WhiteOak Capital Management Consultants LLP

WHITEOAK Capital Management

The White Oak Capital group offers investment management and advisory services for equity assets totalling more than USD 5.9 billion. White Oak provides investment services through a wide range of fund vehicles with domiciles in India, Ireland, Mauritius, and the UK, catering to individual and institutional clients in India and across the globe, in addition to segregated managed accounts for top global institutions. Prashant Khemka founded White Oak Capital Group in 2017, following his tenure as the CIO of the India Equity and Global Emerging Markets Equity divisions at Goldman Sachs Asset Management. The WhiteOak Capital Group has offices in India, Mauritius, Singapore, Spain, Switzerland, and the UK through which it conducts business.

Mr. Prashant Khemka – Founder, White Oak Capital Management:

Prashant founded White Oak Capital Management in June 2017. Prior to this, he served as the CIO and lead portfolio manager of GS India Equity at Goldman Sachs Asset Management (GSAM) from March 2007 to March 2017, and also for the Global Emerging Markets (GEM) Equity from June 2013 to March 2017. Prashant started his professional investing career in 1998 at SSGA in Boston as a senior portfolio officer of Enhanced International Equity in the quant group. He joined GSAM in 2000 as a research analyst in US Growth Equity and rose to become Senior Portfolio Manager and Co-Chair of the Investment Committee by 2004. Prashant returned to Mumbai in 2006 to start GSAM's India business and served as the CIO and CEO/Co-CEO of their domestic Asset Management Company. In 2013, he was also made the CIO and lead PM of GEM equity. Prashant has received several accolades as the CIO and Lead PM of GS India Equity, including AAA rating from Citywire and Elite rating from Fund calibre, among others. He graduated with honors from Mumbai University with a BE in Mechanical Engineering and earned an MBA in Finance from Vanderbilt University, where he received the Matt Wigginton Leadership Award for outstanding performance in Finance. He was awarded the CFA designation in 2001 and is a fellow of the Ananta Aspen Centre, India.

Mr. Parag Jariwala – Director - Investments, White Oak Capital Management:

Parag has over 13 years of experience in institutional equity research, covering the Banking and Financial Services Institutions (BFSI) sector. Prior to joining White Oak, he worked as a lead analyst with Religare Capital. Before that, he has worked with Macquarie and other domestic sell-side firms covering the BFSI sector. Parag is a chartered accountant and MBA from K J Somaiya Institute of Management of Mumbai University. He also holds the CFA charter from the CFA Institute (AIMR).

According to WhiteOak Capital Management, their primary competency—a distinctive and potent investment culture—is what eventually generates great investment returns. The group values performance above all else. Four pillars make up WhiteOak's investment culture: the investment team, investment philosophy, investment methodology, and portfolio construction. Each of the four pillars works in unison with the others to provide an unparalleled capability when united.

Investment Team:

The investment team at WhiteOak Capital Management is of the highest calibre, with an average of nearly 12 years of industry expertise. Each senior analyst on the team is responsible for conducting research in a particular industry, requiring them to continuously develop their in-depth domain knowledge.

Philosophy:

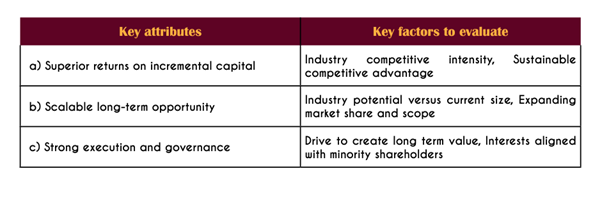

WhiteOak Capital Management's bottom-up stock selection strategy is straightforward and is based on the idea that by making long-term investments in outstanding companies at reasonable prices, investors can generate outsized returns. The two components of this ideology are business and valuation. They look to invest in businesses that offer the strongest balance of valuation and business.

Process:

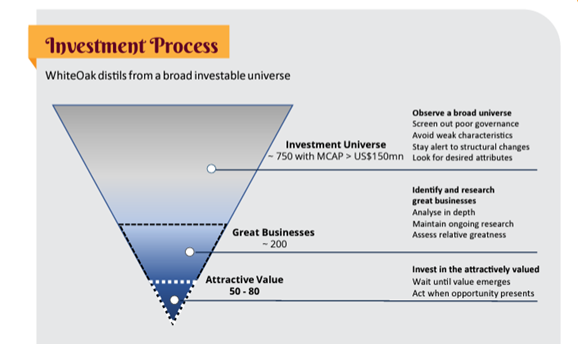

Bottom-up stock selection, based on thorough fundamental analysis and a unique, strict analytical methodology, is how the team hopes to generate alpha. They search for excellent companies that are outperforming significantly over the long term and are currently trading at a significant discount to their intrinsic worth.

Portfolio Construction:

WhiteOak's portfolio construction technique aims to ensure that alpha is produced by stock selection and is not swiftly supplanted by risk factors that are not stock-specific throughout any possible time frame. The team strives to maintain a well-balanced portfolio that reflects its knowledge and opinions about stock selection rather than being influenced by non-stock specific macro factors like market timing, sector, currency, or other such factor exposures. This balanced strategy, which also balances the portfolio risks, works exceptionally well with the bottom-up mindset and process of WhiteOak.

Philosophy:

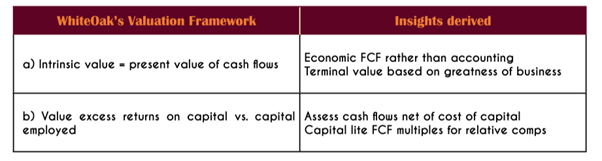

WhiteOak Capital Management offers a straightforward yet effective investment theory that favours stock selection above macrobets when investing in companies. They believe that investing in excellent companies at appealing prices can produce outsized profits over time. A great company is well run, scalable, and produces greater returns on additional money. When the current market price is significantly below the underlying value, valuation is appealing. WhiteOak's investment strategy is based on bottom-up stock selection, which is the main source of returns. When a company is trading at a significant discount to its true worth, as is the case today, WhiteOak Capital Management looks to invest in those businesses. The team stays away from companies with inferior traits like inadequate corporate governance, low returns on additional capital, and companies at risk of being replaced or becoming obsolete. While avoiding weaker combinations, the team searches for investment opportunities that reflect strong business and value pairings. Business and valuation are the two essential cornerstones of WhiteOak's investment philosophy.

Valuation

When the present price is much below the intrinsic value, valuation is appealing. The team would like to emphasize that, despite their strict valuation practices, they do not employ any of the widely accepted accounting indicators, such as P/E, P/B, etc. because they are highly biased. Instead, they use economic cash flow multiples and DCF, which are produced from their own Opco Finco Framework.

Additionally, WhiteOak seeks to steer clear of companies that exhibit weaker traits, such as:

- poor corporate governance, which can take many different forms, such as siphoning of money or value, stock price manipulation, unethical business activities, or misaligned interests.

- Poor returns on additional capital as a result of excessive industry competition or poor capital allocation.

- The risk of substitution or obsolescence brought on by technical advancements

Portfolio construction and risk management

The goal of portfolio design is to make sure that stock selection determines portfolio performance and that non-stock-specific risks do not outweigh stock-specific hazards. WhiteOak aims to:

- Maintain a balanced portfolio of carefully chosen businesses independent of benchmarks.

- Ensure that stock selection influences alpha generation.

- Deliberately abstain from market timing, sector rotation, and other such top-down plays.

- Recognize, keep an eye on, and manage residual factor risks that result from stock selection

The team believes that maintaining a balanced portfolio is a prudent risk management strategy with the goal of ensuring that performance is a function of the team's stock selection skills rather than being influenced by non-stock specific macro risk factors like market timing, sector, currency, or other similar factor exposures. WhiteOak may decide to accept some of these factor risks to a controllable level (for instance, a higher allocation to mid-cap stocks), but only if such risks are more than commensurately offset by the increased possibility of strong stock specific returns. The risks in the portfolio are in line with their bottom-up strategy and mindset thanks to this balanced approach. WhiteOak continuously checks a number of risk variables to make sure the risks in their portfolio match their estimation.

We conducted an exclusive interview with Mr. Parag Jariwala, CFA - Director - Investments in order to know WhiteOak Capital Management in depth and enable the investors to make informed decisions. The questions and answers are reproduced verbatim

With major economies sliding into recession, how do you see India's performance both in the short-term & long-term? How equipped is the Indian market to face the spillover effects of the global recession? We have long thought that the market is impossible to anticipate in the very near future, not much different from tossing a coin. India has the largest potential for alpha production of any sizable equities market in the world, as we go into more depth about below, which is what makes it such an interesting market. Despite this, India's economy is nevertheless expected to continue to grow at one of the quickest rates among developed nations. Within the following ten years, it is anticipated by various estimations to overtake Japan as the third-largest economy. In terms of long-term growth, we think India is benefited by a number of secular tailwinds. The most significant factors are its favourable demographics and rising income levels, which are probably sufficient to sustain a multi-decade. The nation is also going through a quick formalization process thanks to significant ongoing structural reforms, which is supported by rising internet usage. The administration is also taking action to build the nation's infrastructure and to domesticate the production of foreign commodities. All of these elements rank India as one of the most potential markets going forward. Additionally, despite not being completely protected, India is partially protected from shocks related to the global commerce.

What is your view on the recent SEBI guidelines for performance benchmark reporting for portfolio managers? What are the changes that you anticipate in the upcoming period and the impact of these regulatory changes in the industry? The recent SEBI regulations are seen by White Oak, one of the founding members of the Association of Portfolio Managers of India (APMI), as a positive step. It wants to promote a great deal of transparency, something top PMS providers like us were already doing. Against the common perceptions, recently small & mid-caps had a short-term boom recently. Do you think large caps can provide the necessary cushion in this volatile scenario? While there are excellent possibilities across the market capitalization range, we think that India's large, diverse small- and mid-cap group, which is even less thoroughly explored, has excellent potential for alpha production. Many subcategories' market leaders are mid-cap companies with a wide growth window. Take QSRs (or Quick Service Restaurants) as an example. The largest listed company in this category is a mid-cap; this segment is still under-penetrated, is still undergoing adoption, and offers a sizable opportunity as it is well-aligned with India's fundamental drivers - strong domestic growth and advantageous demographics. Midcaps do have a larger potential for producing alpha, but equities that are plays on that potential also exist.

With the Banking & Financial Services sectors in their prime health, how do you expect these sectors to play out in the upcoming year? Do you think the interest rate rally will act in favour of these sectors?

- NIM upcycle is likely to remain far stickier. Robust margins should continue into FY24.

- Credit costs have substantial cushion in the form of higher provisions.

- Predictable opex trajectory and d) structural underwriting improvements and a cyclical rebound in vehicle finance/Microfinance/SME sectors should lead to a higher RoA trajectory.

- Key to watch out will be the deposit rate growth which could lag credit growth into FY24.

With more New-Gen HNI & UHNI entering the Investment arena, how do you approach this segment of investors? What is your assessment of the New-Gen Investors & their risk appetite in comparison with the earlier generation of Investors?

Actually, this group of new generation investors is more knowledgeable and acutely aware of what their international rivals are doing. They are often more skilled at integrating trade intelligence through DIY platforms and have a more nuanced view of risk-reward. Contrary to popular belief, these modern investors may be found all around India, including in Tier 2 and Tier 3 cities. But like any other investment group, they value a unique perspective on investing as well as accessibility and high-quality services.

With Whiteoak having active operations outside India, how different will your approach be towards the NRI & Foreign Investors? Do you find any difference in investment approach between Indian Investors & NRIs/ Foreign Investors?

Our approach to investing is the same as well. The general idea is the same, but we have various fund vehicles to enrol clients from various geographic locations. NRIs, however, have a slightly different risk profile from FIIs and are typically more informed about the current trends in India. As an illustration, many consumer categories present a significant development opportunity in India as they are still in the early stages of adoption. Some of these trends are easier for an NRI investor to relate to because they have already been manifested elsewhere.

What is the ideal time frame that the Whiteoak team allocates to monitor & evaluate significant changes in the portfolio? Will there be any pre-fixed calls to trigger changes or actions? As active managers, we think it's essential to have a well-defined sell discipline in order to avoid growing overly dependent on any one investment and to keep a portfolio that holds the promise of future outperformance. In keeping with this strategy, our sell discipline necessitates constant evaluation of the potential gains offered by each investment in light of the company's fundamentals. We don't employ a formulaic stop loss strategy.

The following situations would typically prompt the team to reassess, discuss and potentially sell a position:

- The combination of greatness of business and attractiveness of value has weakened such that it no longer merits continued investment either because (1) A stock approaches its target price diminishing upside potential and an upward revision to the target price is not warranted, or (2) the company’s long-term fundamentals and underlying business characteristics deteriorate

- There is a material governance related development that prompts us to reassess the corporate governance standards of the company

- To generate capital for more attractive investment opportunities. How did your proprietary opco Finco framework respond to the recent market volatility? Do you have any systematic assessment to review this framework? As we've already indicated, our Opco Finco structure is dynamic, and we continually assess businesses depending on their profitability and values. No of where the market is at any given time, there will always be businesses that are undervalued, and if they fit our definition of a great business, our portfolio will include some of these novel concepts.

Analysts are giving out mixed signals on the performance of the equity market in 2023. Also, there is a significant flow towards fixed-income & passive funds in recent times. So, what is your message to investors and how should one prepare to face the market in 2023? Any asset allocation decision, which depends on the investor's risk tolerance, should ideally be made with the help of a financial advisor. Even overseas equity funds can be considered from a strategic long-term viewpoint as they would provide an additional layer of diversity. Market timing refers to making an investment choice based on current market levels or prices. We have always held the underlying conviction that it is virtually impossible to anticipate the direction of the equities markets in the short term, making it similar to tossing a coin. The most fascinating aspect of the Indian markets is their potential for alpha generation, and as a result, market timing has a very high opportunity cost. Consequently, we remain completely committed to risk management from a responsible standpoint.