

- Capitalmind Mutual Fund

- Carnelian Asset Management & Advisors Private Limited-AIF

- CCV INVESTMENT MANAGERS LLP

- Craving Alpha Wealth Fund

- Dalal & Broacha Portfolio Managers Ltd

- DHFL Pramerica Life Insurance

- Dolat Capital Market Pvt Ltd.

- DSP Asset Managers Private Limited

- DSP Mutual Fund

- Edelweiss Tokio Life Insurance

- Emkay Investment Managers Ltd

- ENIGMA INVESTMENT PARTNERS

- Estee Advisors Private Limited

- Exide Life Insurance

- Finideas Growth Fund

- First Water Capital Advisors LLP

- Franklin Templeton Mutual Fund

- Future Generali Life Insurance

- Generational Capital Breakout Trust

- Girik Advisors LLP

- Groww Mutual Fund

- GUARDIAN CAPITAL PARTNERS FUND

- HDFC Mutual Fund

- HDFC Standrad Life Insurance

- Helios Capital Management India Pvt Ltd

- Helios Mutual Fund

- HSBC Mutual Fund

- I Wealth Management LLP

- ICICI Prudential AMC Ltd AIF

- ICICI Prudential Life Insurance

- ICICI Prudential Mutual Fund

- IDBI Fortis Life Insurance

- IDBI Mutual Fund

- IIFCL Asset Management Ltd

- IL&FS Infra Asset Management Ltd

- Incred Capital Investment Advisors And Managers Pvt Ltd.

- IndiaFirst Life Insurance

- Inquant Systematic Investment Managers LLP

- Invesco Mutual Fund

- ITI Long Short Equity fund

- ITI Mutual Fund

- JIO BLACKROCK MUTUAL FUND

- JM Financial Mutual Fund

- KLAY SECURITIES PRIVATE LIMITED

- Knightstone Capital Management LLP

- Kotak Life Insurance

- Kotak Mahindra Mutual Fund

- L&T Mutual Fund

- LIC Mutual Fund

- Life Insurance Corporation of India

- Mahindra Manulife Mutual Fund

- Malabar Fund Managers LLP

- Marcellus Investment Managers.

- Mirae Asset Mutual Fund

- Monarch AIF

- MoneyGrow Asset Private Limited-AIF

- Morphosis Venture Advisors LLP

- Motilal Oswal Asset Management-AIF

- Motilal Oswal Mutual Fund

- NAVI Mutual Fund

- Negen Capital Services Private Limited

- Neo Asset Management Private Limited

- Nepean Capital LLP

- NEXUS EQUITY GROWTH FUND

- Nippon India Mutual Fund

- Nippon Life India AIF Management Limited

- Niveshaay Investment Management Private Limited

- NJ Asset Management Pvt Ltd

- Northern Arc Investment Managers Pvt Ltd

- NUVAMA ASSET MANAGEMENT LIMITED

- Oculus Capital Advisors LLP

- Old Bridge Asset Management

- Pace Financial Investment Adviser Pvt Ltd.

- PGIM India Asset Management Pvt. Ltd.

- PGIM India Mutual Fund

- Pluswealth Capital Management LLP

- PNB MetLife India Insurance

- PPFAS Mutual Fund

- Prajana Advisors Pvt Ltd

- Principal Mutual Fund

- ProAlpha Capital

- Prudent Equity Private Limited

- Purnartha Investment Advisers

- Quant Mutual Fund

- Quantum Mutual Fund

- Quest Investment Trust

- RATIONAL EQUITY TRUST

- Reliance Life Insurance

- Renaissance Investment Managers Pvt Ltd AIF

- Roha Asset Managers LLP

- SageOne Investment Advisors Ltd

- Sahara India Life Insurance

- Samarth Equities Portfolio Managers LLP

- Samco Asset Management Pvt Ltd

- Samvitti Capital Private Limited-AIF

- SBI Life Insurance

- SBI MF AIF

- SBI Mutual Fund

- SENORA ASSET MANAGEMENT CO LIMITED

- Shepherd's Hill Private Investment Trust

- Shriram Life Insurance

- Shriram Mutual Fund

- Singularity AMC LLP

- SMART HORIZON ALTERNATIVE INVESTMENT TRUST

- SOHUM ASSET MANAGERS PRIVATE LIMITED

- Star Union Dai-ichi Life Insurance

- Steptrade Share Services Ltd

- Sundaram Mutual Fund

- Swyom Advisors Alternative Investment Trust

- Tata AIA Life Insurance

- TATA AMC

- Tata Mutual Fund

- Taurus Mutual Fund

- TCG Advisory Services Pvt. Ltd AIF

- The Wealth Company Mutual Fund

- TRUE BEACON INVESTMENT ADVISORS LLP

- Trust Mutual Fund

- Unifi Capital Pvt Ltd-AIF

- Unifi Mutual Fund

- Union Mutual Fund

- UTI Mutual Fund

- Vajra One Cap Trust

- ValueQuest Investment Advisors Pvt Ltd

- Vasisth Capital Private Limited

- VOLVIN LIMITED

- White Oak Capital Management Consultants LLP

- WhiteOak Capital Mutual Fund

- Whitespace Alpha

- YES Securities (India) Limited

- Zerodha mutual funds