Stallion Assets Pvt Ltd

Stallion Assets

Growth-focused portfolio management is the focus of Stallion Asset Pvt Limited. The company's founder and chief investment officer, Mr. Amit Jeswani, holds both the titles of Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT), which is quite uncommon, particularly in Indian markets. He continues to be one of India's youngest and best-performing chief investment officers. The business was launched in 2013 by Mr. Amit Jeswani. He holds a degree in business with finance from Kingston University in London and has been investing in the capital markets for the past 16 years. He began when he was just 16 years old, working with his stockbroker father. He founded Stallion Asset as a Research Analyst company with modest goals, and thanks to the support of his clients, Stallion Asset has grown to become a Portfolio Management Service Firm. Stallion Asset has demonstrated impressive growth in a short period of time from an AUM of a meager 5 cr in 2018 to over 500+ crores as of today by showcasing an outstanding performance of more than 25% CAGR and has grown organically through word of mouth. Stallion Asset is one of the rare players in the industry who have managed to scale an equity Research Analyst firm and start a Portfolio Management Services which has outperformed well in its fund category. Stallion Asset Pvt Ltd seeks to generate alpha for its investors by employing an investing strategy that is incredibly distinct in that they have a wonderful blend of expanding businesses (monopolies & rising monopolies).

Stallion Asset Core Fund was awarded

-The Star Performer (PMS Bazaar) for the year 2019.

- Best PMS in Multicap Category 3 Years (Risk-Adjusted)

- Best PMS Performance in sub-100 crores category on 1-year Absolute Returns (PMS-AIF World) for the year 2019.

- Best PMS across all categories 2-years Absolute Return (PMS-AIF World) for the year 2020

Stallion Asset prides itself on having a very customer-focused culture, which is why they think there should be just one fund—the CORE FUND. They have been able to establish themselves in the market by providing value for the clients by increasing their wealth, and they are still modest and diligent in their efforts to assist their clients in achieving their long-term wealth building objectives.

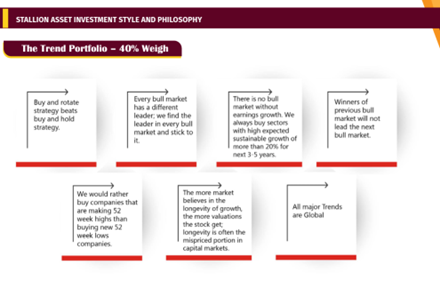

STALLION ASSET INVESTMENT STYLE AND PHILOSOPHY

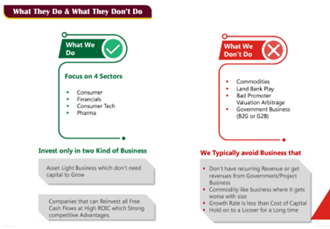

The next ten years in India, according to Stallion Asset, will be even more fascinating than the last ten. Since they are by nature growth investors, they want to take advantage of the opportunities presented in our nation as India's economy grows from $2 trillion to $5 trillion. Stallion Asset firmly thinks that not everything in India will expand linearly as it continues to develop. According to them, there will be industries that expand relatively more quickly than the overall economy, industries that are expanding more quickly than others, and backing businesses that can seize these opportunity sizes by providing a good or service to the cuswtomer are something that they keep an eye out for. The world's top businesses are those whose customers adore their goods and are very challenging to replace. They firmly think that only if all four conditions are satisfied will sustained wealth growth occur.

The aim of Stallion Asset is to invest in businesses with a clear growth path that address a sizable market opportunity, have excellent management that is driven to scale the company, and are market leaders in their industry by providing a unique product that no one else does.

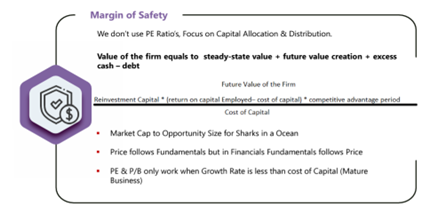

Risk management is equally crucial for their investors, even though wealth creation is of the utmost importance. They continue to be very confident that their internal criteria will be satisfied when appraising a business. Their safety margin is derived from.

THE STALLION ASSET CORE FUND

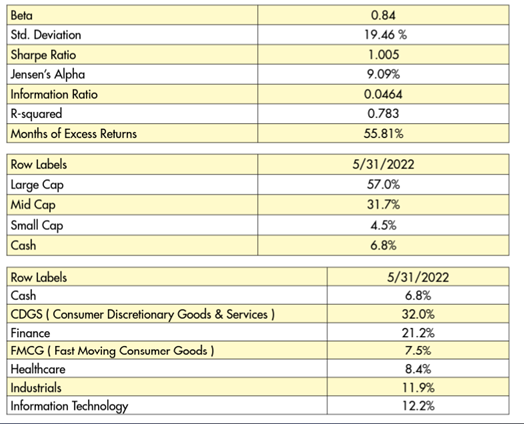

The Stallion Asset Core Fund began operations in November 2018 and has a 25% CAGR. This flagship fund's sole purpose from the beginning has been to aid the Stallion Family in their quest to amass money. The fund's structure consists of 18–25 Stocks because growth investors by nature. They recognize companies with the potential to be leaders and emerging leaders thanks to their special blend of working in the consumer, pharmaceutical, financial, and technology sectors. by making an investment in a top-quality company that is expanding and has a secular, long-lasting, and steady rate of growth. With the support of strong entrepreneurs, they are still very sure that they can continue to increase the wealth of their investors by 18 to 25 percent CAGR over the next ten years. India offers the ideal chance to benefit from expanding high-quality firms.

We conducted an exclusive interview with Mr. Amit Jeswani - Founder & CIO in order to know Stallion Asset Private Limited in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

Technology stocks corrected worldwide and higher wage cost internally and inflation is going to affect the margin of technology stocks in the medium term? Even though it's difficult to predict short-term employee attrition problems in the tech services industry, our long-term outlook is that these companies will grow at a rate of 12–18% US dollar term. Keep in mind, too, that they produce a lot of free cash flow, which is then reinvested via buybacks or returned to shareholders as dividends. Tech Services Profit Pool is 13% of Nifty 500 Profit Pool in FY2022. If Nifty Profit Pools expand at 10-12% over the next ten years, I believe Tech Services should rise much more quickly due to High ROE & Higher Dividend Payout. I don't anticipate Indian technology services companies reaching their peak profitability anytime soon.

Stallion has high conviction on consumer companies and will they remain compounders like in the past in times like this when margin are compressed and inflation is there to stay? Stallion focuses on sustainable trends, and just four sectors see significant sustainable trends. pharma; and consumer, Financials and technology. Always consider your bottom line. For example, the largest shoe company in India generates 230 Crores PAT ($30 Mln), the largest shoe retailer generates 500 Crores PAT ($60 Mln), the largest grocery retailer generates 1400 Crores PAT ($180 Mln), and the largest quick service restaurant producer generates 400 Crores PAT ($50 Mln). These numbers are inadequate, and the opportunity is enormous. As long as consumers continue to love their products and they continue to expand faster than the industry growth (gain market share), consumer stocks will continue to perform well.

Private banks is a drag in any quality focused portfolio off late and with private capex in the verge of coming back, does private banks will shine like it did in the last decade? Financials is about technology, so I anticipate more consolidation in the sector. As of the December quarter, India's banks had disbursed a total of 112 trillion rupees in loans; by 2032, this amount will have increased to 300 trillion. The only issue is who will receive a sizable share of this, who can manage credit risk, and who can excel in technology.

Since inception you were a top performer but in the last 9 months there is a lag in the performance and when do you think the portfolio will make a comeback to top of chart performance again I have no doubt that Stallion's customers will reach their goals. The correction in high growth stocks has affected markets all across the world, and although we have had a little more of a correction than the benchmark, we will still be among the better performing funds a year from now. When we reach 100% alpha in a 3-3.5 year period, we frequently experience an alpha correction. While keeping one eye on protecting cash during this bear market, my other eye is fixed on growing substantially during the upcoming bull market.

Do you think consumer technology companies are at an attractive valuation now compared to historic valuation on back of lots of degrades There are now only 7–10 consumer technology businesses listed in India. Since I enjoy bear market initial public offerings, I am hoping that 50–60 consumer technology companies list over the course of the next year. The majority of business models are currently in a "BUILD STAGE" where they are preparing for 1-2 Decades of 25-35% Growth. We are not valuation specialists in the consumer technology sector since, when compared to private equity deals, these businesses appear to be very expensive, yet when compared to the US equity market, they appear to be very inexpensive. Usually, we start with Small and wait for Business and Price to confirm our assumptions before adding extra weights. For the upcoming 1-2 decades, I am optimistic about the business potential of some local enterprises.

What is your outlook on profit growth of your portfolio estimate for next 3-5 years which will ultimately decide the return from portfolio. The Proven Monopolies Basket will do 15-20% whereas the Emerging Monopolies Basket will do at least 25-30%.

You had an Alpha of 17% over the corresponding index and when do you think the alpha will be healthy in the future?

While I cannot forecast my future alpha CAGRs, I can state that we are improving every day. If our organization previously achieved a 17% alpha CAGR, we should target higher in the future and build a stronger process in current bear market. I would be dissatisfied if my Absolute Alpha in the next Bear to Bull Phase is anything less than 100% because, in my experience, Bear Market Hard Work only pays off in the Bull Market, and the next Bull Market will likely arrive in 2024–2025.

What is your message to the current customers and potential investors considering stallion

First of all, thank you for placing your trust in Stallion. This is a 10-year trip during which we will experience a bull and bear market roughly every four years. More money will be made in the next ten years in India than was created in the previous 75 years combined since independence. The only question is how much money we make as the country moves from 3 trillion to 6 trillion dollars over the course of the following ten years. We anticipate that Nifty 500 Earnings will increase by 11–12% at the same time, from 6.5 lakh crores now to 17 lakh crores in 2032. The Incremental 10.5 Lakh Crores of Profit Pool will not be distributed evenly; some companies will experience 5% growth variously, 11% and 25%. We predict that those with growth rates of between 15 and 25 percent will see the most market capitalization boost. We will continue to keep the historically low beta (risk) of our portfolio. We are convinced that we can help our customers achieve their goals and we will go above and above to meet their expectations while being entirely open and honest with them about our opinions following each interaction.