Finance

ICICI Prudential PMS Flexi-Cap Strategy

"Investing is all about the art of effective risk management"

Market Outlook:

Equity Markets in Anticipation of a Peak-out in Covid-19 Cases- Indian Equity Markets remain volatile as Covid-19 cases rise. However, a focus on vaccine availability and flattening of the Covid-19 curve, may help revive market sentiments in the coming months.

Portfolio Update:

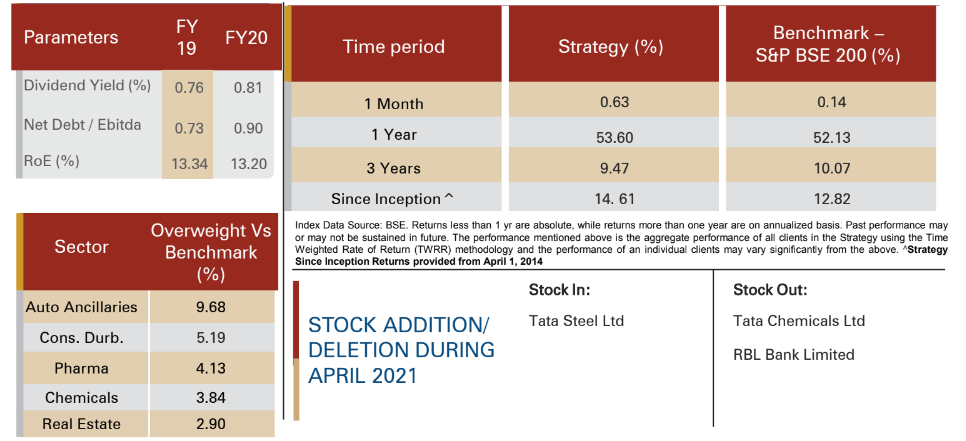

Overweight on Auto Ancillaries, Underweight on Financials- The Strategy remains overweight on Auto Ancillary companies and underweight on Banks and Finance, as compared to its benchmark S&P BSE 200, as on April 30, 2021.

PORTFOLIO INSIGHTS:

INVESTMENT APPROACH

- Investment Objective: ICICI Prudential PMS Flexicap Strategy (the “Strategy”) is a diversified equity strategy that endeavours to achieve long term capital appreciation and generate returns by investing across market capitalisations.

- Basis for Selection of Securities: The Portfolio Manager selects equity and equity related securities of companies from the listed universe space across market capitalisation which fit into the investment strategy of the portfolio. The Portfolio Manager uses a blend of top-down and bottom-up approach for stock selection. The top-down approach helps to identify key macro- economic and sectoral themes for stock selection. The bottom-up approach helps to identify companies that are believed to be attractive investment opportunities in various industries and market conditions.

- Benchmark: S&P BSE 200 index

- Indicative Investment Horizon: 4 years and above

STOCKS ADDED:

Tata Steel Ltd.

- Export opportunities for the Company could offset pandemic-driven challenges to near-term domestic demand. Valuations headwinds such as high leverage have moderated with realization improving and management targeting additional $1bn deleveraging per year.

- Regional steel prices continue to hit new highs in 4QFY21 led by consistent sequential demand recovery across regions, environment-led supply restrictions in China and reduction in export rebate by China. Coking coal prices were flat whereas iron ore prices shot up 20% qoq due to weaker supply by Brazil and Australia. China’s renewed focus on reduction in carbon emission and subsequent restrictions is likely to cap Chinese steel exports and subsequently keep global steel margins elevated. The Company’s Indian sales volumes stood flat QoQ at 4.67mt (up 16% YoY) in Q4FY21.

- The Company’s EBITDA and PAT in Q4FY21 were better than estimates, as higher prices and better volume mix led to better-than-expected realisations. EBITDA/ton for the Company showed sharp improvement owing to the improved macro environment especially with higher offtake from the auto segment. Net Debt at the end of FY21 stood at Rs754bn a decline of Rs306bn YoY supported mostly by Free Cash Flow of Rs237bn for FY21.

TOP 10 STOCK HOLDING IN THE PORTFOLIO:

1 ICICI Bank Ltd- Weightage (%): 6.69

CMP: INR 601, MARKET CAP: INR 415,418 Cr

- The Bank is the second largest private sector bank in terms of loan book size, having a pan- India presence. The Bank’s subsidiaries in life insurance, general insurance, and stock broking are all competitive entities in their respective fields and are developing well as a robust franchise, and may provide support to overall value. A robust balance sheet and pan-India reach, can help it face medium-term challenges. Moreover, its subsidiaries may add value to the overall franchise which may be considered as another positive factor.

- In Q4FY21, the Bank’s performance was marked by broad-based sequential growth, a pick-up in domestic corporate loan growth, and sequential NIM expansion aided by a lower cost of funds. Furthermore, the consistent improvement in RoA has contributed to overall profitability. The liability franchise remained stable, with deposit growth of 21% YoY. Advances increased 14% YoY, with domestic books increasing 18% YoY, driven by a revival across business segments. The Bank reported a healthy NII growth of 17% YoY and 5% QoQ in Q4FY21, driven by loan growth recovery and a 10bps QoQ improvement in the margin to 3.7%. Asset quality has improved sequentially. Despite using provisions of INR35.1bn in 4QFY21, the Bank still has a COVID-related provision buffer of INR 75bn (100 bps of loans). This provides reassurance about likely credit cost normalization.

Axis Bank Ltd- Weightage (%): 4.86

CMP: INR 715, MARKET CAP: INR 219,035 Cr

- The Bank commands a good asset-quality position, with the bank having front-loaded of provision (on a proforma basis), which translates into an improved balance sheet and provides impetus for growth. An improvement in economic growth (helped by a progressive and growth-oriented government policy and Union Budget) seems to be a positive for the banking sector, and established players such as the Bank are believed to be well placed to likely benefit from it.

- The Bank’s Q4FY21 PAT of INR 26.8bn improved on the back of higher treasury income and lower credit cost. Pre-provision operating profit increased by 17% YoY, led by 11% YoY growth in NII. The Bank’s showcased better credit growth of 9% YoY and 7% QoQ, primarily due to traction in the corporate/SME book. Retail grew by 10% YoY and 5% QoQ in Q4FY21.

Motherson Sumi Systems Ltd- Weightage (%): 4.47

CMP: INR 215, MARKET CAP: INR 67,799 Cr

- The Company is a global supplier of auto components, modules and systems. The Company is one of the largest supplier of Electrical Distribution Systems to the Indian automotive industry. The Company has a diversified geographical presence, with 89% of its FY20 revenue coming from outside India, primarily Germany (22%), USA & Mexico (22%) and China (7%). It supplies products to all the major carmakers globally, but has a higher exposure to German carmakers.

- The Company has significant exposure to European Union and US (60% of its revenues), the two regions that were most impacted by the coronavirus pandemic. Revenues are likely to rebound sharply in the new financial year led by (1) the potential of the Company’s new plants reaching their peak revenue potential of EUR1 bn and (2) the likelihood of pent-up demand converting into purchases as consumers might prefer personal mobility.

- The Company is expected to generate free cash flow despite the challenging impact of the Covid-19 pandemic, driven by prudent cost management and low capex due to low capacity utilization. The Company seems to be well placed to capitalize on the recovery in auto demand once the pandemic starts to wane. The Company is expected to report a continued recovery in revenue and margins for all its businesses.

HDFC Bank Ltd- Weightage (%): 4.39

CMP: INR 1,412, MARKET CAP: INR 778,906 Cr

- The Bank has developed a core of retail, salaried customer base, which it monitors closely for business growth as well as effective risk management. Retail funding for the Bank remains encouraging, as reflected in its retail deposits/domestic loans, despite its relatively healthy loan growth in the past five years.

- Q4FY21 results saw steady operational performance along with stable Net Interest Margins (NIMs) and market share gains. Profit After Tax came marginally below expectations due to aggressive provisions, but places the Bank well with adequate cushions going forward; the Bank is taking corrective steps to rectify technical outages seen recently. Asset quality surprised positively and improved sequentially (compared with proforma basis) with decent pick-up in advances and improved Current Account – Savings Account (CASA) helping in sustaining NIM on a q-o-q basis.

Bharti Airtel Ltd- Weightage (%): 4.30

CMP: INR 537, MARKET CAP: INR 294,785 Cr

- The Company is a potential beneficiary of the Indian wireless market consolidation. It has been one of the strongest in defending share from Jio during periods of sharp competition with focused capex on 4G network buildout and capturing 4G upgrades. It is gaining market share at the premium ARPU end of the market from upgrades and premiumization of its subscriber base. Several rounds of capital raising and the listing of Airtel Africa have de-levered the balance sheet.

- In 4QFY21, the Company’s Africa revenue increased 15% YoY to US$1,038m and Ebitda was up 25% YoY. Data and mobile money account for 44% of its Africa revenue. Revenue growth was across regions, with East Africa up 24% YoY and Nigeria up 23% YoY.

- Sharpening the focus on digital business may lead to a likely value unlocking for the Company. Digital business is growing rapidly, and the market opportunity is rising multi-fold. The Company’s had digital assets sitting in multiple entities and thus, it was missing a united push and an opportunity to cross-sell services.

ACC Ltd- Weightage(%): 4.19

CMP: INR 1,883, MARKET CAP: INR 35,356 Cr

- The Company with 33 million ton per annum (mtpa) cement capacity is a pan India player. In 4QCY20, the Company operated its plant at 90% utilisation (CY20 utilisation is 72%)– in this context commissioning of 1.4m MT Sindri grinding unit (4% of current capacity) in Jharkhand is key and may aid CY21 volume growth.

- Total Cement capacity for the Company stood at 33.05mtpa in CY20 with 17 cement plants across 12 states. The Company also had 80 plants spread across 17 states. Share of blended cement improved from 89% to 90% in CY20. Trade: Non-Trade Mix – improved from 78%:22% in CY19 to 79%:21% in CY20. Around 79% of the Company’s cement sales are in the retail segment. Channel network consists of ~12,000 dealers and 56,000 channel partners.

- Recent initiatives around fuel/ market mix optimization and productivity capex/ improvements are steps expected to be in the right direction. A net cash Balance Sheet and healthy Free Cash Flow generation may help for a raise in dividend payout again for the Company.

Sun Pharmaceutical Industries Limited- Weightage (%): 4.06

CMP: INR 654, MARKET CAP: INR 157,021 Cr

- One of the leading pharmaceutical company that is present across a broad spectrum of chronic and acute therapies, which include generics, branded generics, and complex drugs. India and US are the key markets for the Company and constitute around 60% of the total topline.

- The outlook for the US business has improved, following a pick-up in the lucrative specialty business with sales of three specialty products Illumya, Cequa and Absorica now at pre covid levels and the Company expects further market share growth. Also product pipeline, which may unfold going ahead provides potential for growth. Domestic formulations business is also on a relatively better footing, backed by sturdy growth in the chronic segment.

Marico Ltd- Weightage (%): 3.99

CMP: INR 411, MARKET CAP: INR 53,133 Cr

- The Company’s performance mirrors a partial revival of consumer sentiment over the past few months. In line with the industry, the rural sector has been growing better than the urban sector for the Company. The Company is likely to continue to launch new products in the mid- sized Foods categories exploiting the Saffola brand to augment the growth and scale up. The company has strengthened distribution and is aggressively exploiting the e-commerce channel.

- Gaining market share in the core domestic portfolio through new launches, scaling up the food business, and improving growth prospects in countries such as Bangladesh and Vietnam are some of the key growth levers for the Company in the near to medium term. Raw-material headwinds may be mitigated by judicious cost-saving measures and careful price hikes in the near future.

SBI Life Insurance Company Limited- Weightage (%): 3.78

CMP: INR 929, MARKET CAP: INR 92,877 Cr

- The Company is one of India’s largest private life insurer with an Individual Weighted Retail Premium (WRP) market share of 13.3% in FY20. It offers a range of Savings/Protection products and has a distinct competitive advantage in distribution due to its parentage. The Company has a wide-spread network of 937 offices across the country with 130,418 productive agents and manages total AUM of Rs 1.6t as at Mar’20.

- The Company reported 7% YoY growth in individual Annual Premium Equivalent (APE) in Dec 2020 on a relatively healthy base of 17% YoY growth in Dec 2019. The Company’s momentum seems to be picking up after a relatively slow start post-Covid-19 and better Dec 2020 volume is good, as the month of Dec’20 has historically been seasonally the Company’s biggest month in terms of APE sales.

Reliance Industries Ltd- Weightage (%): 3.71

CMP: INR 1,995, MARKET CAP: INR 1,264,588 Cr

- The Company in March 2021, announced acquisition of ~208MHz FDD and 280MHz TDD spectrum for US$7.7bn, increasing its owned spectrum footprint by 55% and the average spectrum life to 15.5 years. The Company acquired new spectrum in the 800/1800/2300 MHz bands, with about a third in the 800Mhz range. This may raise capacity to grow subscribers and may increase flexibility in 5G rollout.

- Although oil prices have risen 24% to ~USD61/bbl in CY21YTD, refining margins are yet to show any recovery due to the continued lack of demand on account of COVID. However, Petrochem demand has been strong, and may result in better margins across most products.

- Market leadership in Telecom may help capture the opportunity in Digital and Fiber as the market consolidates within the top two telcos, while the launch of low-cost smartphones may help accelerate subscriber growth. JioMart’s robust traction, supported by a widening reach and product categories, is likely to accelerate growth in the Retail biz.

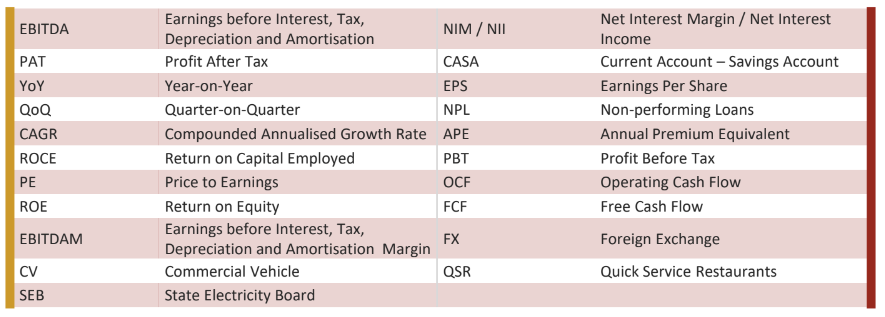

GLOSSARY OF ABBREVIATIONS