ICICI Prudential PMS Contra Strategy

The Strategy seeks to generate capital appreciation by investing predominantly in equity and equity related instruments through contrarian investing.

Contrarian philosophy of investing

- Contrarian investing aims to invest in companies where prevailing sentiments are not positive, but are expected to revive over the medium to long term.

- Often, due to euphoria or panic, stocks prices tend to be driven to unsustainable levels in either direction, leading to overvaluation or undervaluation of a stock or sector.

- The Contrarian philosophy endeavors to focus on companies where the risk is overstated and the prospects for recovery is understated. It tries to avoid themes where widespread optimism leads to overvaluation.

Strategy Construct

- Calls/exposure on stocks currently not in favour in the market

- Sectors that are currently in consolidation

- Selection of sectors with high entry barriers

- Selection of companies that are in special situations

Why Invest?

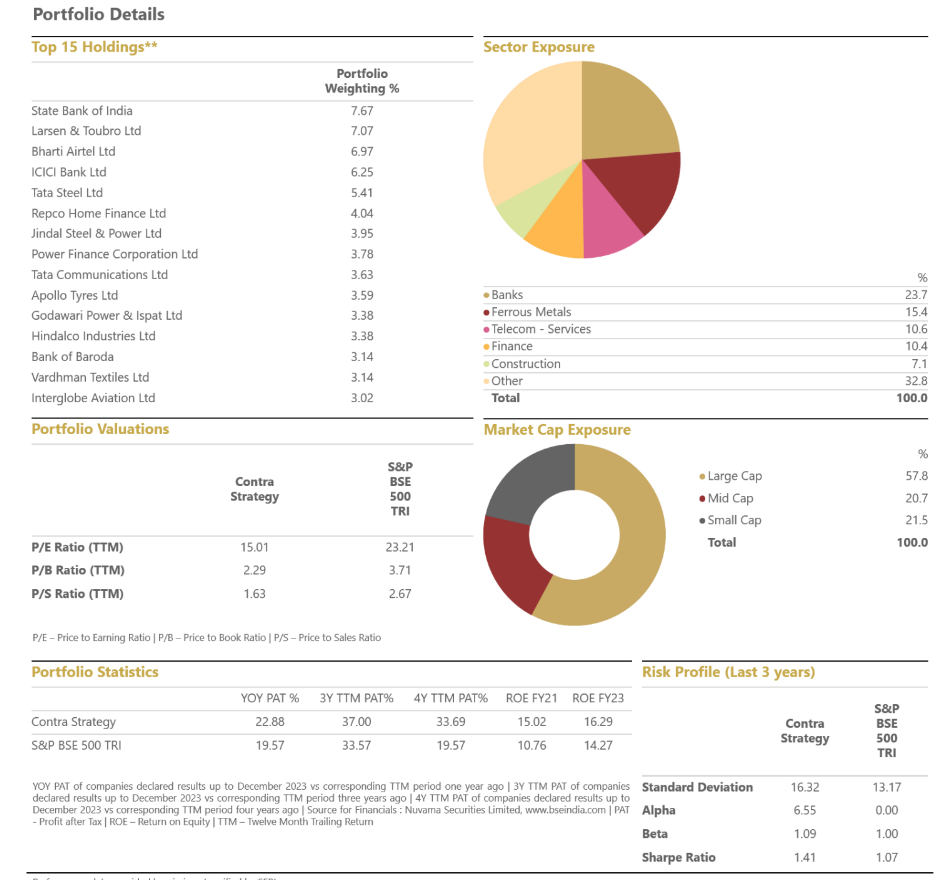

- A focused portfolio of investment ideas, agnostic to market capitalisations.

- Exposure to companies with long term potential which are facing temporary headwinds

- Exposure to opportunities others may be overlooking

- A benchmark agnostic approach aimed at providing optimal risk-reward

Key Details of Strategy

- STRATEGY: Equity

- INVESTMENT HORIZON: 4 Years and above

- MARKET CAP ALLOCATION: Across all Market Capitalisation

- NUMBER OF HOLDINGS: Focused Portfolio of ~25-30 companies

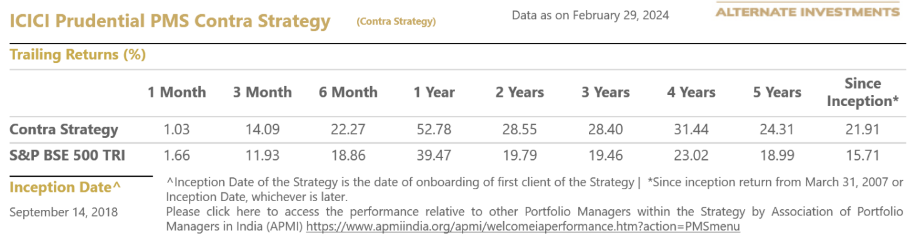

- BENCHMARK: S&P BSE 500 TRI

PORTFOLIO INSIGHTS

Investment Approach

- Investment Objective: ICICI Prudential PMS Contra Strategy (the “Contra Strategy”)seeks to generate capital appreciation by investing predominantly in equity and equity related instruments through contrarian investing

- Strategy : Equity Inception Date: September 14, 2018

- Types of securities: Predominantly invests in listed equity and equity related securities. The Strategy may also take exposure to exchange traded derivative instruments for hedging purpose. For liquidity or defensive considerations or pending deployment, the Portfolio Manager may invest in debt, money market instruments, mutual fund schemes or debt ETFs.

- Basis for Selection of securities: The Portfolio Manager follows ‘Contra’ style of investing which involves taking contrarian bets on equity stocks i.e. taking calls/exposure on stocks which are currently not in favour in the market but are expected to do well in the long run. The Portfolio Manager may also select stocks of companies in sectors where entry barriers are high, sectors in consolidation or of companies in special situation.

- Investment Horizon: 4 years and above | Benchmark: S&P BSE 500 TRI

The Contra Strategy features mentioned herein involves risk and there can be no assurance that specific objectives will be met under differing market conditions or cycles. The Contra Strategy features as stated herein is only indicative in nature and is subject to change within the provisions of the Disclosure Document and Portfolio Management Services Agreement. Please refer to the Disclosure Document & Portfolio Management Services Agreement for details and risk factors. The details pertaining to the investment approach mentioned herein is a subset of details specified in the Disclosure Document. Kindly refer the Disclosure Document for the detailed investment approach before investing.