Turtle Wealth Management Pvt Ltd

Turtle Wealth

The first thing that comes to mind when you hear the word Turtle is "Slow and Steady," but very few people are aware that Turtle and Tortoise are distinct; while the former is "Slow and steady," the latter is "Fast and Consistent." They are Fast & Consistent because they share the same values. The turtle is a symbol of "longevity" as well. A Turtle expects to be among "The Henokiens" when she is 100 years old on average. In business, investing, and as an organization, they desire longevity. Additionally, they are a boutique company that focuses on PMS and has two funds, 212° Wealth Mantra and 212° Growth Mantra, each with a different set of goals. They also provide services such as 212° Portfolio Assessment and Family Office Management in order to have a HALO EFFECT on their company. The CEO and Fund Manager of Turtle Wealth is Mr. Rohan Mehta. In 2012, he helped cofound Turtle Wealth. In 2019, the business was granted a SEBI license, and he was appointed the fund manager of two PMS funds. He is one of the nation's youngest fund managers. He also wrote the best-selling book 212° The Complete Trade, and over the previous ten years, while managing assets worth over $100 million, he has generated returns of more than 21% C.A.G.R. He has also trained over 1 Lac people in financial literacy and been recognized in Forbes Magazine India 2021. Qualifications: Rohan has 16 years of experience working in the financial sector and has an MBA. He also made appearances in a number of media outlets, including CNBC, Bloomberg, Times of India, etc. "Investing in businesses where you earn in times x and lose in%" is his investment mantra. As a fund manager, he wants Turtle Wealth to be the top wealth management firm in India, with $1 billion in AUM and a global reach. He also aims to produce 10 times as much in 10 years.

What to buy?

According to their PPP Process, they purchase businesses with exceptional business and meeting management that are guerrillas in the market against all other monkeys. This is what they adhere to religiously: - ATH Profits - Meeting Management - ATH Price

When to buy?

They buy when all the 3 PPPs Collaborate with each other.

How much to buy?

They purchase 15 stocks, and their Turtle Risk Management System determines the allocation. In the initial stage of a stock investment, they do not invest less than 4% nor more than 6%. The maximum investment amount per stock is 10%,and portfolio trimming is rare. They have a belief in 50% of the Top 5, 30% of the Next 5, and 20% of the Most Recent 5 Stocks.

When to exit?

Prior to entering a stock, they make an Exit decision. They plan for three different forms of exits:

- the price-based exit, also known as the happy loss

- Exit strategically, choosing when to do so based on stock performance and growth

- Exiting if the stock is not performing and not correcting

When to scale up?

They Scale up and give more allocation to the performer stock, as per the company improves the performance in PPP Process

Investment approach and process

They are aware of the strength of the investing process. Finding businesses where value exceeds price is always a struggle between your good and bad emotions, and this struggle is crucial. At Turtle Wealth Management, they strive to maintain a process-oriented environment so that emotions never affect their investing choices. To get rid of any feelings connected to stock selecting, they developed a procedure they call the P.P.P. Stock selecting procedure. The first "P" in their P.P.P. approach stood for PRICE; here, their objective is to identify Good Businesses that are emerging from a long-term consolidation zone and surpassing their ATH, or All Time High. Additionally, they decide their EXIT before ENTRY with the aid of their robust risk management system. They first recognize that a client cannot tolerate a high level of volatility in his portfolio. As a result, they adhere to an average risk management strategy of 18%, taking 1.2% risk of the invested value in each company (15 stocks x 1.2% = 18%). This is only achievable if the trader knows when to sell their stock coldly and without hesitation. Their stock allocation is also made automatically according to the quant; no human emotions are involved in the decision-making process. They looked at the company's fundamentals to locate one with strong fundamentals where Value > Price and Profits at ATH. Their second "P" stood for PROFITS.

In keeping with their ethos, they invest in Guerrilla Business through the 212° Wealth Mantra fund, a business that dominates its industry. In the 212° Growth Mantra, they invest in businesses that are experiencing a turnaround. For years, nothing noteworthy occurred in the company, but recently, the company has started to perform remarkably, which may be the consequence of new management, entry into a new industry or market sector, or a change in the business cycle. They spoke with management or conducted snoopy research to fully grasp the firm in order to ascertain whether there were any shenanigans during their third "P" step, which stood for PEOPLE. It is quite difficult for a company to pass their filters and become a part of their portfolio because, out of the 20 companies on their prospect list, only one or two do well on the test.

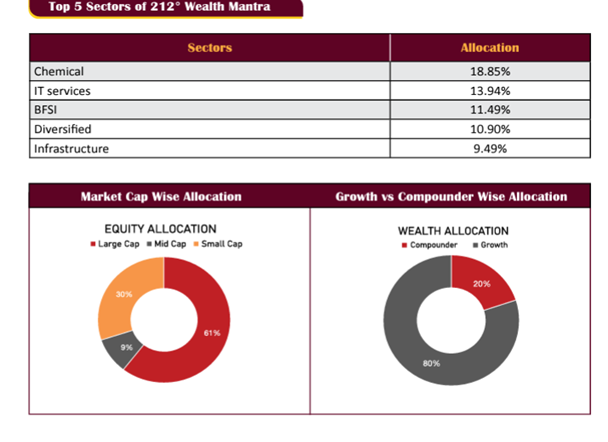

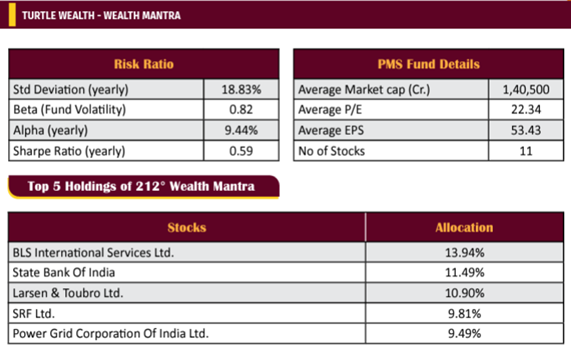

Wealth Mantra

With respect to market cap and sector, Turtle Wealth employs a bottom-up stock selection methodology in addition to a multi-cap investment technique. They invest in Guerrilla Businesses through the 212° Wealth Mantra Fund. Here, they mostly anticipate the Leadership quality of the company, whose profits have increased in the last decade with a turnaround business narrative and whose price has remained stable for at least a decade. They have a small portfolio of 15 stocks, with a concentration on owning businesses that dominate their industry. Over time, they have seen that market leaders typically have a bigger market share after the slump, while smaller businesses typically find it difficult to survive. With a maximum investment allocation of 10% and a minimum investment commitment of 4% in each stock, there is no stock overlap between the two funds. Fundamentally, they see that in addition to the company's market leadership, it also has a high entry barrier and a competitive moat. Additionally, they see that the business has a history of horizontal growth and yet has room for future expansion. Additionally, they are interested in the business with the lowest debt to equity ratio because debt is inherently dangerous and larger debt makes it more likely for a business to file for bankruptcy in the case of a recession. It also makes it more painful for the business in the event that interest rates rise. To ensure the least chance of disruption, they also seek for a company with a strong corporate governance structure and a track record of stable financial performance. They typically keep equities for two years, but this can vary from stock to stock. If the stocks do well, they stay; if not, they sell them. Everyone can invest in any of their funds, but those who want to do so in a business with a moderate risk to reward profile and who desire long-term compounding wealth with lower volatility can do so in the 212° Wealth Mantra Fund.

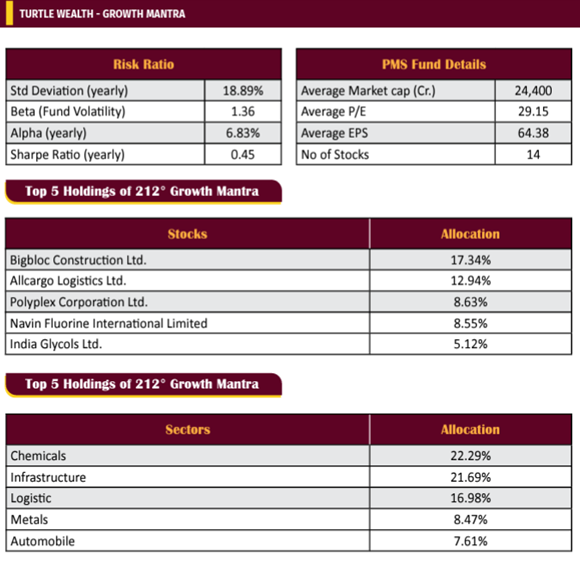

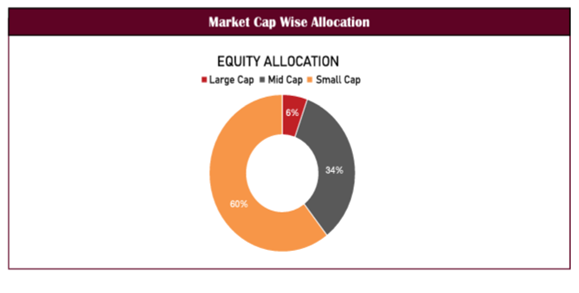

Growth Mantra

They invest in turnaround businesses through the 212° Growth Mantra Fund. Here, they mostly look for high-quality businesses with the potential for the quickest growth, whose prices have stabilized for at least a decade and whose profits have increased over the past ten years. They concentrate on owning businesses that are experiencing a turnaround in their operations. For years, nothing noteworthy occurred in the company; but, recently, the company has started to perform exceptionally, which may be the consequence of new management, entry into a new industry or market area, or a change in the business cycle. They have come to realize that the Turnaround plan is a revival measure for resolving the industrial disease issue and stabilizing its performance over time.

And the business that did that is experiencing exceptional price growth supported by steady margins. With a maximum investment allocation of 10% and a minimum investment commitment of 4% in each stock, there is no stock overlap between the two funds. They also comprehend the causes of the company's turnaround, the organization's sustainability and longevity, and the future growth drivers for the company. They are all aware, for instance, that the market leader in the paints sector today was once a much smaller business but has since catapulted to become India's top brand. They realized that there are lots of young businesses out there that are operating ethically and wisely and have the potential to become tomorrow's probable leaders.

Here they have a concentrated portfolio of 15 stocks. In general, they have a holding period of 2 years in a stock, but it can vary from stock to stock, if they perform well, they stay, if not, they are out! Both of their fund is available for everyone but a person who wishes to invest in the company with the High-Risk vs Reward profile, wants Fast growth, and is willing to take calculated risk can invest in the 212° Growth Mantra Fund.

We conducted an exclusive interview with Mr. Rohan Mehta - CEO & Fund Manager of Turtle Wealth Management in order to know Turtle Wealth Management in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

In wealth mantra, what process do you follow to identify Guerrilla Businesses? We anticipate the Leadership quality firm, whose pricing has been stable for at least ten years and whose profits have increased thanks to a successful recovery.

With the bottom-up approach of stock picking, how do you ensure the diversification of the portfolio? We have little faith in diversification and think it is best to invest in the finest companies where value exceeds cost. Similar to this, we observe that we do not purchase two firms of the same type in a single fund, and as we want to purchase the highest calibre enterprises, diversification is therefore taken care of.

How is the export revenue contribution in your strategies? With global uncertainties are we going to sustain the export growth? Approximately 35% of the Wealth Mantra Fund's revenue comes from exports, while only 25% of the Growth Mantra Fund's revenue comes from exports. Additionally, only 7 of the approximately 25 enterprises that combine both funds have an export revenue contribution of more than 50%. However, we have attempted to strike a balance among the 15 stocks that make up each fund's mix so that our strategy is not overly export-oriented while also benefiting from the China +1 strategy, Make in India, India's competitive pricing, and other global tailwinds.

At this stage, which themes or sectors are you bullish on? We are bullish on Auto, INFRA, Logistic, Shipping and Manufacturing

Where is your journey of spreading financial literacy headed to? believe in country like India where the highest wealth is made in Equity markets still the highest money lies in FD and Gold the linchpin over here is the financial education, we do it to our several seminars, podcast and videos.

Can you brief us about your investment sutra and how you derived it? Our investment sutra has come with lot of experience and the learning from markets, we believe and live by them every time

- Invest in business where value is higher than price with returns in X and loss in % = investing in turn around business, which are less popular in markets but has the highest probability to create a great return, with less risk, and not going forward for the favourite high valued names in markets, where risk is higher than the reward.

- Our Secret Sauce is Pyramiding Profits and Exiting loss = If the company is doing good to give more allocation to it, but if the company is underperforming to exit also without having much emotional value to it.

- IS vs IF investing process = IS are the company which are doing good now and have lot of probability to do good in coming time vs the company which is may do good in coming times but is not doing great right now, we will prefer IS vs IF

What do you think as your Unique selling point of Turtle Wealth PMS that you think would differentiate it from others?

Our Sling shots are 3

- To invest in Turn around businesses with Unique Process

- To Decide Exit before we enter

- To Invest only in Human Friendly business and Sustainable business

Can you just drive us into the journey of the Turtle Wealth AMC during the changing environment and how has fund manager you faced the different times of change? Every market turn teaches us something new. Our fund manager has experienced 10 seller circuits and 3 poor market phases, which has taught him more about risk management than return management, the process than profits, and safety and sanity than insanity. We incorporate the knowledge we gain each day into our operations. Like Apple, we don't make many hardware changes, but we do make software changes.

As per your investment philosophy you say "pyramiding will be done as per the opportunity", could you elaborate it and explain what parameters governs this decision of yours? As a result, when we invest, we have a set of expectations for the company and then we assess how well it has exceeded those expectations. If it has done so and is still on a growth trajectory, we will increase our investment as the plan develops.

For instance: Our initial investment in SRF was 500 rupees, and as of right now, we have increased it to 2500 rupees. We have done this without selling any of our company shares because we believe that if the company is performing well, we should give more, and if not, we should withdraw everything.

What economic variables do you look at while analysing the market and where can investors look for wealth-creation opportunities? Our Macro theme is only 1 = BULLISH ON India, and rest to look forward for business which can be benefited in current to 3 years of the business ecosystem. Like Manufacturing was muted in last decade pre COVID, today manufacturing will add nearly about 50% in INDIAN GDP and will support the Service, the Infrastructure of India, with Make in India and the China downside all is helping manufacturing to grow more and more.