PGIM

PGIM

A full-service investment manager, PGIM India Asset Management provides institutional and retail investors nationwide with a wide selection of equity and fixed-income products. They oversee 22 open-ended funds run by 16 investing experts. They manage the assets of their investors using domestic mutual funds in addition to providing offshore funds and portfolio management services. With about Rs. 102 lakh crores in assets under administration, PGIM is Prudential Financial, Inc.'s (PFI) global investment management division. Through its multi-manager model and seasoned investment teams specialized on certain asset classes and investment strategies, PGIM offers a wide range of investing capabilities. With a dedication to investment performance, product innovation, and integrity, PGIM is built on the strength and stability of its 145-year history and committed to meeting the demands of its international clientele. Prudential Financial, Inc., a Fortune 500 company with a current rank of 55, engages in asset management and insurance, with an AUM of $1.6 trillion (about Rs. 126 lakh crore). A multi-manager approach is used by PGIM, an organization with a 145-year history of strength and stability. It has over 1,300 investment professionals working for it in 17 different countries, and it has great capabilities outside of traditional assets.

ABOUT US

A wholly owned subsidiary of PGIM, PGIM India Asset Management Private Limited operates as PGIM India Portfolio Management Services (PMS). By finding and investing in opportunities without compromising the quality of the portfolio assets, PGIM India PMS aims to provide superior risk-adjusted returns for their clients over the long term. Their unique method of portfolio development guarantees less overlap with conventional mutual fund options. They have a successful track record, which is supported by a highly skilled investment team, potent operational capabilities, and solid research. They provide their customers with back-office support and best-in-class internal IT solutions. They think that regular client interactions are essential to developing a strong, long-lasting connection. To keep clients informed about their investments, they provide regular performance reporting and fund management outlooks.

KEY HIGHLIGHTS

- Launched in July 2013

- Experienced Investment Team

- Offer equity strategies with a focus on Growth at Reasonable Price (GARP)

PGIM India Portfolio Management Services (PMS) - Investment Process

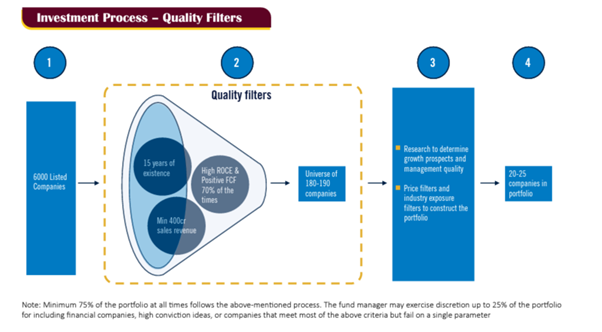

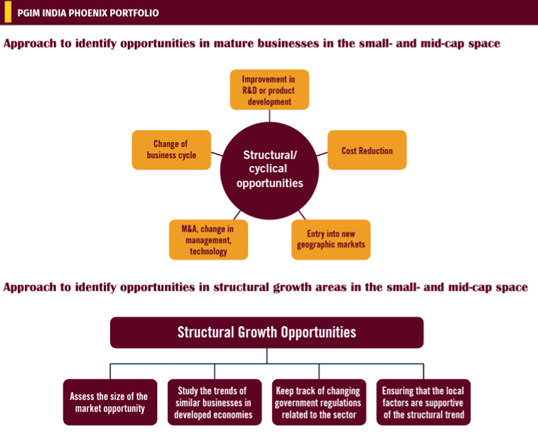

Their investment decisions are refined by PGIM India PMS's careful and thorough investment methodology. They begin with the 6,000 listed Indian firms that make up their investing universe and gradually narrow it down to 180–200 for the PGIM India Core Equity Portfolio and 280–300 for the PGIM India Phoenix Portfolio. They adhere to the Growth at a Reasonable Price (GARP) investment philosophy, which is a straightforward yet powerful investing idea that has been put to the test over many years. While investing in stocks is a strategy for growth, the cost of growth is as crucial. Value and growth are the two pillars of investing that are balanced by the GARP philosophy.

In the past, the markets have fluctuated between extremes of optimism and pessimism, and strategies like growth at any cost and an overemphasis on Price to Book value have been used. GARP can therefore aid in avoiding value traps and excessive overpricing. A GARP-centric portfolio, by virtue of not overpaying for growth but also partaking in the growth of the investee companies, produces superior risk-adjusted return over the long term. The GARP theory produces greater long-term risk-adjusted returns by fusing the greatest features of both value and growth investment. They use filters, such as high return on capital employed (RoCE), low leverage, positive operating cashflows, and stronger governance, among others, to determine whether to include a stock in the investment universe. Many of these measures, in their opinion, would aid in performance by assisting them in avoiding costly mistakes. In order to realize the value of the investment when it reaches its potential, the investment process also includes a clearly stated sell discipline.

ABOUT PGIM INDIA PORTFOLIO MANAGEMENT SERVICES

Deep Asset Class Expertise-Investors rely on PGIM's risk management skills, intellectual capital, and creative solutions as one of the top money managers in the world to achieve their investment goals. With the focus and responsibility of asset-class experts and the top-notch investing processes and risk management of a global financial services organization, their unique investment approach offers the best of both worlds.

Long-Term Perspective- With more than a century of experience managing money, especially during periods of considerable volatility brought on by major events, its managers actively assess the fundamentals to provide superior results for investors.

Breadth of Capabilities-Investors have access to a broad suite of solutions that can be tailored to meet their needs spanning life stages and financial circumstances. Strength, Stability and Trust- With more than 1,300 investment experts in North America, Europe, and Asia, PGIM benefits from their strength and knowledge. It is supported by the 145-year legacy's strength, dependability, and trust. While meeting the constantly shifting demands of their international client base, they continue to be dedicated to investment performance, product innovation, and integrity. They provide investors with assistance through PGIM's global infrastructure, functional expertise, financial strength, and stability while enabling managers to concentrate on portfolio management and returns. PGIM India PMS offers two portfolios currently

- PGIM India Core Equity Portfolio – Multicap oriented approach

- PGIM India Phoenix Portfolio – Small and Midcap oriented approach

Portfolio Manager: Surjitt Singh Arora Surjit Singh Arora is the Portfolio Manager and Principal Office of PGIM India Portfolio Management Services. He has more than 18 years of rich work experience in the equity markets including over 8 years in the asset management industry. In his last stint, Surjitt was Head of PMS and Principal Officer with Tata Asset Management. Prior to that he was with Tata Mutual Fund as Equity Research Analyst. Surjitt holds a Bachelor’s degree in Management Studies from Sydenham College, Mumbai, and a Master’s degree in Management Studies from Sydenham Institute of Management and Research (SIMSREE), Mumbai.

PGIM INDIA CORE EQUITY PORTFOLIO

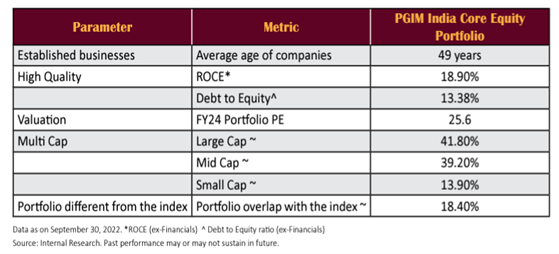

Portfolio Proposition: Presented here invests in high-quality firms with sound structural foundations. The businesses must have a minimum revenue scale, have gone through at least one downturn and come out stronger, have a steady cash flow, and have had a high return on capital employed (ROCE) for the previous ten years. With a concentrated portfolio of 20–25 stocks, they concentrate on owning businesses that are industry leaders. They have observed throughout time that market leaders typically tend to recover stronger and with a larger market share following the downturn, whereas lesser players typically struggle to survive. They seek to invest across market caps and have little overlap with the benchmark. Single sector exposure is limited to 30% and single stock exposure to 10% of the portfolio. Cash retention is a residual tactic. The amount of cash is not determined in advance by the portfolio manager. Cash is held to that degree if suitable investment options are not accessible at a particular time.

The Portfolio Manager looks for

- The ability of the company to grow its sales and profits greater than the industry average, over the next 3-5 years

- The ability of the company to do this without consistently resorting to additional external funding

- The track record of the management in capital allocation and in treating minority shareholders fairly

The Portfolio Manager is constantly aware of market valuations, which should be fair in light of expected future growth. The portfolio is reviewed on a regular basis to determine the best options. When the fundamental investment thesis shifts, the portfolio maintains its sell discipline by selling out of its holdings.

PGIM India Core Equity Portfolio attributes

- Focus on owning companies that are market leaders in a particular domain

- Concentrated portfolio of 20-25 stocks, with a multi-cap approach

- Low overlap with benchmark

Performance Update of PGIM India Core Equity Portfolio

Their portfolio outperformed the benchmark by 14.4% over the course of a year, delivering a return of 12.9% compared to a loss of 1.5% for the Nifty 500. The shift in the portfolio from a pure value approach to one that favours the Growth at Reasonable Prices (GARP) approach has improved the overall performance. The portfolio outperformed the Index primarily as a result of the stock selection in the consumer and specialty chemical industries, as well as an overweight position in the industrials and underweight position in the finance industries. Three of their top positions, Timken India, Phoenix Mills, and SBI, made significant contributions to their outperformance, indicating the portfolio's high conviction judgments.

PGIM India Phoenix Portfolio Key Characteristics - Low overlap with the benchmark of 5.1% - Small and Mid-Cap offerings available at P/E of 25.9 (FY24) - Debt to Equity ratio of the Portfolio (Ex-Financials) is 33.7% - Weighted average Market Cap is Rs. 19,843 crores - Market cap allocation: Small Cap: 46%, Mid Cap: 30%, Large Cap: 14% - Maximum Allocation to a sector at 30% and Maximum Allocation to a stock at 10%

We conducted an exclusive interview with Mr. Surjitt Singh Arora - Portfolio Manager & Principal Officer of PGIM India Portfolio Management Services in order to know PGIM India PMS in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

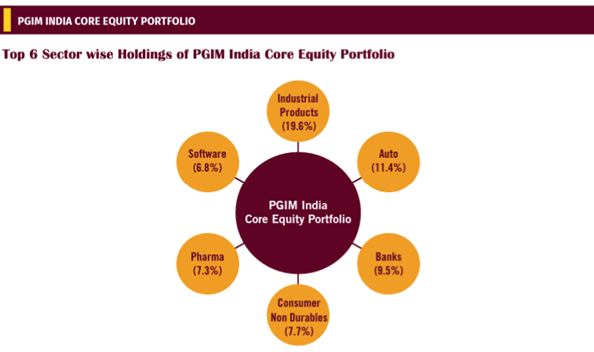

What are those sectors that you are betting on or want to bet on in the medium term, and why? The bulk of our investment companies are either debt-free or have very low net debt to equity ratios, as you can see from looking at our portfolios. Given the current state of the world economy, we favour businesses that are internally focused, or mostly driven by domestic demand, as opposed to those that are primarily dependent on exports. At the same time, domestic data—including increases in credit, personal loans, GST collections, and auto sales—is fairly positive. In this perspective, the industrials (capex-oriented sectors), banks, autos, retail, and residential real estate (exposure through the building materials segment) are a few sectors where we are optimistic given the robust domestic demand.

Industrials & Banks: After a ten-year pause, India's long-awaited Capex cycle finally appears to be gaining steam. Despite a few false starts over the past ten years, we think the latest COVID recovery is looking sustainable and has the makings of multi-year growth. Start-up of several growth engines would stabilize and increase visibility of capital expenditure in the economy over FY22–26. However, we believe that the private sector Capex is about to pick up due to a confluence of multiple enablers such as deleveraged corporate balance sheets and healthy profitability, a well-capitalized banking system with NPA cycle over, and other factors. While government Capex growth would continue to be somewhat dependent on tax collections (FY23 is anticipated to be strong), rising interest rates, mid-cycle capacity utilization, and local demand. During FY2022, private sector Capex lagged behind government Capex, but due to rising Capex across several sectors (cement, metals, power, autos, chemicals, and PLI-led Capex), it will now surpass state spending.

Automobiles: A strong consumer demand and an improved supply chain bode well for the industry. Recent reductions in material costs bode well for the success of the auto industry.

Do you think the banking sector will contribute the most to earnings growth in the coming years?

Given the broad-based loan growth, steady to rising net interest margins, improving asset quality with fewer slippages, and solid provision coverage ratios, we are optimistic about the Banking and Financial Services (BFSI) industry. Along with the confidence in valuations in the banking industry compared to other sectors, corporate balance sheets have grown significantly stronger in comparison to previous years and have been deleveraging for a long time. In our opinion, banks are fundamentally a proxy for both capex and consumer growth, and they are accessible at fair prices with clear profits growth prospects. Therefore, there is a chance that the banking industry will contribute more to earnings growth.

Are you betting big on the consumption theme? Given the broad-based loan growth, steady to rising net interest margins, improving asset quality with fewer slippages, and solid provision coverage ratios, we are optimistic about the Banking and Financial Services (BFSI) industry. Along with the confidence in valuations in the banking industry compared to other sectors, corporate balance sheets have grown significantly stronger in comparison to previous years and have been deleveraging for a long time. In our opinion, banks are fundamentally a proxy for both capex and consumer growth, and they are accessible at fair prices with clear profits growth prospects. Therefore, there is a chance that the banking industry will contribute more to earnings growth.

Do you see any headwinds that could affect the medium-to-long-term positive view? CY22 may be a difficult year for the markets due to the unsteady climate and decline in global economy. The near-term equities valuation advantage enjoyed by the Indian Market may be at risk as a result of rising interest rates both internationally and in India. Additionally, given the inconsistent monsoons in several important states, food inflation in India appears to remain sticky. Indian equities outperformed both emerging and developed markets due to the following reasons: a) U.S. rate hike expectations further hardened due to higher than expected inflation and its future reading, while retail sales and consumer sentiment data remained strong; b) The domestic results season has started on a strong note, driven by banks and IT services, while U.S. earnings have seen a minor downgrade (so far), driven by financials & materials. Given the elevated global macro risk, we anticipate continued market turbulence. The Indian Rupee is under strain as the interest rate gap between the American and Indian economies widens. India, a net importer, could experience a worsening of the Balance of Payments if the Indian Rupee continues to lose value. In the medium run, it would also be important to watch the global geopolitical risk.

Due to significant volatility in the secondary market, do you think the IPO space will remain dull? Will PGIM continue to be IPO-averse?

We make investments in high-quality businesses with sound structural foundations. A good quality firm is one that has attained a minimum revenue scale, has survived at least one downturn and grown stronger, has stable cash flows, and has a greater Return on Capital Employed (ROCE) during the last ten years. The second component has been to own businesses that dominate their respective markets. Growth At Reasonable Price (GARP) is the idea we adhere to. A GARP-centric portfolio, by virtue of not overpaying for growth but also partaking in the growth of the investee companies, produces greater risk-adjusted returns over the long term.

The GARP theory produces greater long-term risk-adjusted returns by fusing the greatest features of both value and growth investment. We offer filters for including a stock in the investment universe as part of the investment process, such as High RoCE, Low Leverage, Positive Operating Cashflows, Better Governance, and others. Many of these measures, in our opinion, would aid in performance by assisting us in avoiding costly mistakes. According to our estimation, the bulk of IPOs occur during bull markets, and if one looks closely, they are primarily offers for sale from current investors. In accordance with our established procedures, we give the most weight to a stock's track record of the last 10 years when appraising it.

With the significant deterioration against the US dollar, is the worst over for the rupee?

Given the elevated global macro risk, we anticipate continued market turbulence. Indian and US market correlation is roughly 0.7 to 0.8 times. Therefore, it would be incorrect to believe that we have separated. The Indian Rupee is under strain as the interest rate gap between the American and Indian economies widens. Being a net importer, India could experience a worsening of the Balance of Payments if the Indian Rupee continues to lose value. In the medium run, it would also be important to watch the global geopolitical risk. Given the current state of global uncertainty, predicting the direction of the Indian Rupee is challenging.

Will the inflation worries remain in the second half of the financial year or is it near its peak now? Despite India's impressive outperformance, markets throughout the world have seen a correction as a result of the inflation and monetary tightening scenarios. India may have sustained growth over a long period of time as a result of the trinity of growing international interest in India, favourable demographics, and higher investments. The majority of raw materials, including steel, aluminium, copper, and oil, have declined from their April 22, 22, peak. As a result, we believe that inflation is about to peak and will likely decline over the next few years. Lower oil prices, a solid earnings growth trajectory, and a slowing down of high inflation (on a high base) are positive signs for the Indian markets.

What are your thoughts on Europe+1 and China+1 themes? Will India be the biggest beneficiary of both these themes?

India's specialty chemicals market was worth USD 32 billion in 2020, with a CAGR of 11.7% from CY15 to CY20. By CY25, the value of this industry is anticipated to double to USD 64 billion, representing a CAGR of 12.4% during CY20-25. This growth is attributable to multinational corporations' concentration on India as a replacement for China as a production market because of environmental risks, where the government is strengthening regulatory regulations. Like in the case of pharmaceuticals and chemicals, a significant amount of manufacturing is moving from China and Europe to nations like Vietnam, Indonesia, and India. Due to proactive preventative efforts, European natural gas inventories are about 90% filled, nearly nine weeks ahead of CY21 levels. As a result, the MoM price of natural gas in Europe has significantly decreased. Gas prices in particular are on the rise, which could compel chemical businesses to reduce output. End-users might try to replace this with inexpensive imports from other countries, which would ideally present a chance for Indian exporters. Following China+1, the Indian market for speciality chemicals might experience disproportionate growth, and businesses with unique offerings might benefit. India's chemical producers are in a position to become a reliable alternative and, in some cases, the main suppliers to international companies.