ICICI Prudential PMS ACE Strategy

The Strategy focuses on a bottom up approach aimed to identify companies with ability to compound earnings due to sustainable moats, longevity of growth and management quality.

The ‘ACE’ Strategy

- ACTIVE SELECTION: An active bottom-up approach aiming to identify around 20-25 high quality compounding companies that meet our investment criteria

- COMPOUNDERS: Aims to invest in companies that can grow earnings driven by strong competitive positioning and with a high longevity of growth

- EXCELLENCE IN BUSINESS, MANAGEMENT & ENHANCING MOAT: Companies that have strong balance sheet, excellent business fundamentals and run by experienced, capable management teams

Strategy Construct-

- A market-cap agnostic portfolio of high quality businesses with a proven track record

- Aims to follow a disciplined approach in identifying assets that exhibit robust financial characteristics

- Aims to invest in companies with strong competitive positioning in a sector that has a high longevity of growth

- An active bottom-up approach aiming to identify high quality growth compounding companies

Why Invest?

- Strategy is sector & market cap agnostic which helps in diversification

- Aims on incorporating a quality strategy to the investment approach for a stable and resilient portfolio

- Invests in companies with good fundamentals which may provide stable earnings growth and have ability to capitalize on growth opportunities

- A proactive investment approach designed for optimal risk reward

Key Details of Strategy

- STRATEGY: Equity

- INVESTMENT HORIZON: 4 Years and above

- MARKET CAP ALLOCATION: Across all Market Capitalisation

- NUMBER OF HOLDINGS: Focused Portfolio of ~25-30 companies

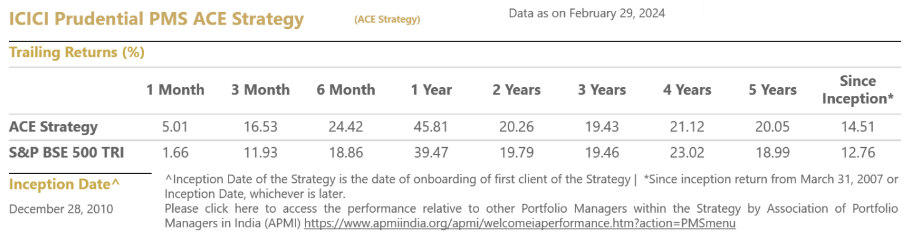

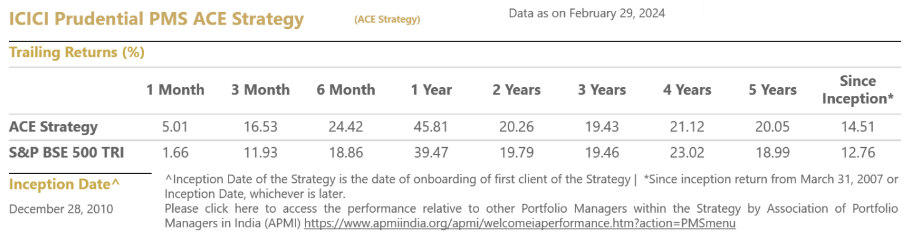

- BENCHMARK: S&P BSE 500 TRI

PORTFOLIO INSIGHTS

Investment Approach

- Investment Objective: ICICI Prudential ICICI Prudential PMS ACE Strategy (the “ACE Strategy”) aims to achieve long term capital appreciation by primarily gaining exposure to a diversified portfolio of equity and equity related securities of “Non-Zero Sum, Under-Penetrated Themes” in India.

- Strategy : Equity

- Types of securities: Predominantly invests in listed equity and equity related securities. The ACE Strategy may also take exposure to exchange traded derivative instruments for hedging purpose. For liquidity or defensive considerations or pending deployment, the Portfolio Manager may invest in debt, money market instruments, mutual fund schemes or debt ETFs.

- Basis for Selection of securities: The Portfolio Manager selects equity and equity related securities of companies from the listed universe space across market capitalisation which fits into the investment strategy of the portfolio. The Portfolio Manager shall use a fundamental bottom-up research for a stock selection and would aim to hold a concentrated core portfolio relevant to the theme of the portfolio.

- Inception Date: December 23, 2010 | Investment Horizon: 4 years and above | Benchmark: S&P BSE 500 TRI

The ACE Strategy features mentioned herein involves risk and there can be no assurance that specific objectives will be met under differing market conditions or cycles. The Strategy features as stated herein is only indicative in nature and is subject to change within the provisions of the disclosure document and Portfolio Management Services Agreement. Please refer to the disclosure document & Portfolio Management Services Agreement for details and risk factors. The details pertaining to the investment approach mentioned herein is a subset of details specified in the Disclosure Document. Kindly refer the Disclosure Document for the detailed investment approach before investing.