PhillipCapital (India) Pvt Ltd

Phillip Capital

The business was founded in 1975 in a building on Phillip Street in Singapore, which is also where it earned its name. Today, it has developed into an integrated Asian financial house with a global presence and is regarded favorably by the global investment community. Mumbai-based PhillipCapital India is a well-known, diversified financial intermediary that provides a wide range of financial services. It has always been adamant about being innovators and providing investors and clients with unique financial products and solutions. PhillipCapital was a pioneer in the introduction of commodities trading and derivatives in India and is now a major force in the Indian securities industry. As an MNC financial institution, PhillipCapital has the greatest systems and procedures in place. But research has been the foundation of PhillipCapital's success. It has a research staff of 25 seasoned analysts with a total experience of more than 200 years; the majority of its analysts not only have 10+ years of experience but also receive good marks from other professionals in the field. PhillipCapital is able to comprehend the specific needs of each client because to its powerful worldwide presence and in-depth understanding of local markets. It offers customized goods and services as a result to satisfy their needs. has a Singapore headquarters and presence abroad in 15 nations. Worldwide Assets Under Custody & Management: USD 47 billion more than 1.3 billion users worldwide money from shareholders exceeding USD 1.5 billion More than 5,000 Staff The Company launched its PMS with the straightforward and modest goal of putting investors' interests first, and it still sees it as their individual responsibility to manage investors' hard-earned money with full seriousness. PhillipCapital has never chased AUM since they aspire to be a boutique investment manager.

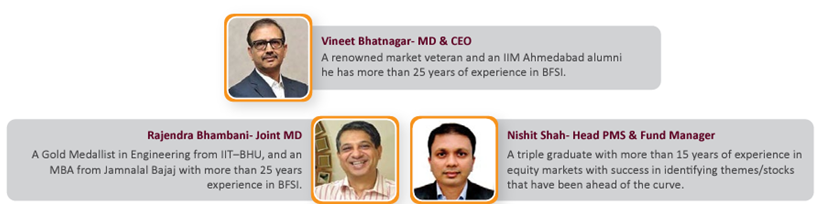

We have conducted an exclusive interview with Mr. Nishit Shah- Head PMS & Fund Manager in order to know the Phillip Capital India Pvt Ltd in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

What do you think is the USP of your PMS and how do you differentiate yourself from competition? Though we operate under a very large umbrella of PhillipCapital group we started our PMS services with a very simple objective of running it as a boutique offering and not run it like a factory operated service wherein one portfolio fits all approach. We strive to customize each client’s portfolio based on when they are entering, what are the valuation of companies that we want to acquire, the market forecast and also on any negative stock/sector list that a client has provided. In PMS we have the flexibility to be 100% invested or take cash calls. Therefore, we often don't invest everything on day one; instead, we build a portfolio over time and stagger the investments. The most important lesson we've learned—and which we faithfully apply—is that there's a chance we'll make a mistake after conducting research. In that case, we'll admit our error right away, sell the stock, and go on to something new. Even if we adhere to the long-term strategy, we also think it's critical to minimize losses and maximize gains.

You mentioned above that you do not invest everything on day one so are you trying to time the markets? No, we firmly believe that no one, and certainly not ourselves, is capable of timing the markets. When we invest the hard-earned money of our clients, we view it as our personal obligation. Given that our investment horizon is 5-7 years and we would not invest Rs. 50 lakhs on Day 1 if it were our money, why would we do so with the money of a client? We won't try to spread out investments over a two- to six-month period if stocks we want to invest in tomorrow are available at a 30% discount due to a market correction. We put in a lot of work creating personalized portfolios and using a staggered investment method, but that is what our clients pay us for in fees. We can't treat our investors unfairly in the name of quick scalability because our goal is to increase value for each of them over the long run. We have the people and technology to manage a sizable clientele, but we don't want to jeopardize the confidence our investors place in us.

We have seen few Multi Asset Products from Mutual Funds houses but under the PMS umbrella We have hardly heard about a Multi Asset Strategy. How relevant is Phillip Multi Asset PMS that diversifies across asset classes?

We only introduce a new product if we believe it will benefit our investors, offer an advantage over competing products, and excite us enough to invest our own money. Our Multi Asset Portfolio was created as a solution for investors who have been investing in fixed income products but are experiencing declining yields, as well as for anyone who wants to benefit from diversification but is hesitant to invest in the equity market due to the volatility and drawdowns associated with the Indian equity market. Our goal is to considerably reduce volatility and drawdown while maintaining returns comparable to equity markets.

What are the key features of Phillip Ethical India Portfolio Strategy ? Again through this product we are trying to fill in a very big latent demand. We were not able to serve a certain community because of their religious belief. So we tied up with well known Shariah Scholars who assist us in identifying Shariah complaint stocks that are in accordance with religious belief and then using our fund management capability we create a well balanced portfolio.

Does PhillipCapital have any skin in the game as far as the PMS strategies are concerned? Yes, we have our companies money invested in our funds