Continuous Drawdown for the third month PMS Performance Dips In June 2022

June month saw a dip in the monthly returns of PMS schemes due to ongoing global tensions on rising inflation and interest rates. Only 129 of the 279 PMS schemes in the PMS Bazaar radar outperformed NIFTY and just six schemes out of them produced a positive monthly return in June 2022.

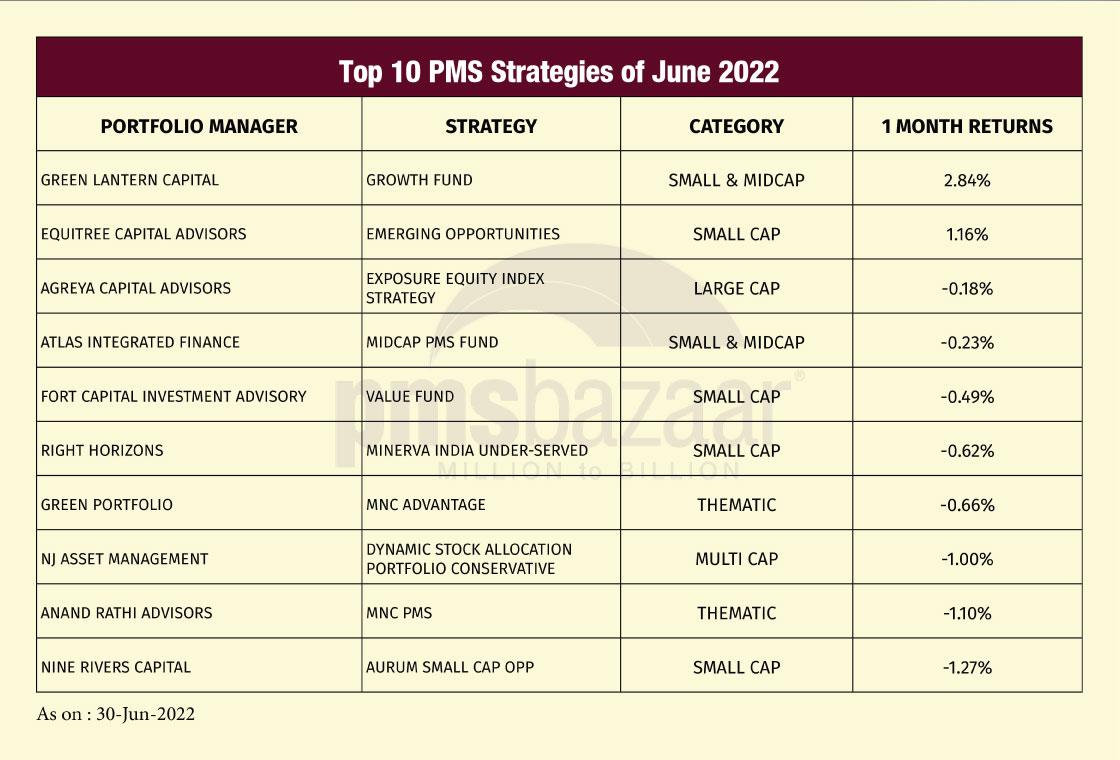

Top 10 PMS strategies of June 2022:

Here are the top 10 PMS strategies identified from the 279 strategies monitored & analyzed by PMS Bazaar.

The Growth Fund of Green Lantern Capital LLP tops the list, yielding a monthly return of 2.84% in June 2022. The fund strategy endeavors to generate superior risk-adjusted returns, in varying market conditions, by investing in Mid & Small Cap companies.

The Emerging Opportunities Strategy of Equitree Capital Advisors Pvt Ltd occupies second place, yielding a monthly return of 1.16% in June 2022. This strategy focuses on long-term value creation.

The EXCEL Strategy of Karvy Capital Ltd occupies 3rd place, yielding a monthly return of 0.85% in June 2022. This strategy holds a debt portfolio with a low to moderate risk appetite.

Get in-depth insights about the remaining entries on the top-performing PMS List of June 2022 and other PMS strategies you want to explore by subscribing to our portal.

Subscribe and get access to insightful PMS data & comprehensive PMS comparisons: Subscribe NOW

Here is a chart depicting the monthly returns of top-performing Equity PMS Strategies in comparison with the NIFTY index for the month of June 2022:

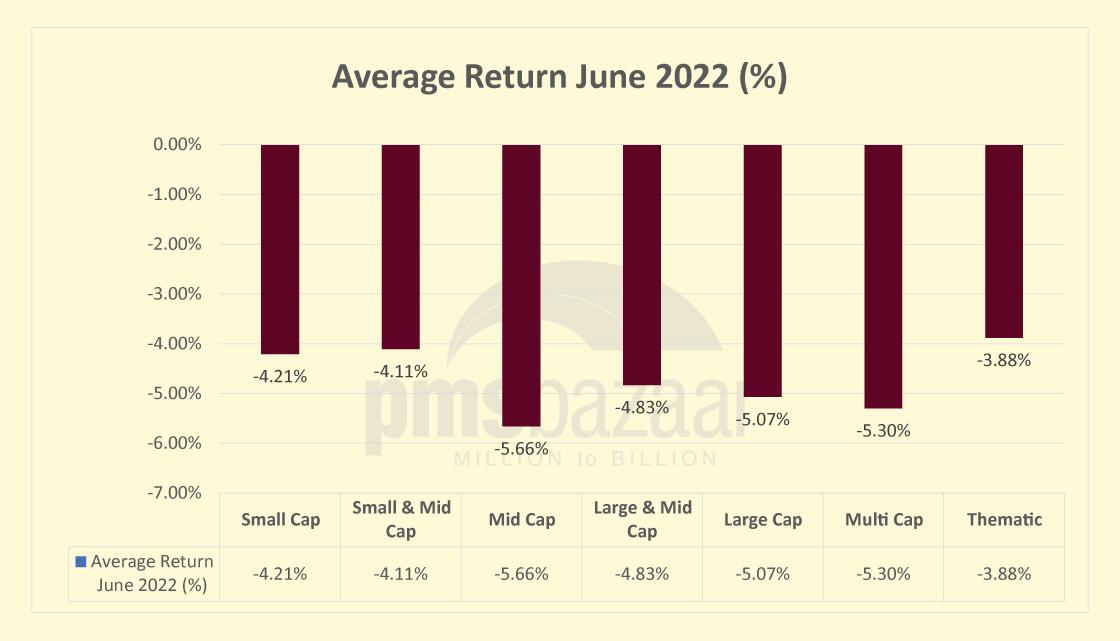

Category-wise analysis of Portfolio management services:

Here is a comparison of average returns of different categories of PMS strategies for the month of June 2022:

Let us look in-depth into each category and identify the top 3 performers in each segment.

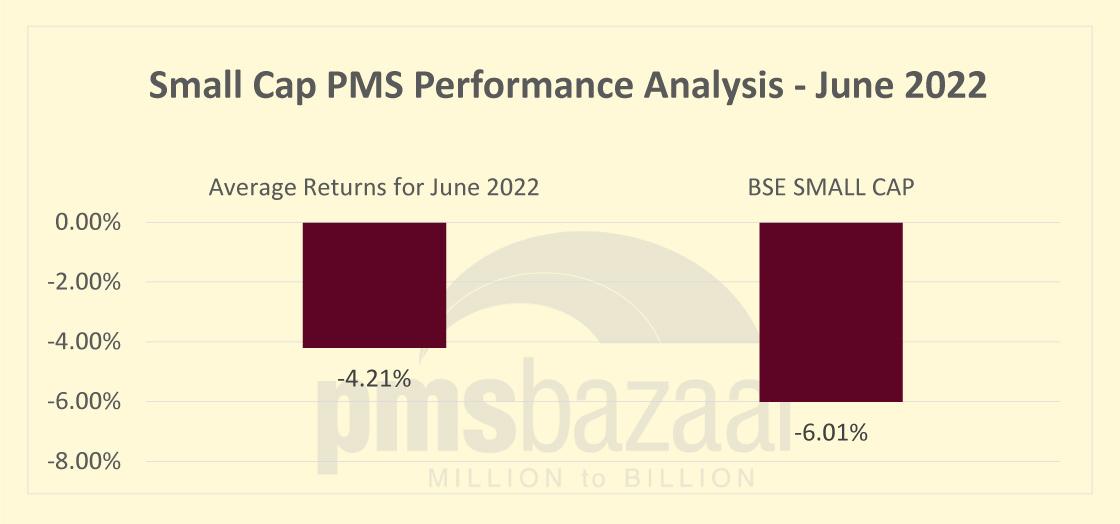

Small-cap:

The Small-cap category recorded an average monthly return of -4.21% in June 2022. 10 out of 15 PMS strategies monitored in this category outperformed BSE Small cap, which stood at -6.01%.

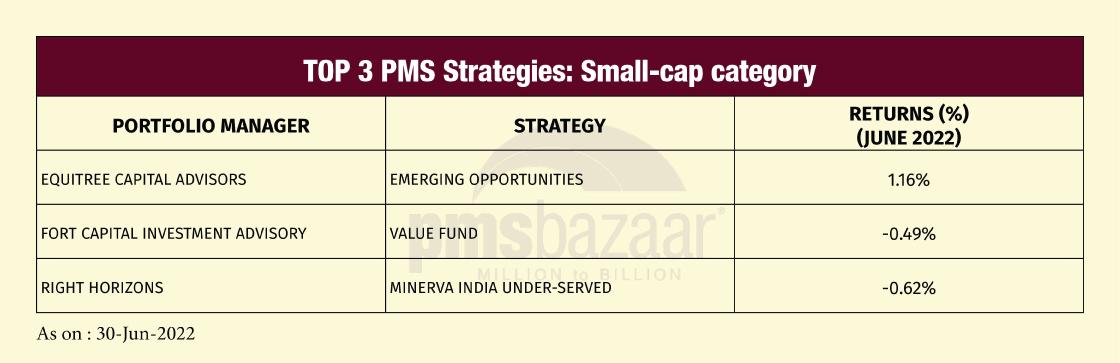

The Emerging Opportunities Strategy of Equitree Capital Advisors tops this category, yielding a monthly return of 1.16%. Followed by it, we have the Value Fund of Fort Capital Investment Advisory (-0.49%) and the Minerva India Under-Served Strategy of Right Horizons (-0.62%), constituting the top 3 performers in this category.

TOP 3 PMS Strategies: Small-cap category

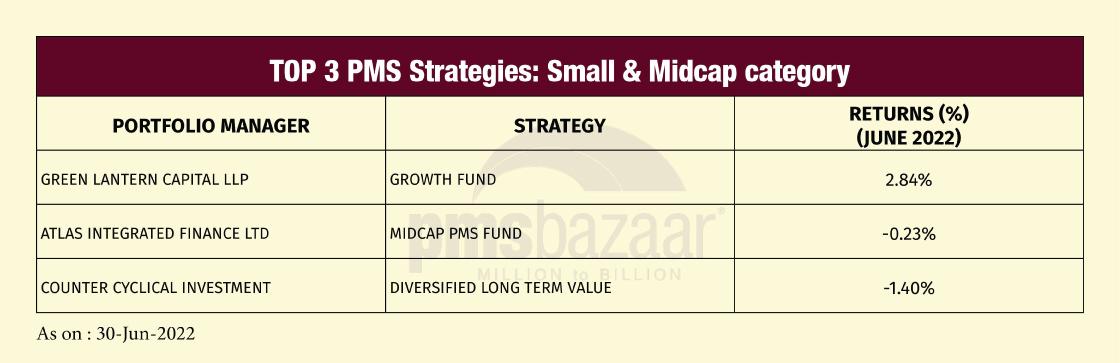

Small & Midcap:

The small & mid-cap category yielded an average monthly return of -4.11% in June 2022.

The Growth Fund of Green Lantern Capital LLP tops this list with a monthly return of 2.84%. Followed by it we have the Midcap PMS Fund of Atlas Integrated Finance Ltd (-0.23%) and the Diversified Long Term Value Strategy of Counter Cyclical Investment Private Limited (-1.40%), constituting the top 3 performers in this category.

TOP 3 PMS Strategies: Small & Midcap category

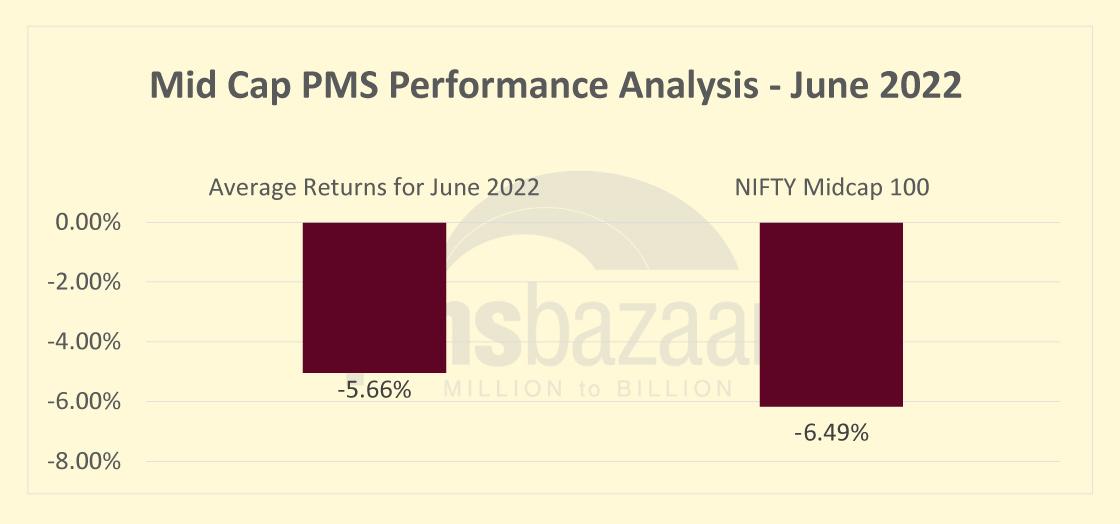

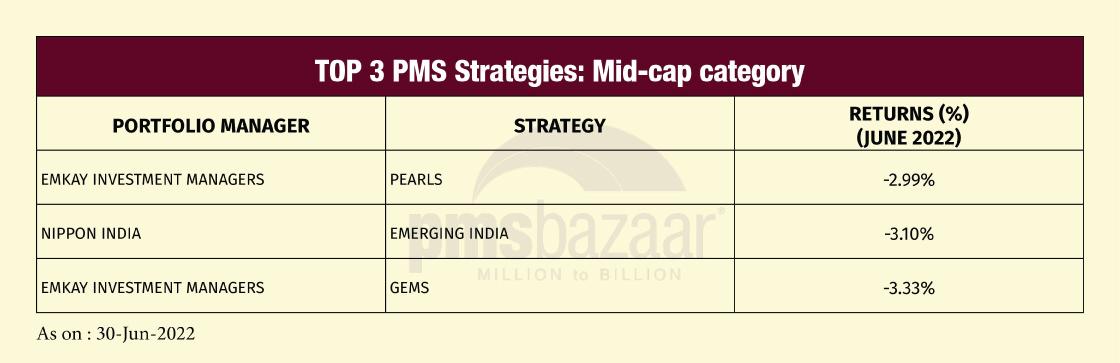

Mid-cap:

The Mid-cap category recorded an average monthly return of -5.66% in June 2022. 14 out of 20 PMS strategies monitored in this category outperformed NIFTY MIDCAP 100, which stood at -6.49%.

The PEARLS Strategy of Emkay Investment Managers tops this list, yielding a monthly return of -2.99%. Followed by it, we have the Emerging India Strategy of Nippon India (-3.10%) and the GEMS Strategy of Emkay Investment Managers (-3.33%), constituting the top-3 strategies of this category.

TOP 3 PMS Strategies: Mid-cap category

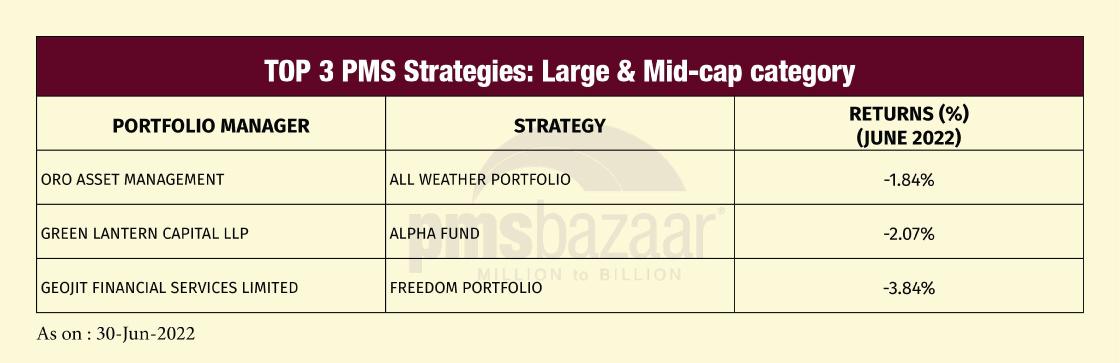

Large & Mid-cap:

The Large & Mid-cap category recorded an average monthly return of -4.83% in June 2022.

The All Weather Portfolio of Oro Asset Management tops this category with a monthly return of -1.84%. Followed by it, we have the Alpha Fund of Green Lantern Capital LLP (-2.07%) and the Freedom Portfolio of Geojit Financial Services Limited (-3.84%), constituting the top 3 strategies of this category.

TOP 3 PMS Strategies: Large & Mid-cap category

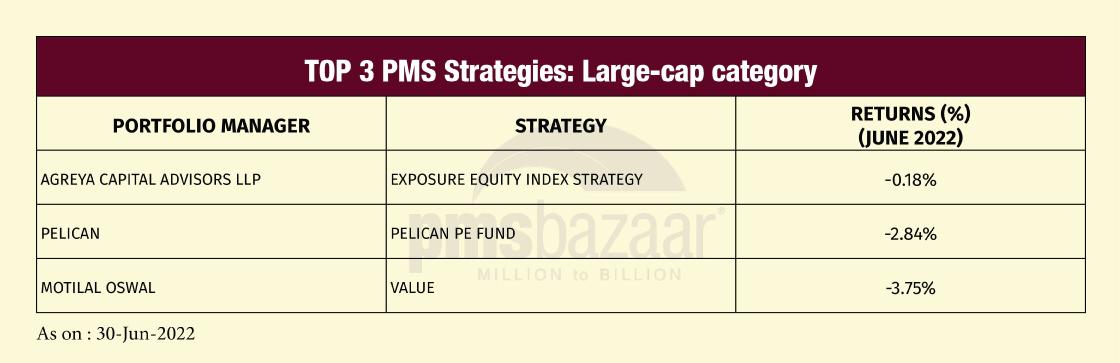

Large-cap:

The Large-cap category recorded an average monthly return of -5.07% in June 2022. 8 out of 20 strategies monitored under this category outperformed NIFTY, which stood at -4.85%.

In this category, the Exposure Equity Index Strategy of Agreya Capital Advisors LLP tops the Large Cap Category with **a monthly return of -0.18%.**Followed by it, we have the Pelican PE Fundv of Pelican Investments (-2.84%) and the Value Strategy of Motilal Oswal (-3.75%), constituting the top 3 strategies of this category.

TOP 3 PMS Strategies: Large-cap category

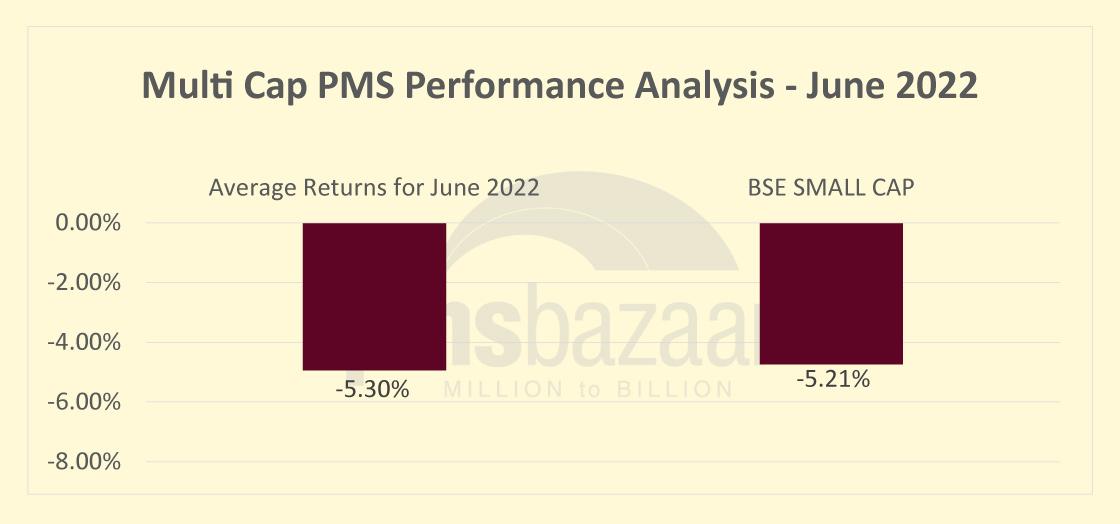

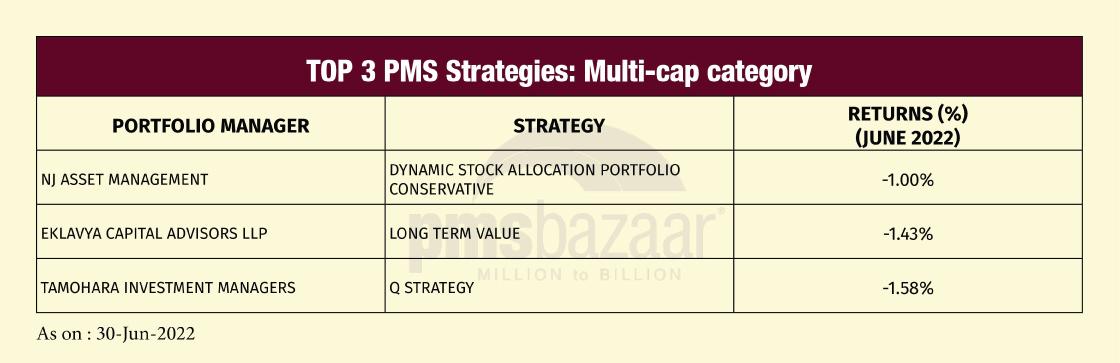

Multi-cap:

The Multi-cap category recorded an average monthly return of -5.30% in June 2022. 70 out of 147 PMS strategies monitored under this category outperformed BSE 500, which stood at -5.21%.

The Dynamic Stock Allocation Portfolio Conservative of NJ Asset Management tops the list with a monthly return of -1.00%. Followed by it, we have the Long Term Value Strategy of Eklavya Capital Advisors LLP (-1.43%) and the Q Strategy of Tamohara Investment Managers (-1.58%), constituting the top 3 performers of this category.

TOP 3 PMS Strategies: Multi-cap category

Thematic investment:

The Thematic category recorded an average monthly return of -3.88% in June 2022.

The MNC Advantage Strategy of Green Portfolio tops the list, recording monthly returns of -0.66% Followed by it, we have the MNC PMS Strategy of Anand Rathi Advisors (-1.10%) and the Healthcare Portfolio Strategy of Incred PMS (-1.68%) constituting the top 3 strategies of this category.

TOP 3 PMS Strategies: Thematic investment category

Join the 40000+ Investors and experts accessing our data & reports on PMS & AIF by subscribing to us. With this subscription, you can also access our insightful newsletters webinars, summits, and much more. Subscribe now