Sameeksha Capital Pvt Ltd

Sameeksha Capital

For all of their investing needs, HNI and institutional investors can turn to Sameeksha Capital for assistance. They currently provide the following essential services: (2) Global and domestic portfolio management services with an emphasis on ETFs and mutual funds for both local and international investors. (1) A multi-cap equities approach as PMS offered to domestic and NRI investors.

Bhavin Shah, the company's creator, founded Sameeksha (meaning "Thorough Analysis") Capital in 2015 with the goal of professionally managing and investing his own savings held both inside and outside of India while also allowing other investors to profit from his efforts. As a result, Bhavin manages all of his Indian equities holdings using the same investing strategy that Sameeksha provides to outside investors, and his investments account for more than 15% of the PMS's AUM. This dedication is exceptional and in line with the maxim "putting your money where your mouth is." They think that acting in the best interests of investors.

Sameeksha rejects the use of catchy catchphrases, buzzwords, jokes, or "easy" subjects in her advertising. It is not Sameeksha's intention to romanticize or oversimplify stock selection and portfolio management. Sameeksha rejects short cuts and is very skeptical of formula-based scorecards that frequently produce false positives. For them, investing is getting their hands dirty and working very hard every day to locate real investment possibilities that they feel confident spending their own money in while avoiding landmines.

The investment team at Sameeksha has over 70 years of collective expertise in the industry. On the website sameeksha capital, you can read a thorough profile of their founder and fund manager Bhavin Shah as well as their advisor Eswar Menon. Eswar and Bhavin each have a proven track record of success in portfolio management and equities research. Bhavin has established himself over the past 30 years through each of his positions in the Asian, Global, and Indian contexts. He is admired for his integrity, leadership, creativity, and excellence as well as his propensity for making foresightful decisions.

Both Bhavin and Eswar are very comfortable understanding complex industry dynamics and disruptions that may shape the future of companies available for investment and also understand the importance of use of technology in the field of investing thanks to their prior education and experience in the high-tech sector. Research is the foundation of everything Sameeksha does, and their research team is made up of experts from a variety of fields, including engineering and pharmaceuticals. They are passionate about research, respect Sameeksha's procedures, and conduct in-depth analyses to produce investment recommendations that Bhavin and Eswar must rely on.

Over the past little less than five years, as well as for shorter durations of the last one, two, and three years on an aggregate basis, Sameeksha has been able to generate industry leading absolute and risk-adjusted performance. They are able to tailor investment choices for each of their investors thanks to technology, protecting them from the disadvantages of the model portfolio strategy. Regardless of when an investor made an investment with Sameeksha, they had fantastic results as a result.

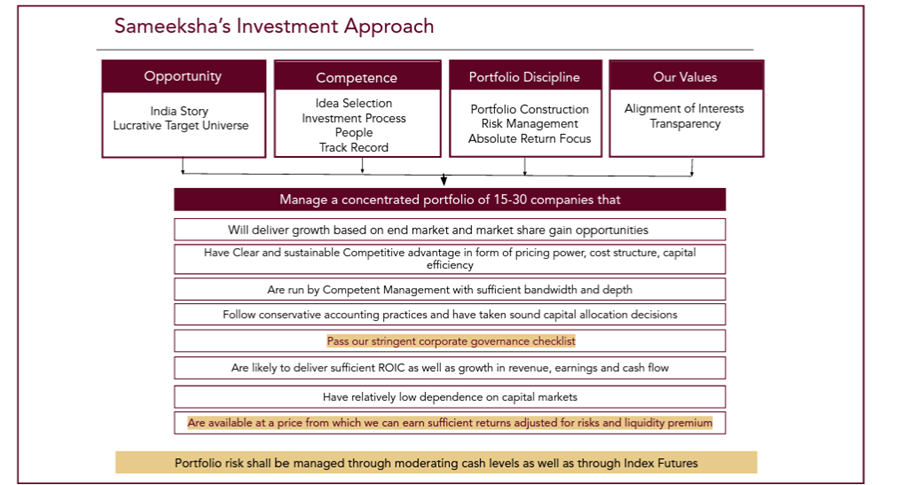

Sameeksha is focussed on investing in Indian companies across market capitalization (with greater emphasis on mid and small cap companies that are not fully discovered) that meet their stringent investment criteria. (Exhibit A)

While Sameeksha's investment strategy may sound similar to those of other funds in many ways, there are a few distinctive elements that seem to set it apart. First off, the corporate governance history of any company Sameeksha invests in is given a great deal of weight. Companies that would ordinarily be appealing but have a dubious history are typically shunned. Also, Sameeksha has the option of resigning from the position if a corporate governance red flag is later found.

Second, Sameeksha only makes investments at a price at which adequate risk-adjusted returns (i.e., greater than 10% CAGR depending on the type of business, company size, and stock liquidity) may be anticipated over the following two to three years. An extremely complex and exclusive dynamic discounted free cash flow model is used to calculate expected return, and it is triangulated using conventional valuation metrics. Unless additional information since the initial determination justifies keeping the name for a longer period of time, a position is exited when such returns materialize.

Third, Sameeksha controls both individual company and overall portfolio liquidity risks by a set of guidelines that allow for the purchase of very tiny but well-priced businesses while limiting the portfolio's exposure to the extreme price volatility that such businesses frequently display. As a result, investors gain from Sameeksha's capacity to spot and place sizeable wagers on great small and mid cap possibilities that are still under the radar as well. In comparison to many other PMSes, Sameeksha invests in slightly more companies—up to 30 generally versus 10-15 in many cases—and does so on purpose to reduce portfolio risk.

Fourth, although being relatively large, Sameeksha can identify businesses that are understudied, poorly understood, or relatively small and thus have not yet been completely discovered. These businesses provide the best chance of producing outperformance.

Fifth, Sameeksha decides to control market exposure by making active cash calls based on macroeconomic indicators as well as by varying the portfolio's cash position based on the opportunity set and the allure of investment ideas.

Sixth, unlike many PMSes, notably the big ones, Sameeksha does not adhere to the widely used model portfolio method. According to Sameeksha team, such a method effectively entails copying the mutual fund model, in which any investor injecting new capital into the pool ultimately owns all the current equities regardless of how appealing they were at the time the investor injected the capital. Instead, Sameeksha treats each new investor contribution or additional contribution from an existing investor as unique and purchases only those stocks for the portfolio that are offered at a price that Sameeksha deems to be sufficiently alluring to have the potential to produce the required rate of return. It demonstrates Sameeksha's dedication to and capability in using technology to provide value to its investors that Sameeksha has invested in developing in-house software to enable this happen effectively and at scale.

Seventh, the fund manager's personal financial commitment brings a fundamentally different approach to investing. Sameeksha is not hesitant to make investments that, while they may be seen negatively by some, particularly those who are in charge of judging fund managers, are wise long-term choices. The returns that investors who have stayed with Sameeksha for a longer period of time have received (23.6% CAGR, 21.1% CAGR, and 28.4% CAGR versus benchmark returns of 15.2%, 13.8%, and 11.3% for periods of 5 years, 4 years, and 3 years, respectively) clearly demonstrate this.

Eighth, having interacted with top management of businesses with market caps ranging from $50 million to $100 billion, as well as being the first call for international institutional investors on some of the biggest tech companies in Asia (TSMC, Infosys), Sameeksha fund managers are able to be successful in getting time from business owners and CEOs to engage in two-way discussion on their business and on a wide range of issues such as financing options, capital allocation, dividend policy, and other topics. Such interactions could occasionally be quite helpful for sourcing liquidity as well as decision-making.

The fund manager and the Sameeksha team, in particular, believe in "rolling up one's sleeves" and doing the necessary research to comprehend any company, as opposed to relying just on the brokers for information. They have no qualms about traveling to a remote location without official permission from the company and speaking with locals to learn the truth about a situation, or they have no qualms about sitting through a wholly formal AGM in order to have a chance to ask important questions to a business owner who is otherwise inaccessible. Some of Sameeksha team's counterparts do take similar pains, but not many.

Tenth, Sameeksha aspires to be a learning- and technology-focused firm that seeks out continual improvement in its processes. They are able to build an ever-growing knowledge database of investible companies in India thanks to their investment method, and such a database is extremely helpful when revisiting an opportunity and working on fresh investment ideas.The Sameeksha crew is completely conscious of the fact that mistakes are made frequently. How to correct such errors is crucial for them. Because Sameeksha employs technology to record their work, they are also able to analyze their prior investment choices thoroughly, identify the kind of mistakes that were made as a result, and find potential solutions to prevent them in the future.

Finally, the investment strategy is scalable because Sameeksha invests across market capitalization and sectors. Over a 4.75-year period, the portfolio of Sameeksha's biggest client saw total gains of 21% CAGR.

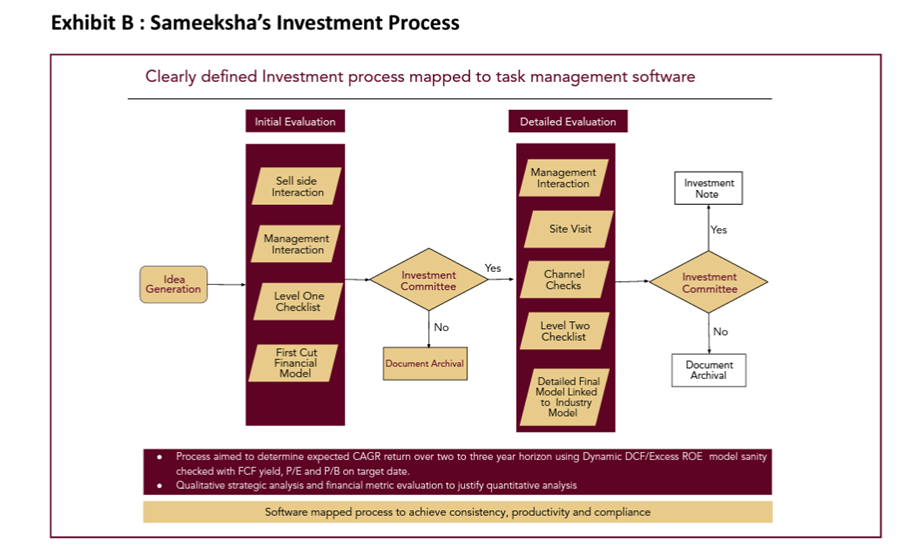

A research-based, rule-based investment process is used by Sameeksha. To ensure that all relevant aspects important to the process of equity analysis are taken into consideration, their process include a set of rules that must be adhered to faithfully. However, there is still room for the inventiveness and originality needed to gain a thorough grasp of every investment opportunity. Based on the lessons learned from previous investment decisions, both the rules and the compliance processes have been strengthened. Ample use of technology ensures that these standards are implemented correctly, which boosts productivity and consistency and helps people avoid the dangers associated with individual biases and errors. Exposure B

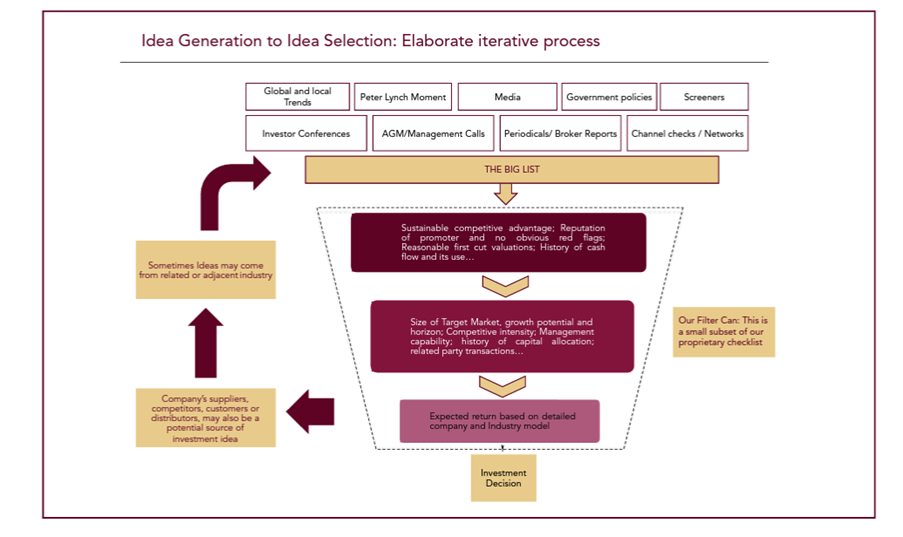

In order to properly assess the growth opportunity, Sameeksha's investment process includes interactions with the companies using both conventional and unconventional methods, the construction of a detailed financial model of the company and the industry, the completion of a detailed investment check-list, and reviews of the investment case at the beginning and end of the process by the entire research team. The investment team, which consists of the fund manager, fund adviser, and research team, is committed to monitoring changes affecting the firms in which it has invested and seeking out new potential investment opportunities. Ideas are found through a range of techniques, including quantitative screeners, quarterly results, investor events, conversations with peers, sell side reports, Peter Lynch Moments (resulting from the use of a good or service), global, Indian, or company-specific developments, and so on (Exhibit C). To decide what should be worked on first, some very rudimentary screening work is done. Ideas chosen from this step go through an initial evaluation process involving management interaction, part 1 of their extensive proprietary checklist that emphasizes comprehension of the key aspects of the business, track record of the company, and overall potential of the business. First level valuation work is done using very sophisticated tools that provide insightful data without the need to construct an extensive financial model.In order to get the essential insights, this stage may also involve engagement with individuals outside of Sameeksha. To decide whether more work needs to be done or if the idea should be abandoned, this work is given to the entire investment team, not just the fund manager.

For concepts that make it past the preliminary round of study, a thorough financial model and company analysis are conducted, and the results are then presented once again to the investment team. The ultimate investment decision is made by the fund manager, who occasionally may need more fieldwork to solidify his reasoning. Liquidity, idea appeal, and degree of confidence are just a few of the variables taken into account when determining the size of a portfolio. A task management tool is used to plan out the complete process, which helps the users follow it and ensures compliance. The Sameeksha team keeps track of the businesses where investments are made, and these names are periodically examined. The tasks related to invested companies are also mapped on the task management software. The manner of documenting all the work is clearly defined and required to be followed. Stocks that make up Sameeksha's investment universe are categorized according to whether they are held at the moment or might be a future investment candidate. The Sameeksha team decides which firms to focus more of its attention on depending on ongoing economic developments, shifts in specific industries or sectors, as well as company-specific happenings like quarterly results

We have conducted an exclusive interview with Mr. Bhavin Shah, Founder & Fund Manager in order to know the Sameeksha Capital in depth and enable our investors to make informed decisions. The questions and answers are reproduced verbatim:

Tell us about the rigorous investment process followed by Sameeksha. What role does automation and engineering research mindset play in that?

At Digital Equipment Corporation, my first position was as a microprocessor design engineer on a team that created the fastest microprocessor ever. They had created very intricate design criteria and a sizable number of verification tools to guarantee that the semiconductor chip, which contains millions of transistors, actually functions. This was done in order to secure the success of such a sophisticated engineering product. I had a lot of opportunities as a new team member to learn about the complexities of chip design and a lot of leeway to come up with a solution as long as I followed the design guidelines and my design passed the verification checks. Some of those engineering buddies from Digital who kept working as engineers are now in charge of the processors that power the most recent macbooks and iPhones, even though I switched to the world of investing. Despite the task's complexity, these former coworkers were able to produce high-quality results thanks to their engineering methodology. Since my initial position at Credit Suisse in the late 1990s as head of Asian technology research, I have grown to have a great deal of respect for such an engineering approach and have attempted to apply it to the world of investing. Key qualitative and quantitative parts of the research process have been standardized and templated at Sameeksha. In our methodology, analysts develop financial models that give us the kinds of insights we need to make investment decisions by filling out a thorough checklist (like an exam paper) and utilizing standard templates. At the same time, just like the chip designers at Digital, our analysts continue to have the freedom to research and account for each company's and industry's distinct characteristics in the model. The analyst can use the time saved by automating some of the routine administrative tasks involved in maintaining models thanks to templateization. This has made it easier for us to examine more businesses in-depth.

Why do you call your corporate governance checklist stringent?

We therefore have a 140-point proprietary checklist, as was already described. Thirty of these 140 pointers are devoted to corporate governance, which is a requirement for every company we research. Through these checklist pointers, we not only perform first-order checks on promoters, related party transactions, suspicious insider trading, auditors, etc., but also second- and third-order checks on the board members and their connections to other companies, entities belonging to other promoter groups, family members, and other businesses that are not listed under related parties. We also examine capital allocation choices and make an effort to evaluate their merits from the viewpoint of smaller shareholders. We also give a lot of weight to the prior statements and actions of the management.

How does Sameeksha differentiate its PMS offering on flexibility, customization and value focus versus its peers?

These are some of the key factors that helps us differentiate from our peers : Flexibility : There are three parts to this as to what we mean by flexibility : Invest in a variety of market caps: The stock market, in our opinion, presents opportunities in a variety of market caps. We wish to use our skills to study small, medium-sized, or large businesses to help us build our portfolio. Due to the higher upside potential offered by many small or midsize companies, and the stability provided by the large cap names, this flexibility enables us to aim for higher returns than a pure large cap focus while also achieving lower portfolio volatility than a pure small/mid cap fund. Our goal of achieving higher risk-adjusted returns depends on this combination, and our performance over the past five years appears to support that goal.

Willing to accept or reject a monetary call: In our opinion, investing during times like the covid-driven market meltdown requires a quick footed strategy. Buy and hold strategies alone may produce stunning portfolio turnover figures that some onlookers love to zoom in on, but they do not always result in better returns for investors. We are operating our PMS for the advantage of our primary stakeholders—our investors, including ourselves—rather than to satisfy the strict selection criteria of some experts who typically dislike funds with higher turnover. We are aware that this may lead to wasteful trading in our portfolio and requires the ability to make a decision about the direction of the market.This led to a greater turnover of our portfolio while also enabling us to achieve notable outperformance, which is likely to have satisfied our investors.

Buy Sell Framework: We have "Buy Below" and "Sell Above" values for each pair of socks that we buy in. These parameters are designed so that, for a given stock, we may anticipate an absolute return over a time frame of two to three years that satisfies our risk and liquidity adjusted return target. When a stock reaches its sell above threshold, we evaluate the available data to determine the best course of action for investments. We think about reducing the size of our stake or exiting it entirely if we find no reason to change that target price and the expected return is much too low for us to keep holding the stock. In essence, we would prefer to have cash rather than a stock that we cannot continue to hold in light of the fundamentals. This strategy might inadvertently aid in our exiting frothy market regions.

Customization: One clear strategy that we have followed since inception is to not adopt the massmarket/mutual fund type "model portfolio" strategy that can save us time and effort but result in suboptimal investment decisions for our investors. Instead, we treat every new capital contribution to our fund as unique. For every new account, we buy stocks that are still available at a price meeting our return expectations rather than simply copying our existing portfolio. We feel that investors in our fund deserve such customization and buying only what is available at the right price is the most sensible way to invest. This approach requires both more work as well as build out of internal capability to handle this at scale (as the number of clients increases). This is why we have developed our own PMS order management software instead of using the one given to us for free by our custodian. This software allows us to ensure we do not lose the ability to customize investment decisions as we scale up. Based on the performance data of clients with varied durations over the last five years, we can safely say that our approach has paid off very well.

Value Focus : Value investing is a highly abused term and it means different things to different people. Without claiming our version is right, we like to state that for us value investing means being able to explain value based on the present value of future cash flows derived using a reasonable set of assumptions that can be justified using sound logic. To do that, we deploy our proprietary dynamic DCF/ERoE methodology for valuations in addition to traditional methods. Every company that we invest must meet our expectations of returns based on our dynamic DCF/ERoE framework. Using this framework, we set Buy Below and Sell above levels and these levels are regularly updated based on changes to the assumptions driven by change in macro variables as well as company specific factors including quarterly results. Our framework allows us to buy not only the stocks which appear undervalued based on traditional valuation measures such as P/E or P/CF or P/B but also the stocks which may not appear undervalued based on such traditional measures but are actually good investments considering long term prospects of the company. Inevitably, our approach precludes us from buying a lot of popular names trading at very high valuations based on earnings momentum or other temporary factors, but where long-term cash flow generation is not necessarily strong.

Tell us how Sameeksha has aligned its interests with investors.

Most importantly, We have skin in the game. My first commitment to Sameeksha was to combine all of my equity assets under our PMS scheme, and since then, that dedication has only increased. I don't receive a salary; instead of being compensated for my work, I rely on the income from my own investments in the PMS. Today, my funds account for more than 15% of our AUM. No side pockets in Indian Equities exist for me. As a result, my investors and I will either drown or swim. Second, the firm's revenue generating is mostly derived from long-term performance thanks to our performance-based fee structure. This indicates that over time, it is likely that our clients will only pay fees based on CAGR returns generated.

How does the cumulative hurdle rate work mechanism to the benefit of Sameeksha investors?

We believe that investors should only pay for long term performance. SEBI has a high water mark concept but we like to go one step further. For a year in which performance is below the hurdle, we carry the hurdle forward.We believe it is only fair that investors pay for performance only after covering for the total aggregate hurdle of current and previous years in which performance was below the hurdle. This way, investors are paying for us achieving long-term performance and are not subjected to paying for fees in a windfall year, may turn out to be without adjusting for lack of performance in previous years. The benefit to investors can be easily demonstrated through an example based on this concept. How do you manage portfolio risk through moderation cash level and use of index futures? We have already mentioned managing risk through moderation in cash level. However there are times where we like the long term story of a stock and do not want to sell it, or if we would want to sell it but unable to sell it due to low liquidity, in such cases, we may use index futures to protect from downturn and hedge the current long positions. Both cash calls and hedging are like weapons at our disposal which we aim to use only when we deem to be really necessary.