Value Quest Investment Advisors Pvt Ltd

Value Quest Investment Advisors

ValueQuest was founded in 1995 as a research company before evolving into a professionally managed PMS company. It was established in June 2010 by Ravi Dharamshi and Sameer Shah and recognized as a SEBI-registered portfolio management firm. The Dharamshi family office, which founded ValueQuest, and its founder Ravi Dharamshi have been investing in Indian equities markets for more than 40 years. They are renowned for their investing expertise, early topic identification, thorough research, and investments in potential wealth producers. Wisdom to see, Fortitude to hold, and Courage to capitalize are the three pillars of their research ethos.

Mr Ravi Dharamshi – Founder & CIO, ValueQuest Investment Advisors

After receiving his MBA from the Mccallum Graduate Business School in the United States, Ravi Dharamshi was encouraged to return to India in 2002 by his early interest in stocks. As part of his first job, he was employed by Mr. Rakesh Jhunjhunwala, one of India's biggest and most reputable investors. He worked on various technological and new-age enterprises in addition to certain private equity investments, and he shown quickness in understanding the pharmaceutical market even before it was a recognized industry. He took over ValueQuest's research department in 2007. He changed in 2010 to become a professionally run PMS firm that was registered with SEBI.

Mr Sameer Shah – Co-Founder, ValueQuest Investment Advisors

Sameer Shah, co-founder, has 23 years of expertise in the stock market in a variety of capacities and is a certified chartered accountant. worked in a variety of roles for Sharekhan, the pioneer in the capital markets at the time. Prior to transitioning to research and portfolio management at ValueQuest, he served as Head of Business Development at FCH Centrum and BRICS Securities, two companies with expanding retail businesses.

Team

Alongside PMS & AIF, ValueQuest is a group of 3 fund managers, 16 analysts, and colleagues. The staff as a whole has an average industry experience of 9.6 years, while the fund managers have an average experience of 22 years. Aside from people with experience in private equity, the team also includes consultants and industry specialists.

ValueQuest – Investment Approach / Philosophy & Process

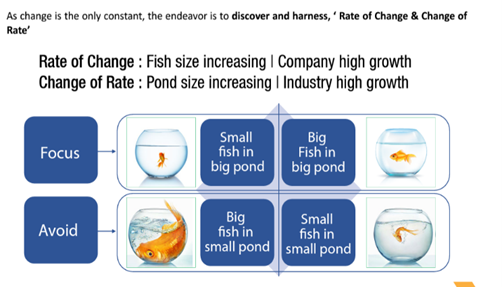

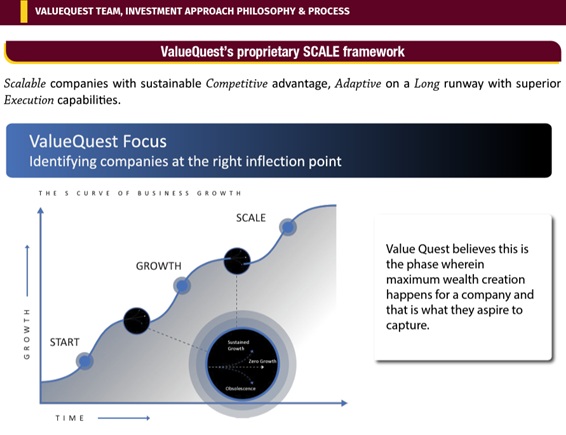

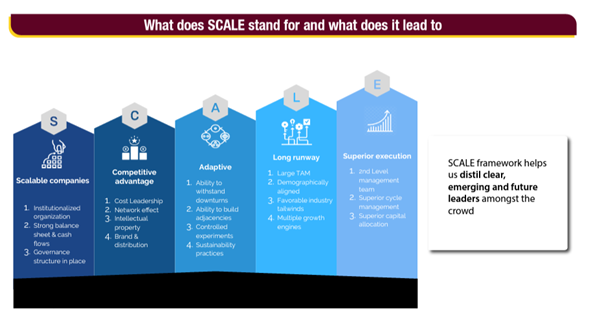

ValueQuest is a boutique portfolio management firm that takes pride in spotting megatrends early on with a strong emphasis on long-term wealth building by selecting successful businesses that are obvious, emerging, or future leaders.

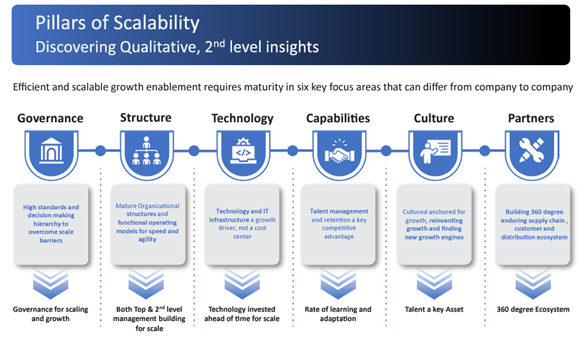

In addition to quantitative insights, the methodology entails finding and discriminating many qualitative insights about the industry and its competitors, which are inevitably not expressed explicitly in any corporate filings or other statutory reports.

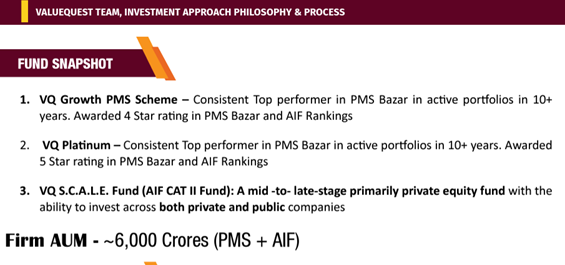

ValueQuest PMS Strategies

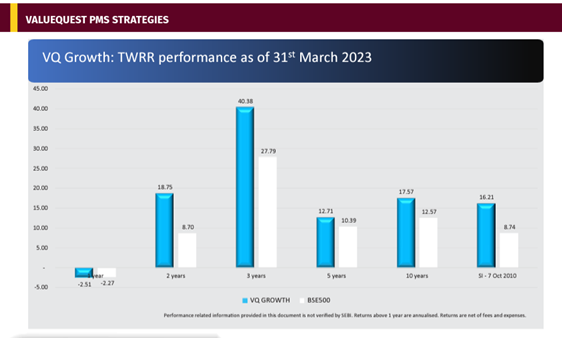

VQ Growth Strategy- Regardless of market capitalization, VQ Growth places a strong emphasis on investing in fundamentally good, thoroughly studied firms with promising future prospects. The potential of compounding will be maximized by this Fund. This fund's investment philosophy is to select high-quality firms with established track records at fair prices and then sit back and let compounding work its magic. Their plan is to capitalize on the company's or industry's growth phase over a rolling three to five-year period.

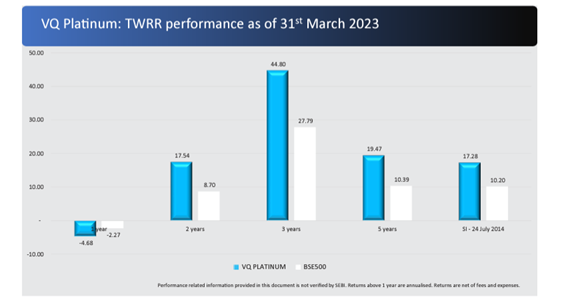

VQ Platinum Strategy- Regardless of market capitalization, VQ Platinum focuses investing in fundamentally good, thoroughly studied firms with promising future prospects. The goal is to spot industry or firm business tailwinds and take advantage of them. The portfolio can have access to unique transactions and special circumstance chances in addition to core portfolio equities that are supplemented with young, new to market, and turnaround stocks. These equities will be chosen with a rolling time horizon of 1-3 years based on business tailwinds and better risk-reward.

We conducted an exclusive interview with Mr. Ravi Dharamshi - Founder & CIO in order to know ValueQuest Investment Advisors in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

What is your risk mitigation strategy in the current volatile market climate? What are the tactical and structural ideas you implement to safeguard your portfolio in this volatile market?

There is no doubt that the last three to four years have seen extremely difficult times with many firsts that we were not accustomed to or prepared for, such as the Covid or an Energy Crisis brought on by an ongoing war, or even the end of near zero or low interest rates that had been the norm for the past 20 or so years. I doubt many people could have anticipated this or changed their portfolios to account for it. According to Danie Kahneman, "People don't seem to be all that risk-averse. They are not against risk for a variety of reasons, but they are against losing, and the prospect of losing weighs heavily on their decision.

The first step, in my opinion, is to stop worrying about the correction and giving market timing a go. The road becomes more obvious as we have a wider horizon. You cannot ignore the industry, but you also cannot stake your entire home on it. Making the appropriate bets is the best method to control risk. Additionally, the price at which you purchase is crucial. You will do much better if you can think in decades rather than in weeks or months. Sensex was 100 in 1979 and reached 1000 in just 11 years, a 10x increase during that time. The subsequent 10x move took place after 15 years, and the subsequent 5x move was not until recently.

We have advanced 5–6 times since 2006 until the present. I'd venture to say that in terms of market returns and economic performance, the coming five years are going to be significantly better than the previous five. Therefore, you shouldn't worry about the impending correction. The only people who claim there is a method to escape it are blunderbusses and liars. To get the best rewards from the market, you must endure it at its worst, thus it is OK to go through that. With US & Europe Banking Crisis creating volatility in Banks Globally, how are you approaching banking as a sector? The fact that Indian banks are among the safest in the world, if not the safest, has been established beyond a reasonable doubt this year. The Indian financial system has relatively minimal systemic risk, according to Aditya Puri. If you compare what happened in the US to what is happening in our country, there are no instances of asset liability mismatch. We have a diverse portfolio, a limit on the amount you can invest, dispersed deposits, reputation management, a combination of technologies, and strong capital. therefore, there is far less risk.

We favour private banks since they do not appear to have any form of overhang in terms of mergers, promoter changes, management tenure, or management skill. We are seeking for stories where the growth trajectory is apparent for the next three to four years and where one could easily envision ROEs rising to 15 to 18% over the following two to three years as loan growth accelerates. After almost ten years, the credit growth has reached 15–16%.

You are among the few who had a chance to work with a big bull of India. What are some of the key lessons that you gained working with him?

Without a doubt, getting to know and work with Rakeshji was a true honour. I started working for Rakeshji in 2003 and worked with him for about 4 to 5 years. During that time, I did a lot of learning. Many claim that starting out in the markets with a loss is advantageous so that lessons can be effectively internalized. However, I arrived at a period when there was a lot of money to be made. His instructions on how to think independently and how to imagine broader truly helped to build my confidence. One of the most important lessons I learned from working with Rakeshji was that you should be able to gamble a lot if you perceive a chance and also realize that the chance return is in your favour. Rakeshji always emphasized the importance of making the right purchase at the appropriate price. Never invest at inflated valuations, he would advise. Never run for positions with prominent companies. He adhered to this principle to the letter and frequently counselled New Age investors to consider stock valuations before making any investment decisions. This was still true in today's age of expensive initial public offerings, and we have seen how that has worked out for some of them.

ValueQuest-Growth and ValueQuest-Platinum have outperformed the respective benchmark since inception. What is your investment mantra to produce your alpha? Warren Buffet once said, "You only have to do a very few things right in your life so long as you don't do too many things wrong." We wholeheartedly agree with this statement. ValueQuest adheres to its founding investing principles.

- locating businesses at the appropriate inflection point

- A powerful screening mechanism and focused portfolio strategy

- Using both top-down and bottom-up strategies.

- Possessing a rolling three to five-year perspective.

- We take an unbiased approach to sectors and market capitalization, which provides us the freedom to follow the finest investment opportunities across a broad range of markets.

What are the key themes you are bullish on for FY24? How do you expect the market to play out in the upcoming financial year?

For the next 5 to 10 years, we have identified 4 megatrends. Megatrends are structural changes with longer-term effects and permanent effects on the environment. Real insights can be gained from understanding megatrends in investment processes. Megatrends therefore have an impact on our investment choices, both the companies we invest in and the methods we use to identify possibilities. Megatrends are strong, revolutionary forces that affect society, industry, and the global economy, and spotting their potential influence is a critical factor in how we make investment decisions. They emerge independently of the economic cycle, and even while they may do so at a different rate and in different ways, they are all capable of changing the industrial and investment environment. The 4 larger trends are 1. Energy Transition 2. Manufacturing 3. Financialisation 4. Consumption J Curve We believe right businesses identified within this trend will provide decadal opportunities to create fabulous wealth for investors.

How important is ESG in your investment philosophy? What are the parameters you look at?

VQ Principles – Ethos towards ESG evaluation of companies:

- Separate business construct from compliance (As some industries by design are negative ESG)

- Do independent & 360-degree evaluation of ‘focus companies’, to screen for negatives

- Lack of disclosures and structured data limits accuracy of any analysis, thus seek shades of grey vs mere black or white

- Does not rely on external scores for exclusion or inclusion, as can be misleading due to mis reporting or mis calculations

- Is seeking to benefit from mispricing arising from moral debates leading to skewed valuations on either side Key Building Block for elimination based on ESG

- Questionable behaviour towards minority shareholders or ecosystem

- Poor financial quality, reporting or complexity

- Unsustainable growth due to qualitative or quantitative factors

- Legal or compliance issues beyond financials and growth

- Practices on the ground, based on 360-degree feedback

- Institutionalization of ownership, management team and incentives alignment.

What are your parameters you look into while investing into deep-value stocks?

We typically don't categorize equities into the growth or value paradigms because our investing criteria never alter. We avoid investing in businesses where the sole alluring factor is the valuation. Business, promoter/management, and values continue to be the major investing factors. Promoters and management, however, have much more weight in smaller enterprises in terms of importance. We use the following framework to evaluate any company's management: Integrity is assessed based on historical performance. Competency is assessed based on the capacity to manage the balance sheet during a recession, acquire market share, and increase addressable prospects. • Alignment of interest - Assessed based on stakeholder involvement, business structure, and prior behaviour with minority shareholders. The fundamental test of any management is their capacity to produce returns beyond their cost of capital over the long run.