Marcellus Investment Managers

MARCELLUS

With the aim of influencing the capital allocation of the Indian economy by directing household savings toward high-quality businesses with a history of effective capital allocation, Marcellus Investment Managers set out on its journey in the year 2018 and aims to provide investors with superior returns. Their quantitative frameworks, which combine forensic accounting and capital allocation, establish their investible universe. They can discover high-quality companies with transparent accounting and governance by using these quantitative frameworks in conjunction with a primary research-driven deep understanding of competitive moats.

In order to generate long-term compounding profits, they develop a portfolio of businesses with significant competitive moats and keep them for extended periods of time with little to no churn. Additionally, the company is committed to providing an excellent investor experience through efficient onboarding and reporting procedures made possible by technology.

Consistent Compounders Strategy (Marcellus's flagship PMS Strategy), Rising Giants Strategy, Little Champs Strategy, and Kings of Strategy are the four PMS Strategies they are now delivering. These strategies are managed by seasoned fund managers and address particular investment objectives.

One of the founding members of Marcellus is Rakshit. Rakshit holds a CFA charter and a B.Tech from IIT (Delhi). Rakshit spent six years (2005–2011) covering UK stocks for Execution Noble (Sector Lead analyst) and Lloyds Bank (Director, Institutional Equity Research). He was ranked in the top three UK Insurance analysts for the mid-cap space over the course of these six years (Thomson Reuters Extel poll). Rakshit has been the head of Ambit Capital's consumer research division since 2011, and in 2015 and 2016 it was ranked No. 1 for Discretionary Consumer and in the top three for Consumer Staples. In March 2017 he introduced Ambit's Coffee Can PMS, which he ran through December 2018. Coffee Can PMS from Ambit, which he oversaw, was one of India's top-performing equities products in 2018.

The Investment committee

At Marcellus, Mr. Saurabh Mukherjea, Mr. Pramod Gubbi, and Mr. Rakshit Ranjan have been appointed to the Investment Committee. Making decisions to buy, sell, or rebalance is one of the Investment Committee's roles and responsibilities. The majority of votes will determine the decisions.

THREE C’S OF MARCELLUS’ INVESTING PHILOSOPHY & PROCESS

The goal of Marcellus is to make wealth creation simple and available by being an honest and open capital allocator. The concepts of Kirby and Thiel served as the foundation for Marcellus, which has since been further developed. The investing strategy rests on three pillars:

Clean Accounts: The investible universe is defined by the quantitative frameworks that combine forensic accounting and capital allocation assessment.

Capital Allocation: Companies with a strong track record of capital allocation are sought for by Marcellus. Marcellus admires businesses that produce free cash flow and reinvest it to support future growth.

Competitive Advantage: Through extensive primary research, the knowledgeable investment team builds a portfolio of businesses with wide competitive margins.

The Research Process

Quantitative screeners: The research process begins with a well-defined two-step quantitative screen: first, the proprietary forensic accounting model, which screens for accounting quality and serves as a good proxy for corporate governance and promoter integrity to protect the interests of minority shareholders; second, a screen to evaluate a company's capital allocation track record over extended periods of time, frequently longer than a decade. These screening processes are periodically improved depending on the investment team's ongoing learning. The investible universe consists of the businesses produced by these screens.

Secondary Research: The next step is extensive secondary research on each company, which includes a close examination of annual reports from the previous 10 to 15 years to track management commentary and subsequent delivery. Portfolio counsellors and sector analysts undertake such a study of annual reports and other secondary research, annotating and recording it for the investment committee and the rest of the investment team to review using a collaboration platform.

Primary Research: According to the secondary research, the corporation can be considered for primary research to confirm the results of the secondary study. Such primary research entails in-depth interviews with clients, vendors, distributors, dealers, rivals, former employees, industry experts, etc. to determine whether or not there are any long-term competitive advantages. The portfolio managers and analysts who serve as portfolio counsellors work together to lead primary research activities. The investment committee and the rest of the investment team receive interview notes for further discussion during weekly meetings.

Valuation: As the investment philosophy is to invest in companies with long growth runways, the firm uses long-term cashflow-based valuation models as opposed to multiples.

Weekly investment and research team meetings: The investment and research teams meet once a week to discuss research findings and decide on the scope of future study for both current portfolio firms and potential new companies under consideration.

Recommendation and investment decision: An analyst or portfolio counsellor may suggest a modification to the portfolio (buy, sell, or modify allocation) in light of such research and talks. A thorough report presented to the investment committee and portfolio manager supports the suggestion. The investment committee will then decide by majority vote if the portfolio manager should submit it to them for consideration.

THREE C’S OF MARCELLUS’ INVESTING PHILOSOPHY & PROCESS

The investment process includes three steps:

- Forensic accounting filters to test the quality of accounts;

- historical consistency of healthy fundamentals for a time period longer than 10 years; and

- bottom-up research to ascertain the strength of competitive advantages and pricing power of the firm, and hence the ability of the firm to deliver healthy revenue growth as well ROCEs. The objective of the philosophy is to achieve a portfolio-level earnings growth of around 20% CAGR with very low volatility regardless of changes in the external environment.

Marcellus SELL calls are triggered based on:

a shift in the firm's requirements for accounting quality and governance;a decline in confidence in the firm's capacity to maintain its competitive advantages and produce longevity (10+ years) of sound fundamentals (earnings CAGR of 18-20%);The removal of a lower growth company from Marcellus' portfolio if a higher growth company with comparable or superior competitive advantages and longevity can take its place. This is because Marcellus doesn't want its whole portfolio to contain more than 15 stocks.

Performance Update

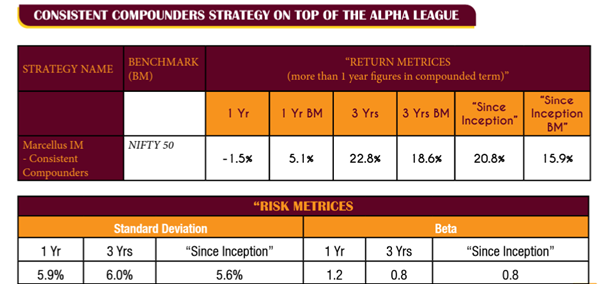

Consistent Compounders Strategy's investment universe includes about 25 stocks. With a targeted average holding time of equities of 8–10 years or longer, Marcellus builds a concentrated portfolio of firms based on their thorough primary research. They have identified and invested in firms that have regularly produced greater ROCE and revenue growth rates in the past. The long-term success of the portfolio is mostly enabled by the rate of fundamental progression (e.g., free cash flow CAGR for non-financial services companies or book value per share CAGR for financial services companies) of this strategy. However, there could be short-term noise that causes the funds to underperform the benchmark for a month, a quarter, or even a whole year. The rate at which Marcellus anticipates the longer-term compounding of the portfolio companies' fundamentals (much faster than India's nominal GDP growth) is what drives this absolute return objective.

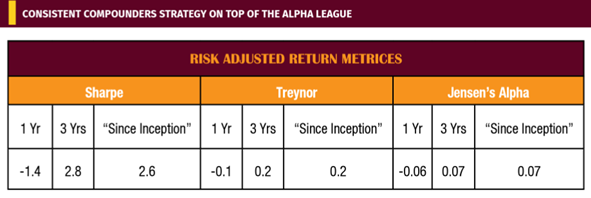

One should always keep in mind that an increase in Standard Deviation and Beta intensifies the return on either direction. Marcellus CCP stands tall in terms of generating superior alpha (CAPM) since inception (0.07), but last year's alpha is affected by increased beta (1.2) associated with the overall portfolio. The positive Sharpe and Treynor ratios of the portfolio show that the CCP has effectively handled market risk as well as business-specific risk.

STRATEGY ANALYSIS: KINGS OF CAPITAL

Performance update

The main goal of the "Kings of Capital" strategy is to acquire a portfolio of 10 to 14 reputable financial institutions (banks, NBFCs, life insurers, general insurers, asset managers, brokers), each with strong barriers to entry, good corporate governance, and careful capital allocation. By acquiring these reputable financial institutions, this plan hopes to profit from the upcoming decade's consolidation in the lending industry and financialization of household savings.

Since banking and financial services are primarily a local industry, Marcellus anticipates that over the coming ten years, Indian private sector players will continue to dominate, especially as it relates to access to technology and capital.

STRATEGY ANALYSIS: LITTLE CHAMPS

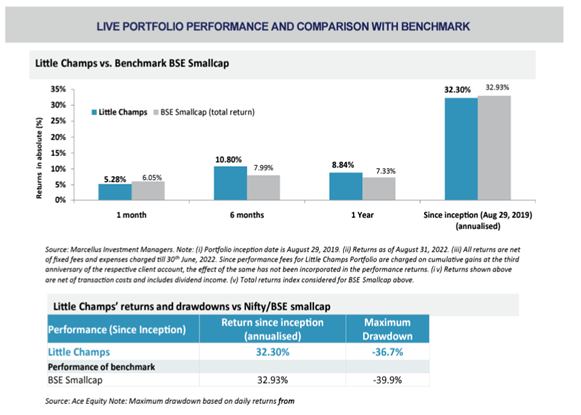

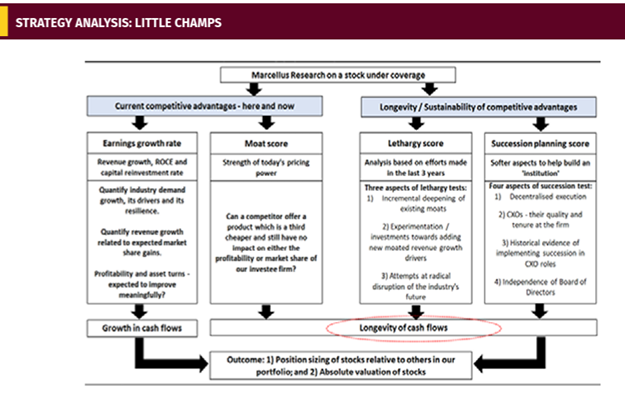

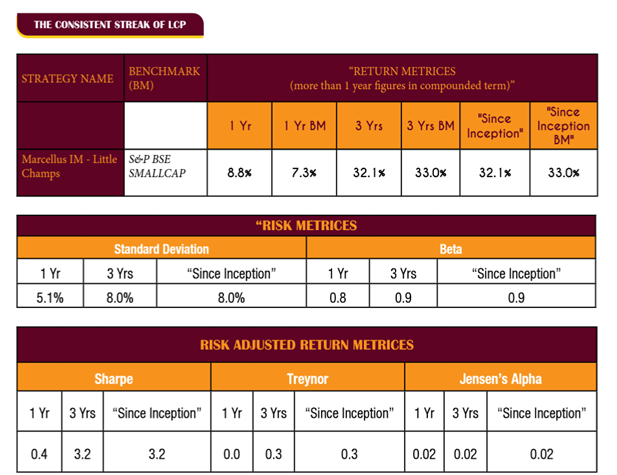

On August 29, 2019, the Little Champs Portfolio went online. The main goal of this strategy is to amass a portfolio of around 15-20 sector-leading brands with a track record of responsible capital allocation, transparent financial reporting, and corporate governance, as well as strong potential for future growth. Even when the commercial potential seems great, this technique avoids names where the cleanliness of the finances or the integrity of the promoters are affirmative while filling the portfolio with companies that have the aforementioned attributes. Marcellus plans to keep portfolio turnover low (not more than 25–30% annually) in order to benefit from compounding and reduce trading expenses. The performance so far is shown in the below table.

On the other hand, Marcellus LCP, which had been in operation for three years, has continuously produced positive alpha creation (0.02) and good risk-adjusted returns from its inception. LCP is the best at managing the business-specific risk of the entire portfolio and producing the required return, with a Sharpe ratio of 3.2. With a Treynor ratio of 0.3, LCP once again leads the field in managing market risk.

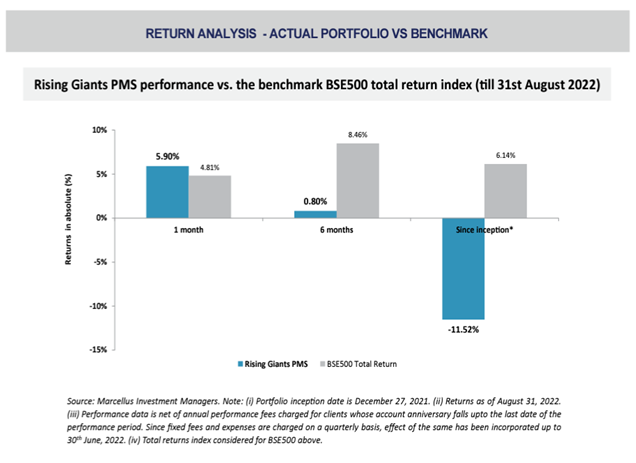

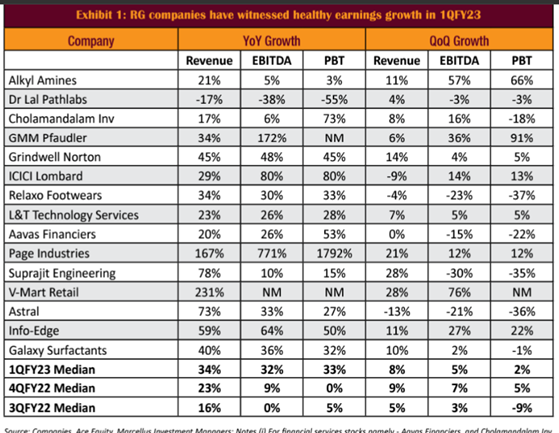

STRATEGY ANALYSIS: RISING GIANT

Performance update for the Rising Giants PMS

This strategy aims to invest largely in high-quality mid-sized businesses with the following characteristics that have a market capitalization of less than Rs. 75,000 crores, primarily between Rs. 7,000 crores and Rs. 75,000 crores:

- Well-moated dominant franchises in niche segments

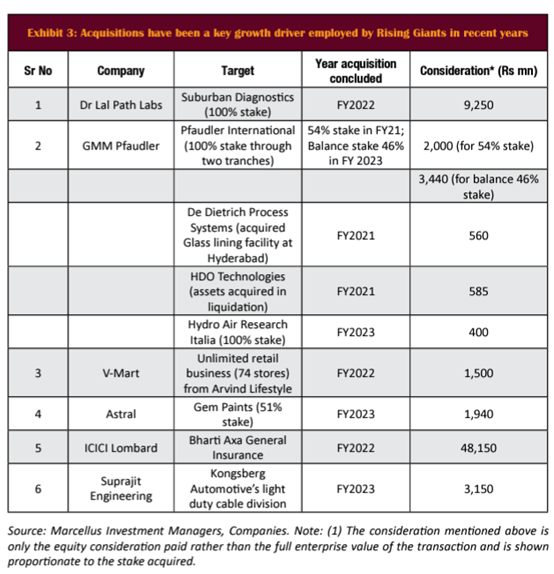

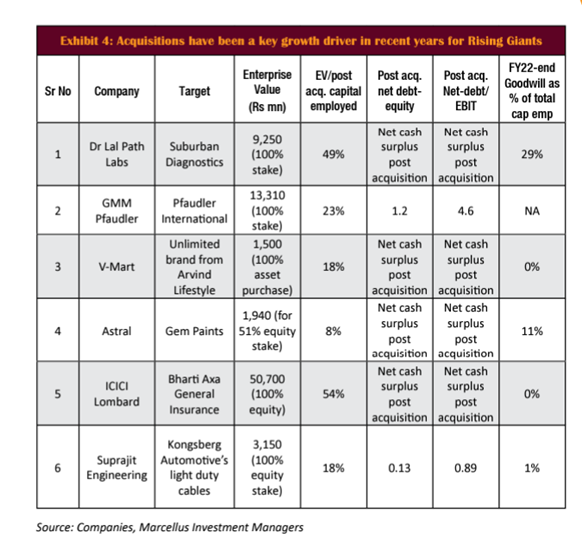

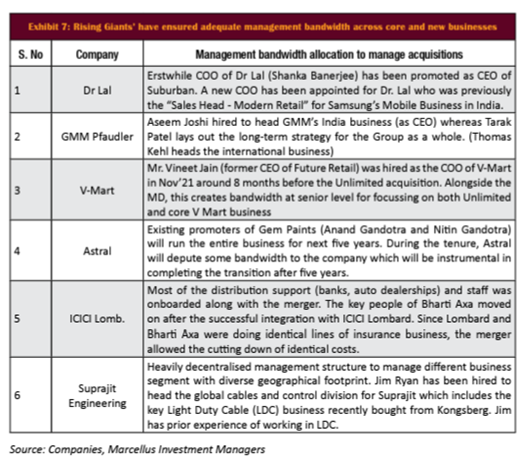

- A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth

- Clean accounts and corporate governance.

A portfolio of 15-20 firms that pass Marcellus' own forensic accounting and capital allocation filters as well as the bottom-up stock selection and position sizing frameworks are created using a universe of 450 companies in this market.

We conducted an exclusive interview with Mr. Rakshit Ranjan - Founder & Fund Manager in order to know Marcellus Investment Managers in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim MR. RAKSHIT RANJAN

India, being the fastest growing economy in the world, what are the key risk factors that we need to keep an eye on?

With relatively few worldwide connections to support its natural economic growth, India is mostly a domestic consumer-driven economy. Macro issues like inflation and interest rates, as well as some geopolitical dangers, are the main threats to India's economic growth. But for the foreseeable future, we see more upside than downside risks to India's economy's expansion.

Is the bottom-up approach always better compared to the top-down approach of stock selection?

A bottom-up strategy to stock selection is significantly more profitable than a top-down method, if the goal of an equity portfolio is to lower risks and produce compounding over the long term. At Marcellus, we build our portfolio of firm’s bottom-up by selecting those with inherent advantages that enable them to profit from macroeconomic volatility, rendering top-down selection unnecessary. When the external climate is difficult, these businesses ramp up their capital deployment to undercut their rivals. For instance, as input cost inflation grows, these businesses defer raising product prices, support margins in part through operational efficiencies, and attempt to withstand competition by raising prices only slightly. On the other hand, input cost deflation occurs when businesses actively reduce product prices to remain competitive. These businesses assisted their channel partners, raw material suppliers, and customers to strengthen their relationships with these stakeholders when there were black swan events or disruptive macro changes, such as demonetisation in 2016, the introduction of the GST in 2017, or the Covid-19 pandemic in 2020. They then accelerated Capex in systems, processes, and other such areas that help accelerate market growth share profits from rivals.

Is it the time to bet on midcaps despite high valuations or small-caps which are reasonably valued compared to large-caps?

To begin with, regardless of their market worth, an investor should never wager on overvalued equities. However, a proper understanding of capital allocation decisions (or lack thereof), and consequently development and longevity of the cash flows of a business, is vitally crucial in order to determine the fair valuation of a stock. Over the long term, a portfolio of high-quality small- and mid-cap stocks will always beat a portfolio of high-quality large-cap stocks, primarily because of the higher discovery factor. On a CAGR basis over the longer term, even a portfolio of high-quality large caps has the ability to outperform the benchmark indices by more than 5% to 8% points. Instead of being based on the season, the decision should be based on the investor's risk tolerance and return goals.

Credit Growth in banking and financial services being improved in the last quarter, what is your view for the upcoming quarters?

Yes, this is a very positive trend, especially considering how few institutions now have strong capital adequacy ratios and, therefore, the capacity to lend at faster rates. With minimal NPAs, notably high capital adequacy ratios (more than 20% in many cases), and great competitive advantages, the lenders in Marcellus' portfolio are ideally situated to profit from this. Through increased market share gains over the next quarters, such lenders are projected to further polarize the lending business.

Throw some light on new-age fintech companies. Are they reasonably valued at present?

It is exceedingly speculative to expect a new fintech business to compound wealth for an investor if they are losing money owing to "customer acquisition costs" and also don't have a history of disciplined capital allocation. We avoid such speculative investing at Marcellus. Having said that, Marcellus owns a number of businesses that have switched from using traditional lenders to using 'new-age' fintech, such Bajaj Finance. These businesses are expanding their fintech products and introducing new revenue growth drivers by drawing on their current base of high-quality customers. As a result, we have investments in 'new-age' fintech business models, but through businesses that are upending the financial services sector in a very successful and cash-generating way, thanks to wise capital allocation decisions relating to technology.

Small-cap Index is far away from its record high compared to mid-cap and large-cap indices. Do you expect a lot of catch-up in the Small-cap index in the coming months?

With a time horizon of a few months, we don't think we can timing investments in any area of the equity markets. According to Saurabh Mukherjea, Rakshit Ranjan, and Pranab Uniyal's book Coffee Can Investing - The Low-Risk Route to Stupendous Wealth, small-cap indexes have produced almost equivalent returns to large-cap indices over a 15-20 year time horizon across all global markets. The statement that a portfolio of high-quality small-cap companies beats a portfolio of large-cap companies is true, nonetheless. We have also seen this in Marcellus' portfolios, where over the past three years, our Little Champs portfolio has outperformed our Consistent Compounders Portfolio by almost 8% CAGR. Therefore, rather than using a technique based on index selection, we place a greater emphasis on bottom-up research for stock selection.

Going forward, what are some investment themes you are betting on?

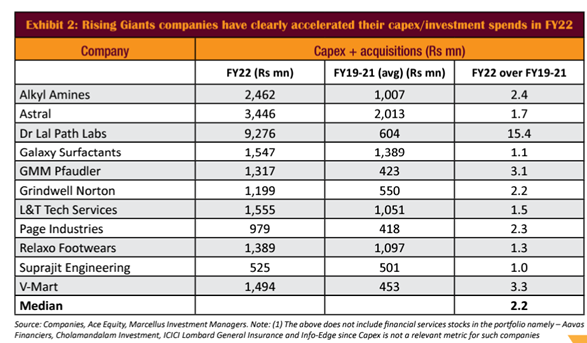

The largest investing theme on which we are placing our bets is the continued concentration of market share of earnings in most industries between one or two key companies. This theme has only been further pushed by difficulties in the external environment over the past five years. Companies that have increased their investments in technology have taken advantage of disruptive opportunities created by the Covid Pandemic and supply chain issues due to the Russia-Ukraine war, and they will benefit most from this subject. The shift in manufacturing demand from some of the other economies to India is another issue from which we are preparing to profit. Which sectors will contribute the most in the Capex cycle? In a recent blog post for Marcellus, we highlighted the fact that over the past few years, a sizable portion of Capex in India has transitioned away from fixed assets and toward Capex focused on technology. Additionally, over the past 12 to 18 months, we have already seen a marked increase in Capex for all high-quality enterprises in order to get ready for future market share consolidation. In the near future, we anticipate these patterns to persist.