Narnolia Financial Advisors Ltd

Narnolia

This year marks the 24th anniversary of Narnolia. Looking back on this journey of more than 20 years, the company has changed from being a major financial intermediary in Eastern India to a name to be respected in the national and international arena for fund management & advisory products. Narnolia claims that achieving this status without making any compromises further supports its ethical standards and firm conviction that no corporate entity can develop over time unless the interests of all of its stakeholders and the general public are fairly balanced in the system. Narnolia has succeeded in creating some of the best goods, systems, processes, and technology available today. What's more, it employs some of the most talented individuals. However, what sets Narnolia apart from rival companies is the 100 years of combined national and international experience of its promoters, who are dedicated to providing investors with "superior and consistent risk adjusted returns."

One of the best data-driven buy-side research teams in the nation has been established by Narnolia, with expertise spanning a variety of asset classes and investment philosophies. The research methods are supported by a significant internal data foundation and infrastructure developed over the previous ten years for both domestic and foreign securities. With sophisticated strategy generation and testing capabilities, Narnolia's patented analytical engine offers both quantitative and qualitative assistance in choosing the right investment strategies. The quality of returns is equally important to Narnolia as the quantity of returns. The investor's returns should be maximized per unit of risk.

Shailendra Kumar Co Founder & Chief Investment Officer

Shailendra Kumar is currently the Chief Investment Officer at Narnolia. He has experience of successfully managing PMS and cat III AIF. Under Shailendra’s leadership Namnolia has received numerous awards including ‘Most Consistent Portfolio Manager and is considered premium investment advisory firm. Shailendra co-founded Namnolia Securities in 1997. He is known for his deep understanding of Investment theories, Stock-selection and Portfolio allocation. He has successfully developed and implemented all four major investing and trading strategies namely, value, growth, reversion and momentum. His preferred investing style is growth in value! Shailendra has a strong academic orientation having authored as well as mentored numerous financial publications. He has done extensive work on corporate valuation and derivative pricing. He has written as well as guided several finance research papers. Shailendra holds a post-graduate degree in Management & Systems from Indian Institute of Technology, Delhi.

Vineeta Sharma Head - Research (Equity)

Vineeta Sharma is the Head of Research at Narnolia. Vineeta has been in Equity research and investment industry for more than 13 Years. Over the years she has evolved her distinct style of growth stock investing which includes a proprietary process of fundamental analysis based on detailed financial modeling and bottom-up analysis of the company’s financial and operating environment. She leads a team of 32 research Analysts covering 192 stocks across 18 industries. Under her leadership, the team has recommended 30 multi-baggers in last 30 quarters. She is known in the industry for her stock selection and recommendation and for her grip over the accounting principles and Financial Statements. She is a qualified Chartered Accountant and holds Bachelor of Commerce (Hons.) degree from Delhi University, India.

For investors who want to take advantage of the equity investing potential to create wealth in the Indian economy, Narnolia Equity PMS is designed to be a core purchase and hold portfolio. By allowing access to 4 separate equity strategies through a single account, Narnolia Equity PMS enables investors to carefully distribute investment amounts between these strategies in accordance with their individual risk profiles. The investor has the opportunity to select their favourite basket of stocks thanks to this. These equity-strategies are specially designed around distinct cap and fundamental growth and quality features. The 'growing in value' investment strategy is followed by Narnolia, which has a proven track record of success. Quality wins out in the end. The word "value" in this context derives from "being valuable" or "quality." The investment candidate for Narnolia is a firm that is displaying or is anticipated to display "growth due to business situation, management strategy, or the inherent moat of the business, a company starts having higher and/or rising RoE, RoCE, and the Free Cash flows value."

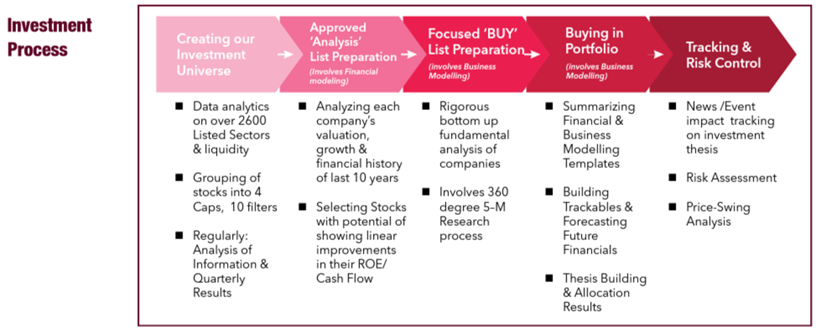

The disciplined approach to investing is supported by our 360 degree 5-M research framework, one of the most comprehensive fundamental research technique. It links market opportunity, management strategies, financial and operating moat to detailed financial models and the valuation envelope. For replicating its success over the long term, the strategy employs elaborate research and investment processes along with explicitly defined risk parameters.

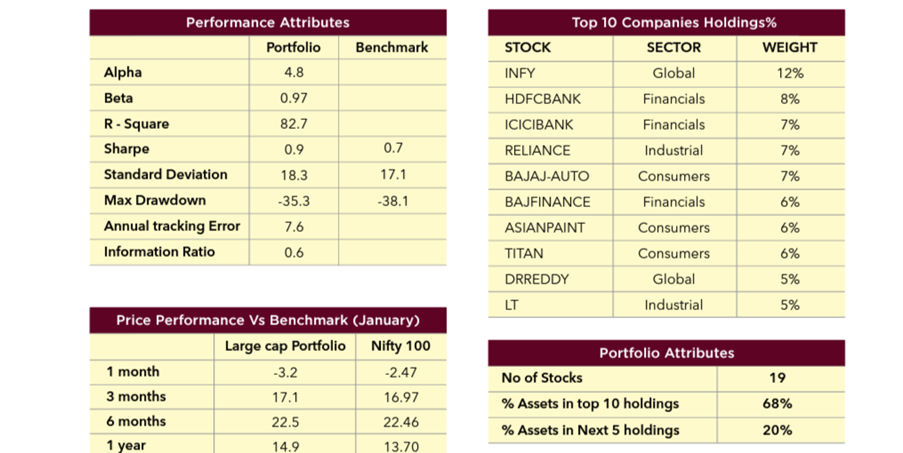

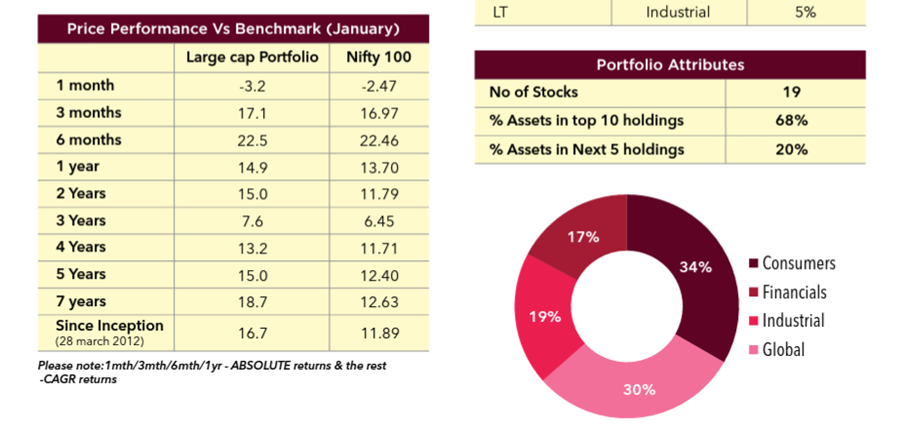

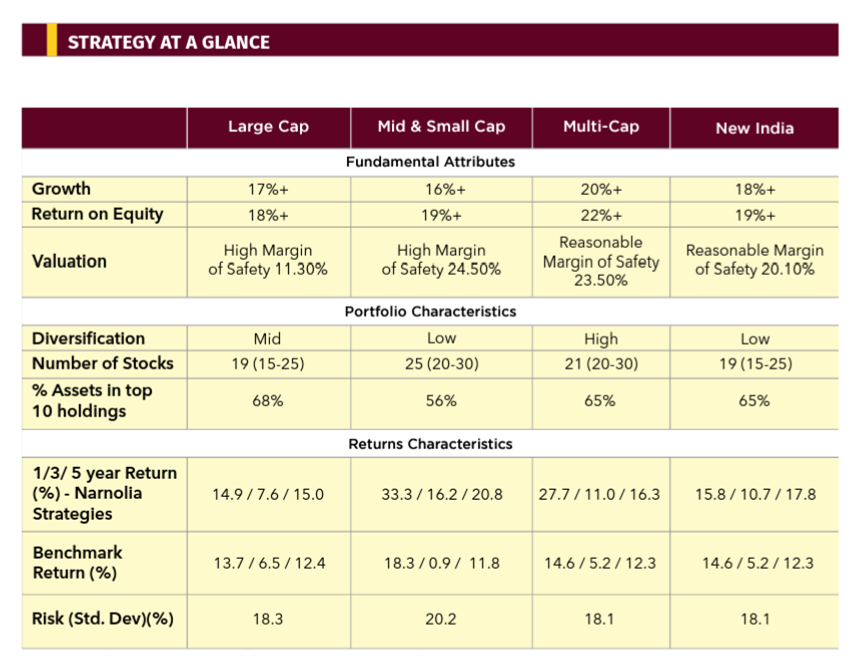

Large-Cap Strategy / Industry Leaders comprises of companies those are leaders in their respective industries in which they operate. 80% weightage in this sub-scheme is to companies those are a part of the Nifty Large cap 100 Index. This index constituents have a high correlation (0.94) with Nifty 50 Index The targeted aggregate fundamentals of the sub-strategy are: Growth - higher than nominal GDP growth ideally above 12%, ROE 20% or more and high margin of safety in terms of current valuation inside the last ten years valuation envelope.

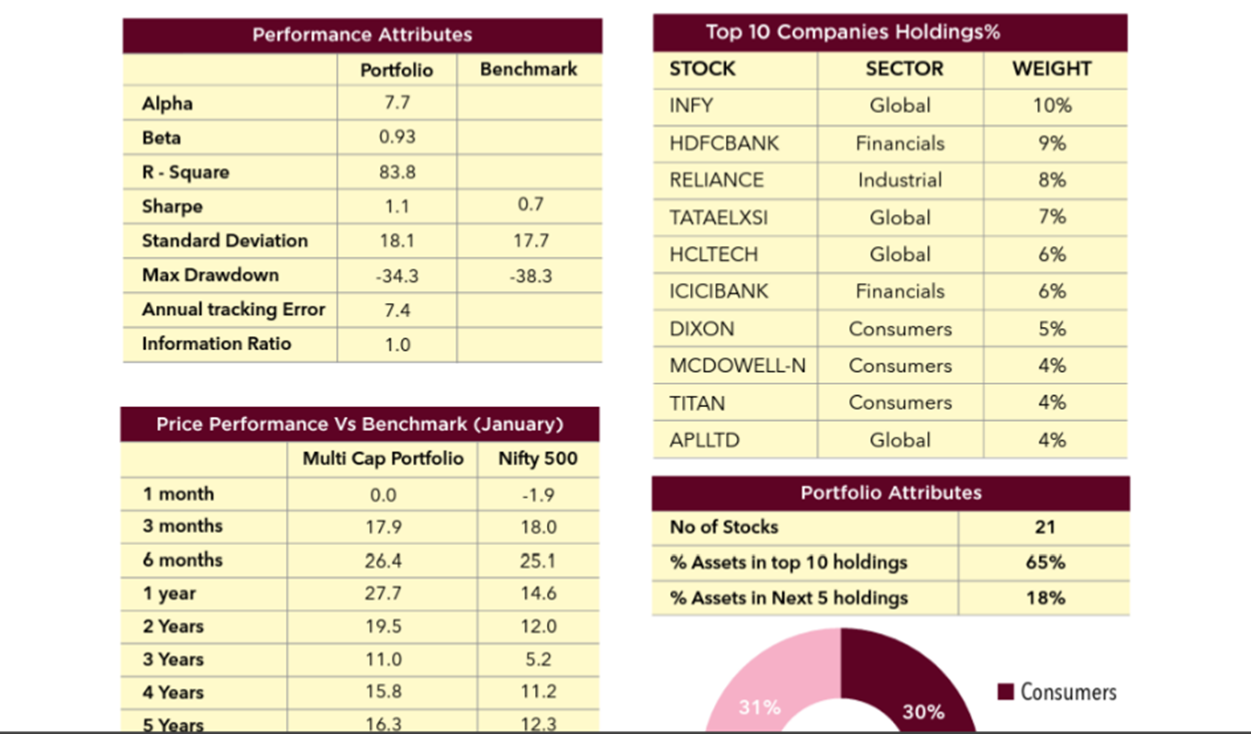

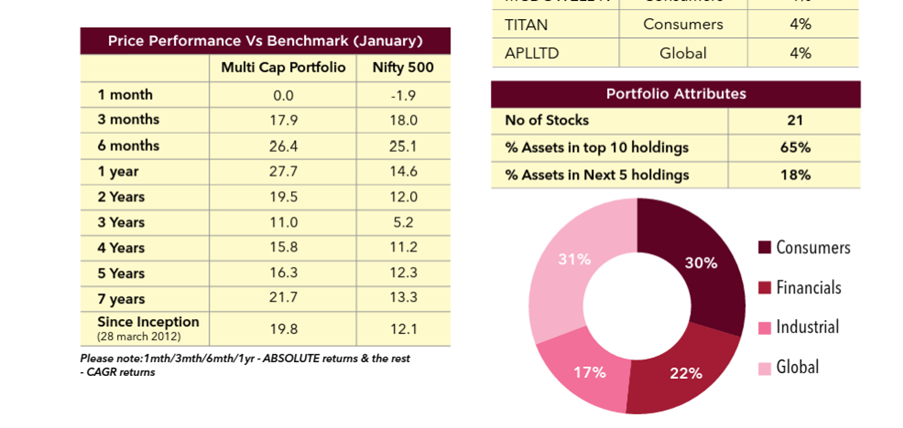

Multi-Cap investing provides opportunity to take optimum investment exposure across market capitalization of Indian listed companies along with diversified industries’ representation inside the investment basket. 80% weightage in this sub-scheme isto companies those are part of Nifty 500 Index The targeted aggregate fundamentals of the sub-strategy are: Growth-ideally above 15%, ROE 20% or more and sufficient margin of safety in terms of current valuation inside the last ten years valuation envelope.

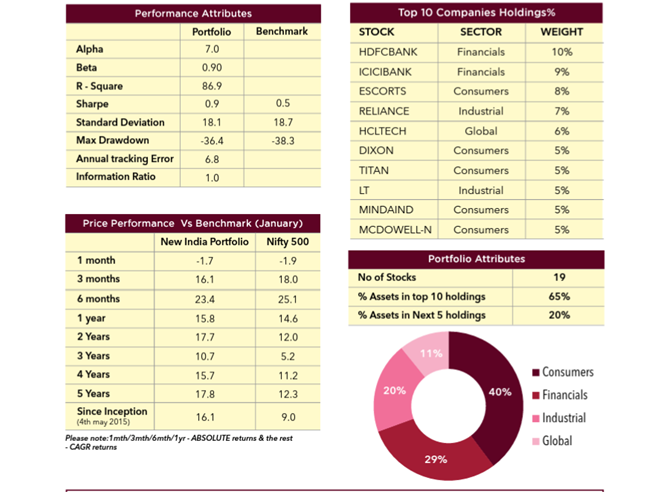

New India Strategy comprises of companies that are capitalizing on the theme of Value Migration’ by investing in companies whose business models are more aligned to the newer ways of production/ consumption. This sub-scheme has multi-cap characteristics. The targeted aggregate fundamentals of the sub-strategy are: Growth - 1.5* higher than nominal GDP growth ideally above 18%, ROE 15% or more and sufficient margin of safety in terms of current valuation inside the last ten years valuation envelope.

We have conducted an exclusive interview with Mr. Shailendra Kumar, CIO in order to know the Narnolia PMS in depth and enable our investors to make informed decisions. The questions and answers are reproduced verbatim: In a crowded PMS market like India, what are the USPs of Narnolia PMS that should be known by investors? We don't think PMS market is over crowded. There are very few players with a long and successful track record. Narnolia has been managing PMS for the last 9 years with a very good performance track record. Few important things that the investors should know about Narnolia PMS are:

- Largest buy side research team following a process and rule driven approach to enable investing.

- Established track record for more than 9 years with delivered performance that qualify amongst the top performing PMS performance in the country.

- Clearly identified investment philosophy that focuses on identify stocks using Growth in Value Principle along with consistency and visibility of future growth.

Share the performance of Narnolia Large Cap, Mid and Small Cap, Multi Cap and New India strategies across market cycles. What kind of alpha have they generated over benchmark and category averages?

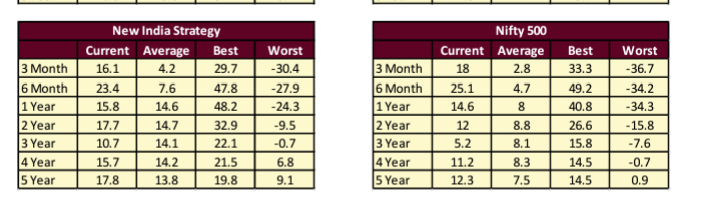

At the same if one looks at rolling basis return, one can notice that the out-performances are very pronounced when markets are in downtrend. Risk Management framework of Narnolia helps investor protects gain made during the bull market.

Broader stock markets are at all-time highs. How are you approaching investments now? Is there juice left in stock prices?

The pricing behavior of the stock market is cyclical. Therefore, in terms of a wide market return, we get 3–4 years when the market grows by 30% year, but we also get 3–4 years when the market consolidates and grows by almost 0% annually. We receive returns that are close to 15% annualized in the long run or over multiple cycles as a result of these two separate stages. The Indian stock market went through a consolidation phase for a good portion of 2017 to 2020. But today, the phase of expansion has firmly begun.

Fundamentally speaking, Indian corporate earnings are expected to grow quickly in the future. From 7.8% in FY08 to 2.8% in FY20, the ratio of Indian corporate profits to GDP has decreased. And so, during the next five years, we anticipate double-digit nominal GDP growth. Additionally, corporate profitability will normalize and increase to 5% of the GDP. This increased corporate profit to GDP ratio and stronger nominal GDP growth imply future corporate earnings growth of 18%, which will also result in increases in price returns. We should also keep in mind that price corrections would occur occasionally throughout expansion periods of the stock market, just like they do during other phases, but because the market is expanding, these corrections must be accepted.