RIGHT HORIZONS

RIGHT HORIZONS

After years of meticulous fundamental & technical research by the Right Horizons Group prior to commencement, RH PMS, a discretionary Portfolio Management Services company, began operations in 2012. Their portfolio performance under choppy market conditions also demonstrates that they have become experts at selecting stocks that can perform well when adjusted for risk. Their fund management team has a collective experience in investment and research of more than 40 years. With the help of CFA, IIT, and IIM graduates, it is led by Mr. Anil Rego, a seasoned investor with more than 20 years of expertise. RH PMS is a one-stop shop for investors, providing a wide variety of strategies under one roof, ranging from products based on artificial intelligence to strategies categorized by market capitalisation.

Mr. Anil Rego – Founder, MD & CIO

A seasoned Investor for over three decades, following a contrarian style Chartered Financial Analyst & MBA from ICFAI Corporate Experience in Business Planning, Corporate Finance, Mergers & acquisitions with Wipro Technologies. A Regular & Featured Speaker on Business Television Channels and a regular Contributor to Articles in Print and Online media. A Panelist at various International Conferences, Seminars, Symposiums, and Global Events. An Author having Penned his own experiences, a Bestseller “Honey, I Lost All Our Money!” A Philanthropist making a difference to the Underprivileged

Mr. Prabhat Ranjan, CFA – Co-Fund Manager

Prabhat Ranjan has over six years of experience in equity and investment research He has done his B.Tech from BVP, Pune, and MBA from Delhi School of Economics CFA charter holder from CFA Institute, USA He covers Manufacturing, Cement, Chemicals, and Automotive, among other sectors at Right Horizons Previously worked as an Investment & Research Associate at Client Associates

Mr. Vijay Chauhan – Co-Fund Manager

Vijay Chauhan is a B.Tech graduate from IIT and has an MBA from IIM He covers Financial Services, Pharma, IT, and consumers, amongst other sectors at Right Horizons He has a successful Track record of investing in Indian Small Cap and Mirco Cap companies

Mr. Piyush Sharma – Fund Manager

Piyush, born and raised in India, is the Fund manager of Right Horizons Minerva Funds. Having spent time with Citigroup and the Bombay Stock Exchange in India, he moved to the United States in 2002, where he covered stocks within Business Services, Autos, Consumer Products, and Financials with Sanford Bernstein, Longbow Research, and Avondale Partners, working in teams that received accolades from leading institutional research arbiters, including Institutional Investor (II) and Greenwich Associates. Piyush received an MBA from the University of North Carolina at Chapel Hill, MS, from MNNIT, and a BS in Accounting from the University of Allahabad.

Mr. Satwik Jain – Fund Manager

Satwik Jain is the fund manager of RH Perennial Fund He has previously led the equities asset allocation at one of India’s largest multi-family offices- Client Associates He has done MBA- In finance & Marketing from IMT, Ghaziabad, CFA Level 2 &FRM Part 1

Core & Satellite Portfolio

Right Horizons PMS employs a distinctive strategy known as "CORE AND SATELLITE". About 80% of the portfolio's core businesses are capital-efficient high-growth enterprises. With a wider margin of safety and superior risk-reward potential, the contrarian bets in the Satellite portion of the portfolio are used for tactical allocations. They have routinely produced alphas using this strategy over the years.

Bottoms up Stock Selection

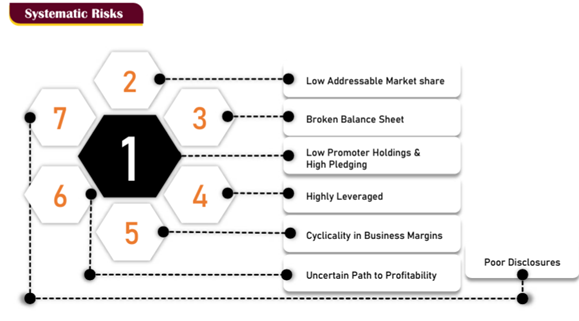

The RHPMS research team uses a bottom-up strategy to stock selection, putting more emphasis on the core elements of a company's operations than the macroeconomic environment as a whole, such as sustainable growth, market size, and promoter stake. The goal is to invest in businesses that outperform both their peer group and the overall market in the long run, while also keeping an eye out for signs of unsystematic risk.

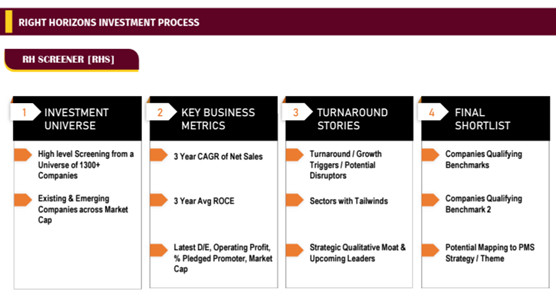

RH Investment uses a four-layer strategy to choose companies that align with their concept. RH Screener selects companies with strong fundamentals from a pool of more than 1,300 companies. Companies are then further screened for turnaround stories, potential disruptors, moats, and emerging leaders. Companies are then given scores based on a wide range of criteria in accordance with the RH Scorecard system.

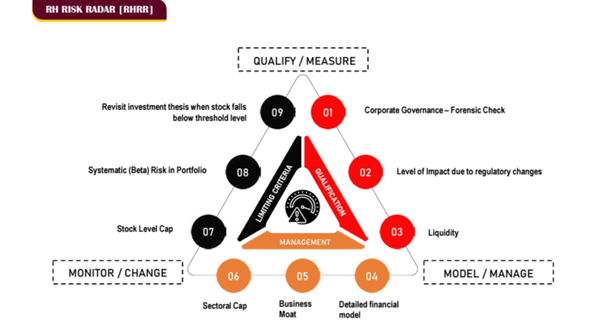

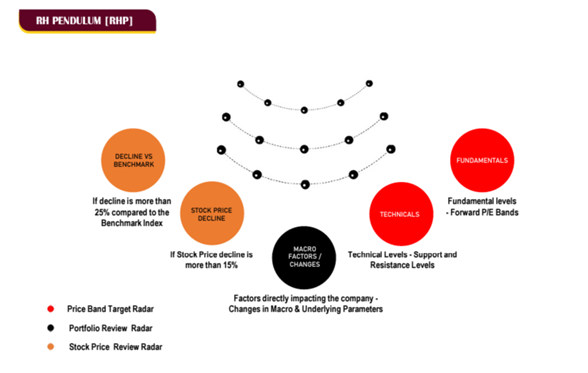

Businesses that meet certain requirements that reduce systematic risk and diversify unsystematic risk in the portfolio are examined by the RH Risk Radar. The RH Pendulum is a re-evaluation methodology that re-evaluates enterprises in the event of price decreases to see if the structural factors supporting the company have altered.

We conducted an exclusive interview with Mr. Anil Rego - Founder, MD & CIO in order to know Right Horizons in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

What is the approximate weightage you assign for your fundamental and technical research in the investment process?

We only make investments and sell positions based on fundamental analysis since it enables us to estimate a company's fair or intrinsic worth based on factors like its business model, competitive advantage, corporate governance, and growth prospects. When the choice to invest or exit is made based on fundamental factors, we employ technical analysis more to better time the entrance or departure point.

Do Large cap (Business Leaders) have an advantage over mid & small caps in volatile economic conditions?

Large-cap schemes typically perform better when there is greater negative volatility and when interest rates are rising because the market views them as providing a margin of safety, and investors gravitate towards such businesses because of their pricing power and lower debt. Companies in our strategies' portfolios have pricing flexibility to pass inflation in input costs on, lesser leverage compared to sector peers, and earnings that are comparatively resilient to economic downturns. Our mid and small cap strategies typically outperform their respective benchmarks in such economic times because the market respects the quality metric. In addition, the RH Flexicap approach gives you the freedom to switch between large and mid- or small-cap stocks depending on your market perspective.

Does RH Screener include SME companies? RH Screener filters businesses with solid fundamentals from a universe of one thousand three hundred listed companies with the highest market cap. SME companies are excluded from this list. Do you hedge for the systematic risk allied with the portfolio?

Markets always carry a certain amount of systemic risk, which cannot entirely be hedged. Models that characterize the risk-return connection and provide the percentage of asset allocation required to reduce systematic risk have been used to develop evaluation tools. Our extensive knowledge of market cycles has also assisted us in reducing this risk. We have procedures in place that have determined allocation restrictions so that additional risks can be diversified away without negatively affecting the performance of the portfolio. Maximum exposure on the stock level is capped at 15%, with a complete range of 20 to 25 stocks in the portfolio. Sector exposure is capped at 30% of the portfolio, or equal to the weightage of the index (whichever is higher).

Other than gold ETFs, what other asset classes are getting your closer attention? RH Flexicap is flexible to move across market caps based on the market conditions and in case of market uncertainties or if volatility increases on the downside. To reduce the impact, we look at raising cash or investing in gold ETFs due to its low correlation with equity and other asset classes. We also have multi asset portfolios that typically hold- goldETFs, debt (through MFs and Bonds) and equity (both stocks and MFs).

How often do you swing the RH pendulum, or does it depends on its own? Our concept, RH Pendulum, is designed to reassess enterprises when they become overpriced or undervalued. In order to phase in entry or exit, we also research the technical aspects of the equities. We examine the firms we hold if there are price drops of more than 15% or if the portfolio declines by more than 25% in comparison to the benchmark. This is done to see if the structural underpinnings of the company have altered. Furthermore, it should be emphasized that the RH Pendulum appears to be focused on the medium to long term rather than on short-term trading.

Brief on RH Flexicap stock selection approach. Does RH Flexicap follow a top-down approach?

We employ a bottom-up strategy to stock selection, putting more emphasis on the fundamentals of the company than the entire macro environment, such as Value generation elements, sustainable growth, Market size, and Promoter ownership in the company. The goal is to invest in businesses that outperform both their peer group and the overall market in the long run, while also keeping an eye out for signs of unsystematic risk. From a pool of over 1,300 companies, we select those with strong fundamentals and further examine them for turnaround stories, potential disruptors, moats, and emerging leaders. Based on a wide range of factors, we assign scores. Companies are chosen to diversify unsystematic risk and reduce systematic risk based on their eligibility scores based on a set of criteria and their capacity to complement the portfolio. Despite the fact that the portfolio is mainly bottoms up, we do track sectoral allocations and have the ability to fine-tune the weights of the companies in the portfolio based on the overall sectoral view. From a risk management standpoint, this is also done.

Did IT stocks bottom out completely or yet to fall in case of a recession in the USA? Throw some light on the current landscape of the Indian IT Sector. Great demand contributed to the Indian IT sector's great success in FY22, while the decline in Nasdaq caused sharp corrections in stock prices. Even while the market is still healthy, revenue growth would be constrained by a US recession because most IT services companies have the greatest geographic exposure to the US. Additionally, the margins' drop to pre-covid levels is being impacted by the rising employee expenditures. Furthermore, the sector will soon be harmed by rising interest rates around the world. Given that the fundamental growth drivers outweigh the short-term headwinds, we have a positive long-term prognosis for the sector. As a result, additional corrections might be employed to build up stock in the industry.

Is India's premium valuation justified compared to the emerging market peers? In the past, the MSCI India Index, which measures Indian stocks, has generally traded at a 44% premium over the MSCI EM Index. According to the P/E multiple as of June 30, 2022, Indian Equities were trading 72% higher than Emerging Markets. While India has been and is anticipated to continue to be one of the fastest-growing emerging markets, other elements such as strong infrastructure, desirable demographics, corporate governance, diverse industry and company composition, relatively lower exposure to cyclicals, benefits in manufacturing from China+1, advantages of digitization and various government reforms, relatively lower government ownership companies that make up the index, and resilient corporate earnings also play a role. Additionally, on the strength of strong profits growth, valuations as indicated by the Nifty's PE ratio have dropped significantly and are now at favourable prices relative to historical averages.

Brief your expectations on Foreign Direct Investment (FDI) into manufacturing in FY23. Under the FDI policy framework, the Indian government has carried out a number of reforms in industries like insurance, military, telecom, financial services, pharmaceuticals, retail trading, and e-commerce. As MNCs seek to establish a secondary base to their Chinese manufacturing operations, this may accelerate. The Indian government has made various efforts and approved a PLI scheme for plants for vital starting materials, with the commercial development of the plants projected to start by FY24, despite the fact that the macro uncertainty has caused outflows of investments in the last nine months. As a result of these activities, global conglomerates are establishing manufacturing facilities in India, positioning the country to become a powerhouse for high-tech manufacturing. Aside from consumers, manufacturers will gain from the lower interest rates than in the past.