Monarch Networth Capital Ltd

Monarch Net Worth Capital

Monarch Networth Capital Limited, a well-known full-service financial services firm, operates in institutional equities, retail broking, wealth and third-party product distribution, global access, investment banking, and fund management. We have more than 145 locations, including our main office in Ahmedabad, Gujarat, and we service more than 2.6 lakh retail consumers through more than 60 branches and 450 sub-brokers. In addition to 50 asset management companies, Institutional Equities keeps close contacts with over 150 organizations. In all areas of its operations, MNCL operates with the single objective of "Client first" and strives to continually deliver value for investors. Our idea generating process is built on two pillars: a thorough investigation of stocks that have received relatively little research and a review of corporate governance.

In the past year, MNCL has witnessed over 50% increase in active retail clients, multiple success stories on the Institutional Equities side and top-quartile performance of our maiden AIF.

MNCL has won accolades at many elite platforms; some of the notable awards are:

- Top performer in OFS segment by BSE in 2019-20

- Best Regional Retail Broker award by NSE in 2018

Monarch AIF, a SEBI-registered AIF category III long-only stocks fund set up as a trust, is a fully owned subsidiary of publicly traded financial services company Monarch Net Worth Capital Ltd (MNCL), which also owns MNCL. Monarch AIF successfully launched its first long-only Cat 3 equity plan (closed ended) in October 2020 with an AUM of Rs. 70 crore (completely raised through its own relationships with HNIs and supported by the fund's differentiated investing style).The debut fund has established a strong track record with absolute returns of 53.7 (post fees and expenditures) . Its AUM as of today is Rs 107 crores. The fund's 12-month returns from February pale in comparison to the 33.4% returns on the NIFTY 500.

Mr Abhisar Jain – Head and Fund Manager, Monarch AIF

Mr. Abhisar Jain has completed his MBA in Finance from SP Jain Centre of Global Management and is a CFA charter holder (US). He has over 13 years of experience in the equity markets with specialization in equity research and niche in identifying high quality businesses. He earned several accolades in his earlier stint as lead analyst for Metals & allied sectors including Best analyst award from renowned Reuters analyst awards for two consecutive years, Top 10 ranking from prestigious Asiamoney polls for Best analyst in small cap category and Best stock idea selection thrice from HDFC MF. He has also worked at Centrum Broking, ICICI securities and TCS earlier in his career

Monarch AIF is committed to grow its investors’ capital by deploying a highly value-added investment strategy and running a concentrated portfolio of 15-20 stocks in its long only equity fund.

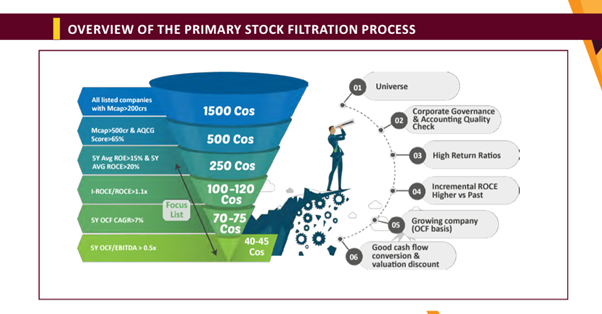

Stage I

To achieve the said objective, Monarch AIF initially draws a focus list of ~250 companies from the universe of listed companies with market capitalisation of Rs 200crs+ using 2 filters:

- MCap above Rs 500 crs and AQCG Score (explained ahead) of 65%+

- Long track record with 5Yr average ROCE of more than 15%

Stage II

From this basket of around 250 stocks which clears 2 basic fundamental checks, more stringent parameters are used to bring it down to a basket of 50-75 quality companies after taking into consideration the following:

- Leaders in niche segment/product/services having strong growth triggers

- Well established business with competitive edge and clean & capable management

- High or acceptable Accounting Quality and Corporate Governance (AQCG) score - backed by internally developed Accounting Quality and Corporate Governance model

- Consistently high return ratios

- Emphasis on returns generated by the company on its incremental capital employed (I-ROCE) in recent years and preference would be for companies which have higher I-ROCE vs their past ROCE

- Higher incremental return ratios (I-ROCE) in recent years vs their past ROCE

- Strong focus on real cash flows and cash flow yields

- Beneficiaries of industry shift or companies enjoying macro tailwinds.

Accounting Quality and Corporate Governance (AQCG) Scoring Tool

Monarch AIF created the Accounting Quality and Corporate Governance (AQCG) scoring system to evaluate any company's Accounting Quality (AQ) and Corporate Governance (CG) and pass or fail the firm according on the score it receives. The information used in the tool for analysis is disclosed in the annual reports of the companies, and the grading is based on data from the previous 5-7 years for each firm (both standalone and consolidated) across 15 key criteria.

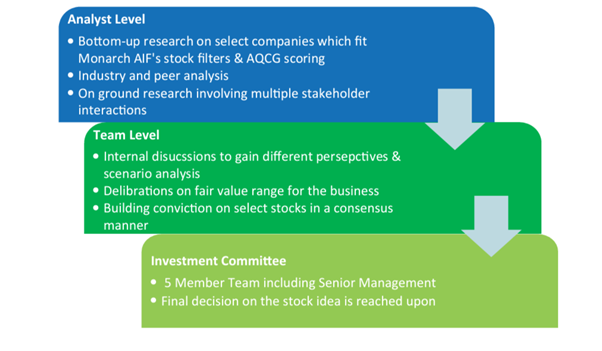

The management and integrity of the companies are being assessed as the key goals of this rating. Companies with AQCG scores higher than 65% are regarded as high-quality companies (in terms of their behavior, financial reporting, etc.) since they have typically managed their affairs well over extended periods of time. Businesses with low scores (60%) on this typically either employed dubious financial reporting methods or had subpar corporate governance. The score tool was back tested using the BSE500 firms. The F-test was used to evaluate the tool's efficacy, and the results were divided into 4 quartiles and labeled as excellent, acceptable, and inferior. As a fund manager, Monarch AIF would put a lot of emphasis on companies with high AQCG scores since they are better managed and are more likely to be led by competent and honest management. However, depending on the growth potential and values at any particular time—for which the deep fundamental research would complete the loop—these companies may or may not be the ideal investments. To make sure no crucial detail is overlooked, Monarch AIF conducts extensive deep dive research, numerous levels of analysis, and conversations before investing in a stock. The team's research analysts do bottom-up in-depth analysis of the company, as well as trend analysis of the industry and comparative analysis of similar businesses. The team discusses the research's key findings, and if there is a strong consensus, the idea is presented to the Investment Committee for final approval before being included in the fund.

MONARCH AIF’S VIEW ON ECONOMY AND MARKETS

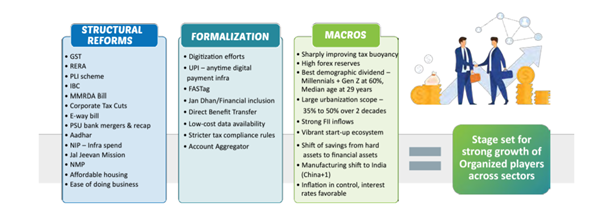

Monarch AIF is optimistic about India's economic prospects and anticipates that the momentum in GDP growth established in FY22E would last for several more years in the coming decade. The investment manager thinks that India will overtake China as the world's third-largest economy in the next ten years and will continue to be a secular long-term story because of: (i) excellent demographics, (ii) large availability of skilled, young and competitive manpower, (iii) low penetration of consumer goods and improving affordability, (iv) spate of structural reforms undertaken in last few years with a potential of many more in coming years, (v) expected large pick-up in manufacturing activity going ahead with introduction of attractive PLI schemed coupled with availability of capital, (vi) huge potential of new age startups and digital focused companies getting access to capital through stock market listings and (v) large unmet needs of infrastructure across the country. Strong growth of organized players across sectors has been enabled by the wave of structural changes, several efforts that have increased economic formalization, and favorable macroeconomic and demographic factors.

Industry leaders and powerful businesses, according to Monarch AIF, are well positioned to take advantage of macro tailwinds and have the potential to become multibaggers in the long run. These businesses harness structural shifts and are focused on the major trends. The fund thinks that additional industries and sub-industries will contribute to profits growth in the upcoming years, with industries like finance, industry, real estate, healthcare, and information technology (IT) setting the pace for future growth. The fund also thinks that there will likely be greater possibilities to create wealth when valuation multiples normalize across sectors.

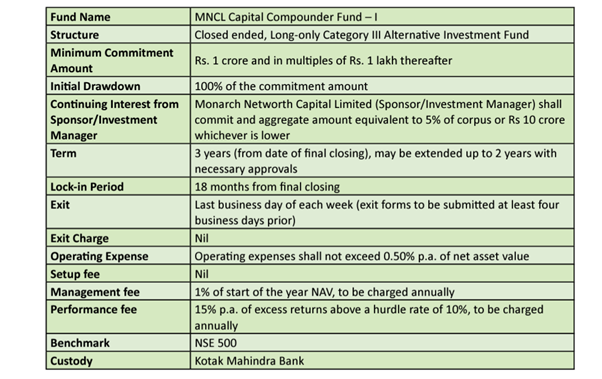

MNCL CAPITAL COMPOUNDER FUND – I

- MNCL Capital Compounder Fund – I (MNCL CCF – I) is a closed ended AIF Cat III long only equity fund which has been recently opened for subscription

- The scheme will follow flexi-cap strategy with a bias towards midcap stocks

- It will have a concentrated holding of investments in ~20 companies with high conviction from a focus list of ~250 credible stocks

- Primary focus will be to look for niche business leaders or companies showing leadership traits with strong track record and multiple tailwinds in place

Key Differentiators

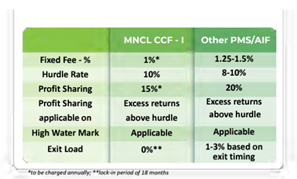

- MNCL CCF – I will not charge set-up fee, entry load or exit load

- Fee structure is designed in a way to ensure no bias amongst classes

- Hurdle rate is on the higher end with fixed fee set on the lower end

We conducted an exclusive interview with Mr. Abhisar Jain - Head and Fund Manager in order to know Monarch AIF in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

What do you think will be the market trend for 2022 post the union budget? How should investors proceed in this new year? We think that budget was entirely growth-oriented and its estimates were quite plausible. We appreciate the government's willingness to be flexible on the budget deficit front in order to foster economic objectives. All attention will be on ground implementation on that front as the significant increase in capital spending was the standout once again. Overall, we believe that the domestic growth environment is still extremely stable, and the budget has strengthened the case for the economy's and corporate India's overall narrative of growth and earnings increase .Although investors can expect the values to adjust as more economic sectors start to rise robustly, we think they should position for structurally bullish equities markets in the next years. We think that as time goes on, the polarization in stock prices will start to diminish, thus investors could need to adjust their portfolios. Our assessment is that certain pockets of high-quality equities and new businesses will correct from their abnormally high valuations to their long-term range in the coming years, and investors should not take the rewards from these pockets for granted.

What do you think of the new age businesses that have been listed in recent times? How should one look at them? The new age enterprises that have recently been listed do have a lot of active users and have provided customers with a simple tech-based solution for a particular good or service, which has in turn contributed to their popularity and rapid expansion. However, the majority of these enterprises are still in their infancy and have relied on both their capacity for innovation and the vast amounts of cash that have become accessible in private markets in recent years to function. This has allowed them to both survive and flourish. Up until this point, these organizations have placed less emphasis on profitability and cash flow generation than they have on growing their customer bases. Fewer companies than it seems have business models that might or might not be robust enough to endure different economic cycles and/or function in less hospitable liquidity environments. While many companies seem to have robust operating modelsand a large potential for growth, but from the perspective of an investor, at least in the short to medium term, the valuations of most new generation enterprises seem constrictive. We think the best way to examine these companies is to evaluate the founders' present stake in the company and their commitment to turning a profit within a reasonable amount of time. Investors must also assess these companies' long-term growth potential and the kind of alliances they can establish by utilizing their user bases. Lastly, because these businesses are still developing and have a short history, For investors, they are likely to have some hits and some misses, so a basket strategy may be the best way to wager on them for those who are truly interested in playing this theme.

What is your view on the equity market at current levels? Which are the key themes on which you are positive? Which sectors do you prefer at this level?

Although we have a positive outlook for the equity markets over the next three to five years, we think that because valuation multiples are higher than the long-term average, index returns may not be strong in the near or immediate future. In the coming years, we anticipate that active bottoms-up stock selection will become increasingly important and may perhaps become the primary source of alpha. The timely implementation of PLI programmes has prepared the ground for a decadal expansion in manufacturing across many sectors, and we anticipate significant opportunities for India's manufacturing sector. We have high hopes for the financial sector and think that India is about to enter a new cycle of credit expansion, which will thankfully get underway thanks to considerably better corporate conditions and much stronger lender balance sheets. Given our youthful and knowledgeable workforce and thriving startup ecosystem, we continue to be fairly optimistic about the expansion of the IT services sector in India. Financials, industrials, several consumer discretionary categories including value clothes, wood panels, and plastic pipes, as well as healthcare, are important sectors that we now like.

What is the USP of Monarch AIF? How do you differentiate Monarch AIF compared to others? The USP of Monarch AIF is that it practices high conviction investing through a concentrated portfolio of 15-20 stocks, with a clear focus on maintaining high slugging ratios in its portfolio (basically an effort to maintain high ratio of gains realized from winning positions vs losses incurred in losing positions). The fund's investment strategy is motivated by the selection of businesses that keep a laser-like focus on boosting operating cash flow and their capacity to generate incremental ROCE. The fund maintains a long-term focus while taking valuation margin of safety into consideration, thus it avoids investing in consensus or popular trades where there is a lack of value comfort. Monarch AIF also offers a relatively straightforward fee structure with no setup fees, exit loads, various investor classes, or charge schedules based on performance, which helps it stand out from rival AIF products on the market.

Which type of investor will MNCL CAPITAL COMPOUNDER FUND-I suit best? The HNI investors who are seeking a concentrated flexi cap equity fund (biased toward mid/small caps) with a focus on building concentrated portfolios of undervalued but growing companies with a long runway ahead of them to become more well-known companies of tomorrow are best suited for MNCL CCF-I. Investors seeking for a fund with a fee structure based mostly on performance and no exit fees should consider the fund. The fund is appropriate for investors looking for value-added items with a high likelihood of producing alpha.