o3 Capital

o3 Capital

Mid-market investment bank o3 Capital counsels customers on financial and strategic matters. It was established in 2007 and currently employs 60+ exceptionally bright people with more than 250 years of combined senior management experience. O3 Capital has provided advice on 155 transactions totaling more than USD 5.7 billion. Corporate Finance and Alternative Asset Management constitute the company's two main business segments.

Mr. E.A. Sundaram, Executive Director & CIO

Public Markets Mr. E. A. Sundaram, is a MBA from IIM, Ahmedabad. He is Executive Director & CIO – Public Markets at o3 Securities. His previous stints include a role as Manager (Research) at SBI Mutual Fund, Head of Research and Fund Manager at Zurich India Mutual Fund, Senior Portfolio Manager at HDFC Mutual Fund, Portfolio Manager at M3 Investment Managers (a family office) and CIO - Equity and Portfolio Manager at PGIM India Mutual Fund. Investment Philosophy Out of his total experience of 3 decades, the last 17 years was in managing long-only portfolios with separately managed accounts and family offices. He has been able to demonstrate taking significant contrarian positions – underweight Technology in 1999, underweight Infrastructure, Utilities, Power in 2007, underweight Midcaps in 2017, no NBFC exposure in 2018, not paying any price for quality in 2019, etc. The common factor being to avoid sectors which were extremely popular and hence avoid the very expensive valuations. This helped protect the portfolio downside when these sectors corrected extensively in subsequent years, while overall delivering significantly above average returns. In his own words, Mr. E.A. Sundaram likes to classify his investing style as “Commonsense investing”. His thesis is simple – invest in strong businesses when they are temporarily unpopular. The unpopularity provides for a good entry price. As long as we are confident about the company’s long-term ability to compete in the marketplace, we should utilize the short-term fear to buy the stock(s) at attractive prices. Plus, if one believes that stock market rewards capital efficiency, then this strategy helps as it deploys money only in companies with long track record of high ROCE (Return on Capital Employed) and also uses the client’s capital efficiently by not overpaying for such companies.

Investment Philosophy

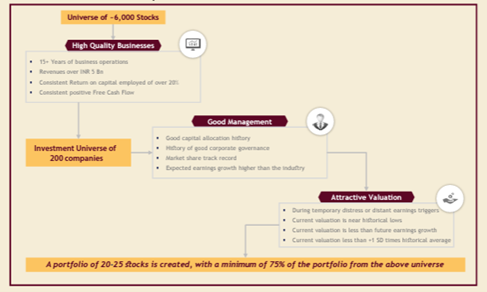

The investment ethos of o3 Capital aims to purchase solid companies when they are quoting at fair prices. As a result, the stock selection criteria and research methodology are designed to favor buying solid companies whose stock is valued fairly. Additionally, they must to fall within quantifiable limits (to avoid misunderstanding).

According to o3 Capital, "By avoiding the wrong things, investment success will be achieved," therefore they start the process of eliminating businesses that don't fit their definition of a successful company.

The following traits should be present in a strong company:

- A track record spanning 15 years or more, preferably more.

- Minimum operational size, which is defined as income of at least Rs. 500 crore in the most recent reported financial year.

- Each year (in the previous ten years) in which the business reported a Return on Capital Employed (RoCE) of 20% or more received a score of 1. Any company can receive a maximum of 10 points for this criterion.

- A score of 1 for each year (in the previous ten years) that the business generated positive free cash flow (cash flows after adjustments to working capital and fixed capital expenditures).

Any organization may earn a maximum of 20 points overall on the previous points 3 and 4. A cut-off score of 14 has been established by o3 Capital below which the companies will not be considered. Companies that meet all three criteria (a) a track record of 15 years or longer (b) reported revenues of Rs. 500 crore or higher (c) and (d) a score of 14 out of 20 or higher on criteria (3) and (4) comprise the investment universe for the Core Value Strategy. At any given time, at least 75% of all investor funds will be invested in businesses from this universe, according to o3 Capital's pledge.

A maximum of 25% is set aside for businesses that do not meet the requirements to be included in the universe, primarily to make room for (i) businesses in the financial sector, (ii) businesses with annual revenues under Rs. 500 crore, and (iii) other businesses that, due to the nature of the industries they compete in, are unable to consistently generate free cash flow or high RoCE but are still formidable rivals in their fields. After the initial filtering process, o3 Capital employs next level of filters, to judge whether... (a) The company has scope to grow its earnings sustainably over the next 3-5 years. (b) The company has had a track record of treating minority shareholders fairly. (c) The stock trades at a valuation that is within acceptable limits. Special emphasis is placed on point (c) above, a stock’s valuation is considered acceptable enough for purchase:

- If the stock’s valuation is lower than its average valuation for the last 10 years, or

- If the stock’s valuation is lower than its estimated growth rate in earnings (based on Bloomberg’s consensus estimates) If a stock's current valuation is more than one standard deviation over its 10-year average, o3 Capital will not purchase it. These procedures are in line with the fundamental investing concept of o3 Capital, which is to acquire solid companies for fair prices. Risk Reduction: The template maintains the following risk reduction standards.

- The amount of exposure to a single stock is capped at a maximum of 10% of the portfolio.

- Amount of sector exposure (up to 30% in any one industry).

- The stock's level of liquidity (the average daily traded volume over the last three months should be sufficient to allow us to liquidate our entire desired quantity in five trading days) Exit Strategy: Any one or more of the following considerations may be taken into account when deciding whether to sell or leave a position:

- When the original presumptions used to purchase the shares are no longer true.

- When the stock's price significantly exceeds what we believe it to be worth.

- When we see a better opportunity for the same perceived level of risk.

- When a redemption request is made.

Performance of o3 Core Value Strategy PMS:

o3 Core Values Framework Regular and Concentrated investments are available through PMS. Both approaches adhere to the stringent, in this report's discussion, value-based guidelines. Both choices are independent of market cap and benchmark. Nifty-500 is the designated Benchmark for both options. For more than a year, the performance of the larger markets has been poor. Both of the choices for the o3 Core Value strategy have shown greater durability throughout this downturn.

Core Value Strategy – Concentrate option was launched in Apr-2019 and the Regular option was launched in May2019. The performances are tabulated as exhibits 1 and 2.

Salient Features of o3 Core Value Strategy

- One of the most transparent businesses, o3 Capital, which has a reputation for putting its clients first and senior management with a combined experience of more than 250 years, is the provider of the strategy.

- The o3 Core Value Strategy's portfolio manager has three decades of investment experience, of which 17 years were spent managing long-only portfolios.

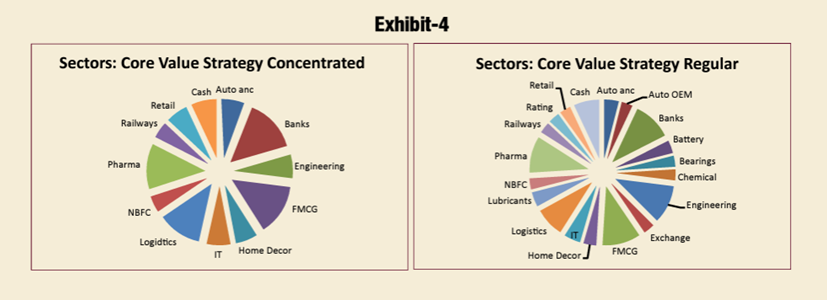

- There are two variations of the strategy to pick from: concentrated (around 15 stocks) and normal (with 20 to 25 stocks), and both have outperformed the benchmark Nifty-500 since its launch.

- The stock selection is based on a carefully crafted investment philosophy and further screened through qualitative and quantitative analysis on the scope of expansion, management integrity, and price-value relationship.

- Neither choice is sector- or market-cap-specific. Both options of the o3 Core Value Strategy PMS are exposed to all Large, Mid, and Small Cap businesses, and both have a respectable cash holding. They are well-diversified across 11 and 18 different sectors.

- With a clear mandate on the liquidity of each stock in the portfolio, the risk mitigation is accomplished by capping the unique stock holding percentile and sector exposure percentile.

- The portfolio construct has an additional positive strength thanks to a clearly stated exit strategy.

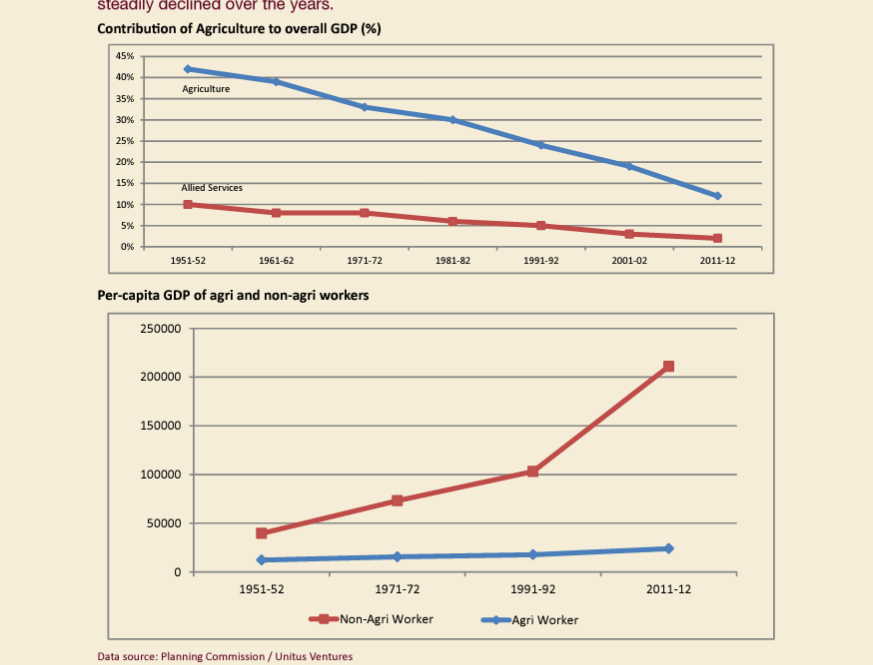

In order to know the o3 Core Value Strategy better and to understand the current Indian economic situation, we have conducted an "Exclusive Interview" with Mr. E.A. Sundaram, Executive Director & CIO - Public Markets - o3 Capital. The questions from PMS Bazaar and the answers by Mr. E.A. Sundaram are appended: There have been many reforms and stimulus package measures initiated by the Indian Government to restart the economy. Though the Government and the Prime Minster have been citing examples of “greenshoots” in the rural economy, there appears to be lack of enthusiasm in the general media. What is your opinion on the recent agriculture reforms measures? It is rather unfortunate that the majority of observers chose to focus on some of the most extensive reforms in India's most important agricultural sector rather than on how much of the GDP the fiscal stimulus package covered. This, in our opinion, is a sign of the times since it emphasizes the immediate rather than the structural and long-term. Since 1991, India has undergone a number of significant economic reforms, but almost all of them ignored the agriculture industry. As a result, agriculture's share of global GDP has been slowly declining over time.

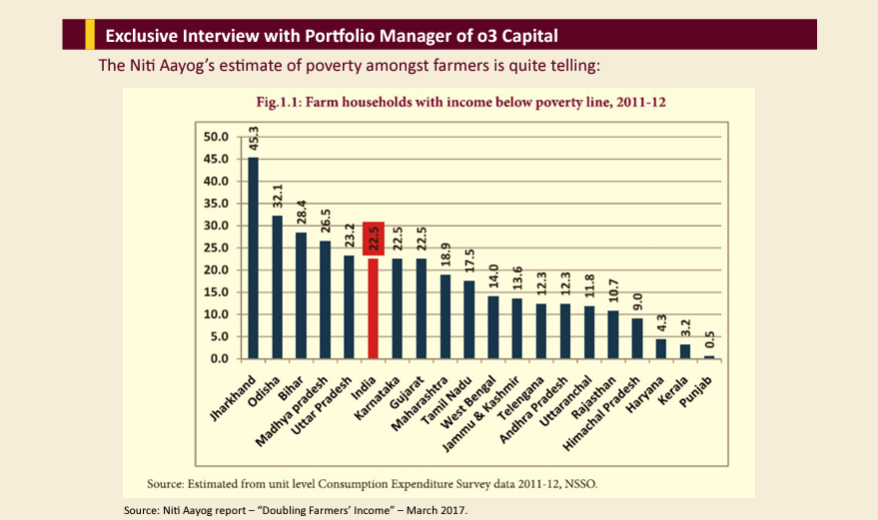

Officially, more than one-fifth of Indian farmers live in poverty on average, and conditions are substantially worse in five important states. Three significant regulatory adjustments were recently announced by the Finance Minister as part of the Covid Relief package: • Modifying the APMC Act to modify the agricultural marketing strategy • The Essential Commodities Act was amended, eliminating the restrictions on the amount of agricultural commodities that a private buyer may store. • Support initiatives to advance contract farming. Eminent agricultural economists like Mr. Ashok Gulati have praised these actions as "pathbreaking" and "long overdue." They may not yield immediate results, but there is no doubt that, if implemented in letter and spirit, they have the capacity of changing the fortunes of rural India, where nearly two-thirds of our population lives. One of the main reasons why the farmer is at the receiving end is the regulatory framework that exists in this country.

- The farmer can sell his produce ONLY to the local APMC mandi (the designated market place stipulated by the Agricultural Produce Market Committee in their respective states)

- The farmer has NO say in determining the price of his produce. This is decided by the Committee member (or his/her representative) at the local APMC mandi.

- The farmer has to incur transport cost to transport his produce to the mandi, but he cannot unload the produce. The unloading has to be done by the APMC

- The arthia at the APMC gets a commission both from the farmer and the purchaser of the produce.

- If, for example, a farmer sold his rice to the local rice mill, the APMC has the power to impose a fine on the rice mill.

- The APMC Act was ironically formed for giving the farmer protection against exploitation. It instead had spawned a new breed of exploiters.

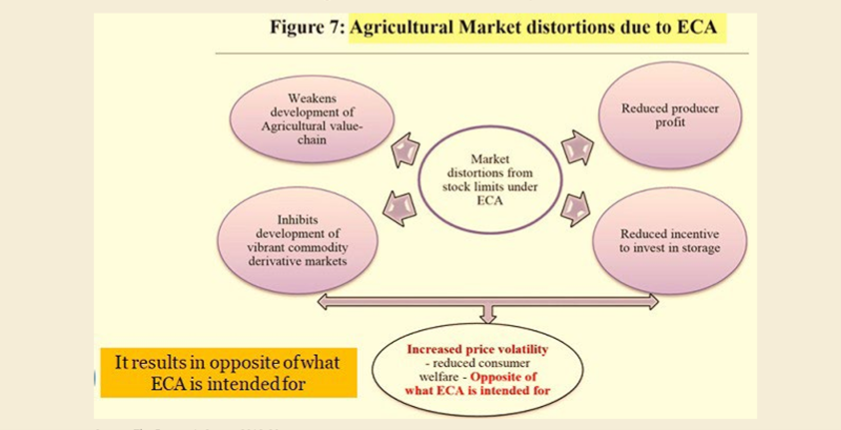

The Economic Survey itself stated that, far from reducing the price volatility in farm products (as was the original intent of the Act), the ECA actually increased price volatility. Besides, it reduced the incentive to invest in storage facilities and inhibited the development of vibrant commodity derivative markets. The Survey had categorically called for the scrapping of the ECA. In one stroke, the government has amended both the ECA and the norms for agricultural produce marketing. In addition, it has also announced a funding support of Rs.1,00,000 crores for the creation of storage facilities at the farmgate. Potential benefits that we see from these steps

- The farmer is freed from the rules of selling ONLY to the local APMC mandi, and at prices which he cannot say no to. The new set of rules gives the farmer a choice to sell elsewhere, if the price is better.

- Contract farming is encouraged, with food companies being the buyers, instead of the local middlemen. The setting up of Farmers Producers Organizations (FPOs) in several states would provide the farmers a platform to negotiate better prices, just as the milk cooperatives did in Gujarat to power the White Revolution.

- The amendment of the Essential Commodities Act (ECA) and the fiscal support to set up storage facilities at the farmgate are likely to encourage investments in much needed storage facilities for agricultural produce. In a country where it is estimated that a fourth of the horticultural produce gets wasted because of a lack of adequate storage facilities, this is a welcome step.

- The intended benefit of these changes is to transfer the balance of power from the middlemen to the farmer/consumer. It is our estimate that the farmer's net income would rise by about 2530% as a result of these steps.

- This would hopefully set the stage for a large-investment in food processing facilities in the country, thus creating employment in rural India for agri-related industries. Of course there are pitfalls. There may be covenants introduced in the law that we are not aware of now. There may be a backlash from the middlemen lobby. The whole thing may take longer than envisaged. However, this is a big step in the right direction.

There is a widespread misconception about “value-investing”, which is just buying stocks with cheap valuations at low prices and waits for long-periods with hopes of recovery? Can you please explain the concept of “value-investing” to make the novice investors to rightly understand the concept and its advantages?

Yes, we are aware that many people have the misconception that "value investing" entails purchasing inexpensive companies with low Price/Book Value multiples or PE multiples in the single digits. This, in our view, is not the proper definition of value investing. Simple common sense investing is value investing. Let's use a few instances from our daily lives as examples. If a store that sells shirts on average for Rs. 2000 per shirt announces a special offer in which a customer can receive the third shirt for free if they purchase two, the average price per shirt during the sale period will drop to Rs. 1333. There would logically be more shirts sold during this sale period.

On the other hand, when the cost of our preferred fruit or vegetable increases significantly, we have a natural propensity to stop purchasing it or, at the very least, purchase less when the price is high. A very high price for the same asset is viewed as a hint to stay away, at least temporarily, in every type of economic activity. A lower price for the same asset is seen as an opportunity to buy more. Value investing is an extension of this rational approach to managing our financial concerns to the stock market.

The two essential ingredients in value investing are the following:

- Restricting the choices to very strong companies. Value investing doesn't just mean "buying cheap".

- Refrain from paying exorbitant prices even if the company is an excellent company. The essence of value investing is the conviction that the returns that one can get from a stock is inversely proportional to the price we pay for it. This means that “Value Investing" would seem irrelevant when there is a roaring bull market. However, it is interesting to see the results of staying away from excessive hype. We present data from several bull markets in our history:

If the capital market is meant to reward (or, alternatively, punish) the efficient use of money, then as investors, we may ensure efficiency by adhering to two straightforward rules: We must (a) decide to exclusively invest in businesses that employ money effectively, and (b) decide to use our capital effectively by not overpaying for the things we purchase. We want to stress once more that value investing is NOT about purchasing inexpensive stocks. It is about getting high-quality products at reasonable costs. Value investing is, in other words, investing with common sense. It will ALWAYS be in style.

In your opinion, Why Should Investor Choose PMS? What should be the position of a PMS in Investor’s portfolio?

An investor may select a PMS for a number of reasons. The expectation that a PMS will provide a larger return than other investment vehicles, however, is one reason why an investor should NOT select one. An ideal PMS would complement the other investment products (i.e., there would be as little portfolio overlap as possible). Only if the investing strategy is different would a portfolio be different. Therefore, in contrast to common investment products like mutual funds, the PMS should ideally incorporate stock selection and portfolio development criteria. This does not imply that a PMS is better than other forms of investment. It merely closes a hole in the investor's complete portfolio.

We would like to elaborate this point a bit more. No investment manager can start with the assumption that he/she will generate a return that is superior to some other investment product. The premise itself will lead the portfolio manager to taking risks that are not necessary to be taken. Besides, the return generated by a portfolio cannot be pre-decided by any portfolio manager, however good he or she may be. All that a portfolio manager can do (and this is the most important thing) is to strictly follow a logical investment process. This process has to be followed even if the results don't seem apparent. Over time, the results will come. In the anxiety to be "no.1" at all points of time, the portfolio manager should not deviate from the stated investment process.

It is important to keep in mind that no investment style, fund, PMS, or portfolio can consistently maintain the top spot on the performance chart. The investor should therefore concentrate on finding four or five "good" goods that are distinct from one another and holding them in his or her portfolio. Finding the "best investment product" would turn out to be difficult and fruitless.

That said, a PMS serves the following needs of the client:

(a) The need for customization.

(b) The need for implementing a "negative list" of stocks or sectors

(c) Higher concentration compared to mainstream products.

(d) Stocks or sectors normally not purchased by mainstream products. The diversification aspect

Investors’ return expectations and risk tolerances vary. To whom the o3 Core Value PMS Strategy will be apt to build their wealth? And what are your advises to such potential investors? The o3 Core Value PMS will be highly relevant for investors who:

- Are looking for a portfolio of strong businesses, but purchased at prices that are not exorbitantly high.

- Have an investment time horizon of 3-5 years, or longer

- Seek to have a qualitative, measurable diversification compared to the mainstream products as a means to spread the risk.

- Most importantly, it balances the need of an investor who seeks peace of mind as well as a decent return. We are confident that ALL investors should have at least a proportion of their overall equity portfolio in a product like o3 Core Value Strategy. How much exposure to take in this product would depend upon individual needs.