Motilal Oswal Asset Management Company

MOTILAL OSWAL

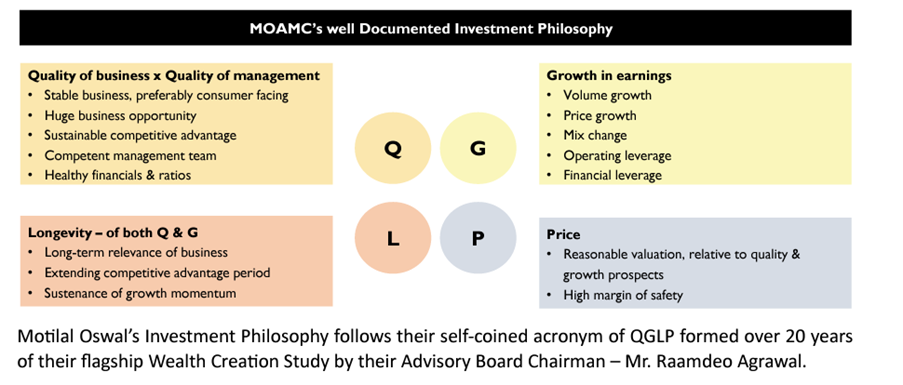

In 1987, Motilal Oswal and Raamdeo Agrawal founded Motilal Oswal Financial Services as a brokerage. Equity research and investing have been this organization's core competencies since its beginning, and they connect all businesses. Their founders' stated objective was to "help people make money in the stock markets." Every business has a beginning, and this one was founded with equity at its core. With a GDP of $279 billion at the time and no electronic trade infrastructure, India had a closed economy. Since then, the progress of the company and the Indian economy have been interwoven. After visiting the Berkshire Hathaway conference in Omaha in 1996, the organization conducted its first Annual Wealth Creation Study. After that, their founder and chairman, Mr. Raamdeo Agrawal, has carried out Wealth Creation Studies once a year. Their investment philosophy has benefited greatly from these research, which have helped them refine it and think about the investing errors they have made. In fact, one of these investigations led to the creation of its investment philosophy, known as QGLP – Quality, Growth, Longevity, and Price. There have been 26 annual wealth creation studies released thus far. The Motilal Oswal Asset Management Company (MOAMC) was established in 2003 after seven years of wealth development studies, learnings, and research. In order for the research team to concentrate on fund management and fund performance, the MOAMC set out to have a minimal number of products available on its platform. Asset mobilization was not the firm's goal from the start; rather performance was. This may be seen by the 2 oldest PMSs still in operation (started in 2003 and 2007 respectively), both of which have beaten the benchmark since its commencement. Raamdeo Agrawal is the Co-Founder and Joint Managing Director of Motilal Oswal Financial Services Limited (MOFSL) and the driving force behind the company’s approach to investing. As Chairman of the firms’ Asset Management businesses, he has been instrumental in evolving the investment management philosophy and framework. He has been authoring the ‘Motilal Oswal Annual Wealth Creation Study’ since its inception in 1996. He is on the National Committee on Capital Markets of the Confederation of Indian Industry (CII), and is the recipient of “Rashtriya Samman Patra” awarded by the Government of India. He has also featured on ‘Wizards of Dalal Street‘ on CNBC. Research and stock-picking are his passions which are reflected in the book “Corporate Numbers Game” that he co-authored in 1986 along with Ram K Piparia. He has also authored the ‘Art of Wealth Creation,’ that compiles insights from 23 years of his Annual ‘Wealth Creation Studies’. Raamdeo is an Associate of Institute of Chartered Accountants of India.

Mr Rakesh Tarway – Fund Manager Rich Experience:

He has an overall experience of 18 years in equity markets, with a focus on identifying emerging businesses in small & midcap segment. Positions Held: He has earlier worked as Head of Midcap Research at Motilal Oswal Securities and Reliance Securities. Track Record: Successfully managing ‘Motilal Oswal Focused Midcap Strategy’ PMS with strong outperformance to benchmark since inception Academic Background: Rakesh has a Masters in Management Studies (MMS) degree from Jamnalal Bajaj Institute of Management Studies (JBIMS), Mumbai. In order to realize the full growth potential of the underlying business, Motilal Oswal's equity offerings have been based on their investment philosophy, Buy Right: Sit Tight, where Buy Right means purchasing high-quality growth-oriented companies at a fair price and Sit Tight means remaining invested in them over a long period of time. They try to manage portfolios with little portfolio churn when combined with a "Buy and Hold" strategy.

Investment Framework

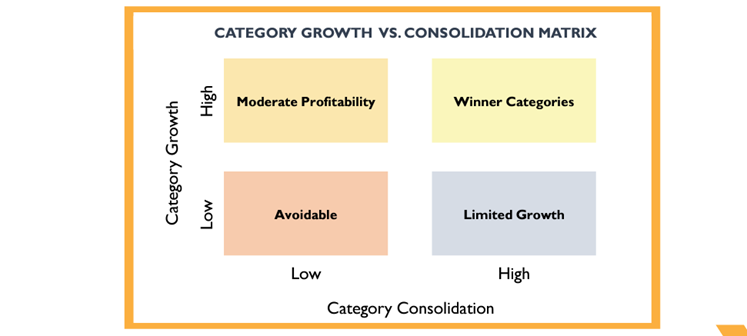

Motilal Oswal’s Investment Framework evolved from the 14th wealth creation study titled ‘Winner Categories and Category Winners’..

- Winner Categories = Winner Categories are sectors, which are expected to grow at least 1.5 times the nominal rate of GDP growth. India’s Next Trillion-Dollar opportunity combined with scalability.

- Category Winners = Companies in Winner Categories that enjoy Entry Barriers and have great management at the helm.

- Winning Investments = Category Winner stocks that are bought at reasonable (but not necessarily cheap) valuations.

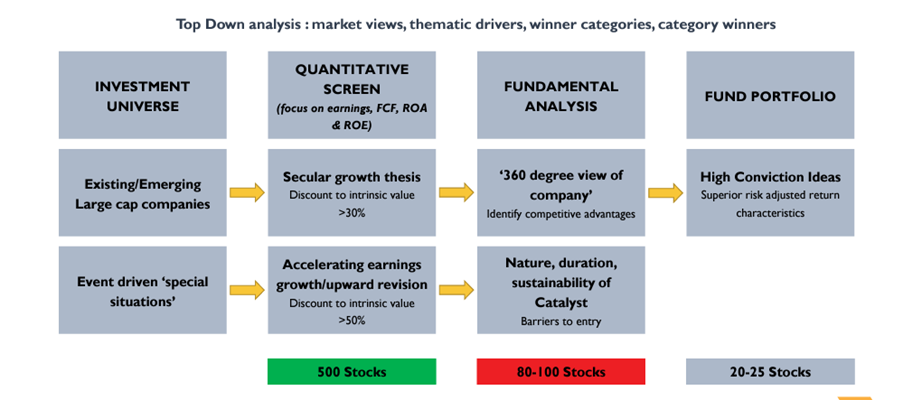

Investment Process Motilal Oswal’s Investment is a three-step approach, comprising of:

Idea Generation Process: In the beginning, Motilal Oswal screens all fundamentals for each industry and subsector, paying particular attention to free cash flow generation, strong returns on investment, and superior growth. Then they examine information from a variety of outside sources, including market conferences, sell-side analysts, and business professionals. Numerous annual reports, competitive analysis, concall scripts, sell-side research, financial/risk modeling, and in-depth industry analysis are all provided by its internal analysts. Additionally, their analysts conduct field research, interacting with vendors, distributors, dealers, clients, the competition, bankers, former workers, and sell-side analysts. Before meeting with senior management or the company's ownership, the Investor Relations team will first connect with you through this post. In summary, they offer a 360-degree evaluation in which a business is thoroughly examined in relation to three different factors: business, management, and finances (including evaluation).

Investment Monitoring Process: The concept generating stage of Motilal Oswal's investing research is just the beginning. They follow quarterly management meetings and concalls to guarantee that there is regular continuous research and monitoring of existing investments through a thorough investment monitoring and coverage process. They often interact with trade groups, trade shows, suppliers, distributors, customers, former workers, and other industry professionals. They also do field excursions to the company's units in an effort to forge partnerships. Additionally, they hold periodic meetings where they examine their investment thesis, which results in a quarterly revision of the 360-degree examination of the portfolio firms.

When do Motilal Oswal exit their holdings?

- When there is a material change in their investment hypothesis

- When there is a change in the business environment or some regulatory changes which alter the business model of the portfolio company

- When management misallocates capital

- Extreme euphoric valuations of the portfolio company

Classifying companies into Mini, Mid and Mega

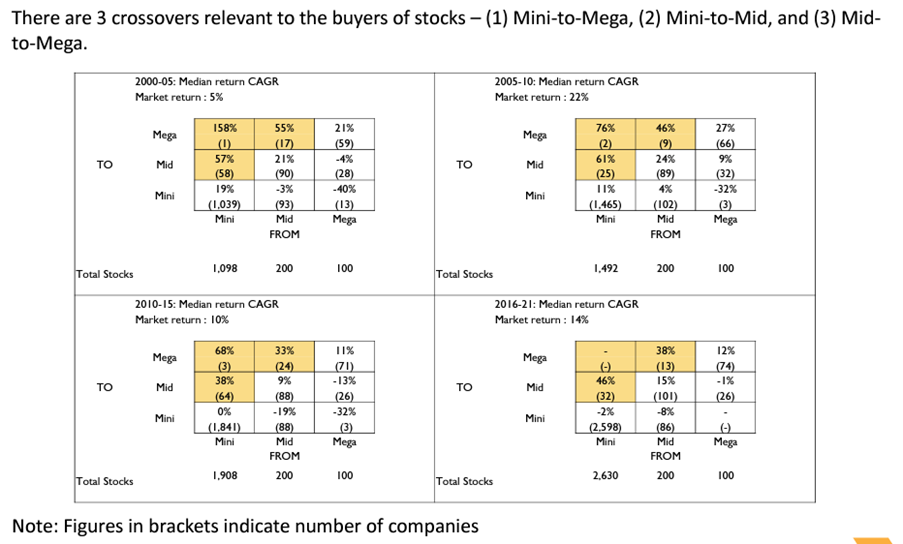

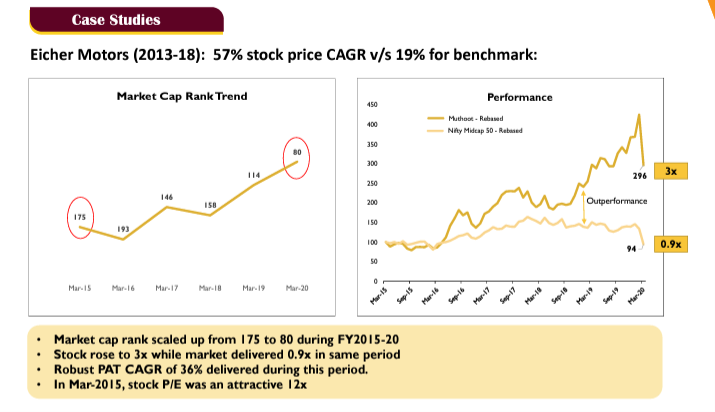

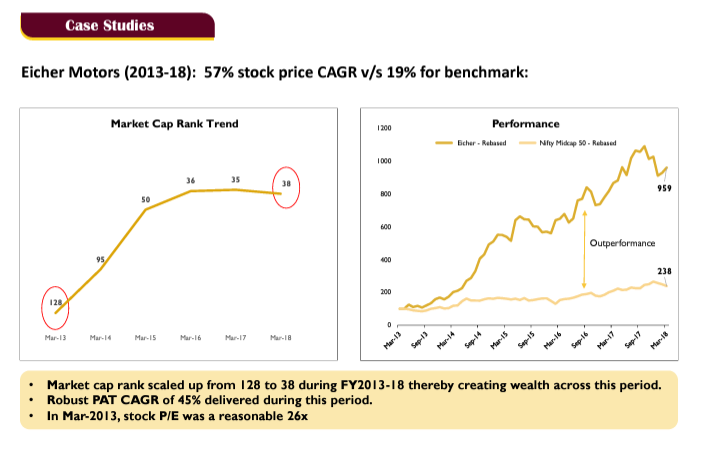

The 20th Annual Wealth Creation Study, which was published in 2015 by the organization's chairman, Mr. Raamdeo Agrawal, served as the inspiration for the mentioned scheme's central concept. According to the survey, stocks are divided into three categories: Mega, Mid, and Mini. The top 100 stocks are in Mega, the next 200 (i.e., 101st to 300th) are in Mid, and the remaining stocks are in Mini. The term "Mid to Mega" refers to a stock moving from the Mid category (ranks 101 to 300) to the Mega category (top 100). Any company that achieves this critical mass and scale in its operations and is recognized for it by the stock markets will have crossed a crucial threshold.

Crossover by the company from Midcap to Megacap category • Achievement of critical mass & scale • Recognition by markets of the same The above transition is mainly seen in companies that are • Industry Leaders • Industry Tailwinds • Value Migration beneficiaries

Why Mid to Mega

MOTILAL OSWAL INDIA EXCELLENCE FUND – MID TO MEGA – SERIES II

According to the data, of the three, mid-to-mega is the most lucrative in terms of risk-adjusted returns and most likely in terms of associated likelihood in any 5 year cycle over the course of two decades.

2016-21 Outcome • 13 of 200 Mid companies crossed over to Mega size generating 38% CAGR • Strike rate is 6.5% (5x higher) • Applying MQGLP filtration processes can significantly improve the strike rate • Only 32 of 2,630 Mini companies crossed over to Mid size • Strike rate is Low at 1.2% • Downside risk high Such a crossover logically predicts good profits for its investors. Additionally, the bigger the profits for investors, the faster such Mid-to-Mega crossovers occur. As a result, they concentrated on mid-to-mega companies within a realistic time frame of five years from the year of purchase.

Mid-to-Mega – A lollapalooza effect

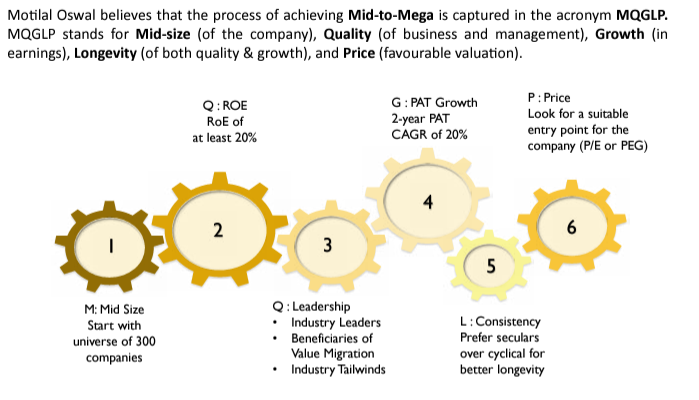

The expression "Lollapalooza effect" was made well-known by Charlie Munger, Warren Buffett's business partner at Berkshire Hathaway. It represents extremely significant results brought on by numerous interrelated elements. According to Motilal Oswal, the Mid-to-Mega effect is one of these lollapalooza effects, when a number of variables, including size, quality, growth, longevity, and purchase price, combine to elevate the stock's ranking from mid to mega.

Universe

Companies that have increased their Market Cap rankings, without necessarily moving from one category to another, have also produced profitable results. From 2000 through 2021, with a 5-year bucketing period, the median chance of rank improvements in enterprises between 301 and 400 is 20%. The average return generated is 41%, while the average alpha over the Sensex is 23%. • Primary Universe: 80-100% of the portfolio companies shall be chosen from ranks 101 to 400. • Discretion : 0-20% of the portfolio companies may be chosen from ranks 1-100

Selection Criteria

Why Mid-Caps now?

The present alpha level of Nifty Midcap 150 over Nifty 100 is roughly 3% on a 5-year rolling return basis, which can move up due to mean reversion. Mid-Caps have traditionally outperformed Nifty and Small cap in the long term.

- A reliable signal for investing in mid-caps is the Nifty Midcap 100/Nifty 50 ratio. The Mid Cap ratio had previously peaked in 2018 at 2.0, indicating space for future expansion.

Positioning of the portfolio: Up to 30 equities, heavy on mid-small caps. Here are a few instances from the Motilal Oswal India Excellence Fund, which was established in July of 21 and has an AUM of INR 1,000 billion.

- Manufacturing with a focus on exports: Companies like Dixon Technologies and Amber Enterprises are putting a lot of emphasis on this theme as a result of the enormous growth in contract manufacturing and production-linked incentive programs.

- IT Services: Covid has been instrumental in reducing the five-year investment in digitalization to under three years. Many businesses across industries were compelled to transition to digital operations and increase their digitization spending in order to stay in business. Mastek and Persistent Systems are holding.

- Theme of Cyclical Recovery: A gamble on infrastructure and real estate with a bet on cyclical recoveries. Polycab, APL Apollo Tubes, holding

- Insurance should be viewed as a financials sector with a multi-decadal growth story. In this digitized environment, the capital market intermediary and fintech sectors are ones to watch. Max Financial Services and Angel One Limited are holdings.

We conducted an exclusive interview with Mr. Rakesh Tarway - Fund Manager in order to know Motilal Oswal India Excellence Fund – Mid to Mega in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

In a crowded AIF space how different is the MOAMC India Excellence Fund- Mid to Mega Series 2? The 20th Annual Wealth Creation Study, which was published by our chairman, Mr. Raamdeo Agrawal, in 2015, served as the inspiration for the captioned scheme's central subject. With conclusions that have been back-tested using data from multiple industries, the study holds up well. A mid-to-mega crossover predicts good profits for its investors. Additionally, the quicker such crossings occur, the bigger the benefits for investors. As a result, we have faith in our investing strategy, which sets it apart from similar products on the market.

In a decade of “Disruptions”- How this theme will Play out - Key Assumption Risks Every day, disruption as a theme changes, necessitating a fresh perspective. We avoid acting in a herd around contentious issues. It's not necessary for disruption to only apply to new-age firms. Opportunities to invest in businesses that are upending established business models exist even within traditional businesses. The AIF is additionally permitted to invest in any IPO prospects. Therefore, if there are any attractive possibilities to invest in companies that are disruptors or have the potential to disrupt the market, the program will do so.

Which customer profile is suitable to invest in this AIF and what kind of allocation is preferred to overall portfolio? The program is appropriate for HNIs seeking to invest in an equity program with a long-term objective of capital growth over five years or more. AIFs are viewed as combining the advantages of PMS (flexibility) and Mutual Funds (benefit of the pool structure). The overall portfolio allocation is based on each investor's tolerance for risk. It is recommended to allocate 10% to 15% to AIFs.

In a dynamic World what are all the risks in mid to mega portfolio assumption? Considering the scheme is small-midcap oriented, any correction in the market, could potentially lead to higher drawdowns. However, the advantage of AIF is that it allows the Fund Manager to call for drawdowns timed to benefit from such correction.

How the fund approaches digitization as a them as it the fastest growing in that category? Covid has been crucial in reducing the five-year timeframe for digitalization to under three years. Many businesses across all industries were compelled to shift to and implement digital operations, raising digitalization spending in order to survive. We have budgeted for IT services, which are accelerating the digitization revolution across all industries. We continue to carefully investigate these digitizing options, which are currently being offered at competitive prices.

Do you invest in New-Age companies which are not in profits now as fund tenure is 5-7 years? The term "New-Age" businesses is more of a media fabrication. Any business should be able to meet the requirements of traditional investing ideas, such as profitability, expansion, and longevity. Open to investing in a new age business that meets these requirements. For instance, after listing, we gave Zomato a little amount of weight since we think that local delivery of food and other necessities will be a significant and expanding market for years to come.

What is the Learning from Series-1 that you are carrying out to series-2? The biggest lesson I've learned over the years is to never overpay for any asset, regardless of how profitable the opportunity seems. The key to investing still lies in having the ability to determine the appropriate price to pay for any stock or asset. On all funds, we would like to be more cautious in that area.