Varanium Capital Advisors Pvt Ltd

Varanium Capital Advisors

A SEBI-licensed boutique investment management and advisory firm with a concentration on developing markets strategies, particularly in India, is Varanium Capital Advisors Private Limited (VCAP). The company offers investment advisory, equity and debt portfolio management services (PMS), alternative investment funds (AIF), and customized structured investment solutions such as FCNs, structured debt, private equity, etc. through both an onshore and an offshore platform (Mauritius domicile having GBL1 license from FSC, Mauritius and FII license from SEBI, India, as well as Cayman domicile). Varanium manages/advises on about $1 billion worth of assets on behalf of HNIs and institutional customers worldwide in a variety of traditional and alternative asset types.

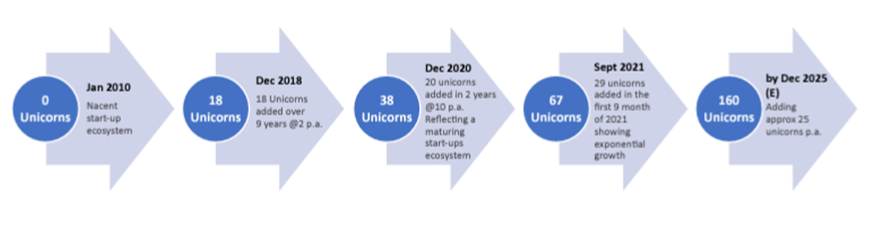

According to the Credit Suisse Report, there will be more than 160 unicorn companies in India by December 2025, which the management of Varanium sees as a sign of greater traction in the start-up sector. Fintech drives financial transactions both online and offline. According to our predictions, fintech will increase exponentially over the next five years as a result of payments, lending, investing, insurance, and neo-banks.

Mr. T.S Anantakrishnan - Founder & CEO, Varanium Capital Advisors

Anant has over 25 years of experience in Portfolio and Risk Management across global asset management firm such as Gold man Sachs and Shumway Capital. In India, his previous experience has been as a CEO of Religare Portfolio Managers, the PMS business of Religare Global Asset Management. Prior to which he headed Portfolio Management business for Prime Securities. His professional qualification includes MBA from NYU Stern, BE-IIT (Roorkee), CFA&FRM.

Mr. Aparajit Bhandarkar – Partner, Varanium Capital Advisors

Aparajit leads the Venture Capital Practice at the firm. He has more than 15 years of experience in Investment Banking, Investor Relations and startup investments. Before joining Varanium, he was CEO of Dice Fintech Ace-a Fintech Venture fund. Before that he was Head Strategy, Jio Payments Bank and various senior roles at Yes Bank such as President, Merchant Banking and Head of Investor Relation. He is a qualified CA, CFA and holds a master degree in Business Administration from NYU stern.

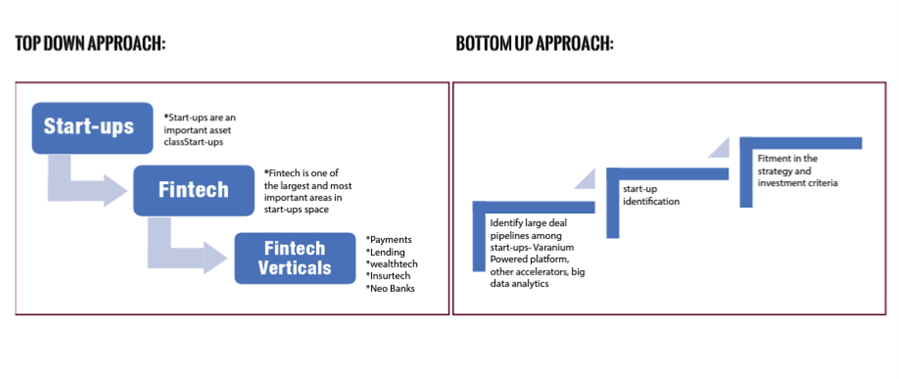

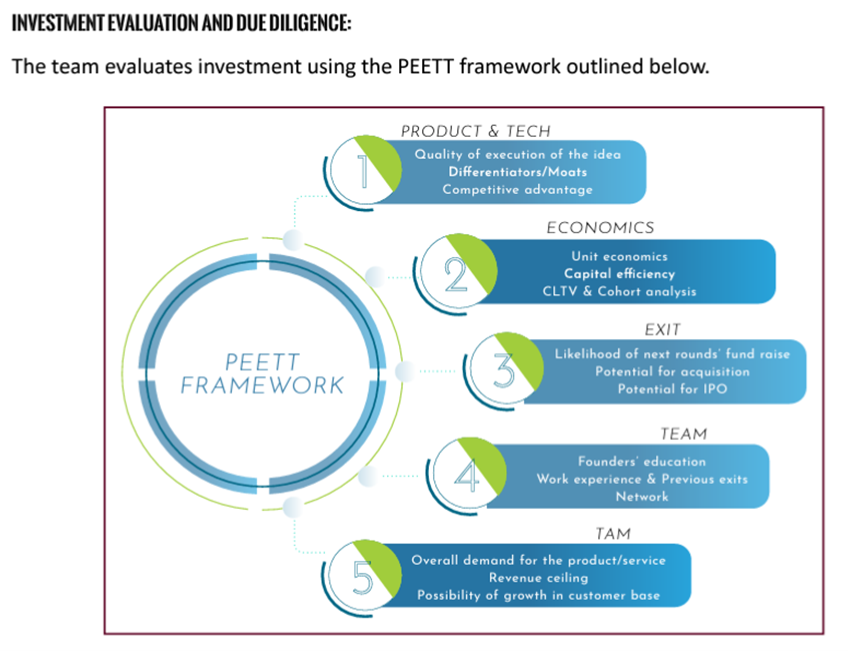

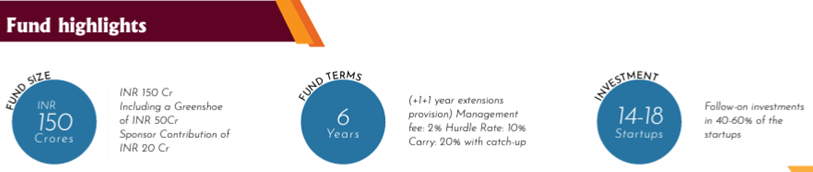

VARANIUM NEXGEN FUND - CAT I AIF

The SEBI has registered the Varanium NexGen Fund as an AIF Category 1 Venture Capital Fund. The fund has a size of Rs. 150 crore, will shut in March 2027. The first investments made range in size from Rs. 1.5 Crs. to Rs. 7.5 Crs. each, with more investments made in subsequent rounds. The fund manager expects that the fund can offer an IRR of approximately 25–28% post fees and carry (but before taxes) based on his historical performance, which included funds that had IRRs of over 70%. s The fund manager has taken a top down and a bottom up approach towards selecting investments.

Startups are increasingly significant as an asset class: In India, startups have emerged as a key asset class during the past ten years. India hadn't yet created a unicorn when January 2010 came around, which is defined as a start-up with a valuation of $1 billion (about Rs. 7300 crores) or more. India has added more than 60 unicorns in the last ten years, going from 0 in 2010 to 67 in September 2021. Over the past few years, unicorn acceleration has risen. Specifics are as follows.

VARANIUM NEXGEN FUND - CAT I AIF

The start-up ecosystem has grown leaps and bounds over the last few years adding unicorns at an exponential pace and attracting over USD 60 billion of capital over the last five years. Key reasons for exponential growth of start ups in India are driven by three major factors:

- Government efforts: To enhance digitization in the economy and open up new taxation opportunities, the government has been supporting start-ups through programmes like Start-up India, Digital India, India Stack, and others. These government programs have significantly contributed to the expansion of the start-up sector.

- Growing start-up ecosystem: Over the past few years, India's start-up ecosystem has developed as a result of entrepreneurs making money for themselves and investors, allowing them to reinvest their profits and draw in new funding. Due to this positive feedback loop, start-ups have experienced exponential development, attracting both fresh and experienced personnel as well as funding from public markets.

- Building enterprises has never been simpler thanks to government efforts. With infrastructure like coworking spaces, cloud computing, accelerators and incubators, and seed money, startups can be formed in less than a week. We anticipate that India will add another 100 unicorns over the course of the next four years, which, on a conservative basis, will generate around Rs. 10–12 lakh crores in new wealth. So it might not be wise to ignore start-ups as an asset class in one's portfolio. As a result, investment in VC funds will play a significant role in the HNI portfolio.

Fintech is an important enabler of the economy:

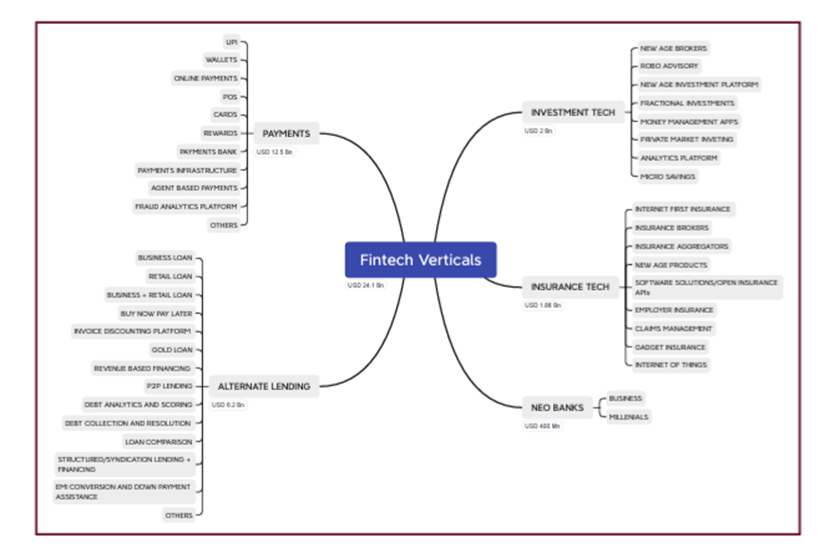

Between 25 and 30 percent of the worldwide market capitalisation is made up of banking and financial services. Financial technology (fintech) uses automation to make financial services faster, more affordable, and accessible to billions of underserved clients. Millions of new customers will start making purchases online as the Indian economy digitizes. Fintech will support these transactions in a number of ways, including Payments Lending, Investment Tech, and Insurtech. The number of digital transactions has increased three times in the year since COVID, reaching a record-breaking 25 billion in real-time. Fintech has drawn about USD 24 billion (approximately 1,75,000 Crs) in capital as a result.

VARANIUM NEXGEN FUND - CAT I AIF

16 of India's 67 unicorns work in the fintech industry. Over the next four years, we anticipate India to produce another 20 to 25 new unicorns. The goal of Varanium's plan is to add two or three unicorns to its stable. Payments, loans, wealth technology, insuretech, and neobanks will be our main areas of concentration.

Bottom Up approach for deal identification:

Aimcrest, the platform that supports the government of Maharashtra's fintech effort, www.mfhfind.com, was formed by the partners of Varanium Capital. It has a sizable and diverse pipeline of acquisitions. More than 1,500 companies, 200 investors, and 60 corporations are on this platform. For Varanium, whose partners are on the selection committee, this ecosystem offers a steady flow of business opportunities. Additionally, Varanium has strong contacts and informal alliances with corporate accelerators like Jio Genext as well as independent accelerators like Fintech Yatra, Finblue, and others, providing them with a selected list of start-up transactions. Varanium also employs proprietary analysis and big data to find start-ups that are worthy of investment. More than 1000 start-ups have made 8 investments or promises to Varanium.

The process used by Varanium Capital entails confirming product market fit through reference checks with clients and the company's existing network, as well as concept validation through follow-on investors. The likelihood of failure is reduced by this method. The Fund also employs experts from each sector to assess the quality of the concept and technical experts to determine the robustness of the technological foundation. Prior to the investment being completed, the company also selects firms to perform legal, financial, and technological due diligence.

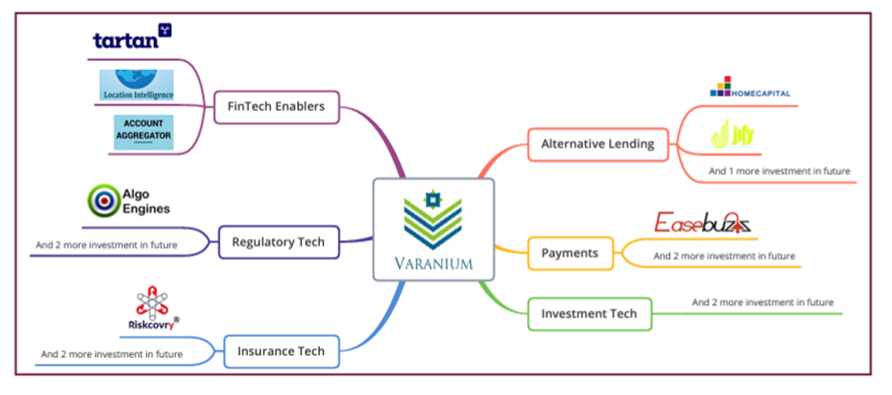

Fitment into Fintech Verticals:

The Fund analyse is fitment into the investment mind map based on investment received by start-up in various verticals of fintech. The fund has made 5 investments and has committed three term sheets. The portfolio makes up the fund in various fintech verticals is shown below:

We conducted an exclusive interview with Mr. Aparajit Bhandarkar - Partner in order to know Varanium Capital Advisors in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

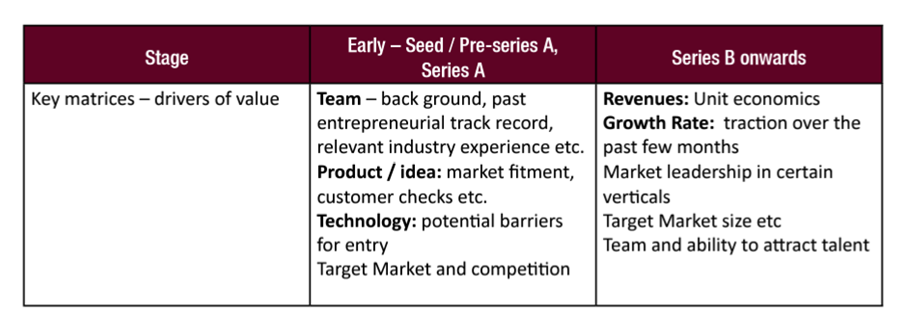

What is the right way to value start-up companies at the time of investment? The value of start-ups fluctuates depending on their stage of development. Early-stage startups, such as seed and pre-Series A companies, are valued primarily based on their management team, their product, their underlying technology, and the size of the market. Starting in later phases, valuations are based on growth rates, sales, and the size of the whole market. Compared to valuation of later stage start-ups, which can be mostly based on revenues and market compatibility, early stage start-up value is more subjective and requires greater judgment. Because of this, valuing early-stage enterprises requires both art and science.

Members of the Varanium IC have held positions as start-up founders, venture capitalists, and public market investors, offering a variety of perspectives on the valuation process. The group also makes use of Prof. Damodaran's from NYU Stern's public market valuation methodology.

Why do you focus on seed, pre series a and series a stage investments? Many companies that are hitting the IPO market today have witnessed massive surge in valuation within a year of last raising private capital. Businesses in the Seed and pre-Series A stages that find an acceptable product-market fit and get additional investment rounds can see tremendous growth with 20X to 100X returns. For instance, I made an early investment in Bank Open, which recently closed a $500 million Series C round led by Temasek, Google, and SBI Ventures Japan. It was initially valued at US 1.1 million and USD 3.5, making my investment (from my fund, a family office) a 100X return if held by the family office. Therefore, investments made in early stages can produce multi-baggers with returns of 20 to 100 times, whereas investments made in firms that are about to go public can produce returns of 2 to 3 times. Early-stage businesses are therefore more risky. Varanium works to reduce these risks through its network and investing procedure. Despite the higher risk associated with early-stage venture capital funds, we think that because of the disproportionate returns, they can significantly increase the yield on one's portfolio and shouldn't be disregarded.

How is a fintech VC fund different from other VC Funds? One of the most popular industries for new businesses in India is fintech.16 of the 67 unicorns in India work in the fintech industry.One of the major startup industries in India, fintech has garnered over USD 24 billion in capital. In the startup economy, the fintech sector, which is a representation of financial services, appears to produce roughly one-fourth of the unicorns in India. Financial services normally have between 25 and 30% of the market capitalization on public markets.Varanium Capital is uniquely positioned to find winners in a broad industry thanks to its strong specialization in this field.Additionally, Varanium Capital's industry connections assist businesses grow their clientele and integrate into the ecosystem of financial services. Since the majority of other funds are generalist venture capital funds, they do not benefit from in-depth industry knowledge. Additionally, Varanium Capital is collaborating with a major US investment bank to create a comprehensive study on the Indian field tech scene.

Not every start-up becomes an unicorn. Most of them fail. How do you mitigate the risks when you invest in a start-up? While not all startups succeed and offer exits in the form of larger VC funds buying out the investment of early stage funds or other startups being bought by big businesses, not all startups become unicorns. The data is based on a huge global sample of start-ups, the majority of which do not even receive seed money from any venture capital fund, despite the fact that the majority of them fail. About 25 to 35% of firms receiving venture capital funding were unsuccessful or barely profitable, which is considered failure. In my previous fund, two out of every eight new businesses failed. Taking into account historical lessons and information from reputable publications, Varanium mitigates the risk of failure by addressing the largest causes of failure. Based on a publication by CB insights, the top two reasons for failure are (1) failing to find product market fit- 49% (2) failing to find next set of investors-29%. the partners of the fund have set up a platform www.aimcrest.com, which connects startups 2 corporates and start ups to investors, through its partnership with www.mfhfind.com, that has over 60 corporates and 200 investors. establishing product market fit through corporate customers and investor interest in next round of transactions reduces/ mitigates the largest reasons for start-up failure.

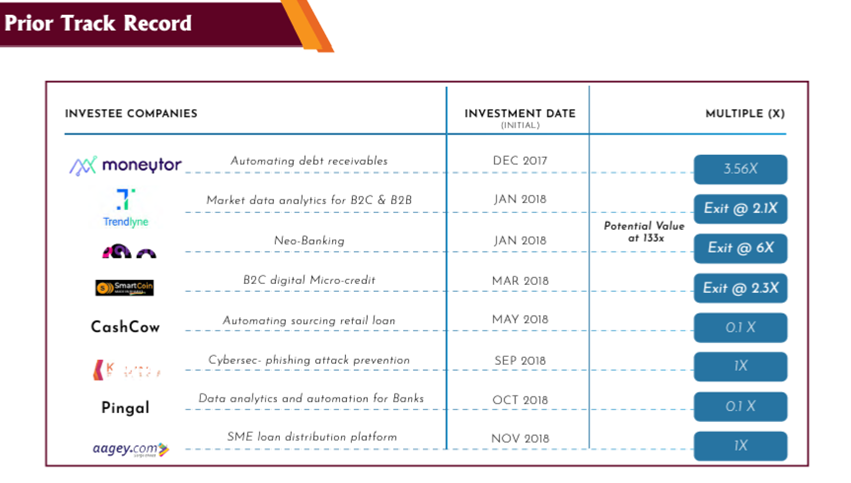

The fund manager has a 100X bagger in his previous portfolio. Can you talk about this? And how did you spot this opportunity? Dice Fintech, a fintech accelerator and Fund, was the name of my prior family office fund. Over 1000 businesses were reviewed by Dice Fintech, and 8 investments were found. One of these startups was called Bank Open. At the seed stage, when bank open was valued at Rs. 8 Cr, and at the pre-series A stage, when it was valued at Rs. 25 Cr, we invested. At that time, Dice Fintech was the startup's biggest investor. Recently, Bank Open raised USD 100 million at a USD 500 million valuation. Based on current assessments, our stock of Rs. 2.25 crore would have been worth more than Rs. 280 crore, representing a return of more than 100X. Another startup, Trendlyne.com, has also done well and, based on sales growth, would have been a 10X bagger. Overall, if the preceding portfolio had been kept, it would have generated an IRR of 78%, which would have resulted in a valuation of almost 30X today.

Investing is not a zero-error game. Plus, start-ups are riskier. In your estimation, what kind of losses can be seen by the fund if 30-40% portfolio constituents don't perform? The inherent risks of investing in startups include business risks that are higher than those of publicly traded firms and liquidity risks because the securities are not traded. We conservatively project a 25 to 28% IRR, or 3.5 to 4X return on the portfolio, based on our present portfolio and the prior performance of my previous portfolio, assuming that 25% of our start-ups fail and that none of them generate returns of more than 20X. Estimate the portfolio's return at a conservative 2-2.5X assuming a higher default rate this weekend. These returns are post-tax but not yet carried over.