Sageone Investment Advisors LLP

SageOne

Samit Vartak, who also serves as the Chief Investment Officer, founded SageOne Investment Managers LLP in 2012 as an investment manager with a focus on the Indian equities market. Samit has worked in the industry for more than 25 years, spending time in both the US and India. For his stock selection, consistent investment philosophy, integrity, clarity of thought, and investment memos, he is one of the most well-known figures in the Indian investment management sector. SageOne manages almost INR 2,300 crores (from just 2 crores in 2012) of client assets through Portfolio Management Services (PMS), Alternative Investment assets (AIF), and advisory services supported by a very strong in-house research team, with an excellent performance of 30% CAGR since inception.

Mr. Samit Vartak, Founder and Chief Investment Officer (CIO)

Samit Vartak is the Founder and Chief Investment Officer of SageOne Investment Managers LLP. Samit has been investing in the equities markets since 1999 and has experienced and studied many bull and bear cycles over the last two decades. He has worked closely with various company managements in the US and India advising them on business strategy, profit optimization, growth and valuation. This experience forms the backbone that helps him better understand businesses and their fair value. He has been early in identifying and investing in multiple businesses across industries before they catch market attention. Samit actively shares his knowledge and learnings through widely followed investor newsletters, lectures at CFA society/industry forums/business schools and media interviews. Samit returned to India in 2006 after spending a decade in the USA working initially in corporate strategy with Gap Inc. and PwC Consulting, and then with Deloitte and Ernst & Young advising companies on business valuation and M&A. Samit is a CFA® charter holder, an MBA from Olin School of Business of the Washington University in St. Louis and holds a Bachelor of Engineering degree with Honors from Sardar Patel College of Engineering (SPCE), Mumbai University.

SAGEONE’S INVESTMENT PHILOSOPHY

SageOne's investment approach is built on a thorough understanding of a business, planning for the future by considering how the business will change over the next three to five years and how it compares to the competitors. Additionally, extensive field research that includes speaking with key competitors and supply chain participants is required. SageOne upholds process rigor and doesn't skimp on the breadth of study.Because of this, it has been able to recognize numerous multi-baggers, including Bajaj Finance, PI Industries, Kaveri Seeds, Deepak Nitrite, APL Apollo Tubes, Balkrishna Ind, Aarti Ind, Godrej Properties, Navin Fluorine, Sequent Scientific, Apollo Tricoat, La Opala, Page Ind, Amara Raja Batteries, and many more. More significantly, compared to the markets' failure rate of between 25% and 30%, SageOne's failure rate (negative returning exits) has been relatively low at below 15%.

SageOne’s Investment Philosophy:

High Growth Businesses

It looks for businesses that gain market share which contributes significant portion of earnings growth. The business should have long-term growth potential of above 20% per year and it should not require too much additional dilution (other than for financial companies) of equity to achieve such growth.

Managements who execute successfully

In India the most common factor in identifying multi-baggers is the entrepreneur/management who is competent and executes successfully in all kinds of economic environments. Quality of business and promoter is necessary but not sufficient condition for investment success. Also just studying the history doesn’t guarantee success. It’s more of a starting point. Your understanding of how the company is positioned for the future against the competition and how the management executes the strategy is important. All these factors have been key to SageOne’s success.

Sustainable Competitive Advantage

SageOne looks for businesses with long-term competitive advantage validated by market leadership, in attractive industries from the point of view of long-term value creation. Return on capital (ROCE) is a very good indicator of the quality of the management team and the competitive advantage of a business. Typically, SageOne looks for sustainable ROCE and ROE of at least 20% that has been achieved without too much leverage (debt).

We conducted an exclusive interview with Mr. Samit Vartak - Founding Partner and Chief Investment Officer in order to know SageOne Investment Managers LLP in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

SageOne builds portfolios in high conviction growth ideas available at prices at or below fair value. At the current juncture, how much of the stock universe is trading below fair value? Is there value in markets, or just limited to pockets? Finding stocks that are undervalued is becoming more challenging, but finding stocks that are valued fairly is not that difficult. The majority of the equities in our portfolios, in my opinion, are trading close to fair value. In general, when equities are materially above fair value, we sell them or reduce our holdings. The bottom line for us is that we select solid companies that have high rates of sustainable growth and are not overly reliant on the economy. We don't mind getting the valuation a little bit wrong, but we can't afford to get the business part wrong. While with the latter you run the risk of permanently losing your capital, with the former you may lose a few quarters of returns. Markets as a whole are far higher than usual historically, but if the economy experiences a protracted upswing, these valuations might end up being reasonable. This is where using mathematics to show that valuations based on quantitative data (PEx) are pointless. Focusing on companies that you have a better hold on and where you can get a lot clearer knowledge of the cost to pay is more effective.

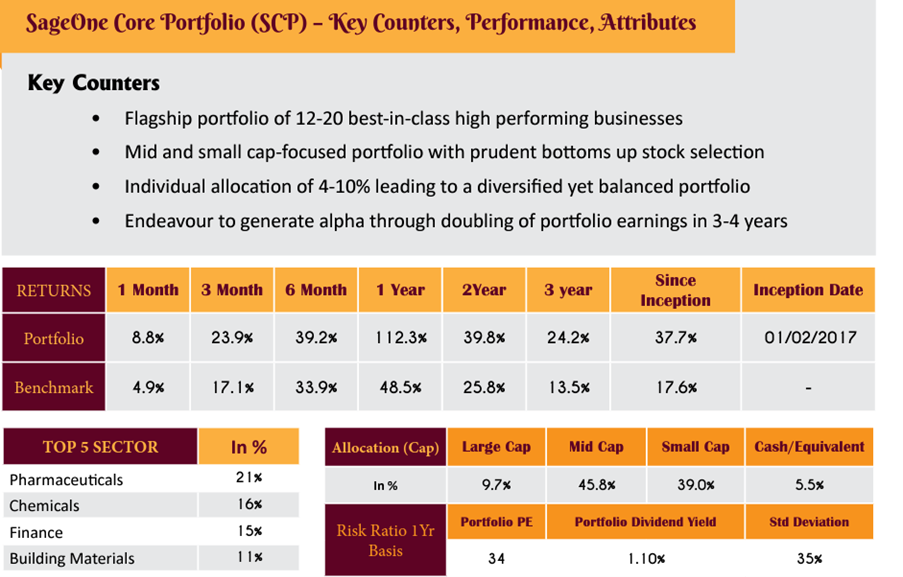

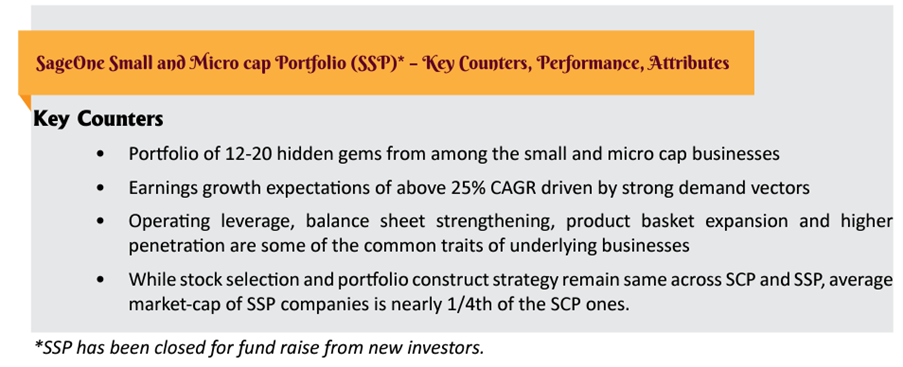

Your hunting ground is generally beyond the top 100 companies. Why? Do you feel the top 100 companies don't offer consistent opportunities for growth and are at attractive valuations? According to our investment strategy, we should only invest in businesses whose earnings are expected to double over the following three to four years, whether at fair value or below. This is in line with the 20–25% CAGR returns we anticipated. We would love to invest in large caps since they give fund managers more liquidity and flexibility, but we rarely find what we're searching for there. As a result, we frequently invest in equities outside the top 100 that we anticipate will eventually reach the top 100 throughout our investment horizon.

In your actively managed strategies, why do you require a minimum investor contribution of Rs 2 crore when the minimum ticket size charged by peers is Rs 50 lakh? We picked up the phone because it was a business call when SageOne was just getting started. The most valuable resources for a fund manager are time (particularly time spent conducting research) and serenity. We are well aware of that. It's crucial to have investors who are aware of the risk involved with equities investing and who have gone through significant drawdowns in order to feel at ease. With a Rs. 50 lakh minimum ticket, we would attract a lot more investors who most likely would participate with us while ignoring the dangers associated with investing in mid- and small-cap stocks and instead would be motivated by historical returns. Many might have missed a significant drop of more than 25%, and when it does, some of them would panic. A fund manager would have to spend a lot of time controlling the investors at these periods rather than looking at the fantastic investment possibilities that are readily available. It hurts so much to see investors acting so frantically. Investors spend a lot of time assessing us and comprehending the risks associated with our plan with a Rs. 2 cr minimum. Additionally, we visit with each person privately to assess temperament and risk tolerance. Can be done in smaller groups rather than in mass. The 80:20 rule is another factor to consider from a commercial standpoint. This would be even more skewed to a 90:10 ratio with a Rs. 50 lakh minimum, meaning the top 10% of consumers will contribute 90% of the AUM. We don't mind skipping the extra 10 or 20% AUM because it greatly minimizes the complexity of the non-investment function and frees up time to concentrate on returns.

In the case of SageOne Core Portfolio (SCP) and SageOne Small & Micro Portfolio (SSP), your portfolio stock weighting is based on conviction. Is this 'conviction' a result of a process or it is the fund-manager's call entirely? Process is what helps build the conviction, but it’s extremely difficult to quantify conviction. Hence the resultant weight is a combination of process and the fund manager’s qualitative call on the business potential.

Tell us about your exit framework for a portfolio stock. We are not a buy and forget kind of investors. We are proactive in exiting if circumstances warrant. Our holding period is around 3-4 years. Most often in 5 years, 80-90% of our portfolio companies would have changed. There are many reasons for which we take a call on exiting. EXCLUSIVE FUND MANAGER INTERVIEW WITH MR. SAMIT VARTAK • Fundamentals of business have deteriorated and our original assumptions of earnings doubling in 3-4 years no longer look feasible • Recent corporate actions indicate diminished focus on creating shareholder value • Price has gone beyond what’s warranted by fundamentals. We are patient here though. • Another stock with similar fundamentals (or valuation) but with much attractive valuations (or fundamentals) has appeared on the horizon • Reducing exposure in the stock/sector or changing equity allocation

Do you see any macro risks for the portfolio emanating from the domestic interest-rate situation? We are keeping a close eye on how the Indian economy is recovering from the COVID 19 disaster. The dramatic increase in profitability over the last three quarters was mostly caused by margin expansion rather than volume growth. Many businesses carried inexpensive inventory during the initial wave, and as the cost of goods and services rose, profit margins grew. We think it won't be simple for these margins to endure in many industries. Additionally, although corporate India is doing well, India as a whole is not doing well, which will affect things like consumption and credit growth. In order to lessen reliance on the recovery and growth story of India, it is necessary to establish a well-balanced portfolio with good exposure to export-oriented sectors. Our portfolio is structured with such balance and includes businesses that experience structural growth as opposed to cyclical dependency. The fundamentals of the companies in our portfolio will be little affected by domestic interest rates, but market sentiment and consequently market values may be affected.

What is SageOne's skin-in-the-game in the portfolios it manages? Over 90% of our CIO's wealth is held in the portfolios of SageOne. Additionally, all workers contribute annually to the SageOne portfolios through a pooled PMS account.